Minnesota: 2030 industry chapter: Health care and medical innovation in Minnesota’s economy

Health care and medical innovation in Minnesota’s economy

Overview: Minnesota’s health care innovation opportunity this decade

Minnesota has an opportunity to further establish itself as a global leader in health care innovation over the next decade. The health care landscape is undergoing significant shifts. Technology advancements, consumer engagement, coverage innovation, consumer-driven delivery, device innovation, evolving risk-sharing, remote care and telehealth are exciting opportunities. In contrast, rising demand, demographic change, rising costs and growing financial pressures, among other factors, will create challenges.

The strongest health care innovators will survive and thrive in the coming decade. This bodes well for Minnesota. Change brings both opportunity and risk for Minnesota consumers, employers, providers, insurers and producers across the health care value chain. Minnesota has demonstrable underlying strengths that position it exceptionally well to capture opportunities amidst change, not least because of Minnesota’s enviable cast of health care leaders as across delivery, insurance, data analytics, consumer insights, biotechnology, medical devices and other health care technologies.

Success is not guaranteed. Minnesota’s health care sector faces challenges and competition from internet companies, retail giants and scores of other entrants large and small across the globe. These emerging innovators and competitors could threaten – or further empower – Minnesota’s medical cluster. Stakeholders in the state’s business community, public sector, and industry support sectors should consider strategic choices that could further strengthen this critical aspect of the state’s economy.

We recommend a series of strategic aims that would provide investment and support where Minnesota’s health care cluster needs it most. Such strategies include:

- Unlock the potential of technology-fueled growth through smart investments in infrastructure, talent and regulatory changes.

- Acknowledge the economic importance of Minnesota’s health care cluster to reinforce and advance Minnesota as a center of global health care innovation.

- Retain investments from existing medical companies.

- Foster and support high-growth medical startups.

- Address workforce availability through local/regional partnerships, regulatory reform, and talent attraction and retention strategies.

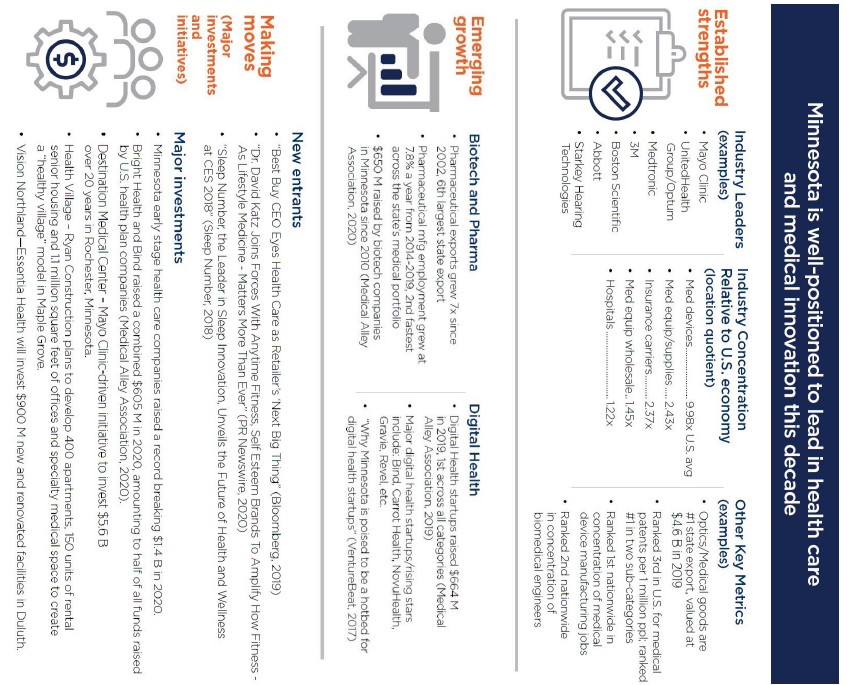

Exhibit 1. Minnesota is positioned to lead in medical innovation this decade

How is Minnesota’s health care and medical technology sector performing?

