Grow Minnesota! Quarterly Economic Snapshot

The Quarterly Economic Snapshot is an overview of key indicators measuring Minnesota’s current economic performance. Analysis is provided in partnership with Grow Minnesota! and the Minnesota Chamber Foundation.

Highlights:

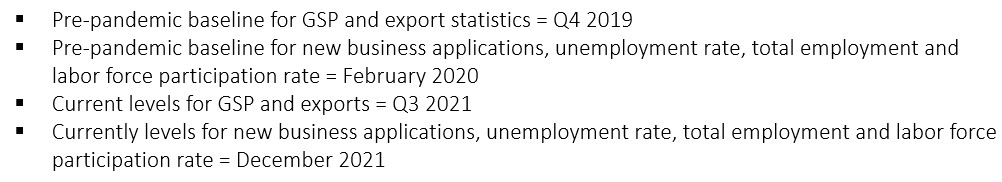

- Minnesota GDP rose to $345.5 billion in the third quarter of 2021, exceeding pre-pandemic levels for the second consecutive quarter.

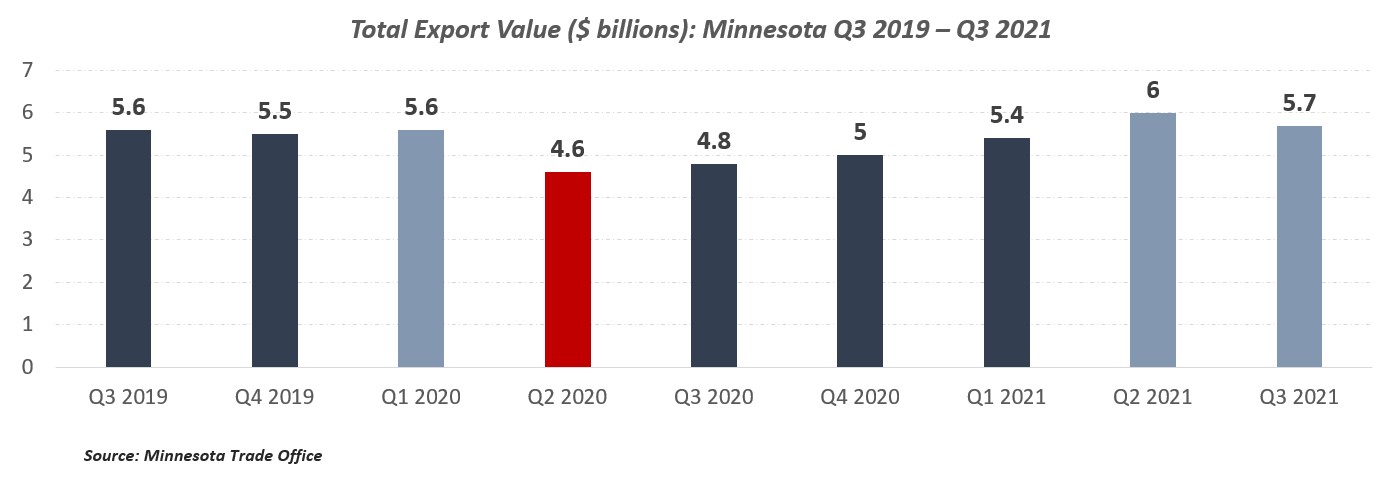

- State exports reached $6 billion in Q2 2021 and $5.7 billion in Q3 2021, rebounding from a low of $4.6 billion in Q2 2020.

