Minnesota: 2030 industry chapter: Tech sector

Minnesota’s tech economy

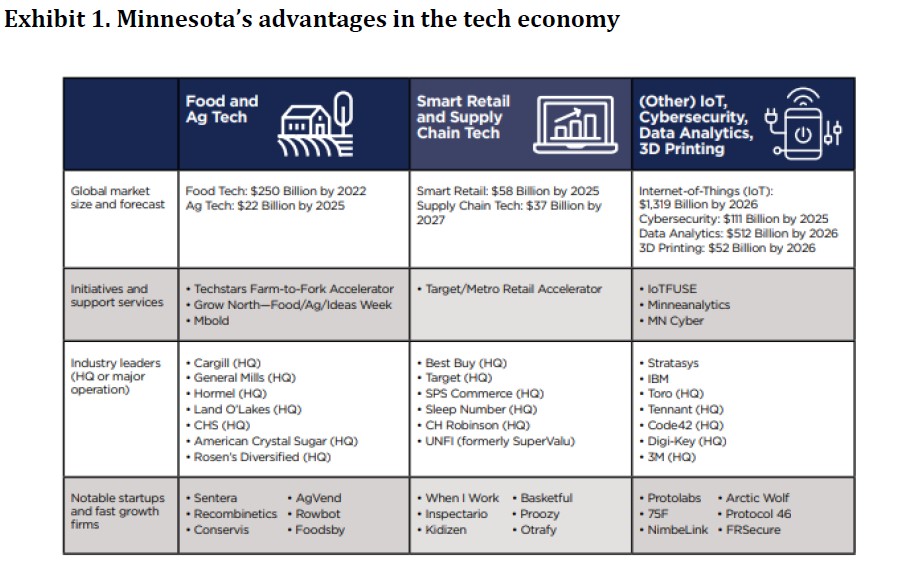

Overview: Minnesota’s tech opportunity this decade

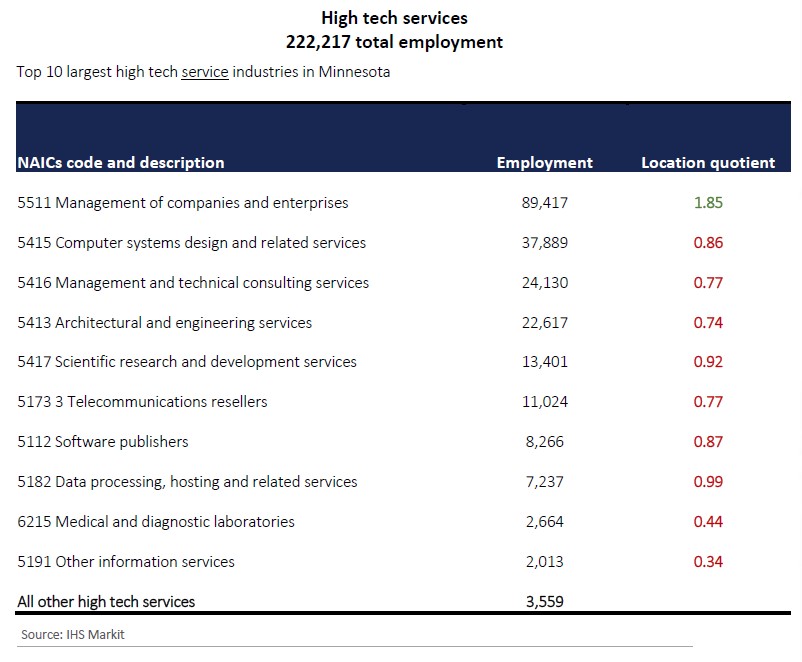

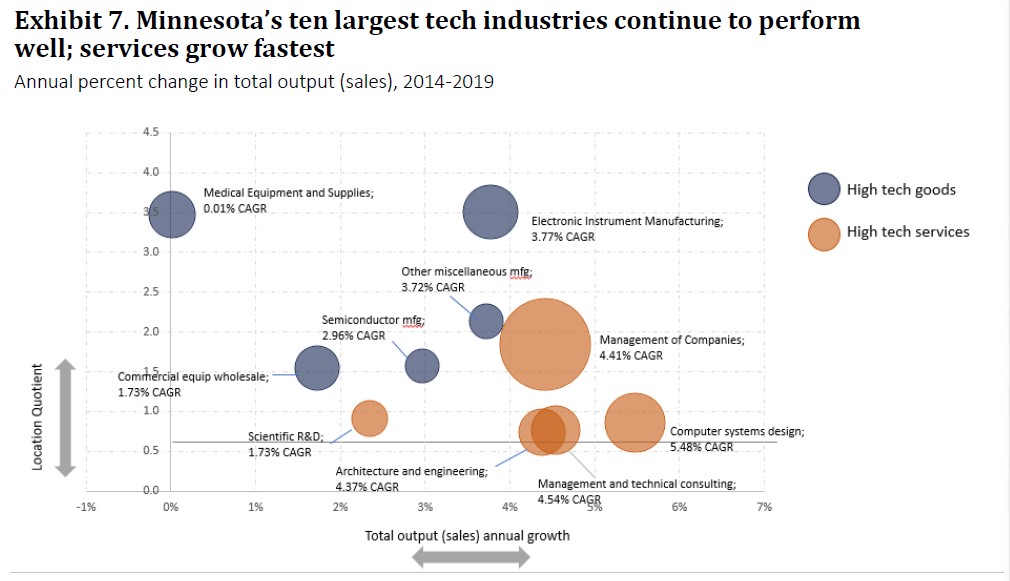

Management of companies/corporate headquarters, medical technology and electronic instrument manufacturing are the state’s leading drivers of high-tech activities, generating a large share of the state’s patents and innovations. While slightly less concentrated than the U.S. average, Minnesota has a substantial number of jobs in tech services broadly, including computer systems design, management and technical consulting, and architecture and engineering services.