1. Health care has transformed Minnesota’s economy, positioning the state as a hub of medical innovation.

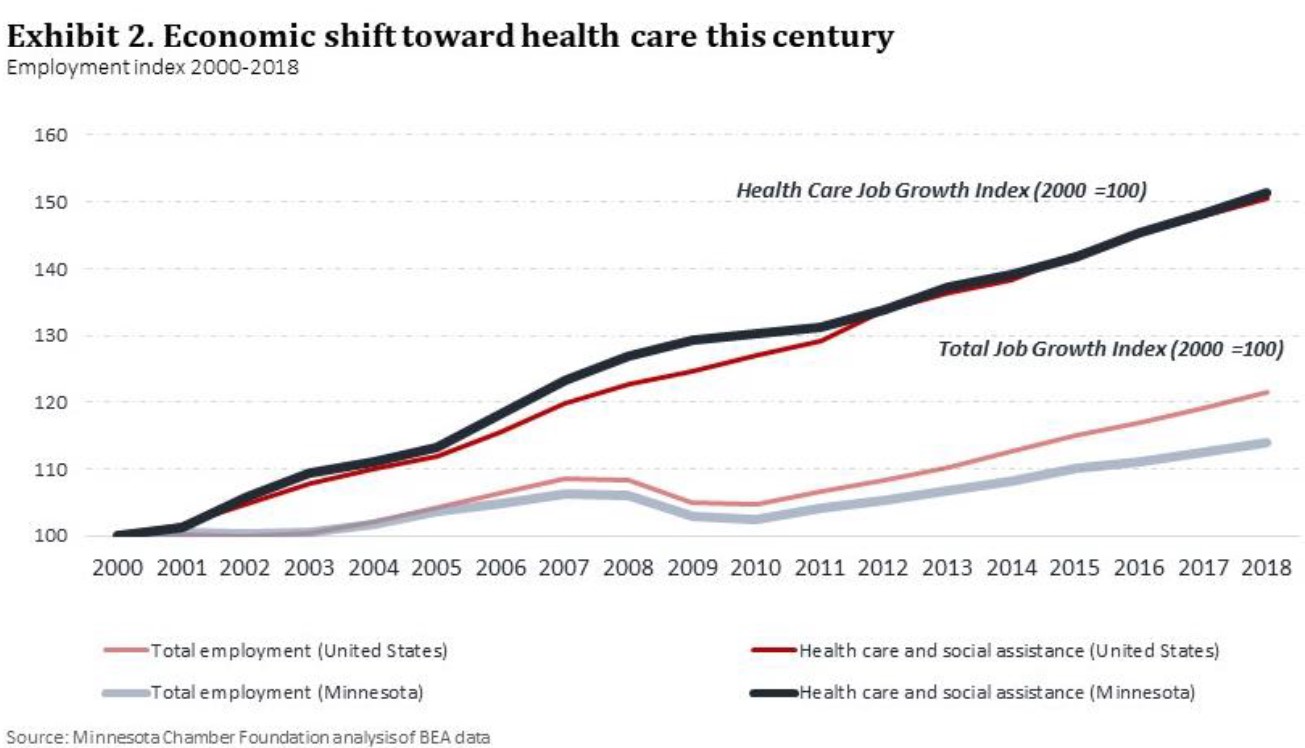

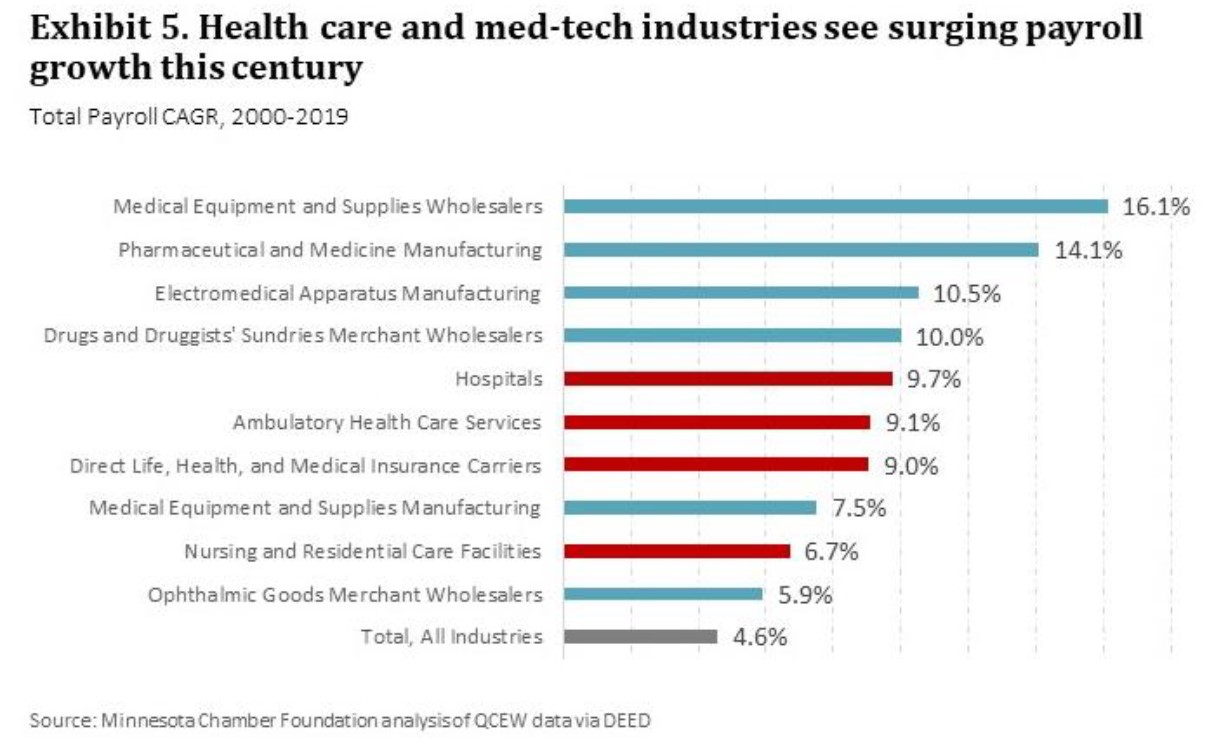

Health care and health care technologies have reshaped Minnesota’s economy over the past three decades. Health care and social assistance employment more than doubled and GDP increased more than five-fold since 1990, becoming the largest sector of the state’s economy.

Growth in health care compensated for the state’s overall lag in job growth relative to U.S. levels in that time. Minnesota now has the 8th highest concentration of health care services jobs in the U.S.

What makes Minnesota’s healthcare sector distinct, however, is not only the size, scope and depth of its health care delivery sector, but also the presence of medical innovation leaders across Minnesota’s various health care sectors.

Minnesota is a national hub for health care innovation, from electromedical device manufacturing (9.9x the national average) and insurance (2.4x national average) to leading delivery systems and research universities. In recent years, Minnesota has also seen emerging growth in bio-technology, pharmaceuticals, and digital health care, pointing to a new phase in Minnesota’s evolving health care landscape.

