Minnesota: 2030 industry chapter: Corporate and financial sector

Minnesota’s corporate and financial sector is a strength to steward and build upon

Minnesota is a recognized hub for corporate headquarters and industry-leading businesses. This strength should not be taken for granted. Home to 18 Fortune 500 companies and 24 Fortune 1000 companies, Minnesota hosts an admirable list of global companies that draw on the state’s highly skilled workforce to sustain their success. This professional and technical talent pool extends beyond just corporate headquarters, making Minnesota a conducive environment for companies in financial and professional/technical services as well.

However, challenges exist. Despite Minnesota’s skilled workforce, the state needs to improve in important areas, such as availability of tech talent, cultivating a diverse and inclusive workforce, sustaining a more positive business climate, and supporting entrepreneurship.

To address these challenges and build on key strengths, Minnesota must move strategically to sustain the vitality of its existing corporate headquarters firms while seeding the ground for creation of the “next Fortune 500s.” We recommend a response oriented toward the underlying conditions needed to help businesses in this sector thrive.

Such strategies include:

- Cultivating diverse and high-tech talent that can meet the growing needs of leading companies.

- Leveraging Minnesota’s relative affordability while addressing business climate concerns.

- Strengthening retention strategies to capture a greater share of the global investment in headcount and capital investment from these leading firms.

- Fostering future Fortune 500s by building on efforts to nurture and support start-up businesses, helping rising stars stay and grow in Minnesota.

- Leveraging remote work to grow corporate support activities across Minnesota beyond the Twin Cities metro.

How is Minnesota’s corporate and financial sector performing?

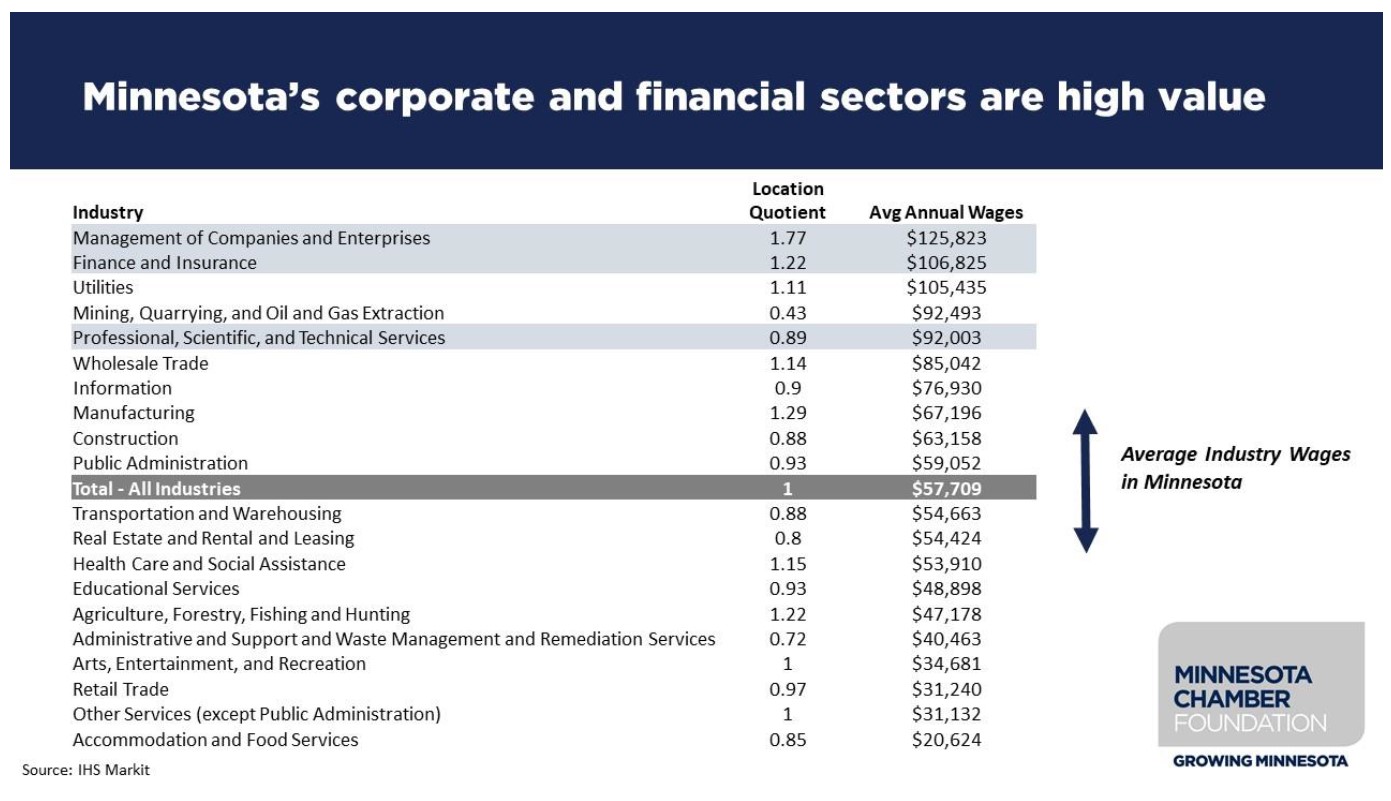

1. Minnesota’s corporate and financial sector is big and diverse, contributing significant economic value to Minnesota as a whole.

Behind many of Minnesota’s economic strengths – such as its high per-capita income and innovation rates – stands the state’s deep bench of corporate headquarters and industry-leading firms. Minnesota is home to 18 Fortune 500 companies and 24 Fortune 1000 companies, as well as leading privately-held businesses such as Cargill, Prime Therapeutics, Mortenson Construction, Taylor Corp and more. Notably, Minnesota’s largest companies span a diverse range of industries, including health care, food and agriculture, retail, financial services and industrial manufacturing.

In addition to corporate headquarters (defined as Management of Companies and Enterprises in the standardized industry classifications), Minnesota also has a large presence of related industries, such as finance and insurance, and professional, scientific and technical services. These industries and the corporate headquarters sector itself share overlapping talent needs, with the professional, scientific and technical services sector often providing essential support services to large, enterprise businesses.

Taken together, Minnesota’s corporate and financial sector employs more than 398,000 Minnesotans, and directly contributes over $43 billion in annual payroll and $66.5 billion in annual GDP, representing nearly a fifth of the state’s total output. This is notable.