Minnesota has high employment concentrations relative to the U.S. in advanced industrial sectors such as metal ore mining, transportation equipment manufacturing, and machinery manufacturing. These industries have smaller employment footprints but include firms with high market shares and significant export components relative to sales. Machinery, vehicles and metal ores, for example, comprise three of the eight largest Minnesota export sectors in 2019, contributing a combined $5.34 billion in state exports, or nearly a quarter of the state’s total export value.

Minnesota’s under-the-radar strengths in technology are a positive, helping drive Minnesota’s economic future. Our relative under-performance in some fast-growing high-tech subsectors, such a software publishing and data hosting/processing, also explains why Minnesota has lagged faster growing states in GDP and employment growth in the last decade. Our comparative lack of high-flying tech successes this decade may also act as a reputational drag on growth, as fast-growing companies and startups have tended to cluster in tech growth clusters, such as Silicon Valley, Seattle, Austin or Boulder.

Challenges also exist. Competition for skilled high-tech workers is intense, and Minnesota needs to improve its supply of available tech workers to take advantage of the growth opportunities ahead. Falling short in educating and training tech talent will constrain our future growth – and may already be constraining growth in key tech sectors. Minnesota must:

- Understand the trends in technology jobs and industries with recommendations for the education and workforce development sectors.

- Leverage existing industry strengths to lead in areas like Internet-of-Things (IoT), fin-tech, digital health, ed-tech, automation, cybersecurity and data analytics.

- Transform education and workforce training programs to prepare for a high-tech future.

- Build on recent programs to accelerate high tech startups.

How is Minnesota’s tech sector performing?

1. Minnesota’s tech sector is large, diverse and stronger than many know. Service industries make up the largest share of high-tech jobs, with high concentrations in headquarters, medical goods, and electronic controls.

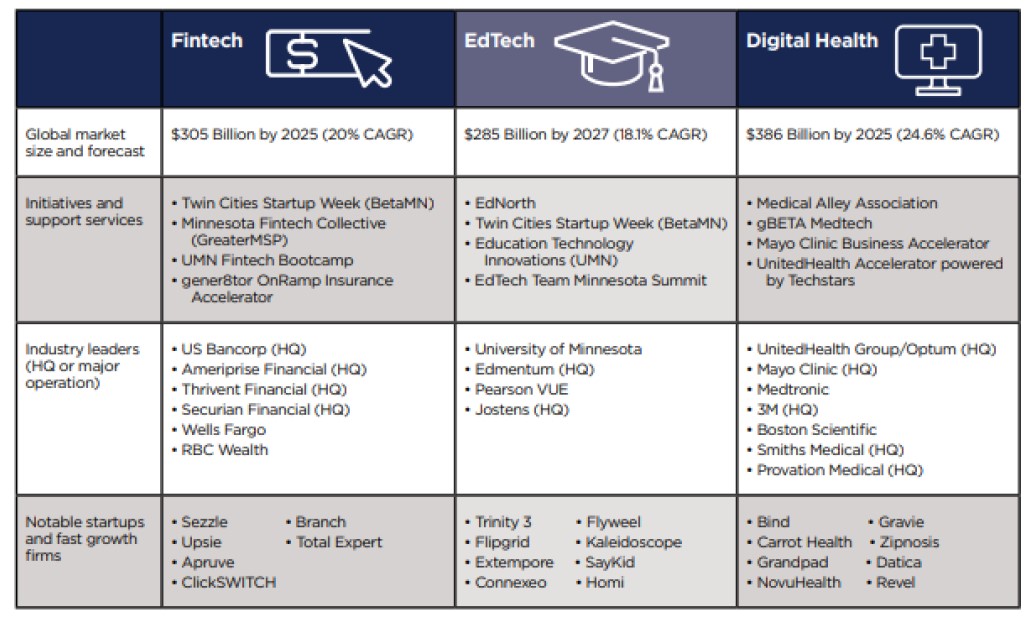

The high-technology sector accounted for 380,263 jobs in 2019, comprising 12.4% of Minnesota’s total non-farm employment, above the U.S. share of 11.9%. The state’s share of high-tech jobs ranked 13th highest among all states and the District of Columbia.

Using the CompTIA Cyberstates definition that includes tech occupations across any industry, Minnesota ranks 11th nationally for its share of the workforce in tech jobs. Leading tech occupations include software and web developers, systems and cybersecurity analysts, and network architects/admin/support. CompTIA’s 2020 report estimates the combined economic impact of Minnesota’s tech workforce at $31 billion annually.

Exhibit 2. Overview of Minnesota’s Tech Sector

2. Minnesota has trailed the U.S. in tech growth, but core industries continue to perform well and emerging investment in new startups shows signs of future growth.

Minnesota’s high tech sector represents a paradox of sorts. Three divergent facts must be viewed together to take in a full picture of the state of high tech in Minnesota.

