2025 State of business retention and expansion in Minnesota

Quick Menu

Grow Minnesota!® background

Grow Minnesota! is a program of the Minnesota Chamber Foundation partnering with dozens of local chambers of commerce and economic development organizations around the state to collect on-the-ground economic insights and connect businesses with resources to grow and expand in the state. Since its founding in 2003, Grow Minnesota!® has conducted over 14,000 business retention and expansion visits and provided direct assistance to thousands of Minnesota companies.

Grow Minnesota!® is grateful for its continued partnership with local chambers, economic development entities, resource providers and business investors for their engagement and continued support

Back to top

Overview and key findings

Each year, thousands of Minnesota companies make critical decisions about how best to position their businesses for future growth. These decisions often involve where to invest in new jobs, facilities, equipment and technology—and collectively, they shape the trajectory of the state’s economy. This report aims to better understand how those decisions are being made and how they are influencing Minnesota’s economic performance.

The 2025 State of business retention and expansion report reveals a mixed landscape. On the positive side, Minnesota continues to see an elevated volume of business expansion activity, including several major projects expected to generate billions in capital investment. Foreign direct investment is also on the rise. Heightened expansion activity reflects Minnesota’s strengths in industries like medical technology, clean energy, food processing, advanced manufacturing and data infrastructure. Many of these successes are the result of strong collaboration between businesses, communities and economic developers —working together to bring complex projects to the finish line.

At the same time, cross-cutting pressures are weighing on broader business growth. Key sectors such as manufacturing have seen declines in GDP and employment. Minnesota lags many of its regional peers in total expansion counts and continues to experience a net outflow of investment, with more companies expanding elsewhere than entering the state. Businesses surveyed this spring report rising costs, cooling demand, economic uncertainty and mounting challenges related to new state regulations and mandates. Several respondents indicated these factors have caused them to delay Overview and key findings: 3 or redirect planned expansions elsewhere.

This complex picture suggests that while Minnesota remains competitive for projects aligned with its economic strengths, broader barriers may be limiting growth opportunities for a wider range of businesses. In an uncertain economic environment, these challenges can tip the scales as businesses weigh where and when to invest. The findings point to both momentum to build upon and areas where policy and support systems must be addressed to ensure Minnesota remains an attractive and viable place for businesses of all sizes to grow and succeed.

Strengths

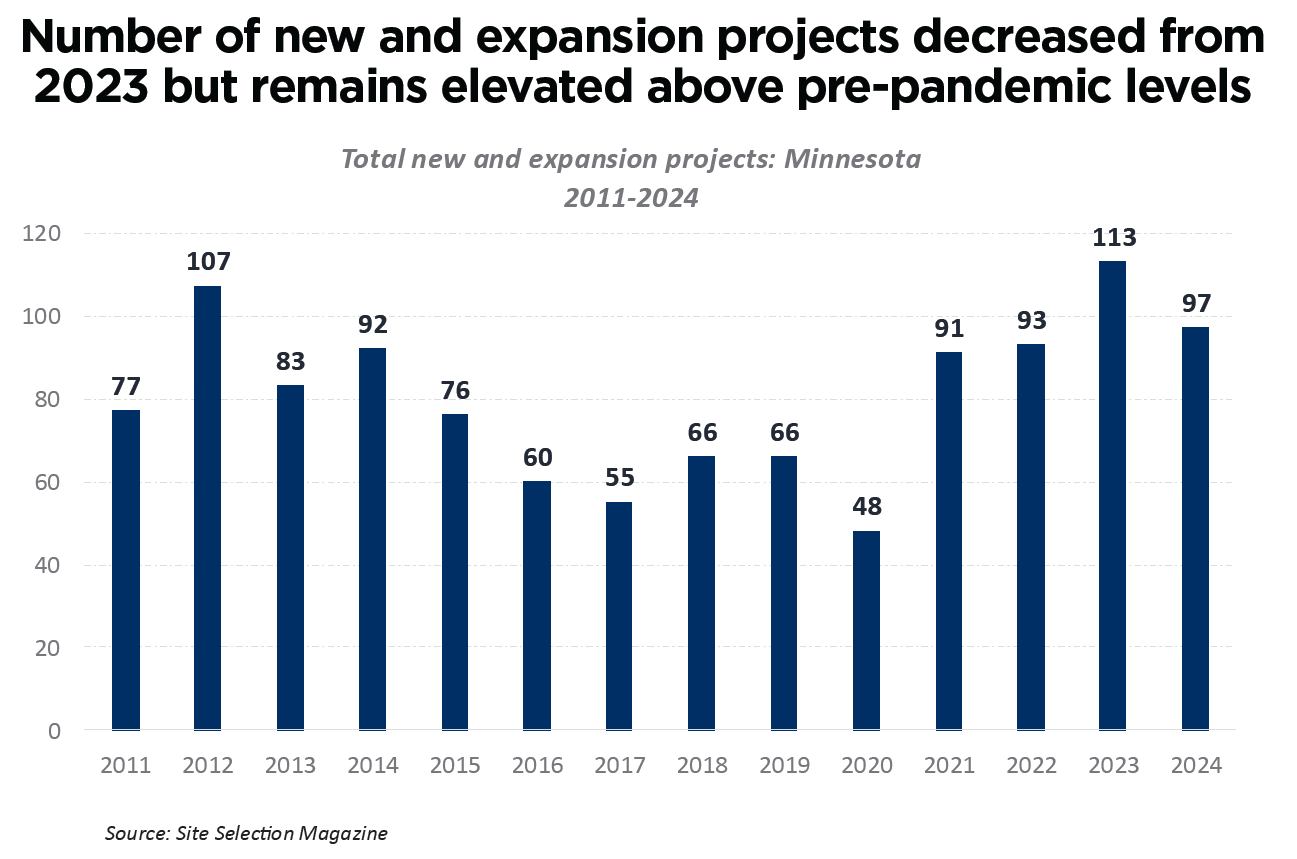

Business expansion counts remain elevated. Minnesota recorded 97 expansion projects in 2024 under Site Selection Magazine’s Governor’s Cup criteria. While slightly down from the prior year, this level of activity remains substantially above pre-2020 norms, reflecting continued investment momentum.

Megaproject announcements drive historic investment levels. Two $5 billion announcements accounted for over 80% of all 2024 capital investment plans, driving total announced investments to $12.2 billion statewide. While these projects are only announced proposals – not completed projects – their intent to locate in Minnesota signals local strengths that could be leveraged to attract additional investments in coming years.