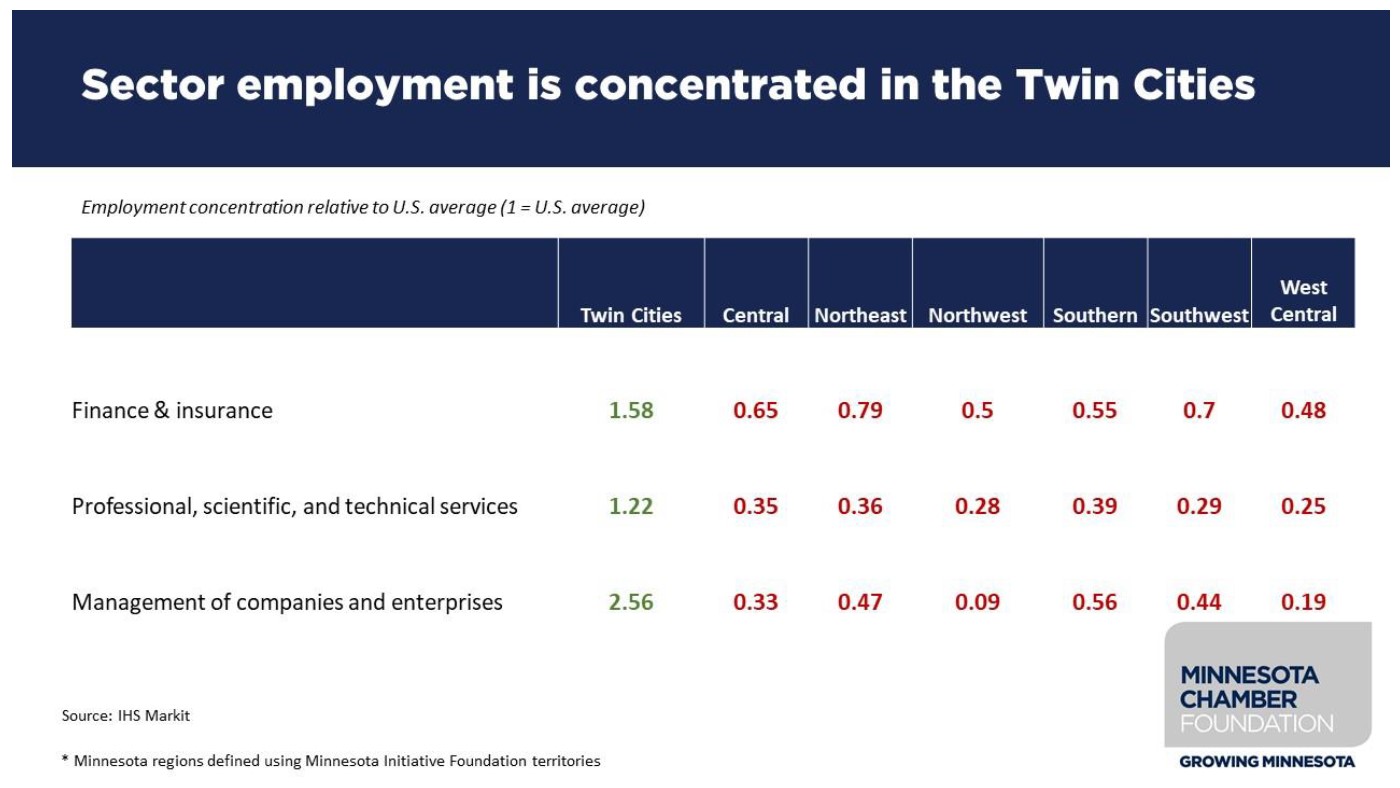

Minnesota also has a particularly high share of jobs in management of companies and enterprises (1.8x the U.S. average), and finance and insurance (1.2x the U.S. average). The seven county Twin Cities metro accounts for nearly 84% of the state’s jobs in these three sectors. However, industry classifications may discount the actual number of headquartered companies outside the Twin Cities region. A global manufacturing company, for example, may be classified as a manufacturer, rather than management of companies, if their production and company management activities take place in the same location. While it is safe to say the state’s corporate and financial activities are largely clustered in more densely populated areas of the state, some headquartered companies in Greater Minnesota are not counted in the management of companies sector for that reason.

2. The corporate and financial sector is a reservoir for high-skilled “knowledge jobs.”

Unlike location decisions based on access to raw inputs or distribution channels, companies in corporate services are largely driven by access to high-skilled knowledge workers.i In this sense, the corporate and financial sector – particularly corporate headquarters – relates less to a vertical industry than it does a set of capabilities that are transferable across a wide range of industry contexts. As University of Minnesota Professor Myles Shaver states in his research on headquarters economies, this includes “capabilities to manage the financial, accounting, legal, human resources, information technology, marketing, and logistics needs of the company. It also includes the expertise required to innovate and launch new products and services.”

Minnesota’s occupational data reveals the extent to which this is the case. Despite representing just 12.5% of the state’s total workforce, these three sectors employ 55% of Minnesota’s computer and math workers, 47% of business and financial operations workers, and 22% of all managers. A closer look at management occupations shows that these sectors make up a very high share of non-industry-specific management positions, including 82% of all Advertising and Promotions Managers, 67% of all Compensation and Benefits Managers, and 55% of all Computer and Information Systems Managers.

The prominence of corporate and financial services in Minnesota’s economy masks other strengths as well. For instance, while Minnesota has a more modest footprint in pure “tech” industries, including software publishing and data hosting, its corporate and financial industries employ large numbers of workers in software development, data analytics, and other information and technical fields, making up a significant share of the state’s information economy. IHS Markit calculates that Minnesota actually has above average shares of employment in key occupational categories such as IT (1.15 LQ), STEM (1.13 LQ), Business Services (1.14 LQ), and High Tech (1.13 LQ). These talent clusters reflect and are largely traceable to industries like corporate headquarters, professional services, and finance and insurance.

