4 key economic takeaways from businesses in 2020 and what might this tell us about recovery?

Does 2021 mean a road to recovery?

Grow Minnesota! conducted in-depth conversations with nearly 300 businesses in 2020, to learn what challenges and opportunities they were facing in light of the immense changes brought about by the COVID-19 pandemic. While not a substitute for hard economic data, these conversations provide key insights into how businesses are navigating unprecedented disruptions, and offer a glimpse at what Minnesota can do to help companies recover and grow in the coming months.

Not surprisingly, the impacts of COVID-19 took center stage in our virtual visits with businesses this past year. However, the results from Grow Minnesota’s! outreach also reveal some surprising insights and notable opportunities that warrant further investigation and response.

Here are four key takeaways from a review of Grow Minnesota! activities in 2020.

- Some businesses are still struggling to find workers, even amidst severe job losses.

- COVID-19 brought major impacts on business revenues and operations.

- Innovation and planned investments remain strong.

- COVID-19 created large scale and immediate supply chain challenges; businesses largely succeeded in managing change.

Notes on the data

- These results represent on-the-ground insights from a diverse range of businesses throughout the state. Information is collected through in-person or virtual meetings with leaders at Minnesota businesses. However, they are not intended to be taken as a representative, scientific poll of the entire business community.

- Grow Minnesota! visits are overrepresented in sectors that were less impacted by the pandemic recession. Thus, our data likely skews more positively than the economy as a whole.

- Due to the disruptions of COVID-19, sample sizes for some questions are smaller than previous years, warranting greater caution in making decisive conclusions.