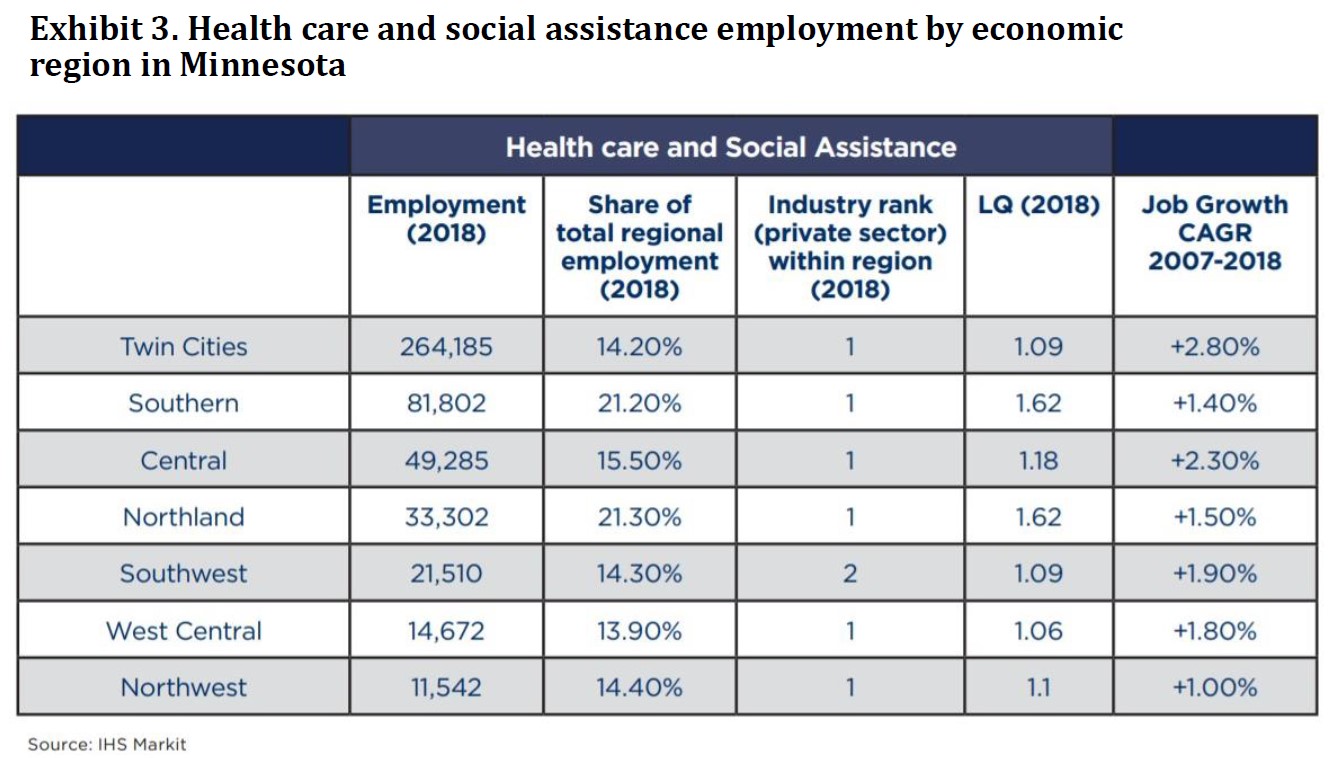

Additionally, Minnesota’s health care delivery sector is distributed widely across the state’s regions. In 2018, health care and social assistance was the leading private sector employer in six of the state’s seven regions, with major players such as Mayo Clinic, CentraCare, Essentia and Sanford Health investing heavily in Greater Minnesota facilities. While medical devices and supplies are concentrated in the Twin Cities, research from Munnich and Horan shows that Greater Minnesota companies are also generating substantial supply chain activities relating to the medical device and supply industry, dispersing the impact more broadly.i