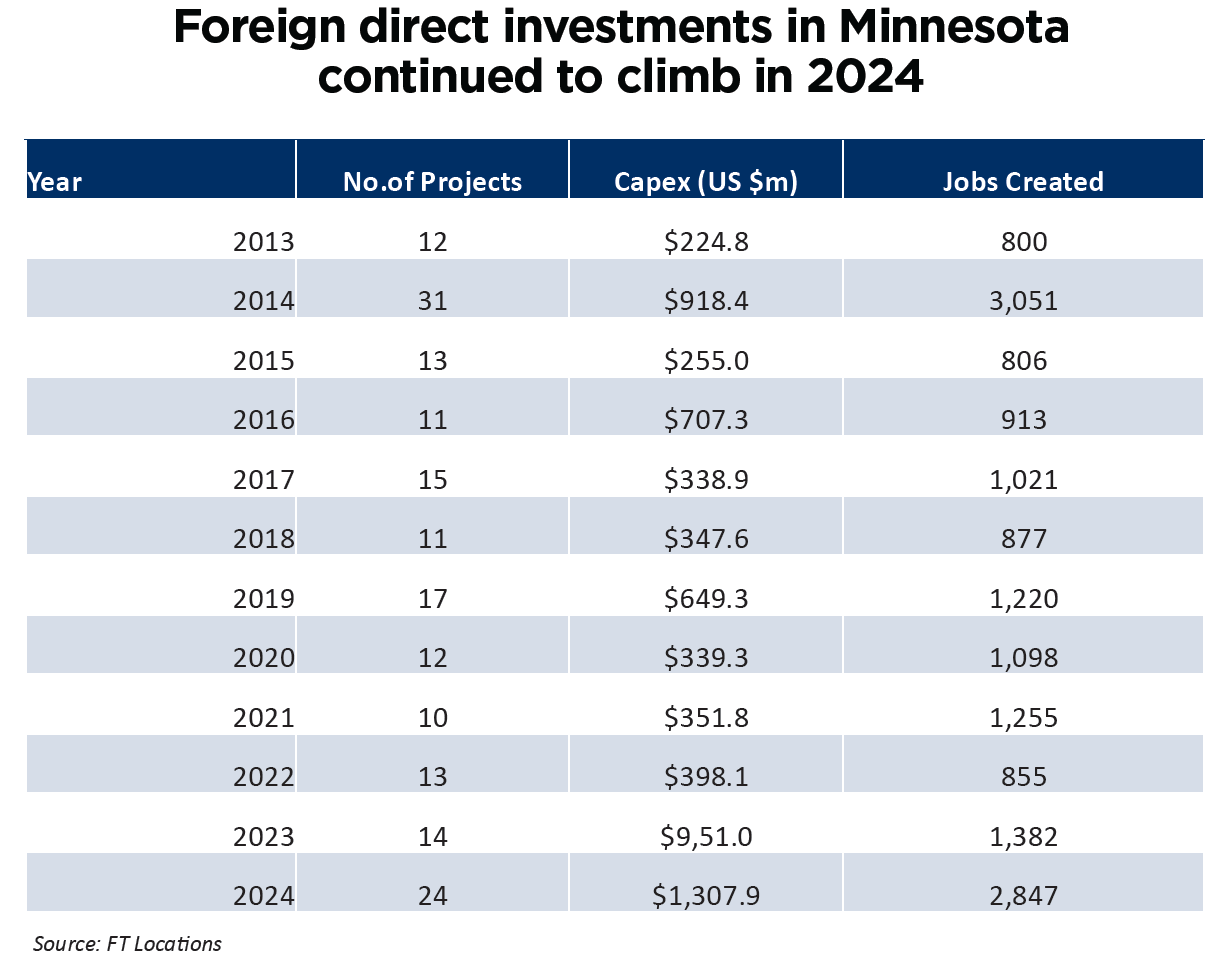

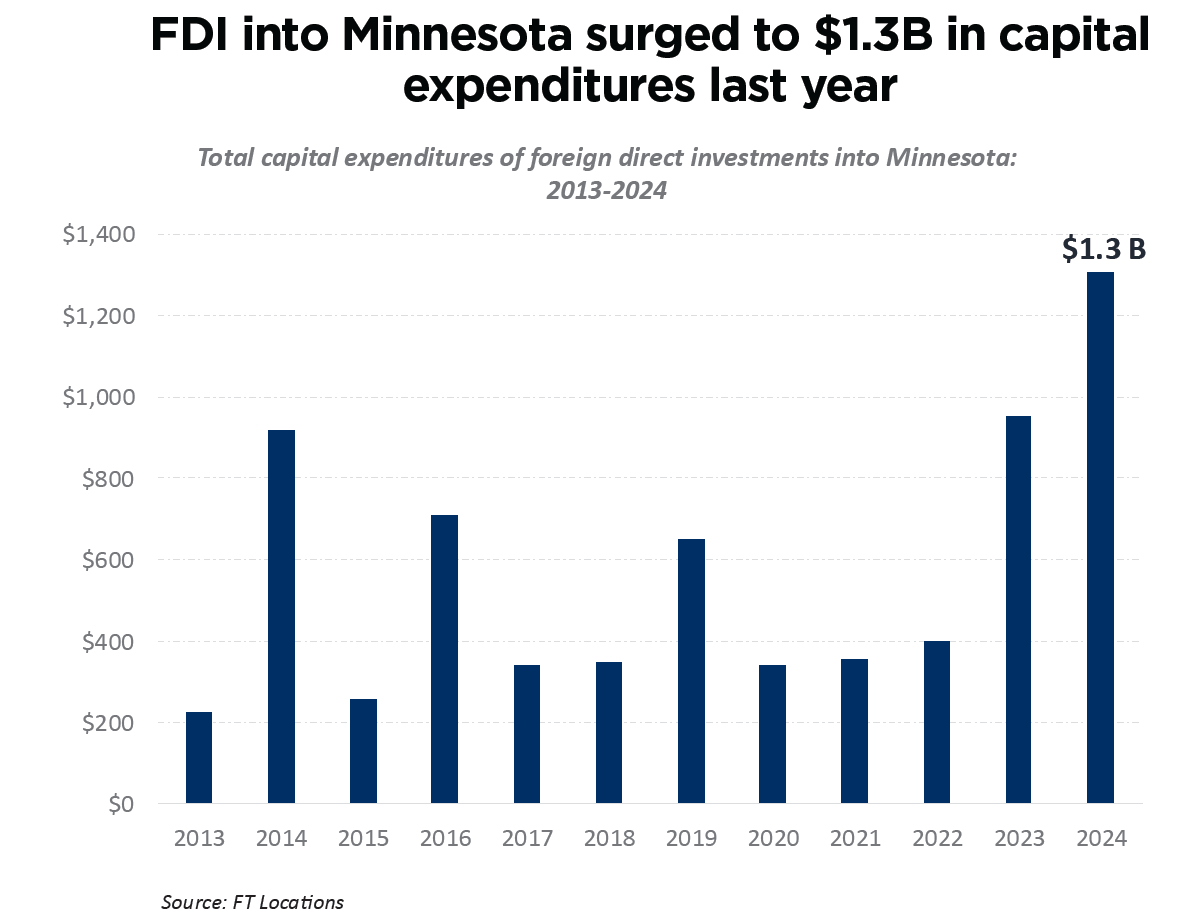

Foreign direct investment is on the rise. Minnesota attracted 24 foreign direct investment (FDI) projects totaling $1.3 billion in capital and 2,847 jobs. Since 2018, foreign-owned firms have invested $4.3 billion across 101 projects in Minnesota.