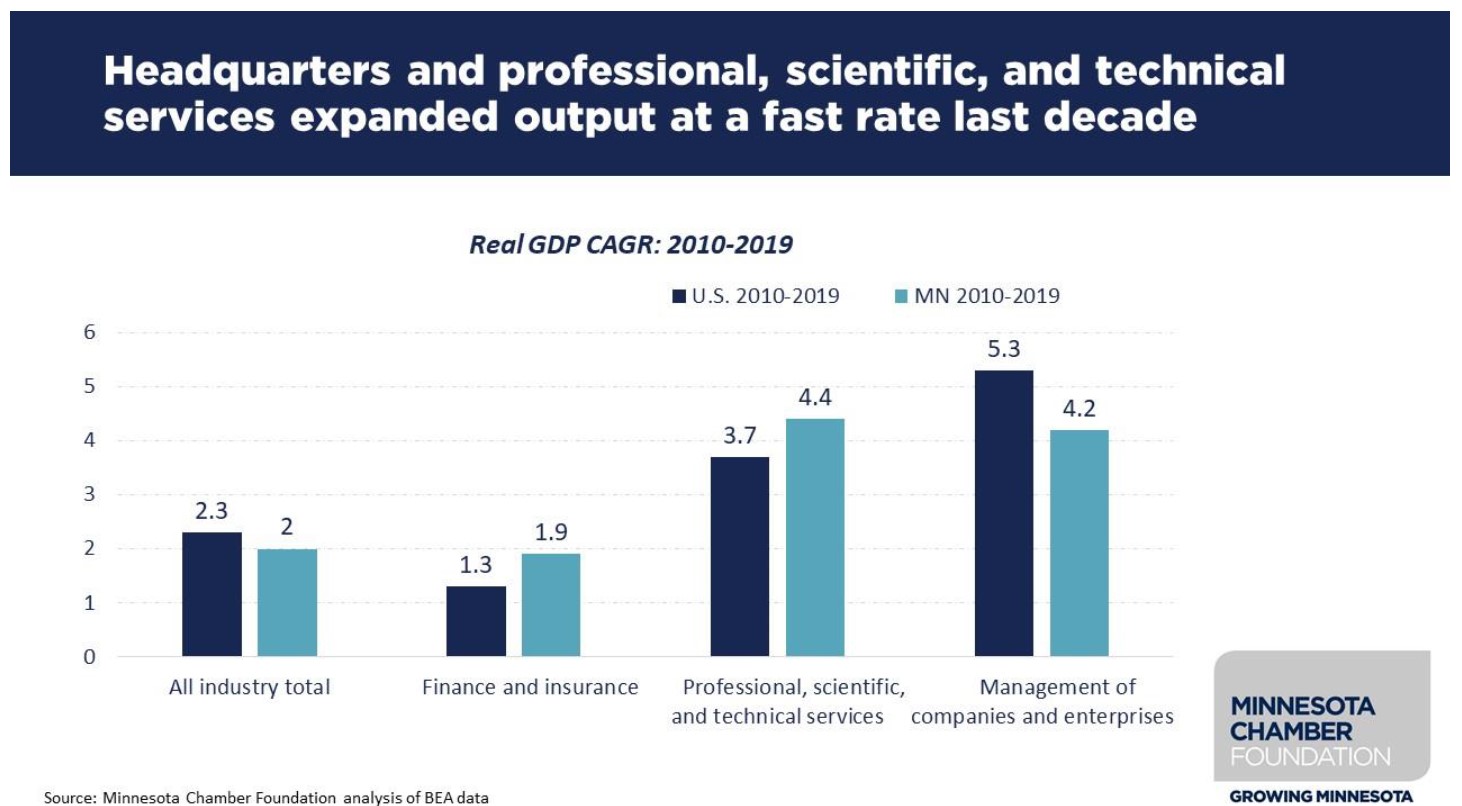

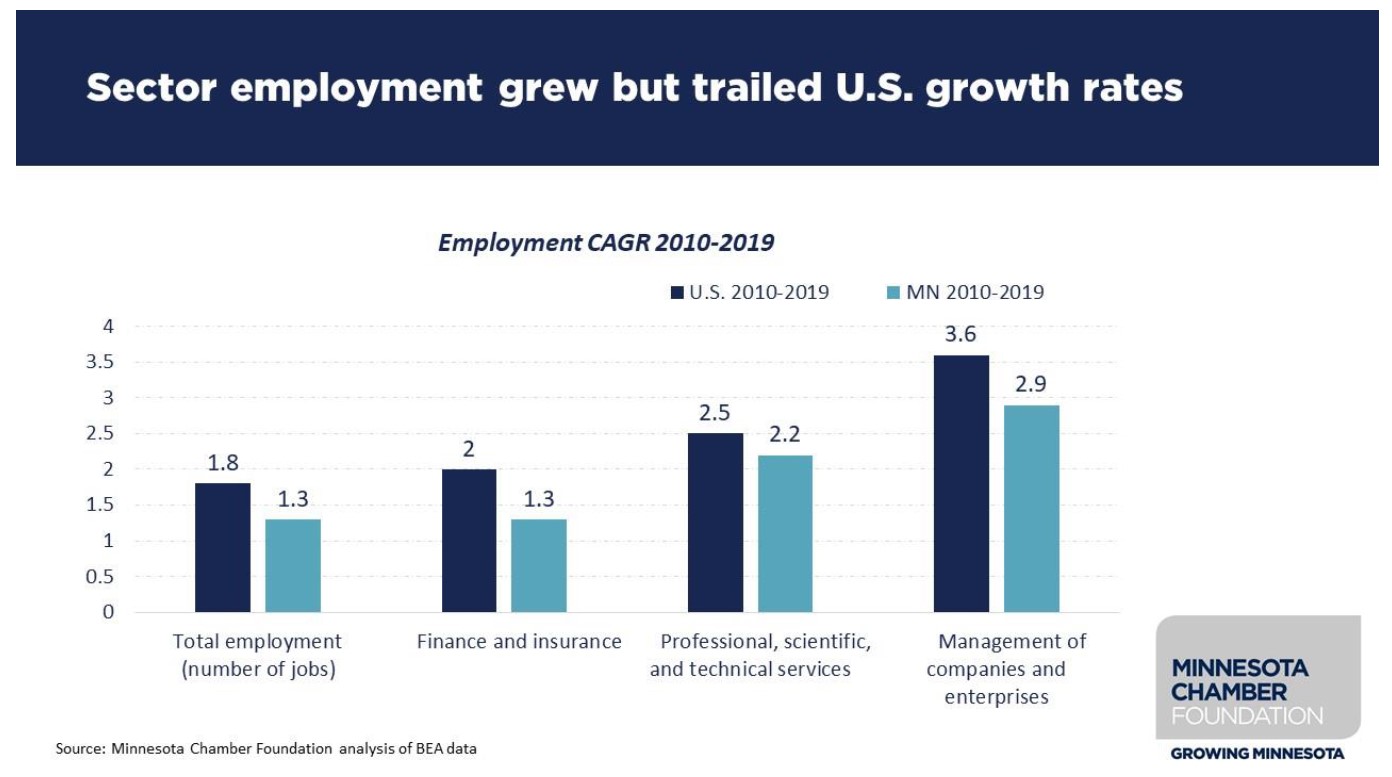

3. Professional, technical, and scientific services and headquarters outperformed other industries, while finance and insurance grew in line with the state’s economy.

Minnesota’s corporate and financial sector expanded at a relatively fast pace over the past decade. Professional, scientific and technical services added jobs at an average annual rate of 2.2% from 2010-2019, while management of companies and enterprises expanded by 2.9% annually. Both industries experienced robust GDP growth as well, expanding at a 4.4% and 4.2% respectively. This was more than double the rate of growth in Minnesota’s economy as a whole. Finance and insurance grew more in line with Minnesota’s overall economy, experiencing 1.3% annual job growth and 1.9% annual GDP growth since 2010.

Growth across all three sectors generally aligned with changes in the U.S. economy. However, Minnesota’s corporate sector performed relatively better in terms of GDP than it did job growth, with employment expanding more slowly in Minnesota than in the U.S. This reflects broader trends in the Minnesota’s economy, with persistently tight labor markets likely constraining job growth prior to 2020. It may also reflect conscious decisions by Minnesota’s corporate sector to grow jobs in locations and geographies other than Minnesota.

4. Corporate and financial activities were shielded from the worst impacts of COVID-19.

The COVID-19-induced recession in 2020 left its mark on every major sector. However, Minnesota’s corporate industries were relatively less impacted than sectors more vulnerable to social distancing measures, such as hospitality or travel and leisure. Employment in management of companies and enterprises fell 5.9% in April 2020 as the sector absorbed the impact of COVID. Professional services and finance and insurance shrank by 2.7% and 0.9% respectively in the same period. Though significant, these losses were far less than those in the hardest-hit industries, many of which experienced up to 50% declines in employment