2. Recent trends show mixed results for delivery and insurance; devices and supplies continue to grow at healthy rate.

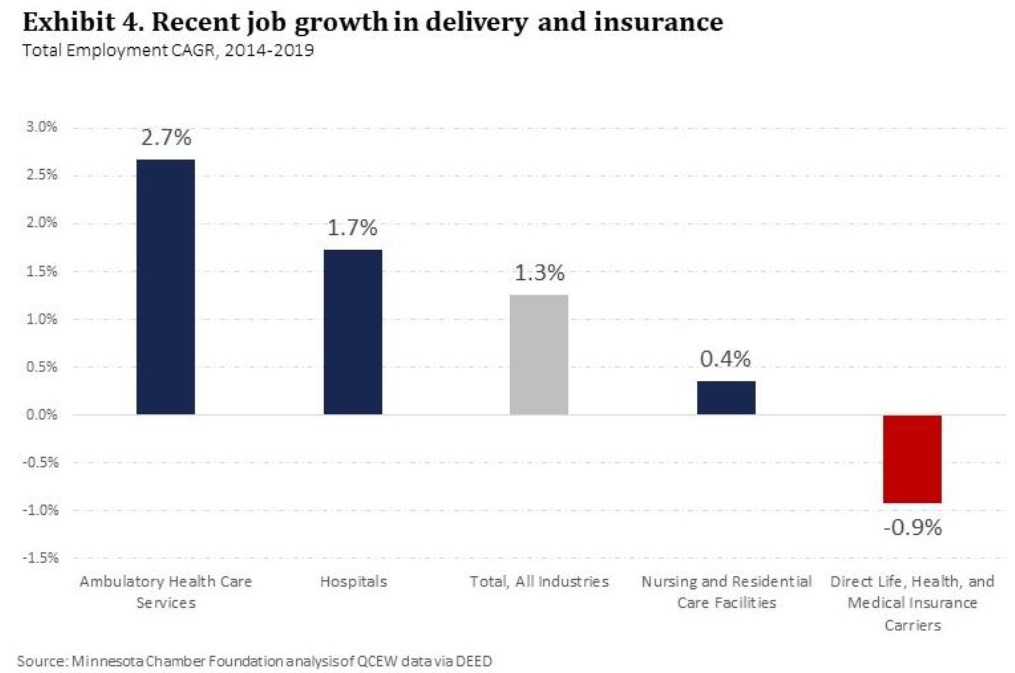

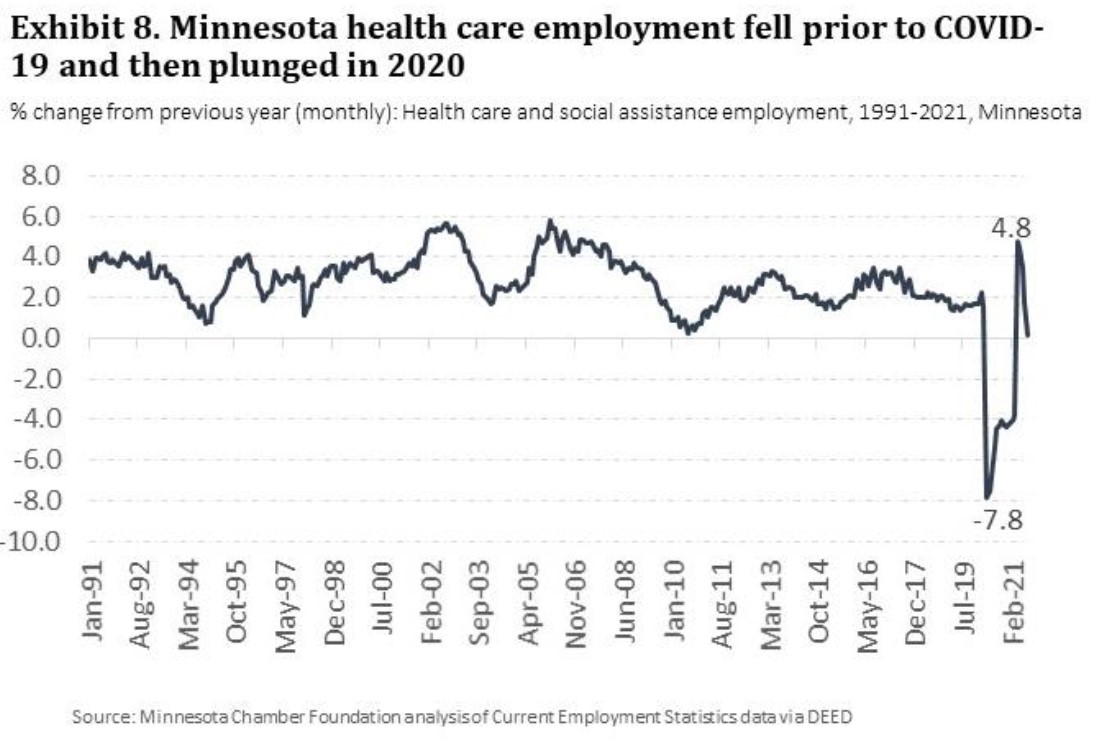

Since 2014, growth in the sector remained stable, but slowed from past years. Total employment in health care delivery grew by 2.1% annually from 2014-2019, while health insurance employment fell 0.9%. Within the health care delivery sector, ambulatory health services grew the fastest at 2.7% annually, reflecting the broader shift toward outpatient services. Hospital employment expanded by 1.7% annually, while nursing and residential care employment grew at just 0.4% over the past five years.

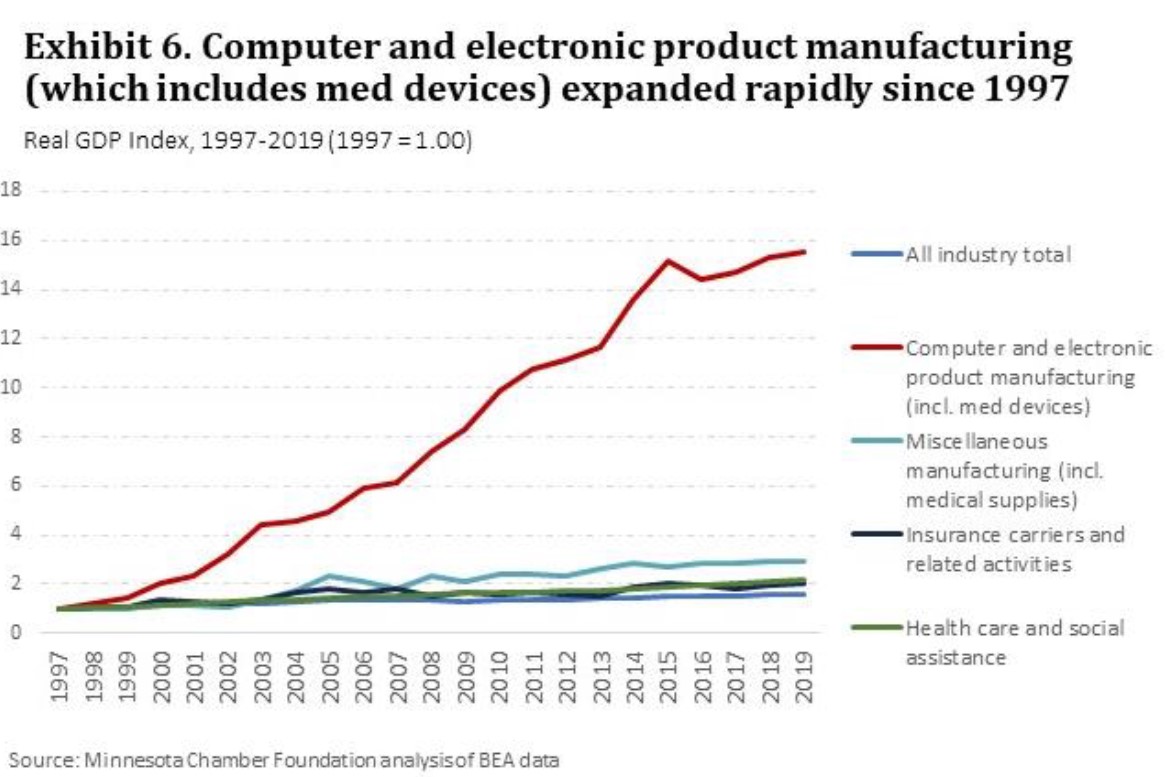

The state’s core medical technology industries – electromedical device manufacturing and medical equipment and supplies manufacturers – grew at a healthy annual rate of 2.4% and 2.6% respectively. And while GDP estimates are not available at the detailed industry level, the Computer and Electronic Product Manufacturing sector – which includes medical devices – expanded at an annual rate of 8.1% from 2007-2019, making it an unparalleled engine of growth in the state’s economy.