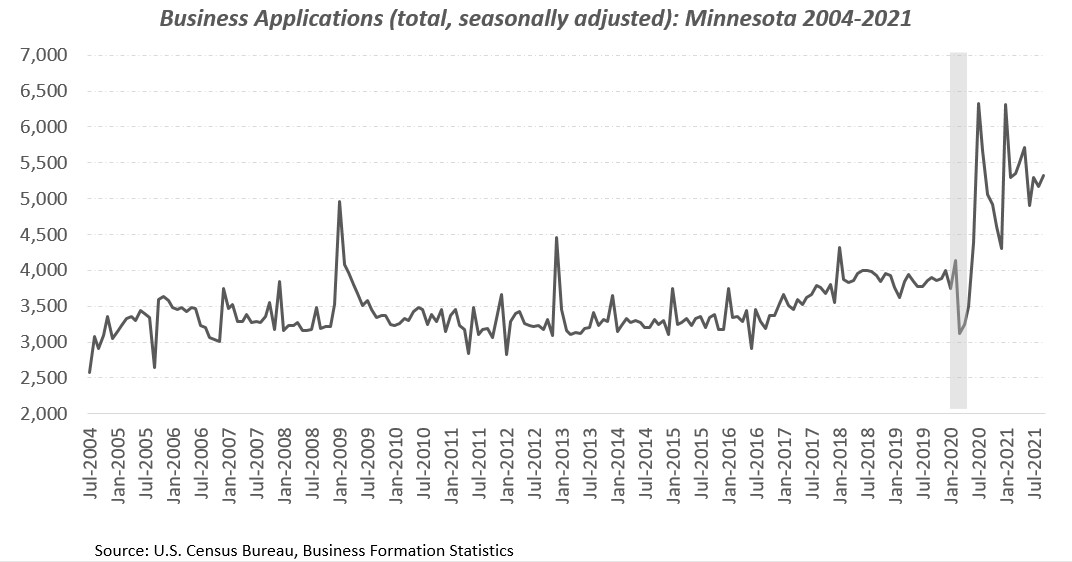

- New business applications – a leading indicator of new startup activity – surged by nearly 25% during the first 20 months of the pandemic.

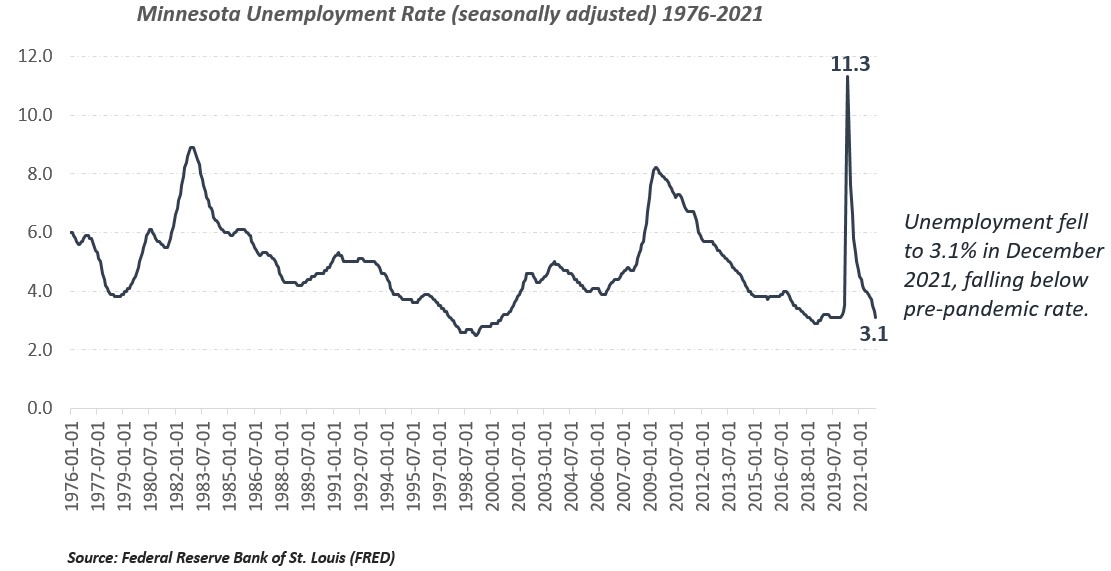

- Unemployment fell to 3.1% in December 2021, a low-point not reached since 2019.