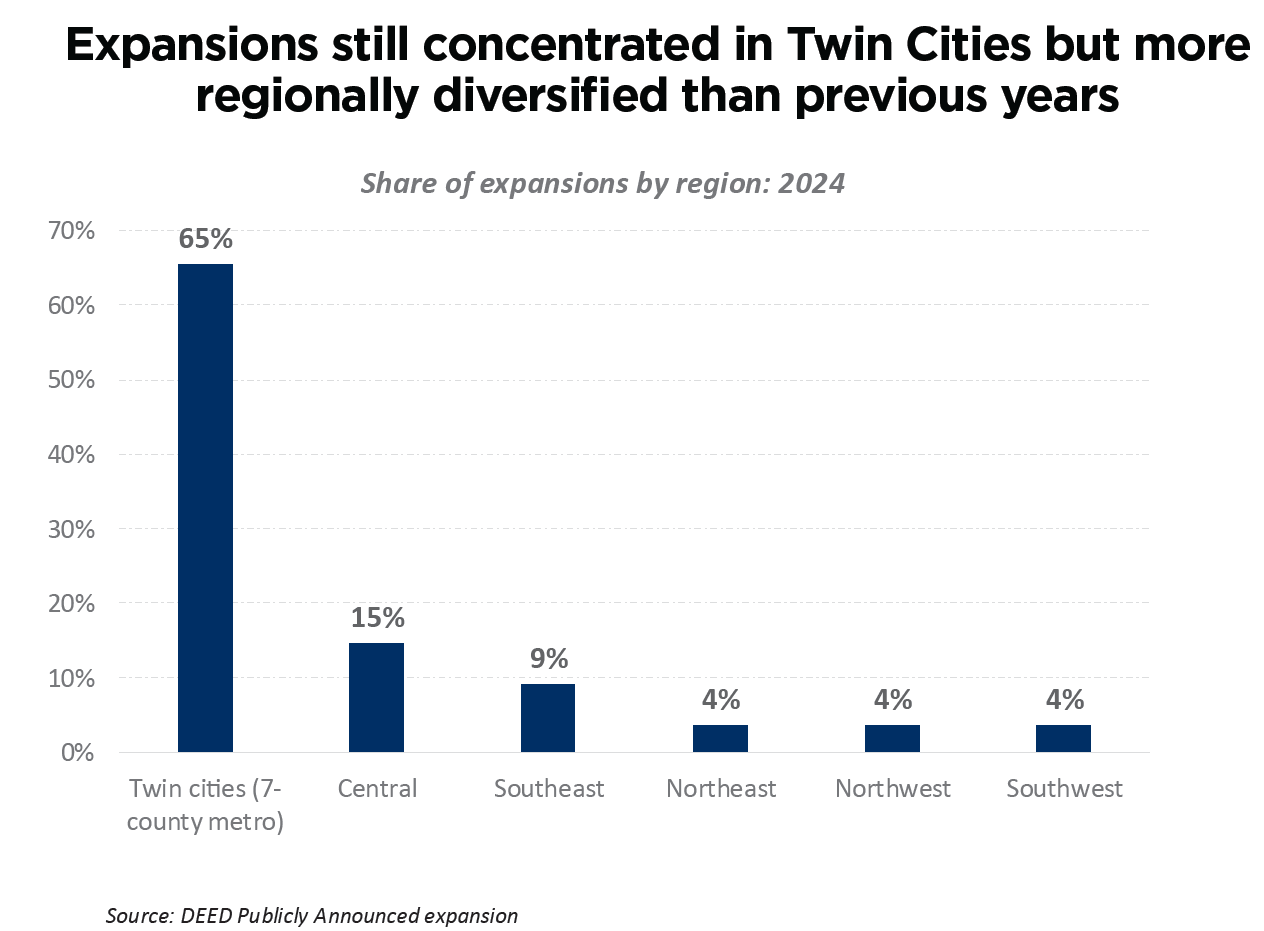

Expansions spread across a diverse range of industries and regions. Expansion activity was distributed across a broad range of sectors, led by medical technology, machinery manufacturing and food processing. While the Twin Cities metro accounted for 65% of projects, Greater Minnesota regions – particularly Central and Southeast Minnesota – also saw significant activity.

Businesses cite strong community commitment as reasons to stay and grow in Minnesota. Many small and mid-sized businesses expressed a deep commitment to staying and growing in Minnesota, citing ties to their workforce, customers and communities as key motivators for future investment.

Challenges

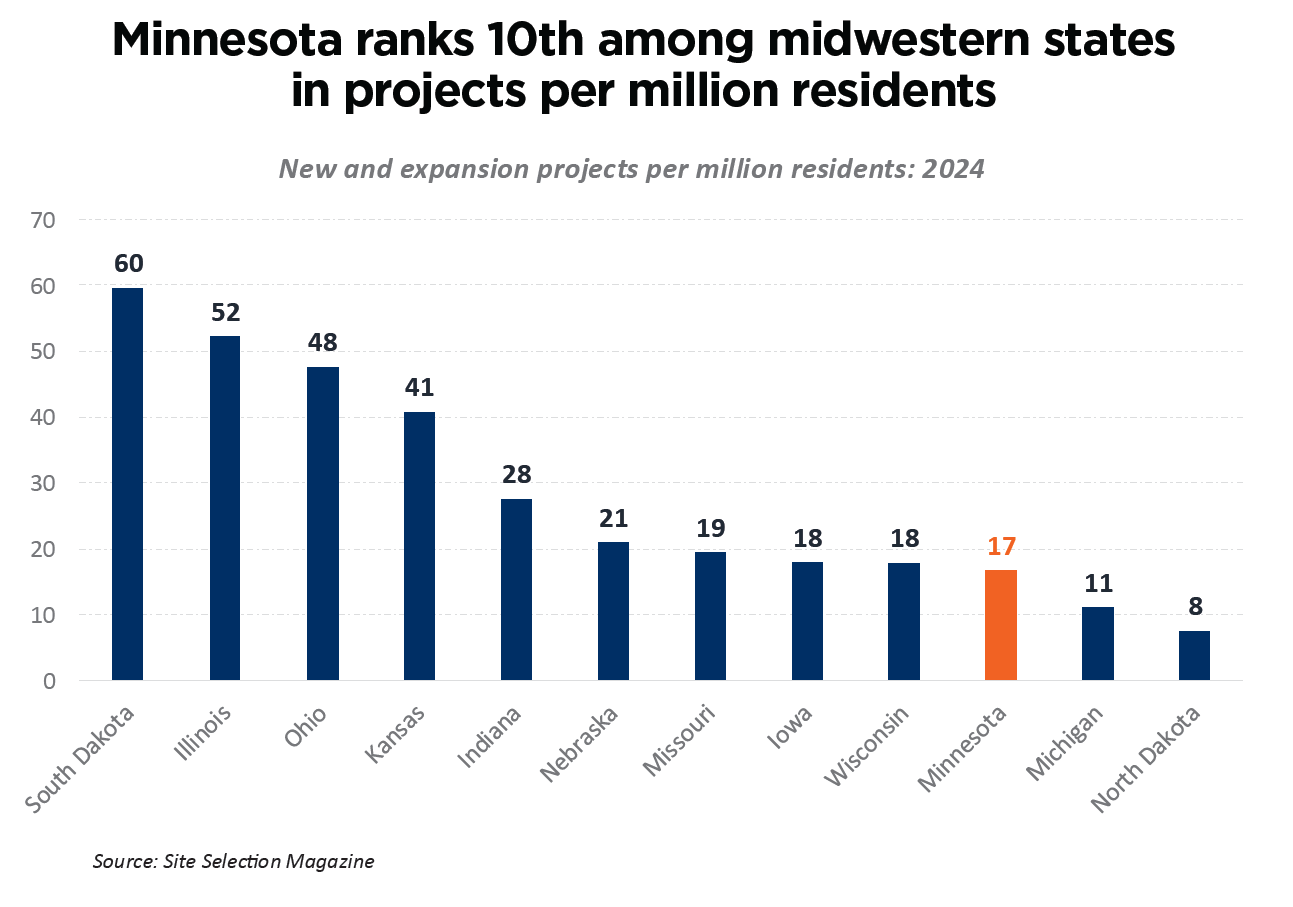

Minnesota trails regional competitors in expansion activity. Despite strong individual projects, Minnesota ranked 8th out of 12 Midwest states in total business expansion projects and 10th per capita in 2024, continuing a multiyear pattern of lagging regional peers.

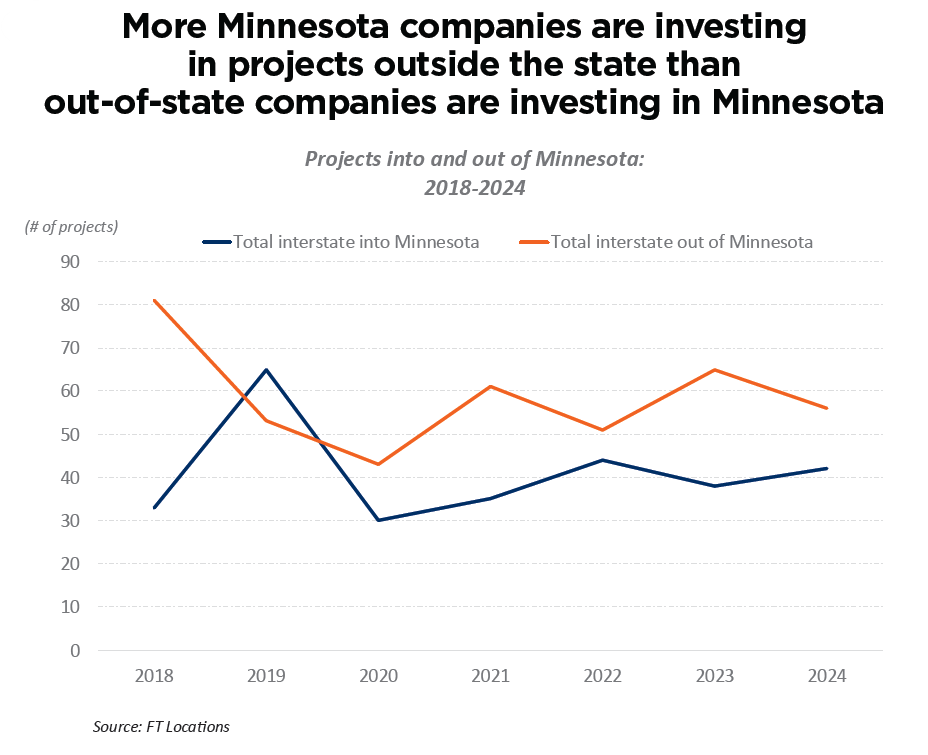

Minnesota continues to experience a net outflow of expansion projects. Minnesota firms initiated 56 out-of-state expansions compared to 42 inbound projects, continuing a trend of more outbound than inbound growth. Since 2018, Minnesota has seen 410 outbound projects versus 287 inbound.

Persistent workforce gaps remain. While labor availability pressures eased from previous years, 59% of firms still reported difficulty hiring. Only 27% of businesses plan to grow their workforce in the coming year.