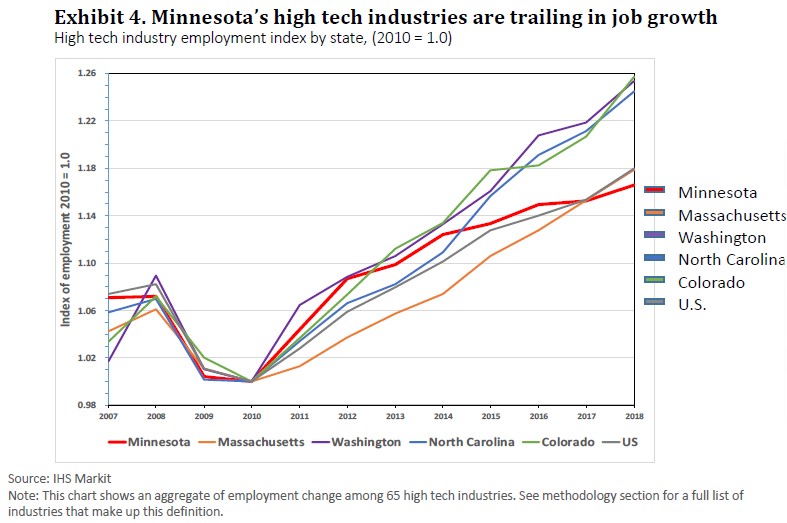

- The state’s tech sector – whether defined by tech industries or tech jobs in any industry – has expanded slower than the national average and substantially slower than leading tech states.

- However, Minnesota’s largest tech industries like corporate headquarters, medical goods, electronic instruments, and computer systems and design services have continued to perform well. Additionally, other service industries like management and technical consulting and architecture and engineering services have grown at a fast pace in recent years.

- Finally, while Minnesota spent most of the past two decades lagging in tech startup activity and funding, the state has seen recent gains that point the way to a more promising future. Venture capital is on the rise and several notable software and cybersecurity companies have made large fundraising efforts in the past several years.

Below we examine these three trends to further illuminate the state of high tech in Minnesota.

Paradox – Part one: Minnesota tech boomed in the 70s, 80s and 90s, but has trailed the U.S. tech sector this century.

Changes in technology and shifting industry trends played a significant role in Minnesota’s fast growth in the 1990s and subsequent slowdown in the 21st century. IHS Markit points out Minnesota was well positioned for the IT boom in the 1990s, as the state’s economic ecosystem had already developed to enable high technology activities. Minnesota’s historical leadership in mainframe computing and high-tech manufacturing “provided both the business infrastructure and the skilled workforce which had been attracted to the area to support the innovation economy.”

Minnesota’s employment in computer systems design grew faster than in California through most of the 1990s. In the 21st century information economy, however, “internet and software engineering capabilities in Silicon Valley displaced other tech centers due in part to the outperformance of universities like Stanford and innovative companies like Xerox.” Minnesota remained a top innovation economy in a diverse range of industries, such as health care and medical technology, corporate headquarters and electronic instruments manufacturing, but the shift from hardware to software put Minnesota at a relative disadvantage.

Analyzing employment trends in 25 different industries related to information technology reveals that “the level of employment in Minnesota’s IT sector began dropping sharply [after 2000] and has remained at about the same level since the mid-2000s, as IT employment in other states started to rise after a trough in 2010.” Some of that employment loss is explained by significant productivity gains in IT. Total real output in the IT sector grew at an annual rate of 2.7%, well above 1.6% in the private sector. As a result, productivity, defined as real output per worker, rose in the IT sector at an annual rate of 3.8% compared to only 1% in the private sector.

Even accounting for these productivity gains, Minnesota’s IT sector simply has not kept pace with the nation’s tech

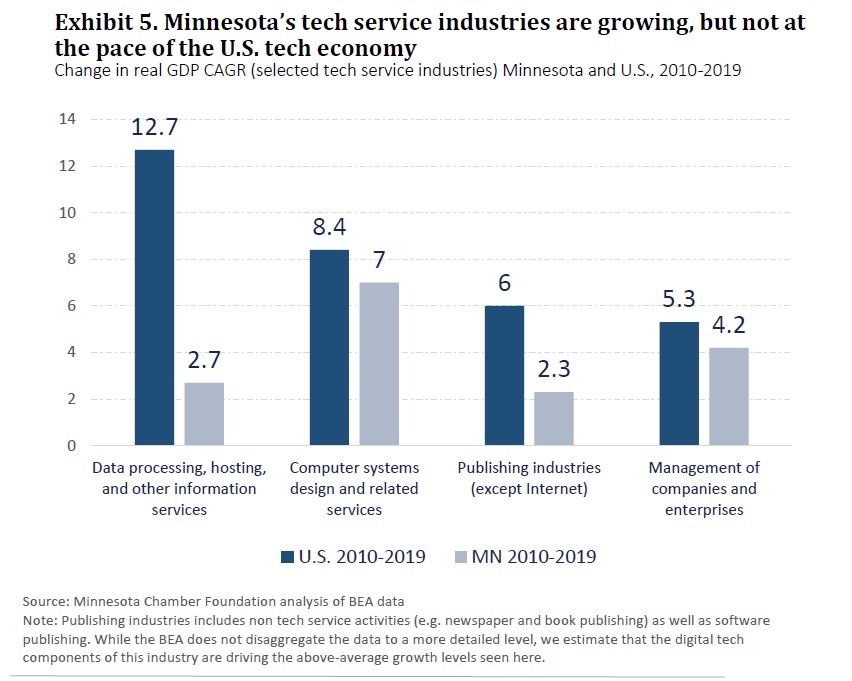

centers, nor has it kept pace with the U.S. as a whole. From 2010-2019, Minnesota’s core digital technology industries lagged U.S. growth in both employment and GDP, expanding employment by a total of just 21% compared to 54% nationally. As exhibit 5 shows, data hosting, processing, and other information services accelerated at a rapid annual rate of 12.7% nationally in terms of GDP from 2010-2019, while Minnesota trailed significantly with just 2.7% growth annually. In fact, a study from the Brookings Institution shows that the Minneapolis-St. Paul MSA ranked near the bottom of the top 100 largest metros in IT services job growth in recent years.