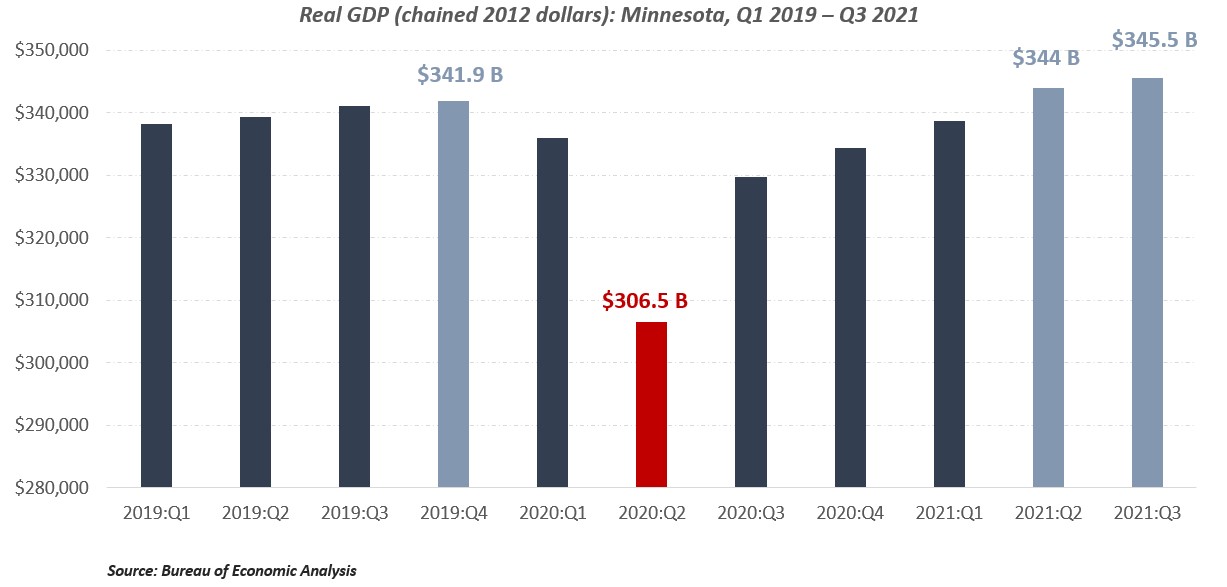

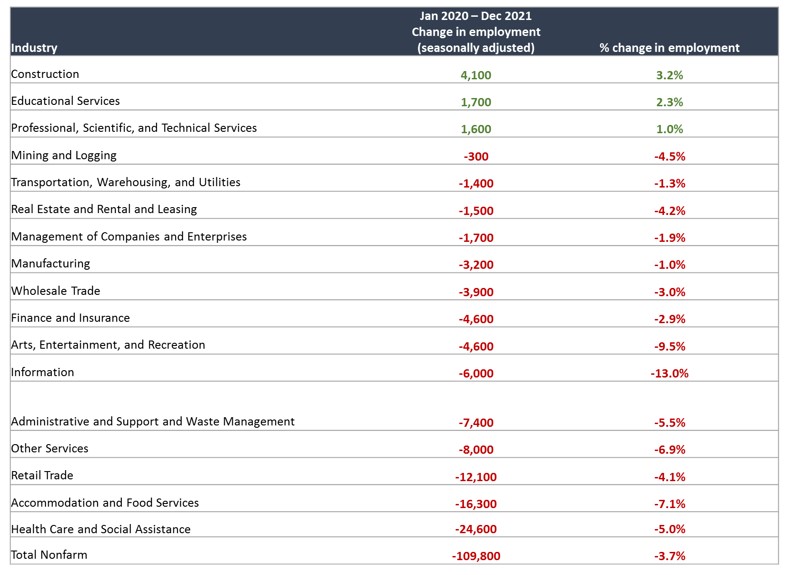

- Despite these positive trends, lack of available workers and supply chain challenges are slowing recovery. Total non-farm employment fell slightly in December to 2,887,400. Minnesota remains nearly 109,000 jobs below pre-pandemic employment levels.