4 Key Findings

1. Some businesses are still struggling to find workers, even amidst severe job losses.

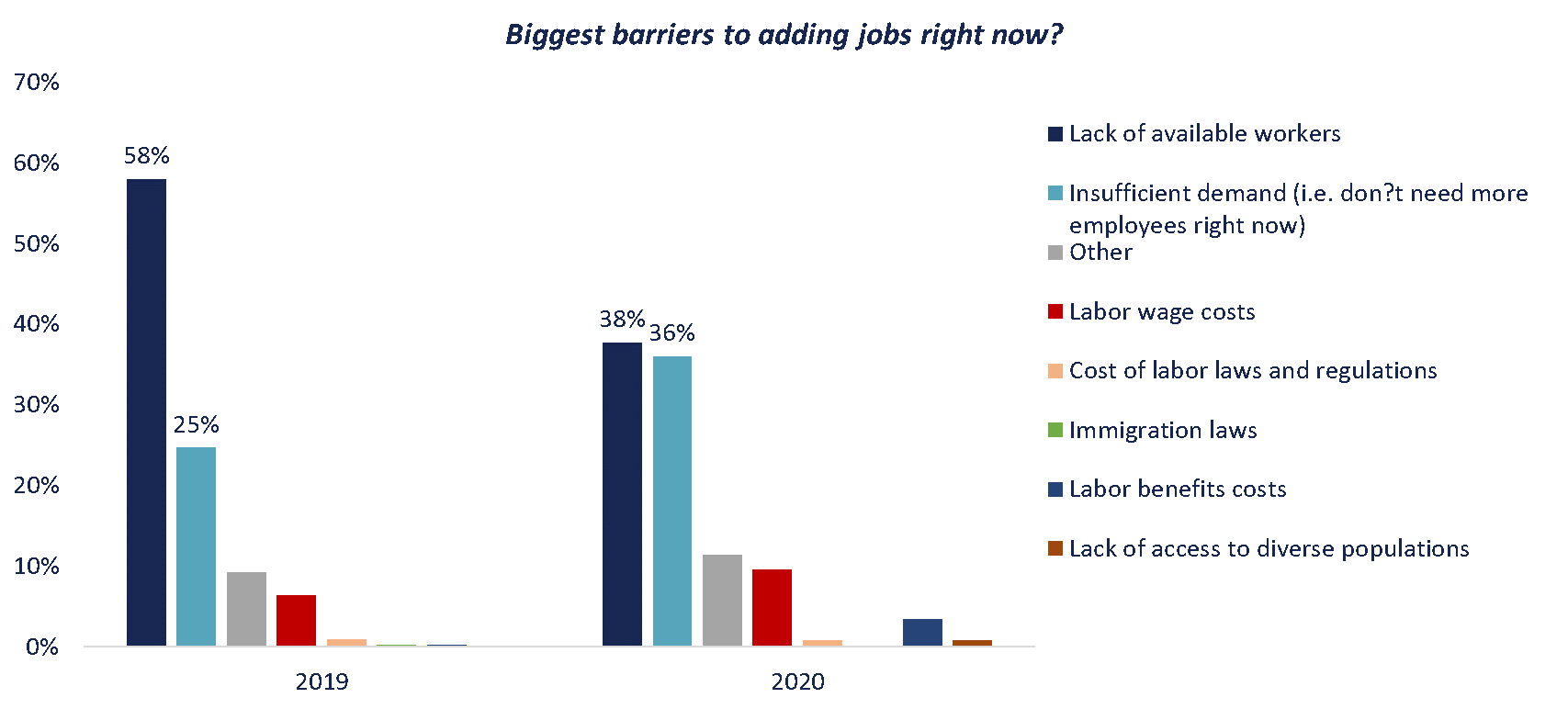

Minnesota headed into the new decade with job growth slowing to a crawl as businesses continued to face significant hiring challenges amid persistently tight labor markets. It appeared as though workforce shortages would continue to be a dominant topic in 2020.

But by March, Minnesota -- along with economies across the globe -- was confronted with a new, unexpected challenge. Within weeks of the state’s first reported case of COVID-19, economic activity had ground to a near-halt as individuals sheltered in place and thousands of businesses were forced to temporarily shut down to prevent the spread of the virus.

In March and April, roughly two thirds of businesses surveyed by the Minnesota Chamber reported medium or large negative impacts on year-to-date sales and revenue, and over 45% said they made modest or significant cuts to their workforce. One respondent wrote that “business dropped 80% in a day.”

These impacts were reflected in the economic data, as Minnesota’s total employment fell by over 13% in April and over 614,000 Minnesotans filed initial unemployment insurance claims.

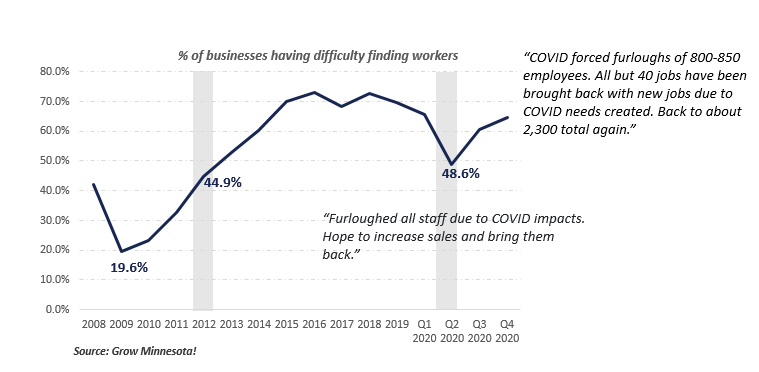

But somewhat surprisingly, businesses have still reported difficulty finding workers throughout the pandemic, even amidst the severe job losses last year. The share of businesses reporting hiring challenges dropped to 48.6% in the second quarter of 2020, a significant decline from 2019 levels. However, this was still more than double the share of businesses that reported hiring challenges during the trough of the Great Recession and roughly the same share of businesses that reported difficulty hiring in 2012. Of course, these results must be viewed cautiously, as the information tracked through Grow Minnesota! retention visits is not indented to be a representative survey of the state’s business sector.

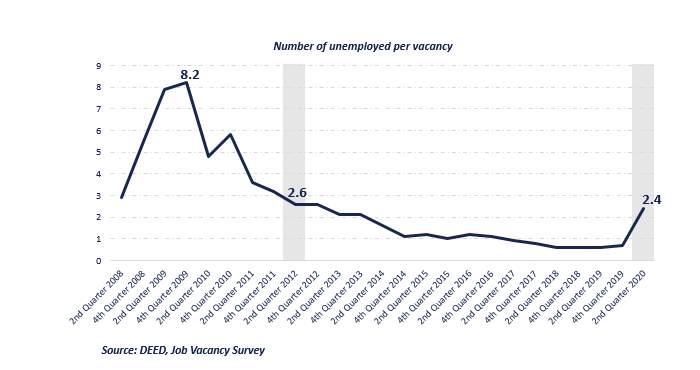

Yet, comparing these results to the Minnesota Department of Employment and Economic Development’s (DEED) Job Vacancy Survey bears striking similarities. Here, the number of unemployed persons per job vacancy – which can be viewed as an indicator of workforce availability – in Q2 2020 was roughly equal to 2012 levels as well, and significantly below the levels seen in 2009. Ironically, job vacancy rates were highest in some of the hardest-hit industries such as Health Care and Social Assistance (21%), Retail (20%), and Accommodation and Food Service (13%), suggesting that job seekers may be holding back from taking in-person jobs due to barriers like health concerns or child care availability.