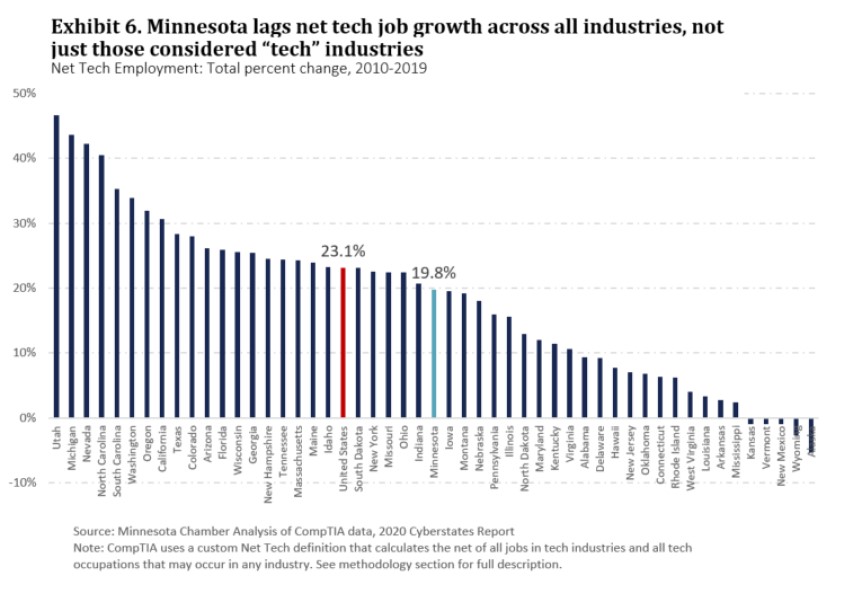

A similar picture emerges when looking at occupational data across all industries, and beyond those typically categorized as “tech or IT” industries. Between 2010 and 2019, CompTIA calculates that Minnesota’s Net Tech Employment grew a total of 20%, ranking 26th across all states.viii Minnesota trailed peer states such as Wisconsin, North Carolina, Colorado, Washington and Massachusetts. Minnesota tech job growth even trailed other Midwestern states, including Michigan, Ohio, Indiana and South Dakota. Narrowing the focus to just computer occupations, Minnesota’s state ranking dropped to 49th in IT occupational job growth from 2014-2018, further demonstrating the sluggish growth in IT jobs.

Minnesota may have been able to push past its below-average job growth in software and tech services in the short-term due Minnesota’s continued innovation in other areas. But the state’s long-term economic competitiveness could be threatened if Minnesota continues to cede ground in these important industries. In fact, it would seem almost a certainty.

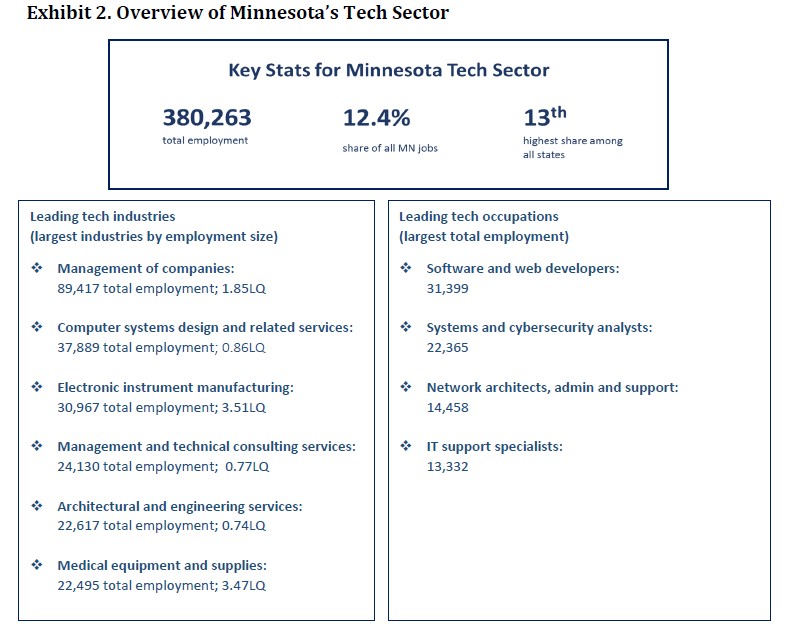

Paradox – Part two: Core tech industries like headquarters and med-tech continue to perform well, while high tech services see fastest growth

Though Minnesota’s growth has trailed areas like software and IT services, its core high technology industries continue to thrive. Corporate headquarters, medical technology, and key high tech manufacturing sectors such as semiconductors, electronic instruments, and other miscellaneous manufacturing (which includes specialized industries like sports and athletic equipment) have performed well. A more detailed look also shows strengths in high tech subsectors, such as industrial controls and measuring devices, or other industrial machinery (which includes additive manufacturing). This actually positions the state for growth in emerging areas likes IoT, automation and 3D printing. As digital technologies transform businesses across all industries, Minnesota is also poised to see tech jobs grow in key Minnesota sectors such as health care, food and agriculture, and manufacturing.