and struggled to keep the doors open amidst shutdown measures. Firms in the corporate sector were cushioned in part by their ability to more easily shift operations to remote work environments without substantially disrupting workflow. The significance of the dramatic acceleration in remote work remains an important question relevant to future growth opportunities and risks in this sector.

5. Entrepreneurship rates continue to lag, but Minnesota is seeing meaningful gains from fast-growing companies.

Minnesota became a hub for corporate headquarters primarily through the success of home-grown companies that started in Minnesota and built significant operations over time. Of Minnesota’s 18 Fortune 500 companies, 16 were founded in the state. It is Minnesota’s entrepreneurial legacy, rather than corporate relocation efforts, that created the state’s stock of leading companies. Yet, the rate of turnover and churn in the economy means that Minnesota must continually foster new business growth to maintain this legacy into the future. As a 2016 report from Innosight states, “at our forecasted churn rate, about half of the S&P 500 will be replaced over the next 10 years.”iii Indeed, of the companies appearing in the first Fortune 500 list in 1955, only 52 remained on the list in 2019.

Without robust entrepreneurship and retention of fast-growing companies, Minnesota cannot expect to remain a headquarters economy long-term. Recent trends show mixed signals in this arena. Minnesota lags the nation in business formation, ranking 49th among all states in the number of new businesses per 100 persons. Like other economic indicators, Minnesota also faces racial disparities in entrepreneurship that must be addressed. Overall entrepreneurship has slowed overall in Minnesota over the past two decades, reflecting broader national trends of declining business formation. However, the state ranks 4th nationally in five-year business survival rates. This suggests that Minnesotans may start fewer businesses, but those that do get off the ground are more likely to survive past their early stages.