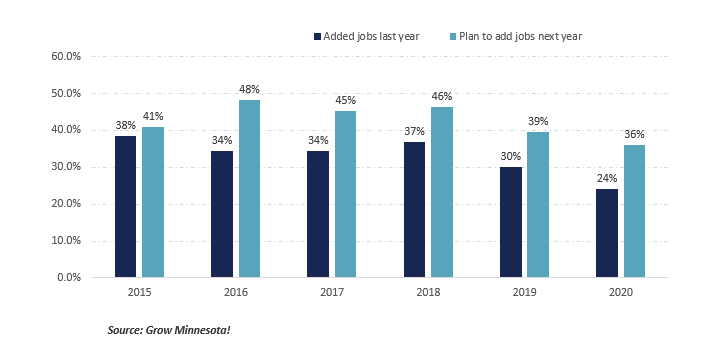

Grow Minnesota! will continue to track developments in this trend and seek to better understand what barriers businesses are facing to recover the job losses experienced last year. Encouragingly, over a third of businesses visited expect to add jobs in 2021. While getting back to full employment could take well into 2022 or beyond, businesses are taking steps now to recover from the 2020 impacts and position themselves for growth.

2. COVID-19 brought major impacts on business revenues and operations.

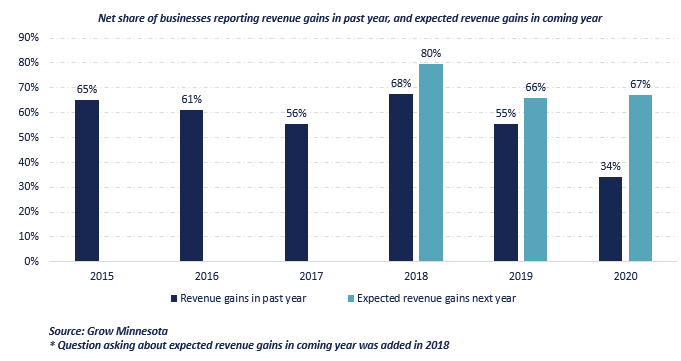

Not surprisingly, COVID-19 has created immense disruptions to business operations around the state. These impacts were seen clearly in the falling share of businesses that reported revenue gains. In 2020, just over a third of businesses reported increased revenue gains over the past year, compared to 55% that said the same thing in 2019. Again, this likely underestimates the actual impact given the underrepresentation of hard-hit sectors in our sample, such as restaurants, accommodations, recreation and entertainment, salons, and so forth.

For example, the Minnesota Chamber Foundation’s Economic Recovery Dashboard shows that small business revenue fell by 51% from January to April, and 40% fewer small businesses were open compared to pre-COVID levels.

How did COVID-19 impact businesses? Some examples….

- “More than third of our business is supported by loyalty programs for health and beauty salons and retail. We went from 1,100 salons to 2.”

- “Our biggest customer is shut down and represents more than 50% of our revenues. We received a PPP loan but need customers to come back online soon. We don't want to lose employees.”

- “We went down 40% in revenues, but are slowly coming back.”

- “Lost 70% of our enrollment, so revenue is way down. We are utilizing social media to let people know we are still open.”

- “Initial dip in revenue due to COVID, but are now coming back through online offerings.”

- “Were down 25% in sales in March due to COVID but are now almost back to pre-COVID levels.”