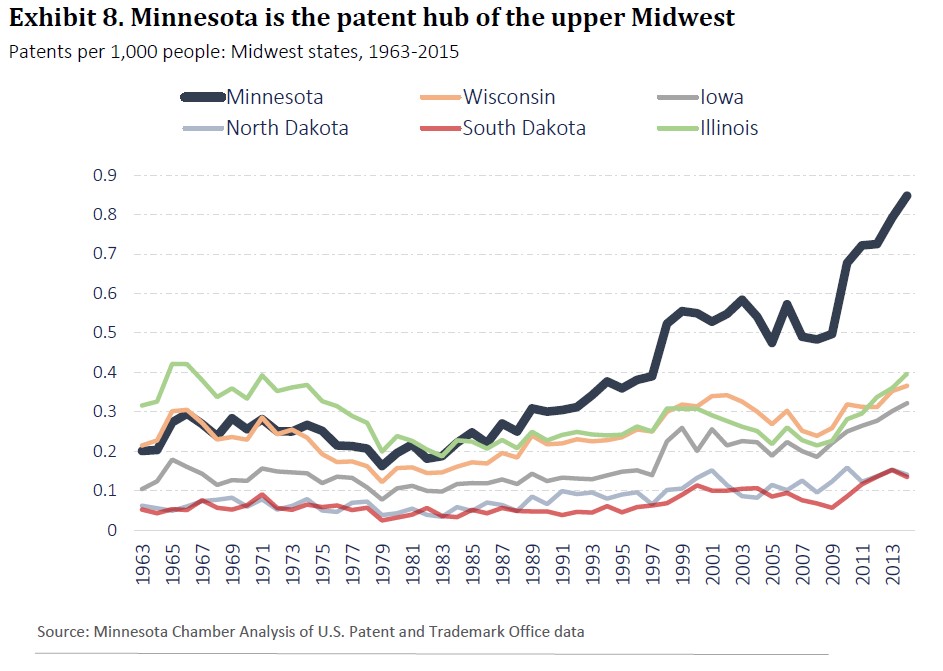

Minnesota’s specialized high-tech activities have also driven patent activity in recent years, further establishing Minnesota as the patent hub of the upper Midwest. Patent activity in Minnesota slowed after a surge in the 1990s. However, starting around 2009, Minnesota patents accelerated, surging far beyond regional peers and tracking closely with top patent-producing states such as California, Washington and Massachusetts. As noted in health care and medical innovation, medical technologies make up the largest share of patented products and processes in Minnesota, demonstrating the outsized role this industry plays on the state’s high-tech landscape.

Finally, underrepresented industries, such as computer systems design, management and technical consulting, and architecture and engineering, made up the fastest growing portion of Minnesota’s high-tech portfolio since 2014, suggesting emerging strengths in high tech services. For example, computer systems design and related services grew GDP at a rapid 7% pace annually from 2010-2019. Employment in management and technical consulting grew 3% annually over the past five years, far above the rate of job growth for the state’s economy overall. In total, Minnesota’s high-tech service industries expanded by a total of 6% between 2014 and 2019, compared to 4.8% growth in high-tech goods.