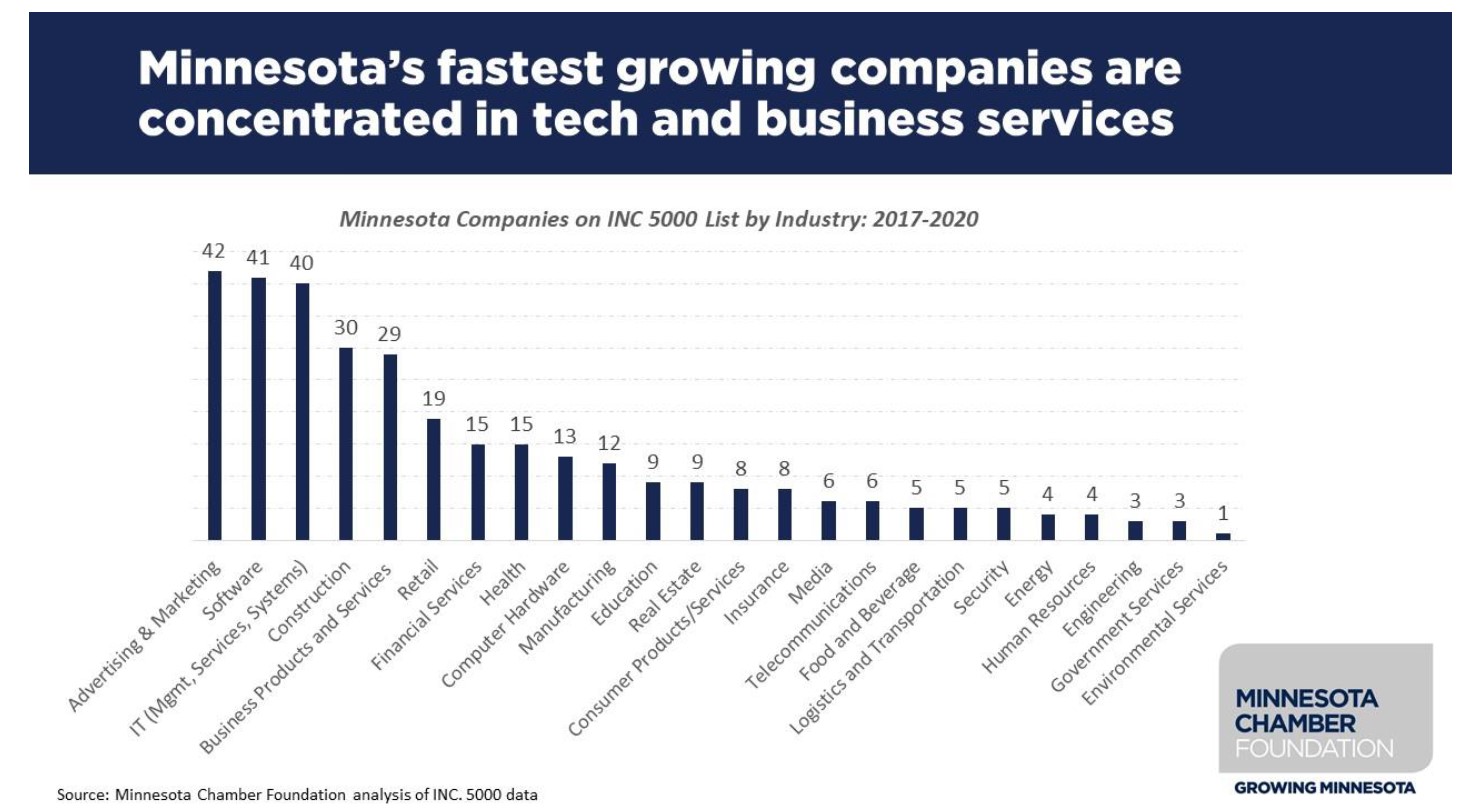

A look at high-growth companies also reveals emerging strengths in Minnesota’s entrepreneurship landscape. Business magazine, Inc., publishes an annual list of the nation’s 5,000 fastest growing private companies. In 2020, eighty Minnesota companies made the Inc. 5000 list, with 52 of those being repeat honorees. Together, these 80 businesses generated $1.6 billion in revenue and created 4,466 jobs. The state’s fastest growing companies have been clustered in digital technology, marketing and advertising, and other business services, again demonstrating the importance of advanced service industries in Minnesota’s economy. Many also relate in some way to health care, reflecting the significance of Minnesota’s important health care economic cluster.

While the number of Minnesota businesses listed among the nation’s fastest growing companies has declined over the past five years, venture capital trends point in a more favorable direction. Minnesota recorded all-time highs for new venture capital deals in Q4 2019 and Q3 2020 – driven largely by health insurance startup Bright Health. In fact, Minnesota had its best year ever on this measure in 2019 with $908 million raised.v Additionally, Minnesota witnessed its two largest IPOs on record in 2018 and 2020, with Ceridian HCM Holdings and Jamf raising a combined $930 million in initial public offerings.vi These successes coincide with the emergence of a growing number of startup initiatives, funding efforts, and support services providing Minnesota entrepreneurs with much needed resources to invest and grow in the state. Notably, some of these initiatives bring greater focus to underrepresented groups, including entrepreneurs of color, women and Greater Minnesota communities.

![]()

What’s next for Minnesota’s financial and corporate sector?

10-year economic forecast

1. Forecasting outcomes for company headquarters is difficult.

Forecasting future outcomes in sectors like corporate headquarters is difficult due to the outsized impact that a relatively small number of firms could have on the overall sector. Decisions by just a handful of companies could produce significant variations in outcomes for the sector. This is somewhat less true for professional services or finance and insurance, both of which have a greater number of businesses populating their industry.

2. 10-year forecasts show mixed results, with growth shifting toward professional, scientific and technical services.