3. Consolidation and regional investments present opportunities and risks.

The health care delivery sector has seen continued consolidation, growing clustering of services, and strong capital investment in regional hubs. Notable investments by Mayo Clinic in Rochester and Essentia in Duluth, among others, will continue to shape their regional economies for years to come. This continuing trend toward growth and regional consolidation reflects the importance of scale and the push for operational efficiency in the delivery sector.ii The consolidation trend cuts both ways, however, as small and rural providers struggle to gain scale or succumb amidst increasing financial pressures. As the Center for Rural Policy and Development notes, 69% of hospitals in entirely rural counties had unhealthy (i.e. low or negative) profit margins in 2018, with an average margin of 0.1%. By comparison only 32% of hospitals in entirely urban counties experienced unhealthy margins, and overall averaged profit margins of 6.2%.iii This continuing pressure on rural providers presents an especially difficult challenge and risk to maintaining health care access for Minnesotans in less populated areas of the state.

4. Emerging growth in bio-tech, pharmaceuticals, and digital health; unconventional players entering the field.

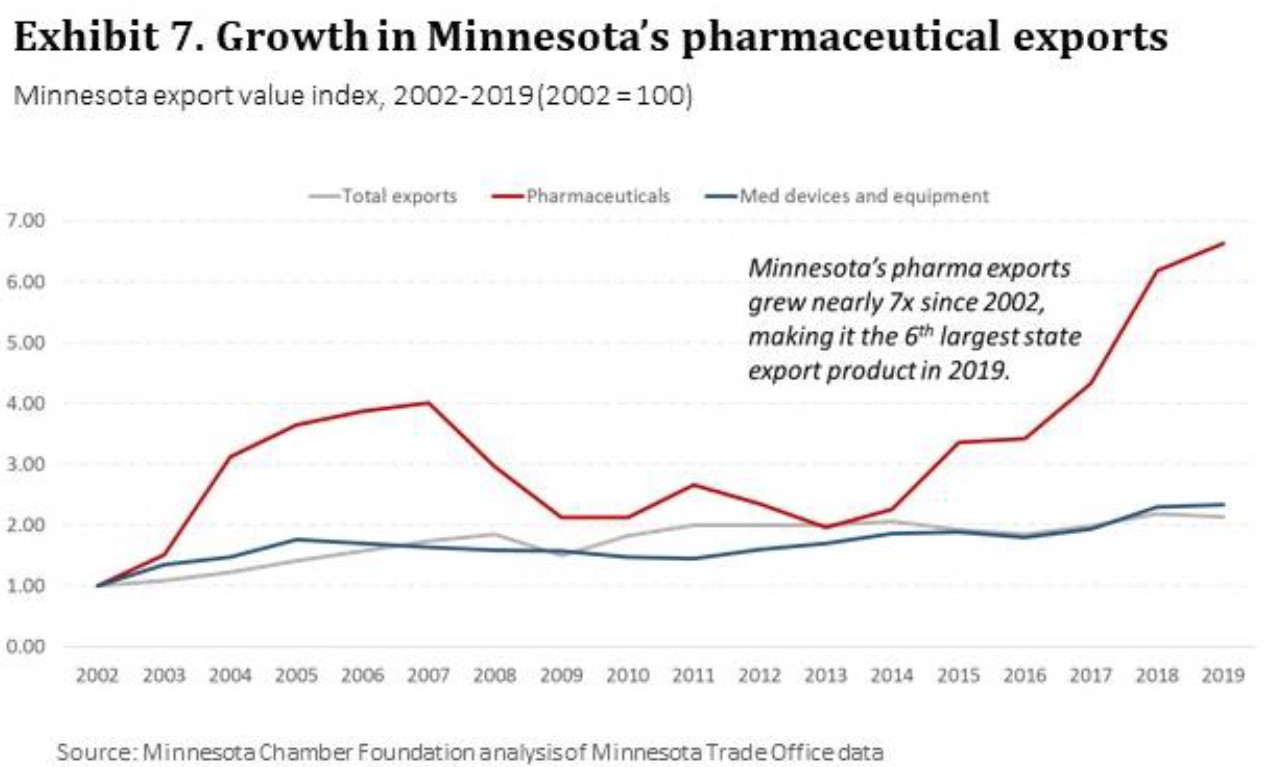

Despite Minnesota’s relatively small bio/pharmaceutical footprint, the state has seen growth and value-creation in this sector. Pharmaceutical manufacturing was the fastest growing segment of the state’s medical portfolio over the past two decades. Total export value of Minnesota pharmaceuticals grew seven times in that time, making it the state’s 6th largest export product despite its much smaller employment size. Major investments from drug manufacturers such as Takeda and Upsher-Smith demonstrate growing traction for Minnesota in pharma.

Digital health care is another growth industry. While standard industry classifications create measurement challenges, Medical Alley Association’s 2019 Investment Report shows that digital health led all categories of startups, raising $664 million in new capital. As digital technology reshapes the broader health care sector, Minnesota’s existing firms are increasingly becoming technology companies. Firms such as Optum, Bright Health and Mayo Clinic, among others, represent some of the nation’s leading innovators in digital health technology and analytics.

Industry shifts and innovations are also attracting new players to the sector, with retailers like Best Buy and fitness centers like Self Esteem Brands, the parent company of Anytime Fitness, making large investments in health care-related business lines.