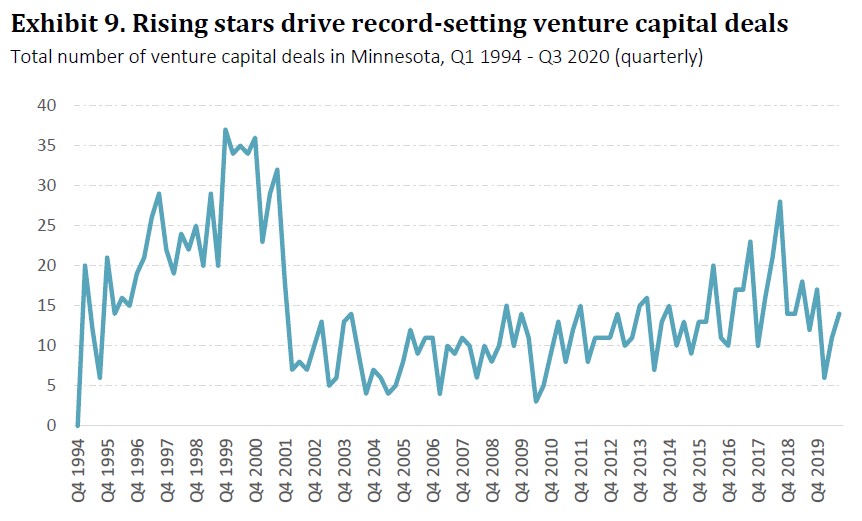

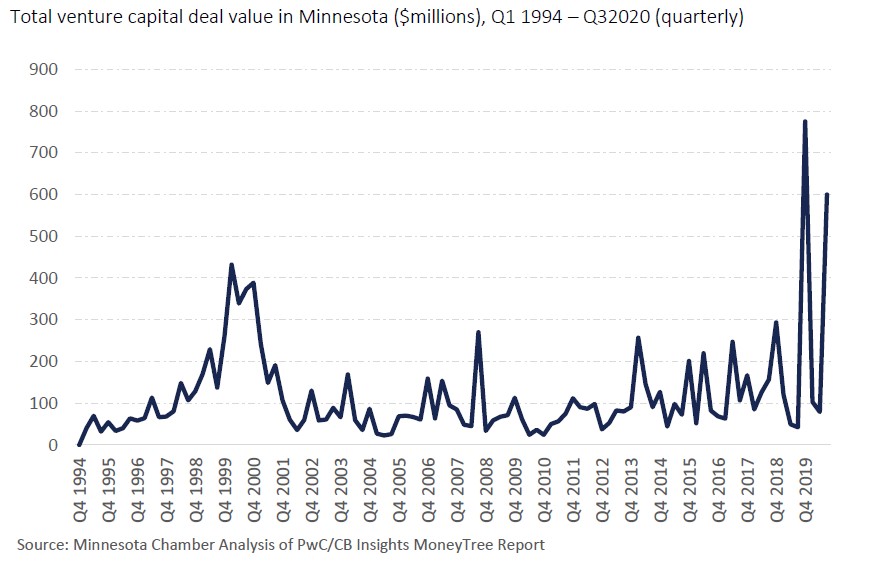

Paradox – Part three: Rising investments in tech startups seed the ground for future growth

As outlined in the corporate and financial sector discussion, many of the state’s fastest growing companies are clustered around activities like software, business services, and marketing and advertising, all of which have significant tech impacts. Major fundraising from companies like Bright Health, Code42, Jamf and Ceridian HCM Holdings are notable, as is the announced relocation of unicorn cybersecurity firm Arctic Wolf from Silicon Valley to Eden Prairie, Minnesota. These successes coincide with accelerator efforts and an increasing level of funding and resources in the state for high-tech startups.

A look at venture capital trends also demonstrates a rising level of investment in high-growth startups overall. After a sharp fall-off in venture capital at the beginning of the century, Minnesota closed more in venture capital deals from 2015-2020 than it did in the whole preceding decade, setting an all-time high in 2019 with $908 million raised. Likewise, the total number of venture capital deals has risen steadily over the past five years, showing promise for future growth in Minnesota.

![]()

What’s next for Minnesota’s tech sector?

Forecasts show relatively slow growth, even as demand for tech skills grows:

Economic forecasts project relatively slow growth for Minnesota’s high-tech activities this decade. However, forecasting models may not take into account factors like those noted relative to rising VC and fast-growing startups. Occupational forecasts from DEED simultaneously show high projected demand for tech occupations like software developers, information security analysts, and data analysts. How can high demand for high-tech workers be reconciled with relatively slow growth projections for the sector? We believe this combination of forecasts highlights the underlying limiter of low labor force growth and concern that an under-supply of high-tech talent and Minnesota’s specific industry mix concentrated in sluggish sectors could combine to constrain tech growth going forward.

These are important issues to address.