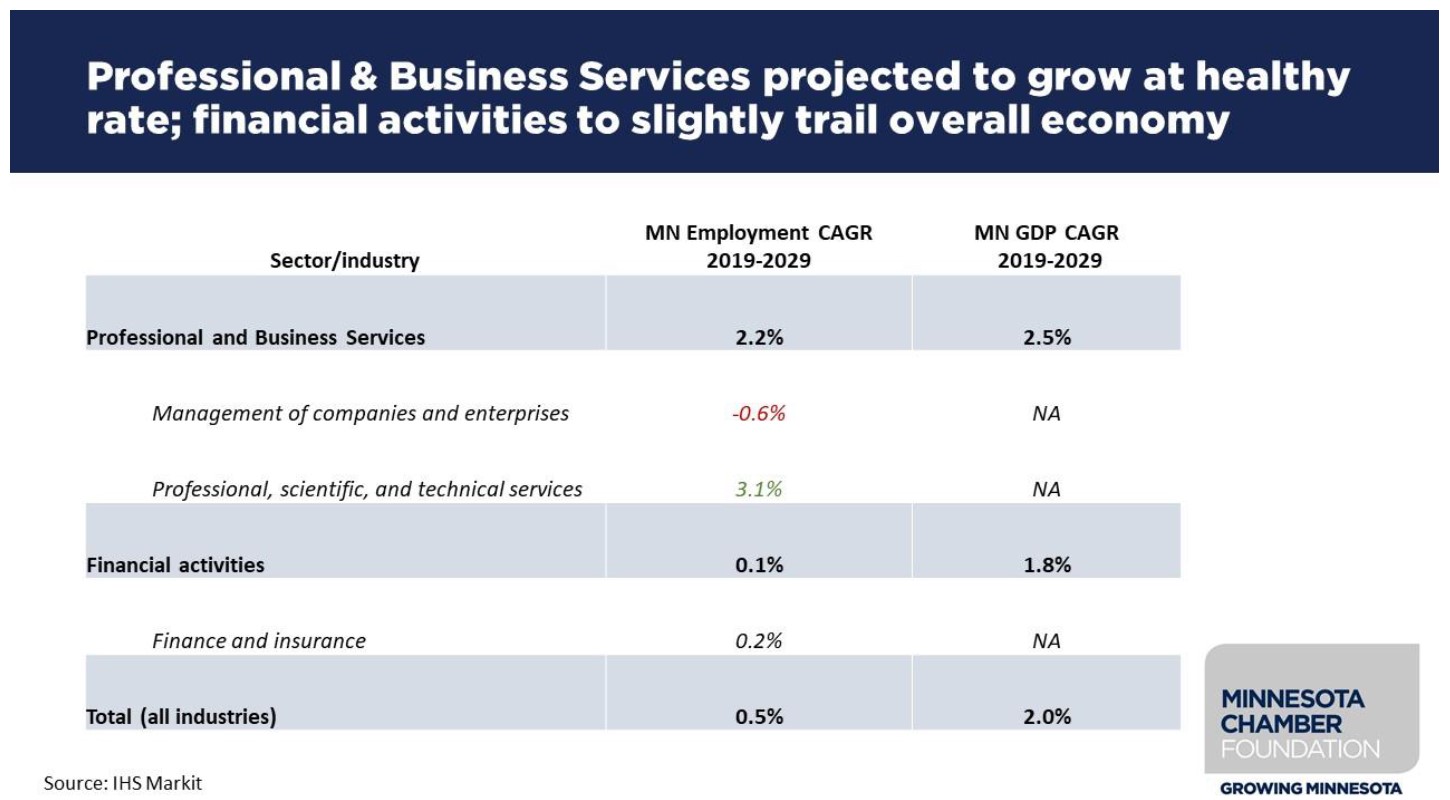

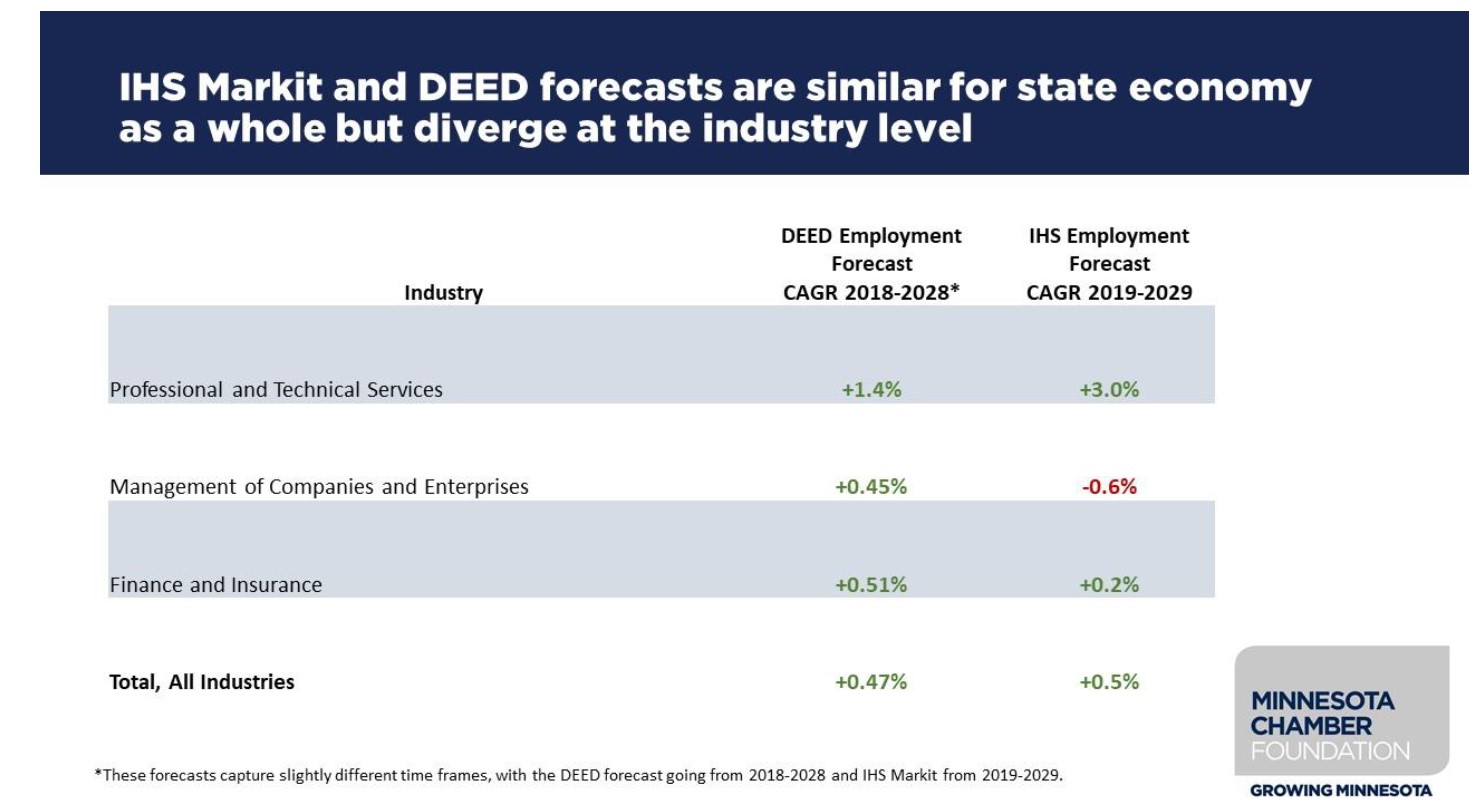

Noting with caution the difficulty in forecasting outcomes for the management of companies industry, it is worth examining sector projections for the coming decade to understand the potential levels of growth that can be expected. IHS Markit’s ten-year forecast projects mixed results for Minnesota’s corporate and financial sector. They project total employment in the Professional and Business Services supersector, which includes management of companies and professional, scientific, and technical services, will expand at an average annual rate of 2.2%, with GDP growth of 2.5% a year. Both would be well above the projected growth rate for the state’s economy as a whole. The Financial Activities supersector, which includes finance and insurance, is forecasted to add jobs at a slower pace of 0.1% annually, with GDP growing at 1.8% per year, more in line with projections for the overall economy.

The mix of growth across these three sectors is projected to be concentrated in professional, scientific and technical services, with finance and insurance experiencing near flat job growth and management of companies projected to shrink slightly. This underwhelming forecast for headquarters jobs could be due to a continuing emphasis on productivity gains and/or greater levels of outsourcing to the professional services and administrative services sectors.