Rising operational costs are straining business performance. An overwhelming 96% of surveyed businesses reported higher costs in 2024, with 42% calling the increases significant. Insurance, labor, supply chain inputs, taxes and regulatory compliance were the most commonly cited drivers.

Policy and regulatory headwinds adding cost and uncertainty for businesses. Businesses cited Minnesotaspecific policies – including labor mandates like Earned Sick and Safe Time – as drivers of added cost and complexity. Some firms reported pausing expansion in the state or moving investments elsewhere due to concerns about the long-term business climate. Further, changes in federal trade policies sparked new worries from respondents about how these changes will impact costs and demand.

Back to top

Report methodology

Unlike other areas of economic measurement, there is no singular source of data on business expansion activity for regions or states. Businesses are not required to publicly report on decisions to expand or invest in new activities. However, a variety of third-party entities collect expansion data through public announcements in news outlets or company websites, real estate and construction reports, economic development agencies and other sources to track and assess business investments.

This report uses several sources to piece together information on business expansion activity in Minnesota. While not a perfect science, it provides useful insights about a critical component of regional and state economic performance.

Note: The terms “business expansions,” “projects” and “business investments” used throughout this report refer to activities that typically include a combination of job creation and capital expenditures (e.g., real estate, equipment and machinery, etc.) to increase the productive capacity of the business. Focus is given toward tradable industries that aren’t locationally bound to one particular community or region, and thus could potentially relocate or expand across regional or state boundaries.

Sources

- Grow Minnesota!® survey of Minnesota businesses: Grow Minnesota!® conducted an online survey of Minnesota businesses to collect insights on their recent and future expansion activities. The purpose was to better understand some of the factors that influence Minnesota businesses’ decisions to expand and where to place those investments. Report methodology: 5 Responses were collected through a non-scientific survey of 348 businesses, which was in the field in March and April of 2025. It was initially distributed by the Minnesota Chamber of Commerce and then distributed through local Grow Minnesota!® partners in various communities around the state. The largest share of responses came from manufacturers (17%), with the remaining responses coming from firms in 19 different industries at the 2-digit NAICS industry level. Responses were submitted from 42 counties throughout the state. Survey responses were weighted slightly toward Greater Minnesota communities due to the location of participating local partners and to better understand differences across the state. Since the survey did not use scientific sampling methods, readers should take caution in interpreting the results.

- Site Selection Magazine/Conway Projects Database: Site Selection Magazine uses a proprietary database called Conway Projects Database to track new and expansion projects throughout the United States. Its annual Governor’s Cup awards measure and rank activity across all states. Their report tracks projects with “a minimum investment of $1 million, creation of 20 or more new jobs or 20,000 square feet or more of new construction.”

- FT Locations: This database tracks cross-border greenfield Foreign Direct Investment (FDI) and includes state-to-state project activity. This source shows the headquarters location of the company making an investment (source location) and the location of where the investment takes place (destination location), enabling analysis of investments into Minnesota from out-of-state companies and investments originating from Minnesota-based companies going to other states.

- Department of Employment and Economic Development (DEED), Publicly Announced Business Expansions dashboard: Each quarter, DEED updates an interactive online dashboard showing summary statistics and individual project information on expansion announcements throughout the state. As they note on their website, the list is not comprehensive of every expansion in the state. However, it includes valuable information on many impactful business expansion projects in Minnesota.

- Job Creation Fund, Minnesota Investment Fund, and Minnesota Forward Fund funding awards maps: DEED publishes information on awards issued through the Job Creation Fund and Minnesota Investment Fund, which are two of the state’s primary expansion incentive programs. Their online map of awards lists the funding recipients, award amounts, job creation and capital investment estimates and other related information.

Back to top

2024 business expansion activity

Total project activity as reported by Site Selection Magazine, fDi Markets, and direct surveys and interviews with regional and state economic development organizations.

Key questions: How many projects are occurring in Minnesota over time? How does this compare to other states in the Midwest and around the U.S.?

Business expansion activity in Minnesota remains strong but continues to lag regional peers. Minnesota saw 97 new or expansion projects in 2024 that met Site Selection Magazine’s baseline criteria for inclusion in the Governor’s Cup rankings—defined as at least a $1 million capital investment, the creation of 20 or more jobs, or new construction of 20,000 or more square feet. While this represents a slight decline from 2023, the level of activity remains substantially higher than before 2020. From 2021 to 2024, Minnesota recorded 394 such projects, compared to just 235 from 2017 to 2020.

Despite this upward trend, Minnesota continues to trail many of its Midwestern peers. In 2024, Minnesota ranked 8th out of 12 Midwestern states in total project count and 10th in projects per million residents, according to Site Selection’s Conway Projects Database. Since 2019, the state has had 508 qualifying projects—more than neighboring Wisconsin but fewer than regional competitors such as Illinois, Ohio, Indiana, Michigan, Kansas and Missouri.

Foreign direct investment (FDI) into Minnesota is rising steadily. Minnesota attracted 24 FDI projects in 2024, according to FT Locations, totaling an estimated $1.3 billion in capital investment and 2,847 new jobs. Since 2018, foreign-owned firms have announced at least 101 projects in the state, representing $4.3 billion in projected capital expenditures and 9,534 jobs. These investments have originated from 20 countries, with the United Kingdom, Germany, Japan, Canada and Spain accounting for nearly half of all projects and two-thirds of total capital investment. Notable announcements in 2024 include Italianbased Sofidel’s investment in Duluth’s former ST Paper site and Japanese-owned Polar Semiconductor’s expansion of chip production capabilities in Bloomington.

While incoming FDI has increased, outgoing FDI from Minnesota-based companies has declined. For example, in 2013, Minnesota firms initiated 97 new projects abroad, compared to just 12 incoming projects from foreign companies. By 2024, however, FT Locations recorded an equal number of outgoing and incoming projects—24 each—with incoming capital investments exceeding those leaving the state. The causes and long-term implications of this reversal remain unclear, but merit further analysis given their potential impact on Minnesota’s global investment profile.

Minnesota continues to experience a net outflow of business expansion projects, though 2024 saw a surge in potential inbound investment. In 2024, FT Locations tracked 56 expansion projects from Minnesota-based companies in other states, compared to 42 inbound projects announced by out-of-state firms. These inbound announcements include both new entrants into Minnesota and expansions of existing operations.

This imbalance continues a broader trend: since 2018, Minnesota has seen 410 outgoing projects versus 287 incoming ones. Analysis of project origins and destinations reveals a geographic pattern—Minnesota tends to attract more projects from companies in the Northeast, West Coast, and parts of the Great Lakes and Interior South, while losing more to the Southeast, Southwest and central Midwest.

Despite this net deficit, 2024 marked a turning point in investment scale of incoming projects. A handful of large projects contributed to an influx of expected capital investment in Minnesota. Altogether, out-of-state firms announced $10.9 billion in new capital investments in Minnesota in 2024, with plans to create 6,038 jobs. This single year of incoming investment exceeds the total from the previous four years combined.

Back to top

Public announcements of expansions in 2024

Business expansion projects in Minnesota as reported by the Department of Employment and Economic Development’s directory of publicly announced business expansions.

Key questions: What were the largest expansion projects in Minnesota in 2024? How were projects distributed across regions and industries?

Minnesota received two $5 billion megaproject announcements in 2024, accounting for over 80% of total capital expenditure commitments. The remaining expansions averaged $38 million in expected capital expenditures and 90 new jobs per project. The Minnesota Department of Employment and Economic Development recorded 113 publicly announced business expansion projects in 2024, totaling $12.2 billion in expected capital investments and 4,370 new jobs. While the total number of expansions is similar to past years, the total investment levels rose significantly in 2024, as two proposed projects – a sustainable aviation fuels facility in Moorhead and a data center development in Farmington – plan to bring $10 billion in new capital investments to the state. These projects are still in proposal stages and final outcomes are not guaranteed.

However, they represent among the largest expansions in the state’s recent history should they come to fruition.

Outside of these two megaprojects, the remaining 59 expansion announcements recorded by DEED (where capital investment levels were revealed) averaged $38 million and 90 new expected new jobs. Notable projects include:

- British-based BAE Systems’ construction of a 248,000 square foot facility in Maple Grove that will bring $31 million in capital investments and 500 new jobs

- United Therapeutics’ $100 million investment in a research farm in Stewartville

- 3M’s healthcare spin-off, Solventum, which announced plans to locate its headquarters operations in Eagan

- SkyWater Technology’s $127 million in planned expansions of chipmaking production at its Bloomington facility

- Philips Image Guided Therapy’s decision to invest $31 million and add over 150 new jobs to expand operations at its Plymouth facility.