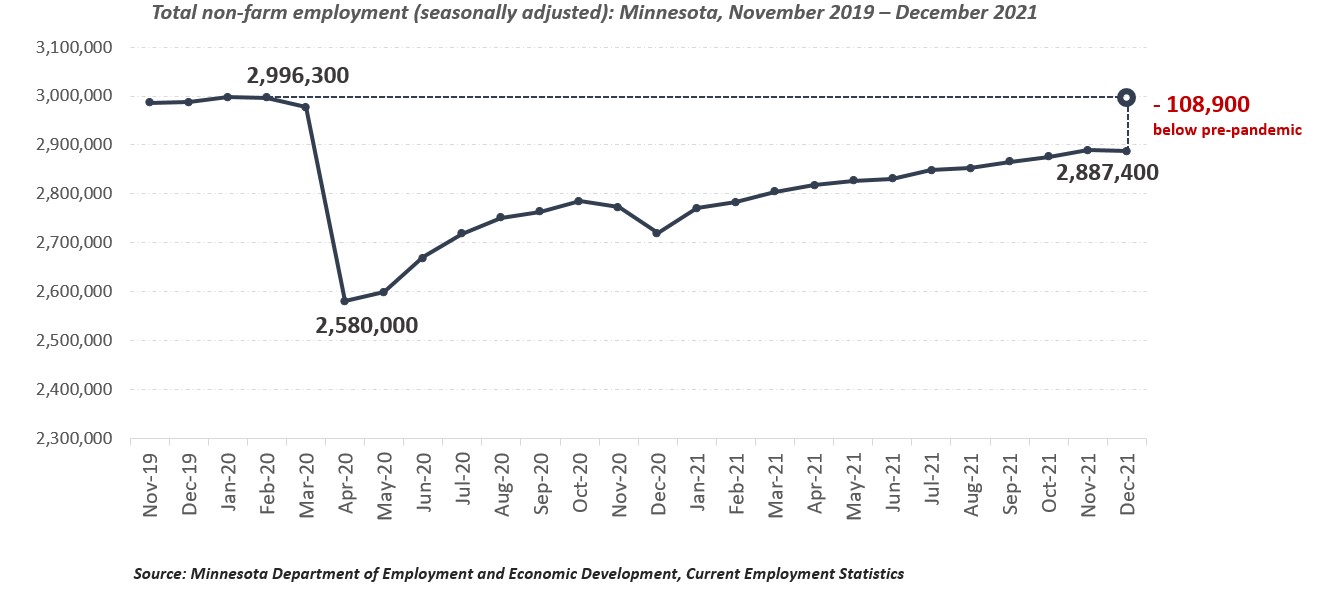

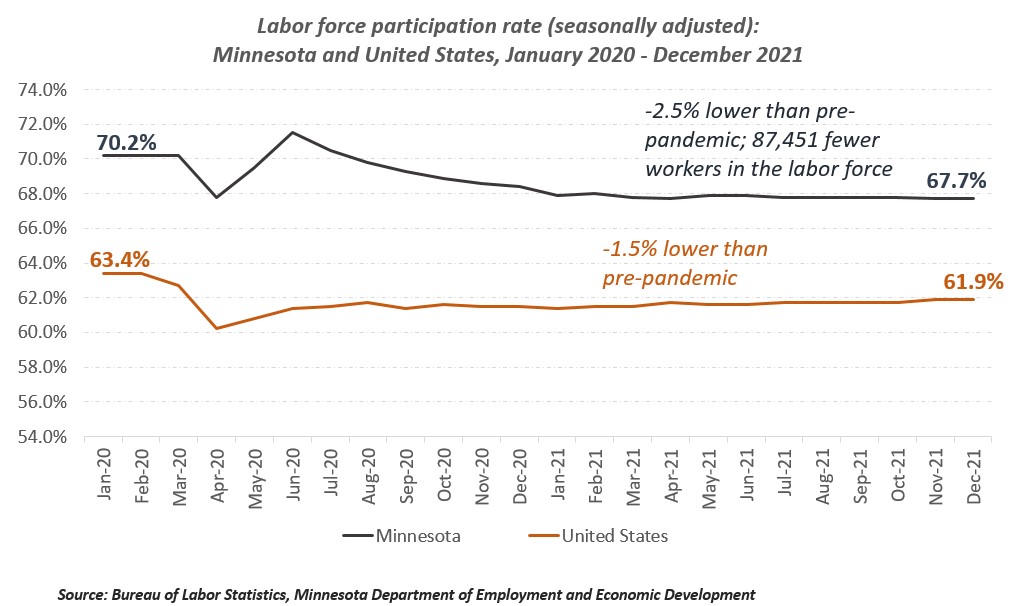

- Minnesota’s labor force participation remained unchanged at 67.7% in December and fell by 2.5 percentage points over the course of the pandemic.