5. The COVID-19 pandemic exposed strengths and vulnerabilities in Minnesota’s health care sector.

Despite significant challenges and immense strains on Minnesota’s health care delivery sector, Minnesota’s broader medical sector fared better under COVID-19 than hard-hit sectors like leisure and hospitality, which contracted by over 50% in March and April. Total employment in Minnesota’s health care and social assistance sector fell -2.9% in 2020, and insurance carrier employment fell by -6.8% from the previous year. The state’s medical technology industries remained more stable in 2020, as demand for a variety of COVID-19 related medical goods rose worldwide. Employment in electromedical and electrotherapeutic apparatus manufacturing (i.e. medical devices) fell by just -1.5% year-over-year, and medical equipment and supplies manufacturing actually expanded by 1.5%. As of Q1 2021, Minnesota’s medical related industries continued to recover, with all except insurance carriers climbing within 2 percentage points of 2019 employment levels.

The COVID-19 pandemic revealed vulnerabilities as well. The loss of revenue streams for hospitals and clinics intensified pressures on providers – particularly in rural communities – as routine and elective care consumption fell. The combination of COVID-19 and falling revenues could force further consolidation or closures in the future. This creates risks for consumers and communities alike in the form of lost access to health care services and lost economic activity.

![]()

What’s next for Minnesota’s health care sector?

10-year economic forecast

1. Health care and social assistance sector employment projected to recover by 2022, though uncertainty remains.

According to 2021 state forecast data from IHS Markit, Minnesota’s health care and social assistance sector is expected to reach pre-pandemic employment levels by late 2022. Over the ten-year timeframe of Minnesota: 2030, health care and social assistance is forecasted to expand at a 0.8% average annual rate. Of course, many factors could influence the speed of recovery, including the effectiveness of ongoing efforts to contain the spread of COVID-19 itself – but deeper dynamics are shaping the industry as well. The forecast for Minnesota’s larger health care and social assistance sector provides useful insights for the future trajectory of health care employment levels nonetheless.

2. Forecasts did not predict firm-level innovation and expansion in the past – and may not accurately project innovations of the future.

Economic forecasting cannot anticipate the specific decisions and outcomes of individual businesses. For example, Medtronic’s annual net sales increased over 477% from 1995-2005, contributing significantly to the expansion of Minnesota’s medical device sector. More recently, the rapid growth of Bright Health has given Minnesota its first true unicorn, with the three-year old company reaching a valuation of $2.2 billion in 2019.vi Because such success stories are inherently not built into forecasting models, forecasting the future outcomes of a sector as dynamic as health care is difficult – particularly when future growth may be driven by aa relatively small number of high growth-potential firms in areas such as digital health, bio-tech, pharmaceuticals, insurance and medical devices. Looking at planned investments and recent trends may provide a better outlook for the state’s future in these industries (see exhibit 1).

Discussion: Trends shaping the future of health care

The concurrent forces of rising global healthcare demand, rising costs and technological disruption are driving significant trends that will impact healthcare in coming years. Some of the trends potentially shaping the health care sector over the next decade include:

- Shift to value-based care: Health care is being reshaped by a shift toward value-based care delivery, whereby providers are rewarded for patient-based outcomes rather than the volume of services provided. Value-based care delivery models prioritize prevention, wellness, quality, cost reduction and specialized carevii, all of which reorient incentives and risks across the health care value-chain.

- Coordination across the continuum of care: The increasing focus on patient outcomes is leading to greater coordination between providers and partners. As the Center for Rural Policy and Development states, “The value-based payment philosophy offers incentives for hospitals to coordinate care across multiple service areas, creating a continuum of care that is both preventative and reduces in-patient admissions and readmissions.” The American Hospital Association recognizes this as one of four key strategies to improving performance in value-based care models.ix This trend toward coordination across the care continuum is creating new opportunities for collaboration and partnerships.

- Digital transformation and interoperability: Advancements in both medical science and new technologies are fundamentally changing health care services and products. Technologies such as artificial intelligence, machine learning, advanced analytics and Internet-of-Things (IoT) bring significant opportunities to scale the collection and use of Big Data.x Such advancements aim to improve patient outcomes and reduce costs. However, restrictions on information sharing between providers and partners remains a barrier to realizing the full potential of these technologies and thus limits improvements to coordinating care across systems. As Lehne et al. put it:

- “Digital data are anticipated to transform medicine. However, most of today’s medical data lack interoperability: hidden in isolated databases, incompatible systems and proprietary software, the data are difficult to exchange, analyze, and interpret. This slows down medical progress, as technologies that rely on these data – artificial intelligence, big data or mobile applications – cannot be used to their full potential.”

- “Digital data are anticipated to transform medicine. However, most of today’s medical data lack interoperability: hidden in isolated databases, incompatible systems and proprietary software, the data are difficult to exchange, analyze, and interpret. This slows down medical progress, as technologies that rely on these data – artificial intelligence, big data or mobile applications – cannot be used to their full potential.”

- Information security: With the opportunities of interoperability come challenges related to data safety and security. A 2019 report from Deloitte suggests that health care providers and partners should “consider collaborating to create an environment to help raise the bar and improve how they share information safely and securely.” This could be done through “consistent use of data standards and open APIs and protocols” and could “improve access to and interoperability of EHR systems by enabling the flow of data from different applications and platforms, while maintaining privacy and security standards.”

- Telehealth/virtual services: COVID-19 has accelerated the use of virtual visits and telehealth services. Such changes could impact the health care sector in the next decade, producing opportunities but also risks. During a Minnesota: 2030 focus group in November 2020, one Minnesota health care provider stated they conducted more virtual visits in one day (during the pandemic) than they did in all of 2019. Indeed, the CDC reports that during a one-week surveillance period in March 2020, “telehealth visits increased 154% (p<0.05), compared with the same week in 2019.” Even in the first three months of 2020 (much of which was prior to the pandemic), approximately 1,629,000 telehealth visits were conducted, a 50% increase from the 1,084,000 encounters in the same period in 2019.xv These statistics likely understate the overwhelming shift toward virtual visits in 2020. While future levels of telehealth are unknown, providers indicate that whatever their post-COVID reality becomes, it will not be a mere reversion to 2019 practices.