Business expansions in 2024 were clustered in the Twin Cities metro area, though significant projects spanned all corners of Minnesota. The seven-county Twin Cities region accounted for roughly 65% of the expansion announcements (71 out of 110 projects). Suburbs such as Bloomington, Brooklyn Park, Plymouth, Eagan and Maple Grove each saw multiple expansions, reflecting a continued trend of activity clustered in certain pockets, particularly in the northwest metro.

Outside the metro, Greater Minnesota still secured notable expansions. Fifteen percent of expansion announcements in 2024 are expected to take place in Central Minnesota, with projects clustered around the St. Cloud region. Nine percent of expansions were in Southeast Minnesota. The Rochester area saw multiple projects – four in Rochester itself plus others in nearby towns. The remaining twelve percent of expansions were spread evenly across Minnesota’s northeast, northwest and southwest regions.

Expansions took place across broad range of industries, with medical and machinery manufacturing seeing the most activity. Minnesota’s medical technology and health sector led the state in expansion activity during 2024, with 16 separate projects – the highest of any category. Close behind was the machinery manufacturing sector with 13 expansion projects. Other active sectors included food processing (six projects) and fabricated metal products (five projects), followed by several industries tied with four projects each (electrical equipment, engineering services and chemicals). Notably, emerging segments like data centers also saw multiple large-scale projects, highlighting the growing role that data infrastructure is playing in overall business investment activity.

Back to top

Trends and factors driving business investment decisions in Minnesota

Findings from surveys and interviews with Minnesota businesses and local, regional and state economic developers.

Key questions: What factors influenced overall expansion activity in Minnesota in 2024? What opportunities and challenges do businesses report as they seek to grow and expand?

To better understand the factors shaping Minnesota’s business growth and expansion, Grow Minnesota!® conducted surveys and interviews with around 350 businesses in the spring of 2025. The following section summarizes key themes that emerged from this outreach.

Note: See the methodology section on page 4 for more information about the survey referenced here.

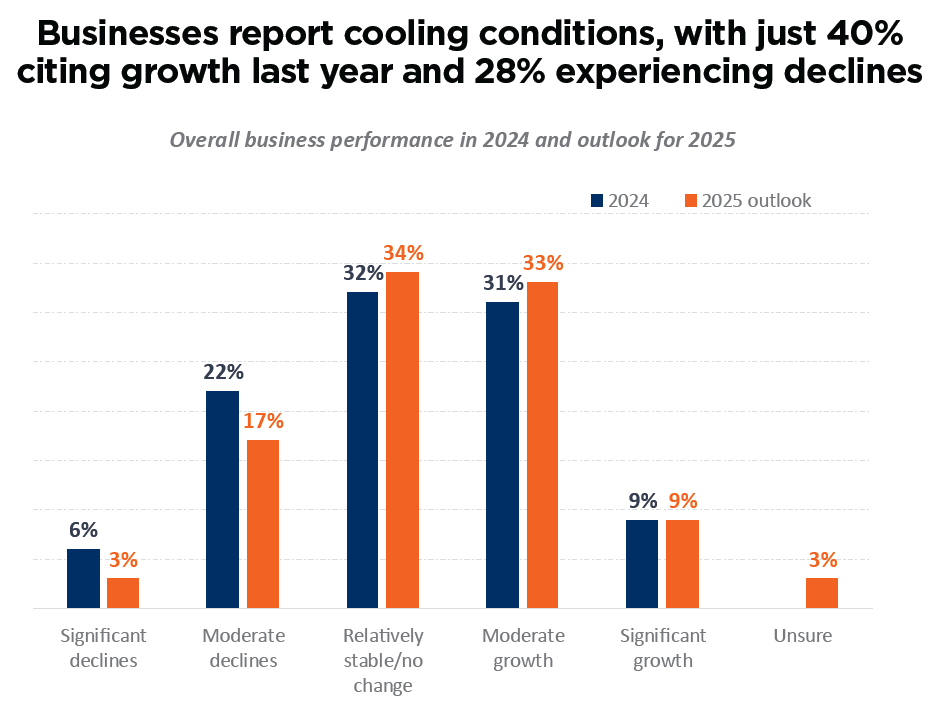

Businesses report cool down from previous years, but majority are still planning for future growth. Two thirds of survey respondents reported overall stability or moderate growth over the past year, with just 9% experiencing significant growth and 20% reporting moderate or significant declines.

When compared to responses in the 2023 and 2024 State of Business retention and expansion, there is a notable downward shift in business performance. For example, 53% of businesses reported moderate or significant growth in 2023, compared to just 40% in 2024, and a higher share reported declines in 2024 than the previous year.

Businesses cited examples of broader economic conditions creating headwinds to growth. Respondents wrote:

- “Bigger impact is that economic costs are increasing for our customers so they are spending less or not spending at all with us.”

- “The fact that rates have not fallen as anticipated has hurt both our expense side and our revenue generation as our clients have tabled or deferred projects.”

- “Interest rates and uncertainty lead to construction projects being put on hold or stopped completely.”

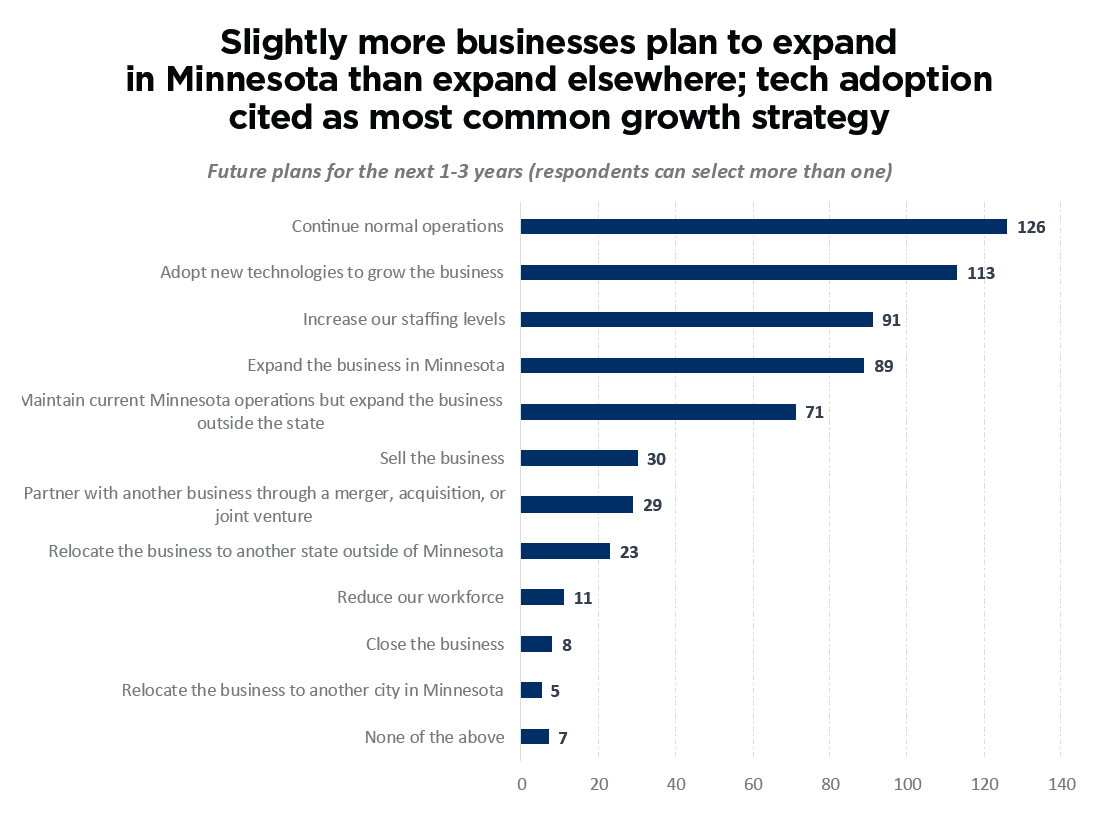

When asked about future plans, a plurality cited that they plan to continue maintaining normal operations or adopt new technologies to grow the business. Overall, 65% had plans to expand the business, with slightly more planning to expand in Minnesota than expand elsewhere, and another 23 businesses considering relocating the business to another state.