Economic Briefing: Minnesota’s Economic Recovery

As we near the two-year mark of the COVID-19 pandemic, Minnesota’s economy remains in unusual territory. In one sense, the state has crossed the full recovery mark, with economic output (GSP), state exports, new business applications, and unemployment levels all returning to their pre-pandemic baseline or better. Like the rest of the U.S. economy, however, Minnesota faces substantial labor market and supply chain challenges that are slowing job recovery and pose new risks to the economic outlook going forward.

Demand outpaces supply, slowing recovery:

Labor demand rebounded strongly in late 2020 and 2021 as overall economic conditions improved. As Wells Fargo cites in their November economic outlook, Minnesota had the third-largest increase in job openings across all states the U.S. in October, and job openings have doubled over the year.

But despite rising demand, labor supply is constraining job growth.

More than 87,000 people left Minnesota’s workforce since the start of the pandemic, exacerbating hiring challenges for employers around the state. Labor force participation fell broadly throughout the U.S. during the pandemic as well – this issue is not unique to Minnesota. However, the decline has been slightly steeper in Minnesota than the U.S. as-a-whole, falling by 2.5 percentage points since January 2020 compared to 1.5% nationally.

Hiring challenges are reflected by continued sluggishness of job recovery in Minnesota. Total non-farm employment inched down in December 2021 to 2,887,400. This leaves Minnesota nearly 109,000 jobs short of its pre-pandemic baseline. Leisure and hospitality employment rose considerably from its low-point in 2020, but needs to recover an additional 20,900 jobs to reach full strength. Staffing challenges within health care and social assistance are of concern as well, with the sector remaining nearly 25,000 jobs below pre-pandemic levels.

This combination of labor shortages alongside rising employer and consumer demand – among other factors – has led to inflationary pressures in the economy. This raises uncertainty and concerns for the outlook in 2022. However, state economies have an opportunity to help businesses grow amidst the supply-side constraints occurring now. One such way is to recognize emerging strengths and work to sustain and accelerate momentum in those places.

Signs of strength in Minnesota’s economy:

The good news is there are indeed notable strengths present in Minnesota’s economy. While tightening labor markets contribute to hiring challenges, they have also helped remedy the soaring unemployment levels that raised concerns earlier in the pandemic. Minnesota’s unemployment rate fell to 3.1% in December 2021, a low-point not reached since 2019. Unemployment fell broadly across demographic groups in the state as well. The unemployment rate for Hispanics in Minnesota fell to 4.3% in November (below pre-pandemic levels) and Black unemployment dropped below 4% in the late summer of 2021 before rising to 5.3% in November. Sustaining job gains for Minnesota’s BIPOC communities should continue to be a priority going forward.

Minnesota’s economic output is also on the rise. The state exported $6 billion in goods in the second quarter of 2021, and surpassed pre-pandemic GDP levels in the second and third quarters of 2021. The quick rebound of economic output in the face workforce and supply chain shortages is one indicator of a potential productivity boost under way. This is important because structural demographic factors are all but certain to slow Minnesota’s labor force growth further in coming years, putting greater relative importance on productivity gains to grow the state’s economy. Minnesota has long benefited from a productive and innovative economy, with high value-added industries like medical technology, advanced manufacturing, R&D, finance and insurance, and others driving economic performance.

Finally, one of the surprising outcomes of the pandemic-era economy has been a resurgent interest in entrepreneurship. New business applications rose by nearly 25% in the first twenty months of the pandemic, with applications increasing for both likely employer and non-employer businesses. If these early indicators of business formation come to fruition, it would amount to a wholesale reversal of long-term declines in new firm creation. This rise in entrepreneurial interest has occurred alongside strong venture capital investment into the state, indicating momentum among high growth-potential firms.