The Minnesota Department of Employment and Economic Development (DEED) forecasts a more balanced mix than the IHS Markit forecast, projecting modest growth in management of companies of 0.45% annually from 2018-2028, and professional services growth at a pace of 1.4% annually. The difference in time frame between the two prevents a direct comparison, but this contrast may also demonstrate a level of uncertainty and the range of possible outcomes involved in such future-looking exercises.

3. The corporate and financial sector will require more talent, particularly in areas like software development and data analytics.

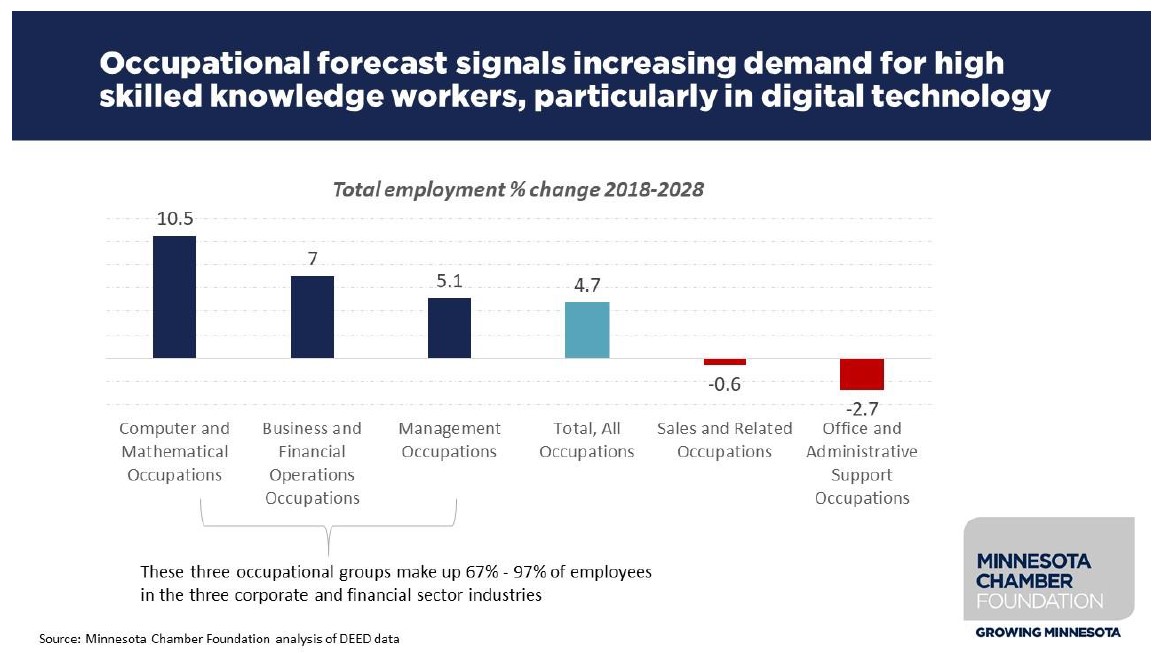

Regardless of overall growth, it is likely that the mix of jobs within these industries will increasingly shift toward higher-skilled positions. The demand for and availability of talent – whether managerial, operational, or technical – will play a significant role in Minnesota’s ability to sustain the growth of its corporate sector going forward. The Department of Employment and Economic Development’s long-term forecast shows particularly strong growth in computer and math occupations, with jobs in this group projected to grow at over twice the rate of all occupations. This includes jobs in software development, data security, and statistical analysis.

Insights from focus group meetings with leading Minnesota companies also suggest that important talent needs and demands are increasingly being felt within their companies. While Minnesota possesses a strong talent pool overall, it is not clear the state is producing tech workers in sufficient numbers to meet this growing demand. That is a concern relative to this important segment of Minnesota’s economy. If this is indeed the focus of job growth – and adequately skilled workers cannot be found within Minnesota – that job growth is likely to occur elsewhere. It is safe to say that the future of Minnesota’s corporate sector will be largely dependent on Minnesota’s ability to foster and provide greater numbers of skilled workers in these important fields.

Discussion: Trends shaping the future of corporate and financial activities:

National and global trends are also shaping Minnesota’s future. For example, the economic shock of COVID-19 and the ensuing recession and recovery accelerated responses such as remote work and e-commerce. Impacts on commercial real estate could alter the future of downtown business districts, or even change location decisions for companies. Below we examine what early indicators suggest about such trends and what this might mean for Minnesota.

- Future of corporate offices and headquarters campuses: The dramatic acceleration of remote working during the COVID-19 pandemic has raised questions about the future of corporate offices, including large headquarters campuses. Will the future continue the recent shift where work becomes more decoupled from physical office locations? Will businesses move away from core urban centers to less expensive real estate. Will businesses opt permanently for flexible work schedules – and what would this mean for Minnesota corporate headquarters locations that have traditionally gathered hundreds or thousands of employees under one roof or on one campus?

Much remains unknown, and short-term trends may not endure into the future. But recent surveys suggest the future will include more flexible work arrangements and office settings, rather than a wholesale return to pre-pandemic norms. Similarly, a future where vast majorities of workers work only from home seems unlikely. But even a partial shift to greater work-from-home could impact corporate real estate and downtown business districts.

A September 2020 survey by CBRE showed that 73% of companies anticipate allowing more employee choice over where and when they work, but only 3% expect that the bulk (three-quarters or more) of their employees will be fully remote in the future. Indeed, 100% of businesses said that office locations remain important for collaboration and innovation, company brand and culture, and social interactions among employees.vii Flexibility, rather than largescale dispersal, therefore appears a more likely outcome. As a report by WeWork states: “[T]he pandemic has helped business leaders realize [sic] that it doesn’t need to be a choice between one or the other. It’s about designing spaces that allow for flexibility of use. There isn’t one blueprint of office design that works for all.”

The impact of the pandemic and remote work experience on dense urban centers remains another open question. Cities and downtowns could be reshaped by the rise of remote work, but they will undoubtedly continue in some form as powerful engines economically. As research by Richard Florida suggests, the availability of highly skilled knowledge workers remains the preeminent factor for corporate location decisions.ix This argues against the potential uprooting of headquarters from large urban areas altogether. As Florida states, “a likely outcome is a more distributed hub-and spoke system of corporate location, with major headquarters facilities in urban centers, surrounded by satellite complexes to service remote workers.x It is too early to make conclusions about the future of work, but it seems likely that areas with highly-skilled workforces, competitive business climates, and key assets like major regional airports will continue to attract private sector investment for years to come.