Several companies explained how the increased cost of capital, economic uncertainty or state-level business climate concerns forced them to rethink or delay expansion plans.

- “We will look at consolidating manufacturing operations outside of Minnesota. We will still have small operations and sales office here but will move to North Dakota for cost and tax reasons.”

- “We planned on adding another location and expanding both of our current locations but a lower than expected first quarter drop of 30% revenue has caused significant alarm and we have ceased all future growth plans until our revenue improves to regular levels.”

- “While growth is always the long-term hope, the focus right now is on managing cash flow, controlling expenses, and continuing to serve our loyal customer base in a meaningful way.”

- “We are trying to grow and expand but with rent costs and people holding on tighter to their money right now, expansion is not an option.”

Of those with future growth plans, many respondents cited efforts to innovate and invest in new technology. Firms are responding to economic conditions and pivoting, such as adding automation capabilities or diversifying into new products. In times of slow economic and population growth, companies are increasingly finding new opportunities to improve productivity and leverage technology to meet new customer demand.

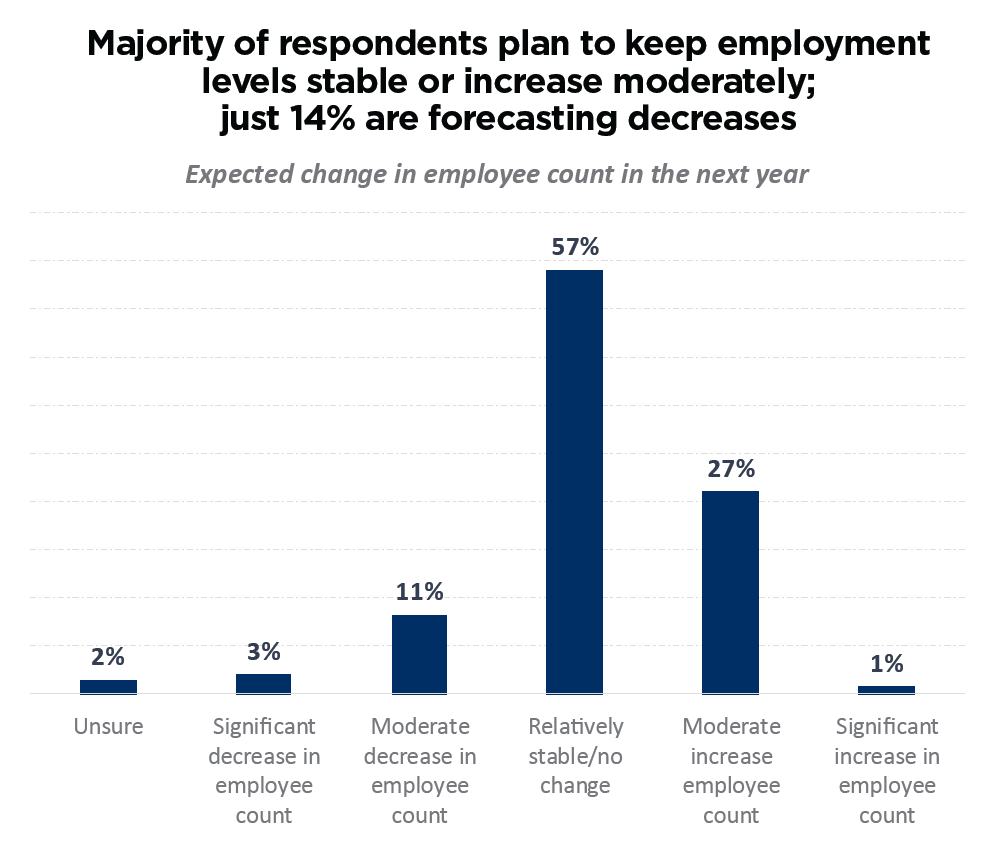

While labor availability remains a challenge, fewer businesses are reporting hiring difficulties. Hiring demand cooled slightly from the previous year, as only a quarter (26%) of businesses plan to increase their employee count and over half (57%) expected to keep their headcount stable over the next year.

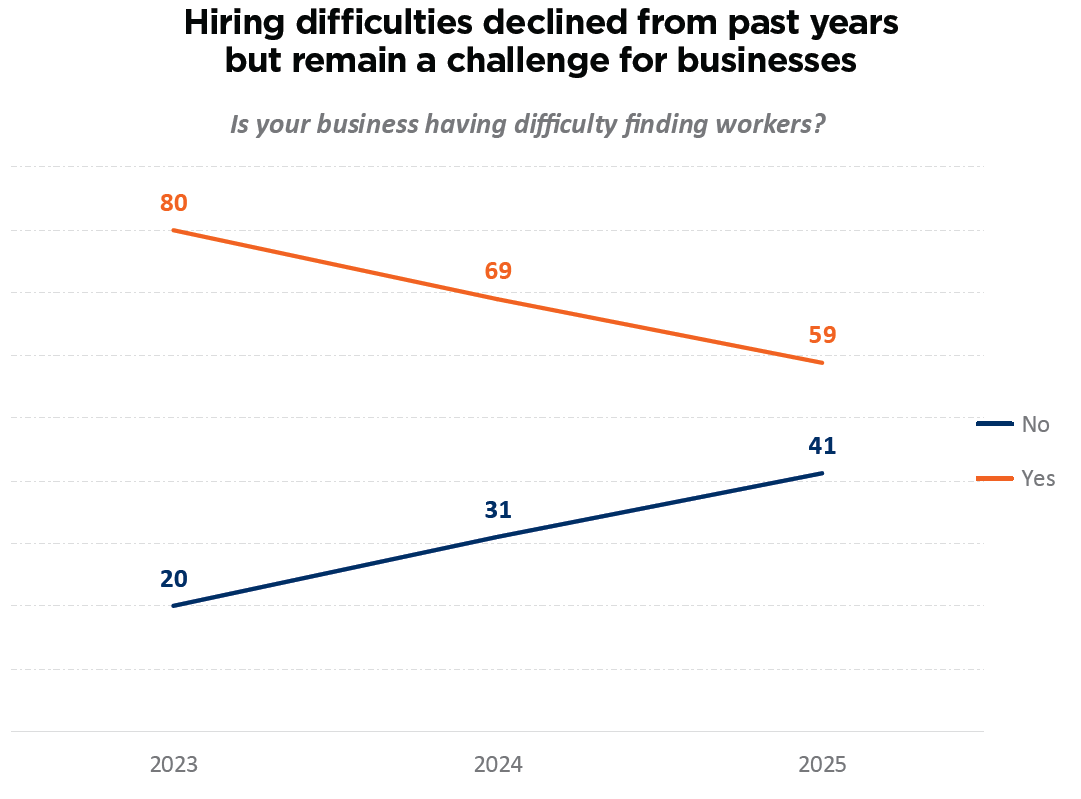

This reduction in hiring activity – in combination with recovering supply in the labor market – has led to fewer businesses reporting workforce availability challenges. 59% of businesses reported difficulty finding workers, down from 80% who reported challenges in 2022 and 69% that had challenges in 2023.