- New entrants and competitors: As technologies and business models change, new entrants outside the traditional health care sector have emerged. PwC states, “powerful global forces are transforming the industry into a nimble, innovative and modular ecosystem serving the consumer, with profound implications for players new and traditional.”xvi They suggest this trend is driven by three underlying forces: a.) growing demand in emerging nations that may allow for greater experimentation in health care products and services; b.) a shift toward outpatient services and direct consumer engagement driven by rising costs and overburdened facilities; and c.) growing demand in wellness and prevention, a market estimated to have reached $1.49 trillion globally in 2014.xvii Recent moves from companies like Walmart, Apple, Google and Amazon illustrate this trend and create new competitive threats to Minnesota’s health care and med-tech sectors. However, this diversification of stakeholders also brings opportunities as well for Minnesota companies such as Target, Best Buy and Sleep Number who are able to adapt and create value in this changing environment.

- Cost pressures are creating greater consolidation and shifts to outpatient services: As providers struggle to balance the gap between costs and reimbursements, many are pressured to consolidate, merge or shift services from in-patient to out-patient settings. McKinsey estimates that hospitals’ share of revenue from out-patient services grew from 30 percent in 1995 to 47 percent in 2016.xviii While some of this revenue is merely shifted from in-patient to out-patient settings within the same hospital system, some of it leaks out to new competitors and more convenient sites of care, such as urgent care clinics, free standing emergency departments and retail clinics.

In addition to the growing reliance on out-patient services to control costs, providers are turning to consolidation, mergers and acquisitions. This may be particularly true in rural areas that lack large patient pools. The Center for Rural Policy and Development states, “the ongoing shifts in the health care market, particularly given the impact of COVID-19, will be significant and long-lasting. Therefore, we can expect horizontal and vertical mergers and acquisitions to continue into the future, and along with them, continued consolidation of services away from smaller rural providers and toward more centralized locations within the larger population centers.”

- Workforce challenges: Finally, like many other sectors, challenges surrounding its future workforce create a significant hurdle to be overcome this decade. Workforce shortages in health care are not unique to Minnesota. The United States and countries around the world are struggling to build an adequate pipeline of physicians, nurses, and other practitioners to meet demand, particularly in more rural regions.xxi This challenge involves both the total number of available health care workers, as well as the skillsets they bring into the workplace. Indeed, the adoption of innovative technologies is dependent on the ability of workers in the health care field to utilize them well. Deloitte states, “while workforce-focused technologies are being introduced with increasing frequency, they may not attain their full clinical value if health system employees are not equipped to adopt and use technologies in the most efficient and effective way. Furthermore, clinical staff likely need to understand, and be able to convey to patients, the benefits that digital technologies can bring while being confident that the technology meets the requisite regulatory and data protection standards.” For Minnesota, widespread technology skills are clearly needed not only in the health care delivery sector, but also in insurance, medical goods and related industries as well. Minnesota’s response to these and other health care trends will be critical if the state is to capture its best growth opportunities and further its enviable position as a global healthcare innovation leader.

Minnesota’s opportunities to grow the health care and med-tech sector

Minnesota has numerous strengths that position the state to lead in health care innovation this decade, fueling future growth in the state’s economy and contributing to the health and well-being of people around the world. As COVID-19 has revealed, the global population relies on the medical knowledge, technologies and goods produced by Minnesota’s health care sector. Yet, challenges and risks must be addressed for Minnesota to fully capture the opportunities at hand. Below are some recommendations that should be considered to grow the state’s medical sector this decade:

Address barriers to technology-fueled innovation through smart investments in infrastructure, talent and regulatory changes.

As stated earlier, transformative technologies are poised to ripple throughout the health care sector this decade, providing opportunities for value-creation, improved health outcomes, and cost efficiencies. However, these innovations can be unlocked only to the extent that regulatory environments, infrastructure, and workforce capabilities allow. Minnesota has strengths to build on but is also lagging in other important areas that could inhibit innovation. Attention to these issues may further Minnesota’s ability to carve out distinct competitive advantages against peers in the U.S. and around the world.

- Regulatory barriers to interoperability and virtual care: Minnesota has long prided itself on developing innovative care models and rigorous data privacy rules. However, there are some important areas in which Minnesota finds itself an outlier with respect to its health care regulatory framework. For example, Minnesota is currently one of only 7 seven states that mandates parity in payment for telehealth services with relative to those care provided in-person, regardless of the differences in costs or outcomes associated with these respective care settings. This requirement was passed in 2015, and was originally intended to ensure the growth and development of a robust menu of telehealth services in Minnesota. It was part of nation-leading legislation at the time that put Minnesota at the forefront of telehealth law and regulation. But the explosion of telehealth during the COVID-19 pandemic has fundamentally changed its role in our health care system and may warranting a fresh look at Minnesota’s laws. Thoughtful, flexible, and forward-looking policies will could and should balance the expectations of providers, payers and patients while leveraging the many benefits of telehealth to increase access to care, address health care disparities and inequity, improve quality and outcomes, and lower costs. The absence of such policies could instead act as a barrier to expansion of telehealth in the state, potentially inhibiting both the economic benefits of efficient care delivery and the access to services that a more robust deployment of virtual care would enable.

Additionally, Minnesota’s past innovations in data privacy has cut both ways. On the one hand, Minnesota has developed rigorous rules to protect patient confidentiality through state level regulations. Minnesota’s Health Records Act – which was created prior to national HIPAA laws – now leaves the state with overlapping and redundant rules that actually work against efforts to better coordinate patient care, improve outcomes, and lower costs. Similarly, Minnesota similarly places unnecessary restrictions on the use of its All- Payer Claims Database, significantly limiting its usefulness as a tool to leverage de-identified health insurance claims data to lower health care costs and improving the quality of care. As a result, a state report card from the University of California Hastings College of Law that assesses each state’s progress on price transparency efforts gave Minnesota an unimpressive grade of a “C” in 2020, (though an improvement from improving from an “F” grade in 2017).