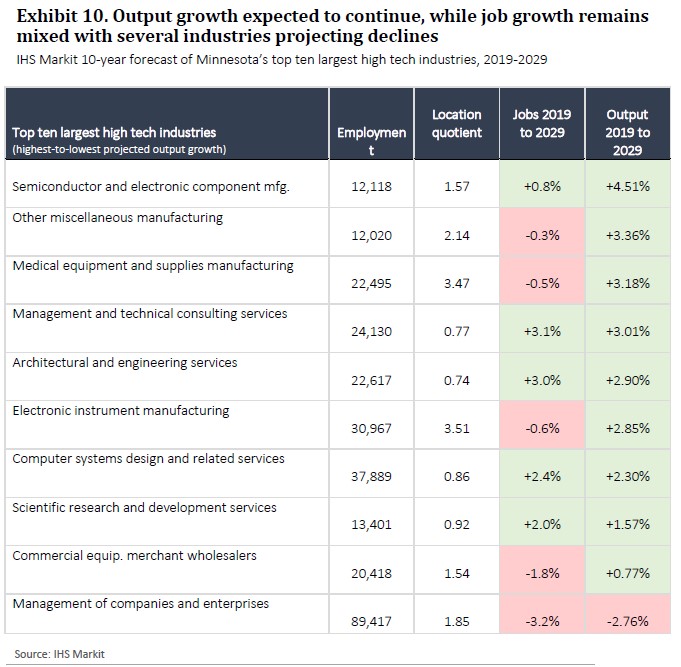

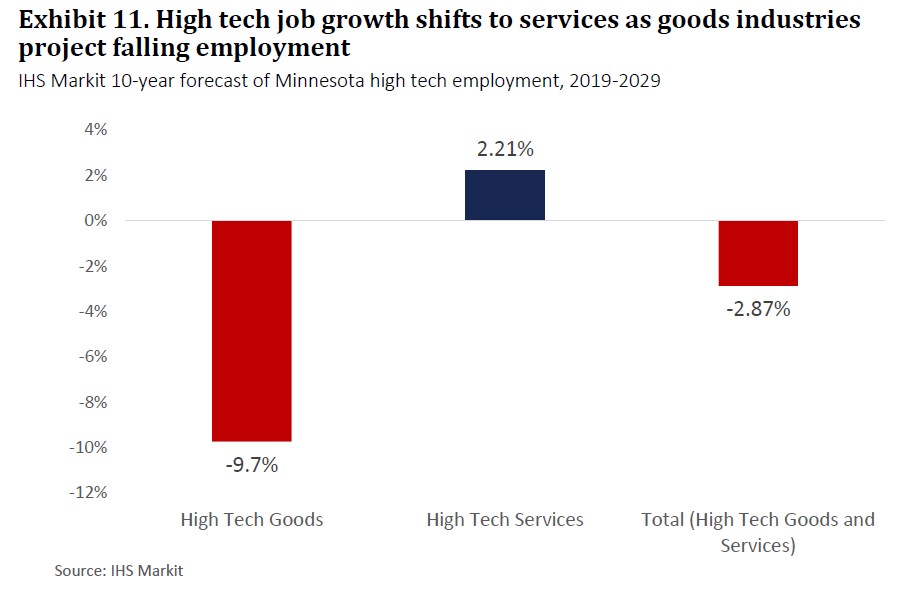

1. IHS Markit forecast of high tech industries – Growth shifting toward services, while manufacturing sheds employment.

Minnesota’s high-tech sector is expected to continue shifting toward services this decade, with activities like data processing catching up after experiencing somewhat sluggish performance last decade. Eight of the top ten fastest projected growth industries are in service categories, though manufacturing industries such as aerospace products, semiconductors, miscellaneous manufacturing, and medical goods are expected to remain strong. Other high-tech sectors of importance to Minnesota, such as metal ore mining and agriculture/construction/mining equipment manufacturing are projected to shed jobs and slow output.

Reflecting a long-term decline in employment driven in part by automation and productivity gains, Minnesota’s high-tech goods manufacturing subsector is projected to decline at an annual rate of -1%, while service industries are expected to increase by a modest 0.2% a year. Overall, Minnesota’s high-tech employment is forecasted to decline by an annual rate of -0.3% this decade. This sector is impacted by IHS’s pessimistic forecast for an overall decline in management of companies, a significant source of high-tech employment in Minnesota.

2. CompTIA forecast: Minnesota is projected to rank 46th in net tech employment growth over 2018-2028 period.

Minnesota’s Net Tech Employment – measured as the net sum of all jobs in tech industries and tech occupations in any industry – is projected by CompTIA to expand by just a total of 8% between 2018-2028.x This negative projection would have Minnesota surpassing only Alaska, Connecticut, Hawaii, Mississippi and Vermont in terms of employment growth across all tech jobs. Leading states such as Colorado, Idaho, Nevada, Utah and Texas, by contrast, are projected to grow tech jobs by between 24% and 42% over the same period. Regional location may provide a partial explanation for Minnesota’s expected underperformance, as states like Illinois and Wisconsin are projected similarly in the CompTIA forecast. Of course, projections are only one possible future outcome, and are therefore subject to significant uncertainty. Yet, CompTIA’s pessimistic take on Minnesota’s future high-tech employment growth may be helpful as well in assessing why Minnesota’s projected performance could fall so far below the mean as well as to develop strategies to address our potential growth limiters.

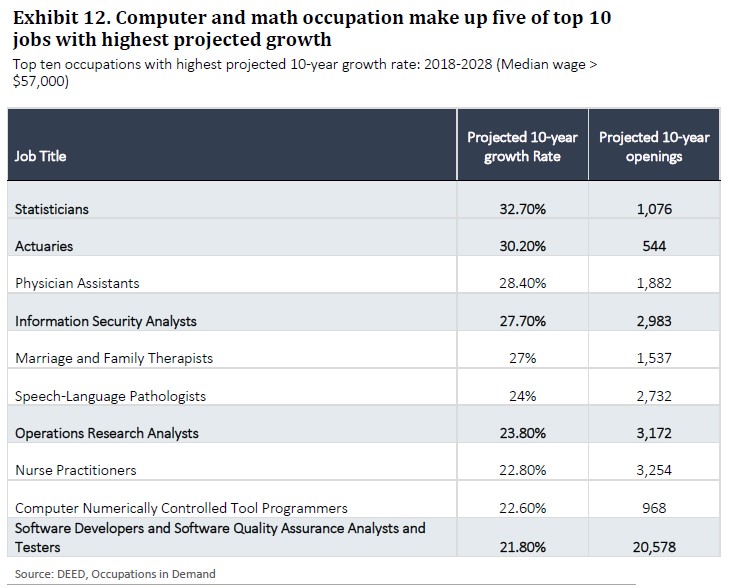

3. DEED occupational forecast – Technology skills expected to be in high demand this decade.

In contrast to the underwhelming forecasts above, the Department of Employment and Economic Development projects high demand and faster growth in tech occupations like software development, information security and statistical analysis. In fact, computer and math occupations make up five of the top ten occupations with the fastest projected 10-year growth rates (see Exhibit 12). More than 20,500 software development openings are projected in the ten-year time frame, an increase of 21.8% over current levels. Additionally, computer and math occupations rank fourth among all occupational categories in DEED’s 10-year forecast, trailing behind only personal care service, healthcare support, and healthcare technicians. This suggests that even if tech employment does lag other states, Minnesota’s workforce will continue to grow and shift toward IT occupations this decade.

Discussion: Future trends in the tech economy

While a full analysis of emerging technologies lies outside the scope of this report, below is an outline of two trends likely to shape Minnesota’s high-tech economy in the coming years.

The digitalization of everything:

- Digital tech

According to IHS Markit, the Information sector is projected to lead U.S. industry GDP growth over the next ten years, with information and data processing services, software publishing, and computer systems design and services projected to grow at annual rate of 12%, 9% and 8% respectively. While digital technologies will reshape a wider range of industries, these core IT sectors are likely to continue capturing a large share of growth in the national economy in the years to come.

This can be further seen in venture capital investment trends. While the number of software deals has declined in recent years, it remains by far the leading recipient of VC funds. In 2018, software companies raised over $23.5 billion in venture capital, outpacing the second largest sector by nearly $10 billion.