3. Innovation and planned investments remain strong.

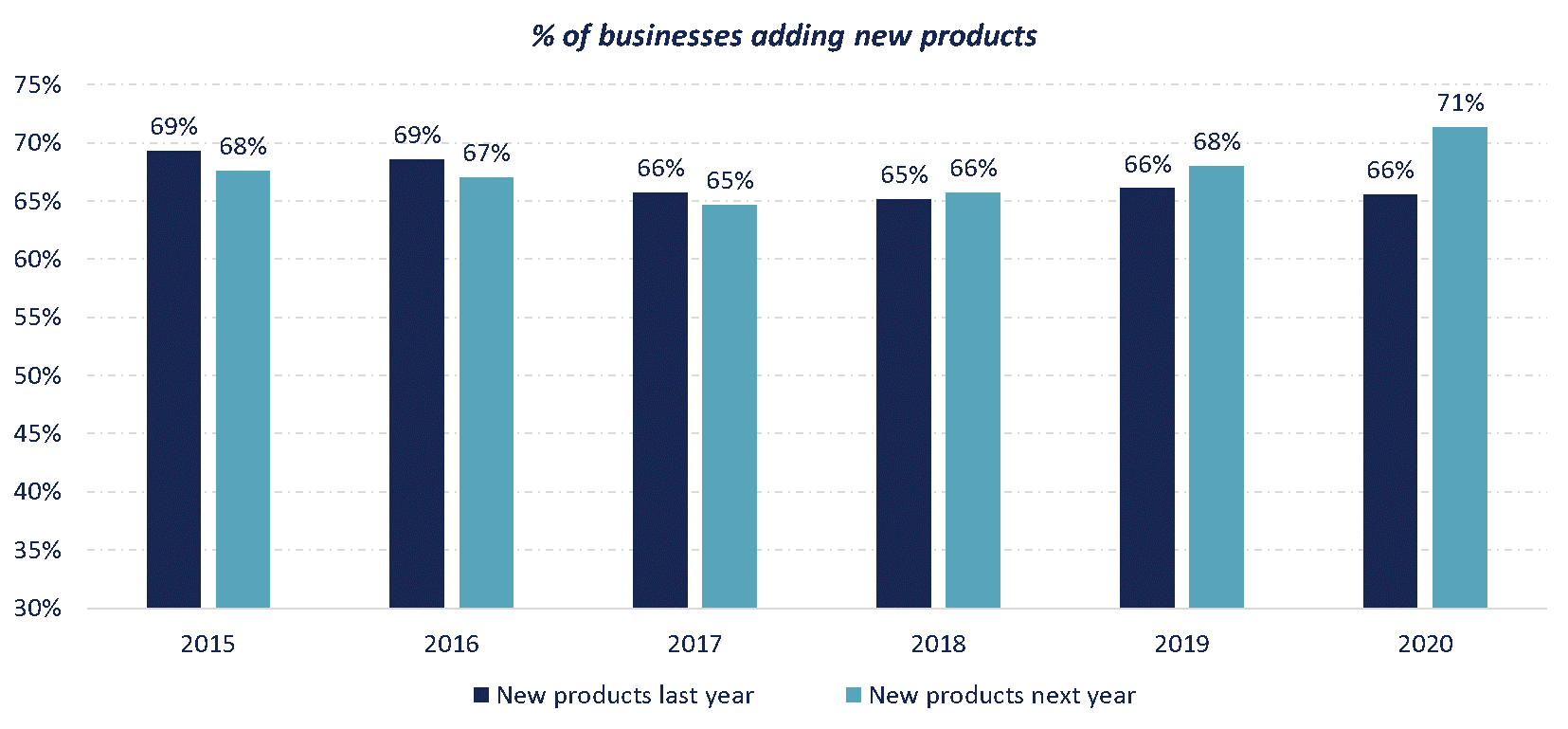

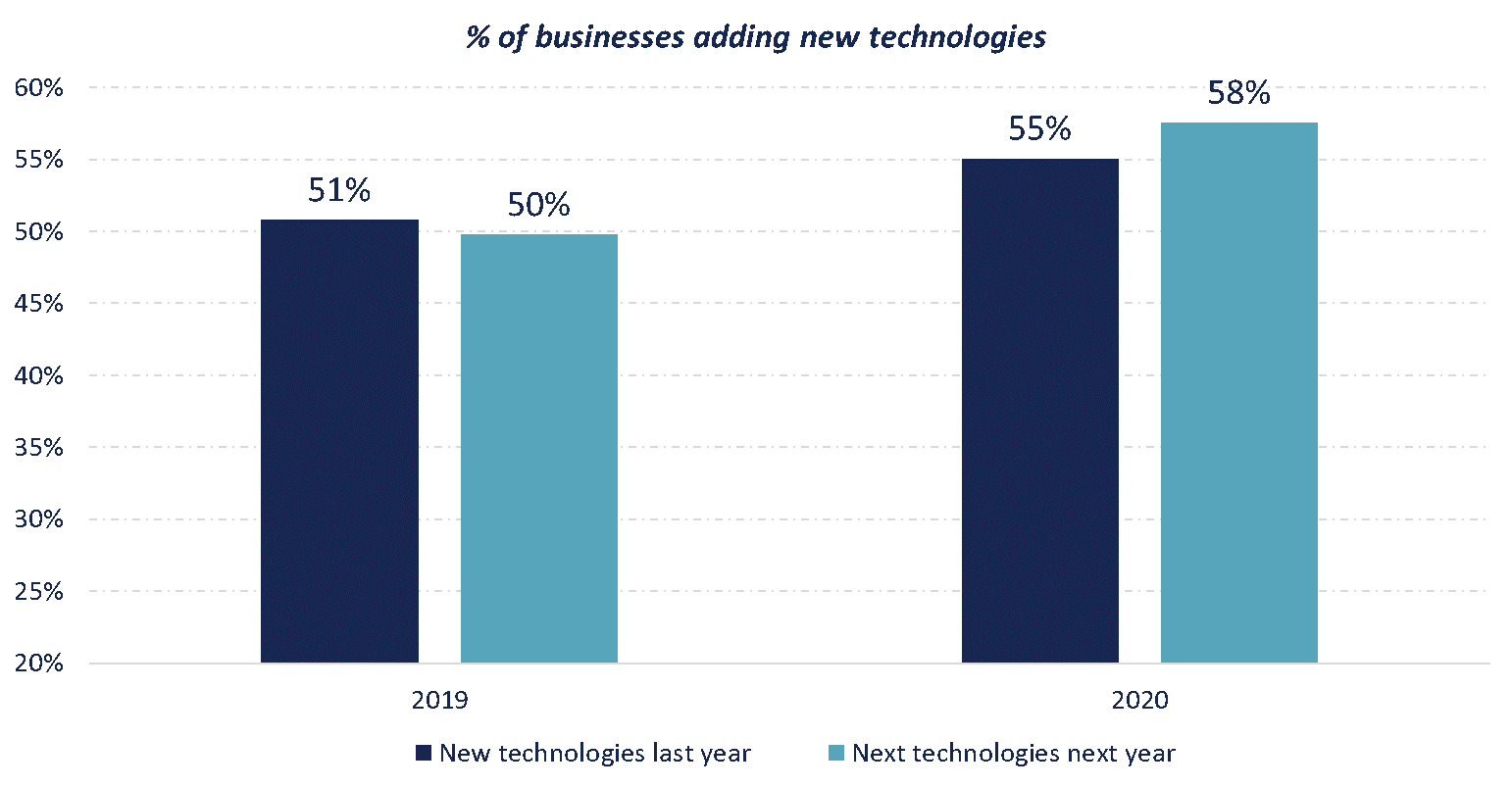

Despite these challenging circumstances, Minnesota businesses continued to innovate by shifting operations, developing new products, and planning new investments for the future. A full 66% of businesses reported that they introduced new products or services last year, and 55% said they added new technologies. These companies are looking to grow through innovation in the years to come as well, with 71% and 58% planning new products or technologies for next year respectively.