The Minnesota Chamber Foundation is currently investigating these trends further in a detailed report on entrepreneurship activity in Minnesota. The report is slated to be released later this spring, and is a follow up to the Minnesota: 2030 report that outlines longer term opportunities and strategies for Minnesota’s economy.

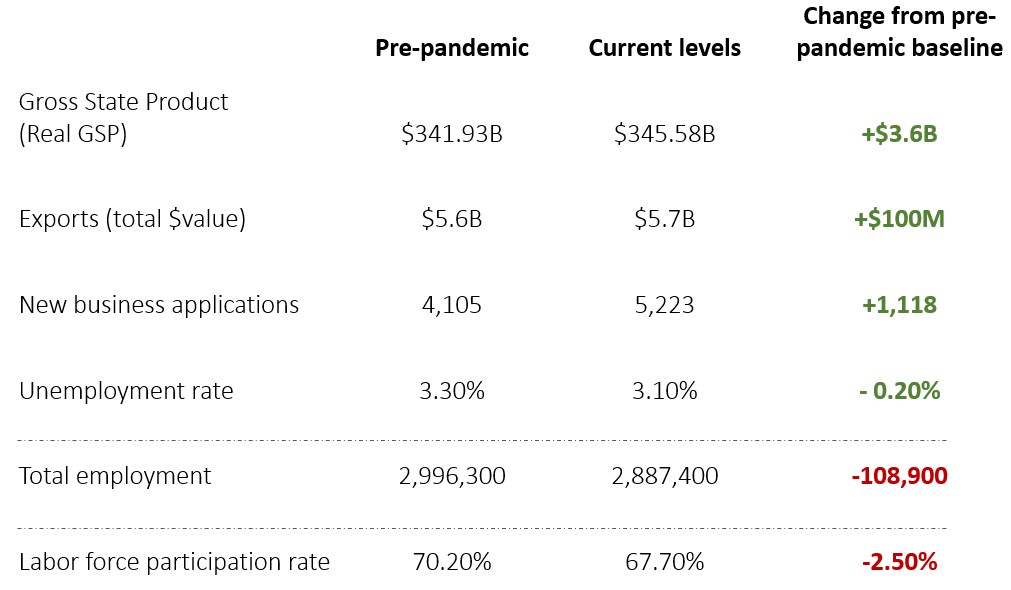

Minnesota’s Economic Recovery at a Glance

Minnesota’s Economic Recovery in 8 Charts:

Minnesota exceeded pre-pandemic GDP levels in the second and third quarters of 2021

Total employment remains far below pre-pandemic levels

Labor force participation dropped by 2.5% during pandemic, contributing to persistent hiring challenges

Unemployment spiked higher and recovered faster than previous recessions

Minnesota exported a record high $6 billion in goods in Q2 2021

New business applications surged during the pandemic

Leisure and hospitality employment remains impacted, but burden has increasingly shifted to health care and social assistance

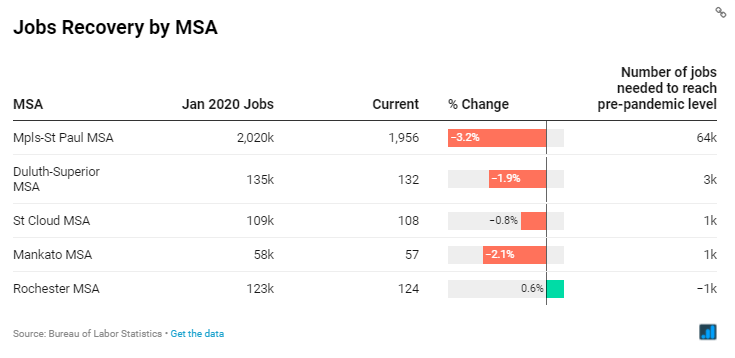

MSP faces largest jobs deficit across MSA’s in the state; Rochester reaches full job recovery

More Grow Minnesota! findings and business resources:

Looking for ways to grow your business? We can help.

Contact Grow Minnesota! staff at growminnesota@mnchamber.com today to get answers to your questions and/or to schedule your Grow Minnesota! visit.