While a full analysis of these such issues is beyond the scope of this report, Minnesota should assess and address such the barriers to innovation it may have inadvertently created by modernizing its rules in these and other critical areas.

- Workforce training: As new technologies accelerate in health care, the skillsets of Minnesota’s medical workforce will be required to evolve as well. This includes equipping doctors, nurses and other practitioners with skills to leverage these technologies effectively. But it also includes meeting the rising demand for tech talent (software developers, data scientists and analysts, systems analysts, and so forth) across delivery, insurance, and medical goods industries. The recent announcement of Google’s first Minnesota facility in Rochester is emblematic of this growing fusion between technology and medicine. Minnesota’s ability to foster continued investment from health care leaders will be dependent in no small part on its ability to cultivate the tech talent needed expand such activities in the coming years.

- High-speed broadband: Minnesota will also require broad and reliable digital connectivity across the state to advance access to care and support health care activities. Broad access to high speed internet is not just an economic imperative but also a public health imperative, especially for rural areas with fewer care providers in their communities. Minnesota should take steps to fast track its goals to provide border-to-border connectivity.

Acknowledge the economic importance of Minnesota’s health care cluster to reinforce and advance Minnesota as a center of global health care innovation.

Minnesota’s health care cluster is tremendously important to the state’s economy. But often even Minnesotans don’t recognize Minnesota’s health care sector as the global innovation leader and economic growth engine it really is. Acknowledging the economic importance of Minnesota’s health care cluster is important to reinforcing and stewarding its growth. Not only is Minnesota home to leading health care companies, but the state also has notable assets in emerging areas such as retail health, wearables and wellness. Not to mention the complementing wellness components of the food sector which have overlapping talent and infrastructure needs.

Fostering collaboration and cross-industry partnerships could help Minnesota better compete against Silicon Valley and other high-tech hubs around the world in growing our health care sector in the years to come. Several initiatives are already underway to promote Minnesota as a global hub of health care innovation, including Medical Alley Association’s national branding campaign to attract talent, investment and profile and its Healthcare Transformation Initiative, the newly created Global Wellness Consortium, the Health Village development in Maple Grove, and Rochester’s Destination Medical Center which will invest $5.6 billion over 20 years. All are foundational elements intended to build on the success of Minnesota’s health care cluster that also have the potential to bring in additional communities and stakeholders along the way. Part of Minnesota’s efforts to reinforce and steward its health care cluster should aim to help Greater Minnesota communities diversify their medical portfolios, including supporting startup and expansion activities for healthcare-related companies outside of the delivery sector.

Retain investments from existing medical companies.

The economic powerhouses within Minnesota’s health care cluster continue to grow and expand. But too often that growth is not happening in Minnesota. There are several reasons. In some instances, that employment growth in Minnesota may be limited by access to talent. The state’s tax and regulatory climate may play a role. Or individual companies may be consciously diversifying geographically for strategic reasons of their own. Whatever the reason, Minnesota is demonstrably losing a portion of that potential employment growth to other states and nations. Despite Minnesota’s many strengths, the state needs to improve its ability to retain a greater portion of that growth and investment by the state’s existing health care industry leaders. The state’s challenges in this area are not limited to healthcare. A shortage of available workers in key areas of need, such as software development – as well as business climate concerns – contribute to companies in many industries and sectors adding headcount and capital investment in places like Texas and Colorado, rather than Minnesota.

Remote work arrangements could heighten the challenge if top talent chooses to live in warmer, lower-cost states while working for a Minnesota employer. This is particularly important as Minnesota has traditionally benefitted from spin-off ventures emerging out existing companies, such as Optum or Bright Health. Minnesota should consider how it can better retain top talent and increase the likelihood that healthcare spin-offs and job creation is happening here, not elsewhere.

Foster and Support high-growth medical startups.

One of Minnesota’s greatest success stories is the history of its many startup companies that have created entire industries. Medtronic was once a startup. United Healthcare was once a startup. 3M was once a startup. Mayo Clinic was once a startup. Startup creation has been one of the great threads of Minnesota’s economic history. Some of that success was the result of geography. But much of it was the result of individual ingenuity, hard work and good fortune. Despite Minnesota’s many strengths, the state does not have strong mechanisms to support and foster potential new high-growth medical startups, and needs to improve its ability to spur new startup growth and retain investments made by the state’s existing industry leaders. A number of recent programs have been developed to better attract and support high-growth potential startups, including startups in the medical sector such as gBETA Medtech. While these early efforts are promising, businesses and public leadership should seek to build on these efforts, devoting particular attention to medical-related startups.

Address workforce availability through local/regional partnerships, regulatory reform, and talent attraction and retention strategies.

Minnesota will need more workers across health care and med-tech fields this decade. This includes workers in health care delivery – nurses, physicians, support staff, etc. – as well as individuals with health care knowledge working in related fields. For example, software developers with basic knowledge of the health care industry will be valuable in Minnesota’s insurance and medical technologies industries. Other industries – such as long-term care and home health care – have already faced significant challenges finding and retaining workers, with this challenge poised to only intensify over the next decade.

While no one solution can solve this challenge, targeted industry programs can help. Health care providers are already investing in workforce initiatives to help build a pipeline of skilled and diverse talent for the industry. For example, Mayo Clinic is investing in attracting young and diverse talent into gateway healthcare careers. This program not only seeks to attract and train talent for existing jobs such as nursing assistant and medical assistant, but also to foster career paths through which graduates gain valuable work experience that can help them decide to further their training and education to advance to higher-level positions and certifications. This is one example of many already operating across the state, but more attention will be needed to attract and train the health care workers necessary to grow Minnesota’s health care cluster through 2030.