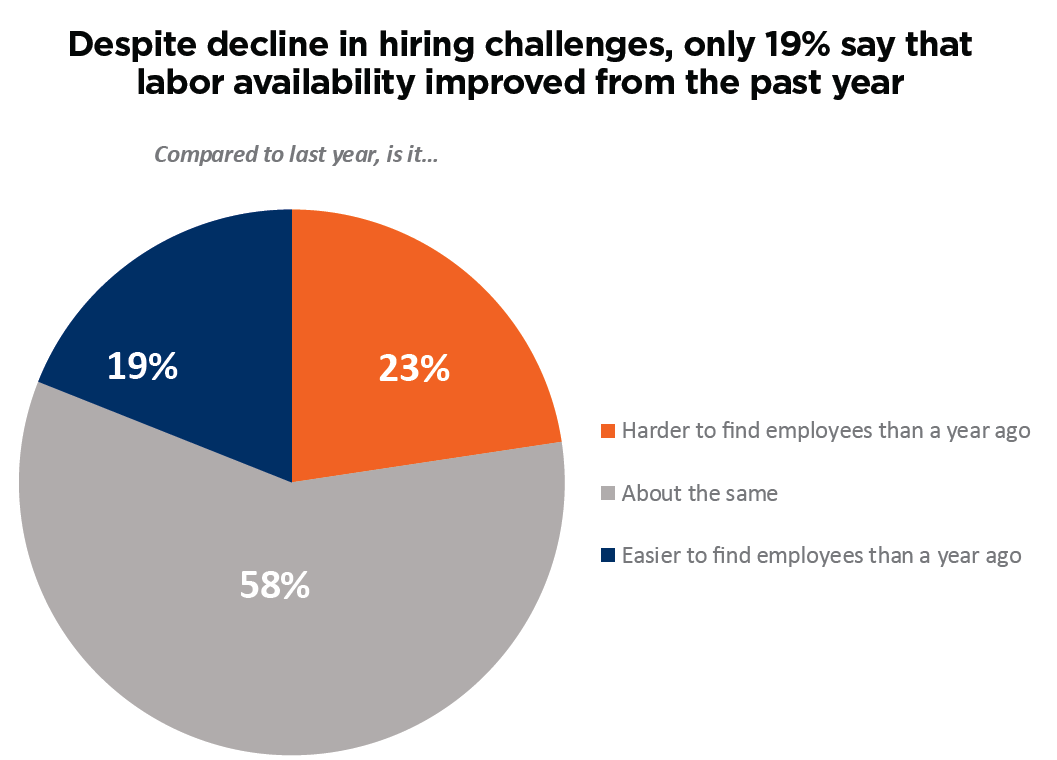

However, general workforce availability remains a significant issue for many businesses. Over half are still experiencing hiring challenges and less than 20% said it is getting easier to find workers. As noted in previous research from the Minnesota Chamber Foundation, the state’s underlying demographic changes have led to a decades-long trend of slowing population and labor force growth that is constraining businesses’ ability to access talent.

Some companies revealed how the availability of labor force is holding them back as they turn down orders due to workforce constraints. One business wrote: “We would absolutely grow if we could find the employees, but it’s been that way for the past 5 years.”

The tight labor market and increased competition for employees mean that firms are eager to retain their employees. Respondents shared how they compete for labor and how that affects their cost of doing business.

- “Labor continues to go up as well. We have to keep giving raises to keep up with the high demand and keep our staff here and engaged.”

- “Labor shortages are driving higher wages. Access to skilled labor, health insurance rising, interest rates rising, and regulations increasing are driving more overhead expenditures”

- “Lack of labor to hire and rising pay keeping the people we have”

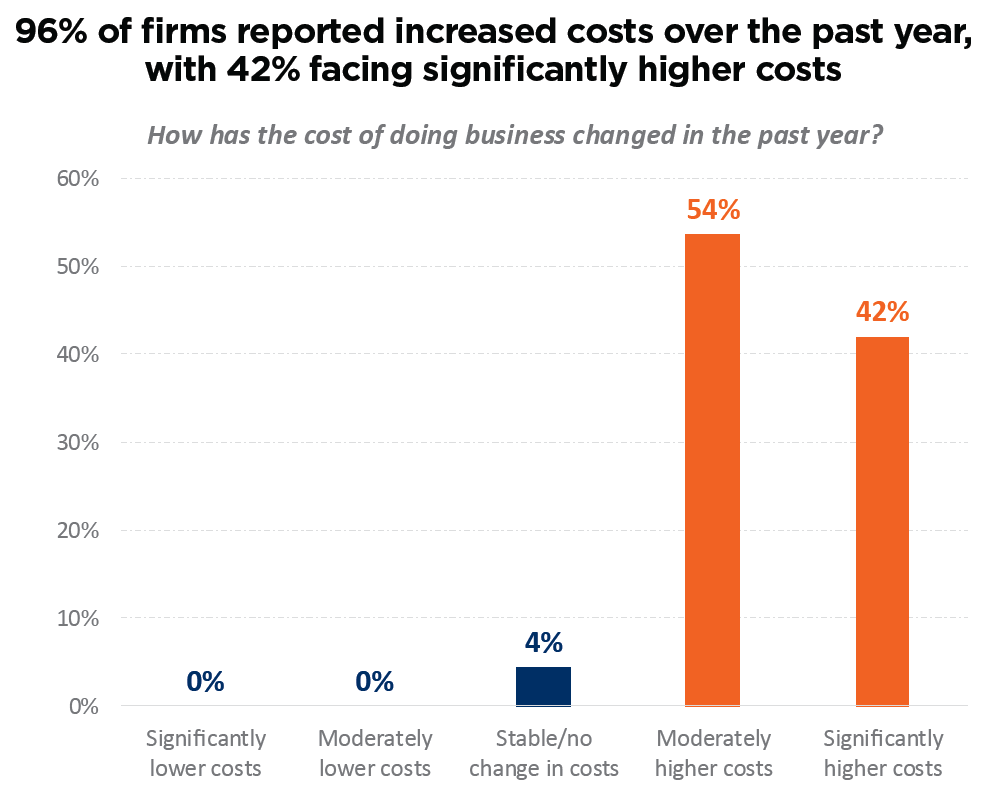

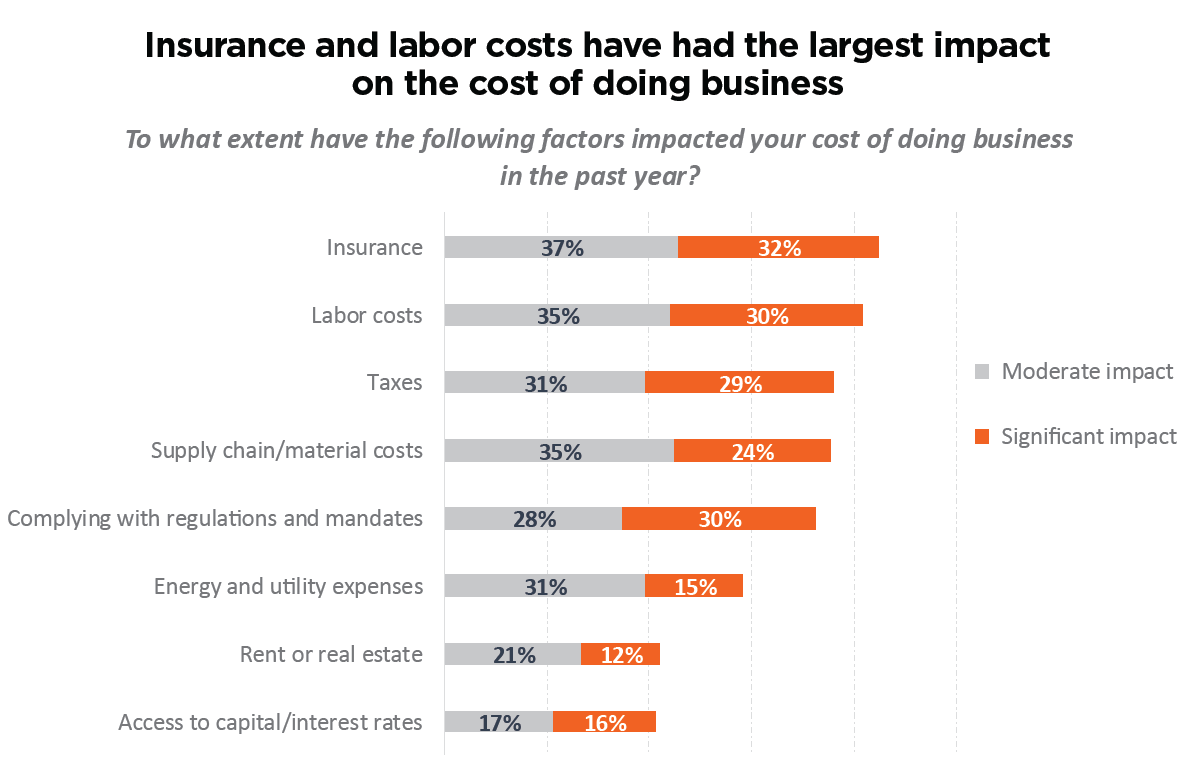

Businesses report significantly higher costs over the past year, with range of issues impacting their cost of doing business. When asked how the cost of doing business has changed in the past year, not one of the 317 responses said that costs had decreased and just 4% reported no change in costs. In total, 96% of businesses report cost increases, with 42% of those stating that they experienced significant increases over the past year.

Respondents were asked to share how costs changed over the past year in eight areas of their business. Rising insurance costs were cited as the most common cost driver, with over two-thirds (68%) reporting moderate or severe impacts. Labor costs were a close second with just under two-thirds (66%) saying that it has a moderate to severe impact.

Other top cost drivers included taxes, supply chain inputs and complying with regulations/ mandates.