Yet, even a modest long-term shift toward remote and flexible work arrangements presents opportunities and risks. On the plus side, companies in high-cost coastal regions could look to states like Minnesota as an attractive alternative that combines a highly-skilled workforce with lower costs of living. Remote work arrangements could present opportunities for Greater Minnesota communities as well. A more remote workforce would allow Greater Minnesota businesses to expand the hiring pool without the need to relocate employees to larger cities.

Remote work employees at Twin Cities businesses could potentially move to smaller communities while keeping their metro-based job, providing a population boost to suburban and rural communities well beyond the metro area.

These same trends also present risks, however. Minnesota’s headquartered companies could potentially circumvent the state’s slow growing labor force by looking for talent able to remotely work from elsewhere.

Minnesota’s opportunities to grow the corporate and financial sector

Minnesota has an opportunity to leverage its significant advantages in corporate headquarters, professional services and financial activities this decade. The state’s leading companies continue to perform well, and a pipeline of fast-growing companies show encouraging signs for the future.

The state’s professional, scientific and technical services sector has also grown at a healthy rate in recent years and is projected to continue expanding faster than the overall state economy this decade. Across all three industries, talent will be the key factor in shaping success, as job growth continues to shift toward higher-skill positions.

The state also faces challenges and risks that must be addressed in the coming years. Employment projections signal slowing job growth for corporate headquarters and the finance and insurance sector in the next decade. This may be further exacerbated by Minnesota’s own slowing labor force growth that has struggled to supply sufficient numbers of workers in high-demand occupations. We’ve heard directly from leading Minnesota companies that the demand for large and diverse talent pools has often meant that investment in new jobs and offices occurs outside of the state. Despite some notable successes, entrepreneurship has also lagged in Minnesota in recent years with gaps continuing to exist for entrepreneurs of color. Finally, changes in remote work present both opportunities and risks that must be addressed as the state prepares for its post-pandemic future.

This combination of opportunities and challenges requires a strategic response from Minnesota’s public and private sectors. Below is a framework for addressing these issues:

1. Prioritize diversity and tech talent to ensure a dynamic corporate sector future.

This is not a new issue, but it remains the elephant in the room for Minnesota’s business community. This is particularly true for global companies looking across the U.S. and beyond for where best to invest in jobs and offices.

Business leaders in our discussions made clear that diversity and talent are only increasing in importance – and that both will be critical factors in determining whether Minnesota remains a corporate headquarters location long term.

A number of initiatives are already underway to address the dual imperative of diversity and talent, such as Greater MSP’s Make.It.MSP. Building on these types of initiatives across the state will be critical this decade.

2. Leverage affordability and address business climate concerns.

Affordability cuts two ways. Minnesota offers a lower cost of living than many peer states, particularly compared to the nation’s “superstar cities” challenged by soaring housing costs, congestion and gentrification. At the same time, Minnesota’s business climate is less competitive than many fast-growing regions in the sunbelt and mountain west.

Minnesota cannot continue to be successful as a hub for leading companies if it remains both a low population growth and high business cost state. Leveraging the state’s relative affordability, while improving its business climate could be a critical success factor over the decade.

3. Develop focused efforts to retain investment and capture greater shares of the job and business expansion of existing leaders and rising stars.

Business location decisions make headlines. But a far greater number of jobs is won or lost each year in the decisions Minnesota companies make about where or whether to expand and grow nationally and internationally. We’ve heard directly from headquartered companies that acknowledge not choosing Minnesota as a place to add new jobs or invest capital. In some cases, diversification or market development drove those decisions. In other cases, it was access to talent or the ability to source employees from other, deeper talent pools. Some businesses choose to keep management functions in Minnesota, while growing production or operations in states with larger talent pools or more favorable business climates.

Capturing a greater share of investment from current Minnesota companies – whether existing sector leaders or fast-growing new startups – should be a top priority for Minnesota. Coordinated efforts to retain a greater portion of the jobs and/or capital investments Minnesota companies may make elsewhere could be a major economic growth strategy for the state. Programs like “Grow Minnesota!” from the Minnesota Chamber of Commerce play a critical role in helping Minnesota’s top employers and fastest growing companies connect to resources and overcome barriers that might otherwise prompt an investment of capital or the growth of jobs elsewhere, encouraging those companies to grow in Minnesota.

4. Build on startup activities to seed the ground for the next homegrown star. A number of startup funding and support initiatives have emerged in recent years.

These investments are critical to Minnesota’s ability to continually build its pipeline of high growth-potential companies. Medtronic was once a startup. United Healthcare was once a startup. Even 3M and Mayo Clinic were once startups. Minnesota’s newest company with a compelling new idea could be the Medtronic or United Healthcare of the future. What do they need? What resources and support mechanisms would be helpful? How can we facilitate and support their future growth and success? States that successfully support entrepreneurs and startups are investing in their own economic future. Minnesota should strive to be best in class in nurturing and supporting its next generation of rising economic stars.

5. Explore remote work as a way to grow corporate/financial employment outside the Twin Cities metro.

Minnesota’s corporate and financial activities are largely clustered in the Twin Cities metro region, but many companies in this sector have facilities in greater Minnesota. While the full future of remote work is uncertain, Greater Minnesota communities should be aggressively seeking to leverage remote work opportunities as a trend to their benefit. This could occur in two ways.

First, regions and communities could work with existing companies to help identify and expand hiring pools beyond their immediate location. Doing so could enable companies to find the workers they need to grow while maintaining their operations in Greater Minnesota.

A second opportunity involves promoting Greater Minnesota’s quality workforce and quality of life – and their lower cost – to recruit corporate professionals now able to work remotely who may prefer Greater Minnesota’s lifestyle and livability advantages. This could grow the local economy of smaller communities by attracting well-paid workers to live and work in their region, rather than in the Twin Cities. Attracting two dozen highly-paid technical workers, for example, with the lifestyle benefits of living in a smaller community, would be the rough equivalent of attracting a medium-sized tech or professional services company – benefitting the community’s economy in much the same way. Greater Minnesota should view the move to flexible and remote work arrangements as an employment and community growth opportunity.