- Blurring the line between goods and services

Digital technologies are reshaping businesses across sectors, both in how they operate and the type of products they make. Internet-of-Things (IoT) technologies increasingly bring manufacturers into service-related activities. As an article by CITI states, “The Digital Revolution has edged out the era where economists could neatly distinguish manufacturing from the service sector. While it’s hard to say exactly how they’ll be categorized, the time has already come: New inkjet printers come with ink replacement subscriptions; Cars come with navigation services; Smart TVs come networked to stream. Exercise equipment now comes with live-streamed instructions.” This will certainly continue.

- Automation and advanced manufacturing

Automation and advanced manufacturing is a dominating trend. The global process automation market is expected to reach USD 114.17 billion by 2025, a CAGR of 7.23% over next five years.xiii Sales of industrial robots have increased almost four-fold since 2009, with Asia the strongest market and China alone surpassing the total market volume of Europe.

The U.S. manufacturing sector is the second largest in the world, renowned for its innovation capabilities, Manufacturing leads the automation trend here. As the U.S. share of global manufacturing value declined from 29% in the early 1980s to 18.6% in 2015, the U.S. turned increasingly to process automation and smart manufacturing technologies. That trend will continue, impacting overall manufacturing employment.

Workforce is both a constraint and a driver of growth in this area. Productivity and labor savings drive investment, while availability of the specialized workforce needed to program and operate such highly automated equipment is a constraint, with skills in very high demand across the tech industry. High initial investment is a barrier, and the cost of training employees to use the sophisticated equipment can be another, making automation investments sometimes unaffordable for certain small- and medium-sized users. Automation and advanced manufacturing is here to stay nonetheless, likely dampening employment growth in Minnesota manufacturing, while increasing productivity and output.

Minnesota’s opportunities to grow the tech sector

1. Understand the trends in technology jobs and industries with recommendations for the education and workforce development sectors.

Minnesota has strengths and weaknesses in its tech sector. But the negative forecasts for future growth from IHS and CompTIA must be addressed. The positive DEED projection for job growth is the other lever. The conundrum is clear. Technology skills are and will continue to be in high demand, but projections suggest that Minnesota’s future growth will be constrained by an inadequate supply of highly skilled tech talent. This would limit Minnesota’s future economic growth. Further research should be conducted to make clear: a.) where Minnesota actually stands relative to tech and tech talent, and b.) what we need to do to improve and grow the supply of high-skilled tech talent to drive Minnesota’s future growth. Minnesota has strengths in multiple sectors across a range of tech activities. The key is to ensure Minnesota remains positioned to capture growth in the areas fusing new technologies into traditional industries, while better growing the tech subsectors in which Minnesota ranks low – before Minnesota falls even further toward the bottom of the pack. Leading employers have shared that they already struggle to find enough tech talent in the state, often looking and hiring elsewhere to meet these growing demands. Our paradox of strengths and weaknesses warrants further investigation and a detailed plan outlining how Minnesota will remove the barriers that seem to stand in the way of achieving our full high-tech future.

2. Leverage existing industry strengths to lead in areas like Internet-of-Things (IoT), fin-tech, digital health, ed-tech, automation, cybersecurity and data analytics.

Minnesota possesses key strengths in advanced fields such as: corporate headquarters, financial services, health care and medical technology, machinery manufacturing, just to name a few. Each of these industries are undergoing transformations in what they produce and how they operate. Whether through digital transformation, data analytics, artificial intelligence, machine learning, internet-of-things, 3D printing, cybersecurity, blockchain or automation – firms in these industries will be on the forefront of technology changes over the next decade. This means that Minnesota does not have to try building a new industry – its existing industry clusters and innovative businesses will be the ones that can drive tech growth in the coming years.

Further, Minnesota’s deep knowledge in specialized industries make Minnesota a prime location for startups and existing firms creating technology solutions for these industries. As exhibit 1 shows, Minnesota already has traction in areas like ed-tech, fin-tech, digital health, cybersecurity and more. Venture capital and startup resources are on the rise, and these digital transformations are largely to credit.

3. Adapt and transform technology education and workforce training to better prepare Minnesotans for a technology-driven future.

Minnesota needs to rethink how it gives people the skills to succeed in a changing economy. New technologies are creating disruptions across our economy and changing the type of tasks performed in the workplace. The implications of this are broad and will require the state think creatively about what types of actors are best-suited to deliver certain kinds of training and education. This includes aligning K-12 and higher ed offerings to evolving demand in the economy. But it also includes the wide array of actors that are involved in delivering targeted training to job seekers or existing workers, whether through earn-and-learn programs, certificate “boot camp” training programs and other on-the-job training programs.

4. Build on recent programs to accelerate high tech startups.

As noted above, Minnesota has experienced recent traction in new startup activities and funding in recent years. This includes new initiatives and programs such as Forge North, Hill Capital, Great North Labs, Techstars Farm to Fork, Lunar Startups, gener8tor, OnRamp Insurance Accelerator, gBETA Medtech alongside many others. Startup support services have also branched out widely, including efforts to foster high tech startup activity in Greater Minnesota regions, such as the state’s Launch Minnesota program, the gBETA St Cloud accelerator, the Center for Innovation and Entrepreneurship in Mankato and the Mayo Clinic Business Accelerator Program in Rochester.

A full list of programs, funds and initiatives is too long to list here, but many of these have been created in just the past five to ten years and are gaining momentum. This gives Minnesota a buildable base of support services needed to foster the high tech businesses of the next decade. Maintaining this momentum amidst the challenges brought by COVID-19 and the resulting economic downturn will be imperative, particularly given the uptick in new business filings seen since the middle of 2020. A next step would be to evaluate what resources