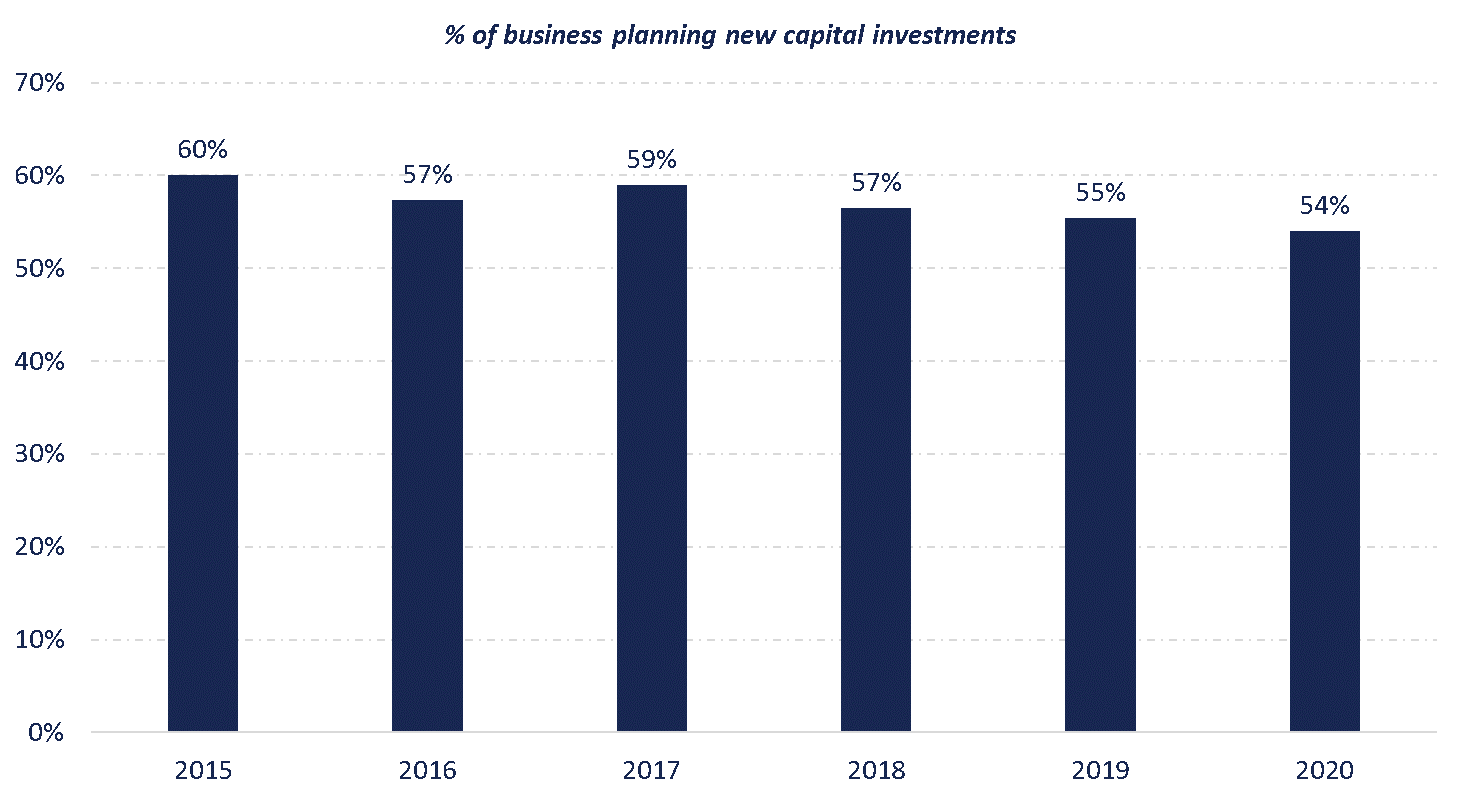

Similarly, new capital investment plans also held steady last year despite falling business investment levels overall. This suggests that a.) businesses are still optimistic about future growth prospects, and b.) some businesses have found opportunities to expand even during this economic downturn. Indeed, a look at announced business expansions from DEED’s website reveals that some businesses, particularly in key sectors like food processing and medical technology, are continuing to invest and expand in Minnesota. Their site lists 123 new expansion announcements in 2020, amounting to over $3.63 billion invested in new capital investments. So while the pandemic and recession has halted some business expansions, other companies are moving forward with plans to invest in future growth in Minnesota.

4. COVID-19 created large scale and immediate supply chain challenges; businesses largely succeeded in managing change.

The COVID-19 pandemic created a sudden shock to businesses supply chains, as demand for PPE and sanitizing supplies skyrocketed overnight and as global supply chains were disrupted. Nearly a third of businesses reported medium or large negative effects on their supply chains in March and April. Much of this was related to businesses scrambling to find face masks, gloves, sanitizer, wipes and other similar goods. Grow Minnesota’s! sourcing and supply chain service -- MN Supplier Match – helped address these needs by opening its database of over 1,000 Minnesota suppliers to all businesses in the state and highlighting suppliers with key COVID-19--related goods and services.

Beyond PPE and sanitizing supplies, some businesses are diversifying supply chains to mitigate risk for their most critical inputs. One medical device company described the importance of having multiple suppliers who can make their product in case one of them is forced to temporarily shut down their plant or can’t fulfill orders because of disruptions further down the supply chain. This could present a longer term shift in how businesses think about the geographic balance of their global, national and local suppliers. This is both a challenge and opportunity for Minnesota businesses and could point to the growing importance of localized supply chains in the future.

We can solve problems for your business

Contact us at growminnesota@mnchamber.com to schedule a Grow Minnesota!® visit, access valuable business resources or reach out to one of our expert staff for assistance.