Interest rates and rent or real estate costs were scored as the two lowest cost drivers. However, this may reflect an issue of timing more than overall impact since the question asked about cost changes over the past year. Numerous openended responses noted the continued impact of high borrowing costs as a continued challenge, even if rates have not continued to rise recently.

Comments from survey respondents show the range and impact of cost issues businesses are facing:

- “Higher costs for labor and materials, hard to keep up with all the price increases”

- “Insurance went through the roof. Labor costs are up, not only in pay but also in benefits paid due to sick time laws. Everything is more expensive.”

- “Health care costs continue to jump yearon- year and are a significant drain on business resources.”

- “Increases in labor and material costs and not being able to increase margin causes reduced profitability.”

- “Cost of capital and supply chain costs (software licensing) are significant drivers. In our industry utility/energy costs are always top of mind and the increase has been seen in almost every state we operate in.”

- “Insurance for liability and property have gone up approximately 10%, despite no claims in FY24.”

- “Increasing material and labor costs make it hard to justify investor and debt exposure.”

Policy and regulatory environment adding costs and uncertainty for businesses. Businesses cited challenges about the influx of state regulations and labor mandates, noting impacts on their time and cost to comply. Additionally, federal tariff policies spurred a new set of concerns for businesses.

At the state level, businesses shared concerns about policies that increase the complexity and cost of doing business in Minnesota. When asked to score the impact on operational expenses, state taxes and workplace mandates both ranked high in the overall impact and in the significant impact category. Many businesses commented on the recently implemented labor mandates, namely Earned Sick and Safe Time and Paid Family and Medical Leave.

Examples include:

- “While we understand and support the importance of employee well-being, [ESST] has resulted in an increased cost to labor, which is especially challenging for small businesses with limited margins.”

- “Labor costs continue to rise, particularly with the recent implementation of ESST law. While we support fair labor practices, the added financial burden is significant for small businesses.”

- “With Minnesota specifically, the new safe and sick time regulations and increased costs are taking way too much time and expense to deal with.”

- “Ever increasing regulations, the cost of insurance (all types including health) and the Minnesota mandates coming into effect in ‘26 will drive costs up in that year.”

- “Even though we offer an above-average PTO benefit, Earned Sick and Safe Time is a significant expense. The lack of guardrails is leading to abuse and costing our company an added $200,000+ annual expense.”

Some businesses shared how state challenges have led them to prioritize investment elsewhere, 16% of respondents said they plan to expand their business in other states. While they may maintain current Minnesota facilities, companies report that the high cost of business, including tax rates and workplace regulations, pushes them to place investment projects elsewhere. Examples of state influence on expansion decisions include:

- “Due to increased costs of doing business in the state of Minnesota, our company is looking to expand our business model in other states.”

- “We would like to expand our operations, however the Minnesota business model is not ideal and does not favor the business and its owners to stay in the state. Tax rates, employee regulations are more of a deterrent than a plus to the business community.”

- “Local government regulation is also becoming prohibitive to starting new projects.”

- “Regulatory delays and conditions drive up the cost of projects.”

- “Winning bids but our customers are delayed MANY times due to regulations.”

- “Minnesota’s tax rates are high and we can deal with that for our existing business operations, but it has made investing here cost prohibitive as we contemplate future projects/ investments, Minnesota’s tax policies are driving investment dollars across our businesses to other states where growth is higher and the urban centers are growing.”

- “Minnesota taxes and employment regulation continue to make it more expensive and difficult to operate in Minnesota. We are continuing to expand our Las Vegas office and reduce our Minnesota office staffing levels.”

- “Permitting and regulatory challenges limit us from expanding in Minnesota”

Due to the timing of the survey (March and April 2025), tariffs loomed large in the short-response answers about challenges and costs that businesses are facing. While the survey didn’t ask directly about tariffs, these short-answer responses provided some insights on businesses’ response to changes in federal trade policies:

- “Tariffs and the threat of tariffs are causing hesitation and cost increases. Federal cuts are impacting project funding. Labor shortages are also impactful.”

- “Trying to weather the tariffs which is impacting cost of product and creating huge uncertainty with our retail customers.”

- “It’s all up in the air right now given the current federal situation, we really have no clue what to expect”

- “Material cost and with the tariffs I am worried about material shortages. I am buying extra to save on price increases but also to make sure it is available when I need it. The only thing worse than having a price increase is not being able to get it at all.

- “Perceived costs of tariffs is also a big unknown for us. Clients are already pulling back on services with the anticipated increase in costs.”

- “Tariffs and threats thereof are impacting our clients willingness to commit to construction projects and is throwing the construction industry into chaos.”

Back to top

ISSUE SPOTLIGHT: Small business growth in Minnesota

Why small business growth matters

While expansions at large firms often dominate headlines, the growth of small businesses is equally important to Minnesota’s long-term economic performance. This section provides an overview of Minnesota’s small business landscape and highlights key insights from survey data on the challenges these businesses face as they work to grow and scale in the state.

How many small businesses are in Minnesota?

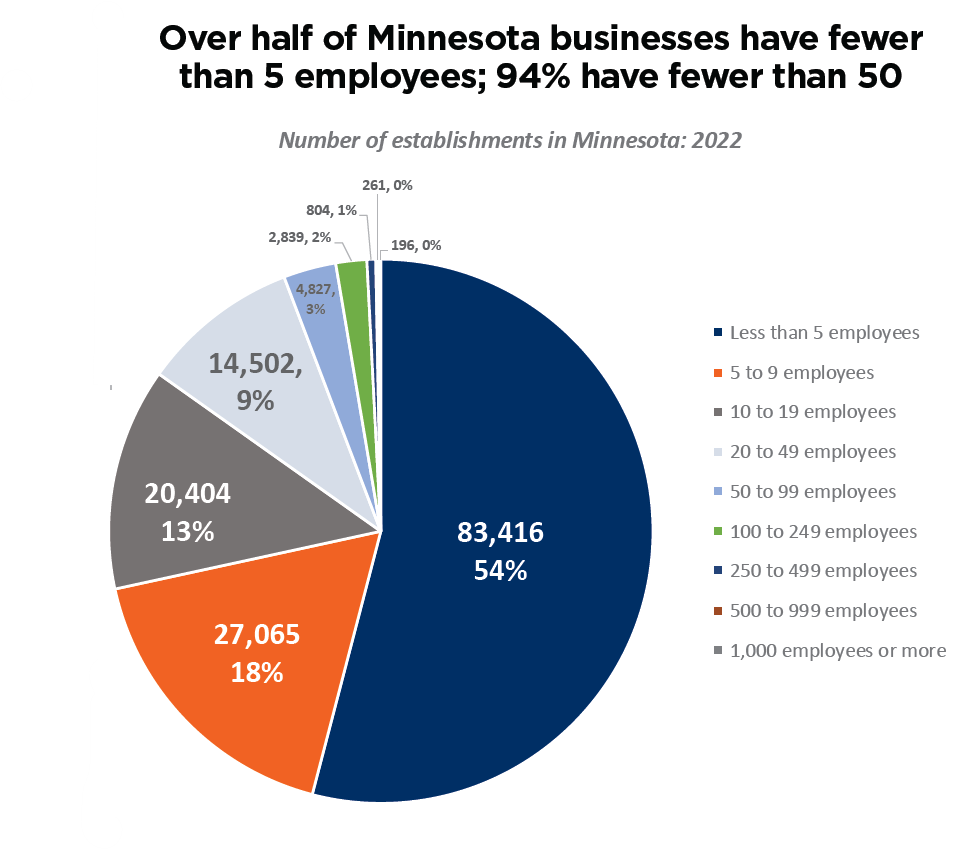

Defining “small business” can vary. The Small Business Administration (SBA) typically includes businesses with fewer than 500 employees in its broad definition.

According to the SBA, Minnesota was home to 547,493 small businesses in 2022—including both employer and non-employer firms. These businesses represent 99.5% of all establishments in the state and employ approximately 1.2 million people, or 45% of the workforce.

Because roughly four out of five small businesses have no employees beyond the owner, it can be useful to focus specifically on employer businesses.

Among employer firms:

- 94% have fewer than 50 employees, employing 1.03 million workers and paying $53.7 billion in wages.

- 54% have fewer than 5 employees, yet still employ over 130,000 people and paid $8.1 billion in wages in 2022.

These figures underscore the outsized role that small businesses play in Minnesota’s economy, not only in number but also in employment and payroll.

Long-term trends in small business activity in Minnesota

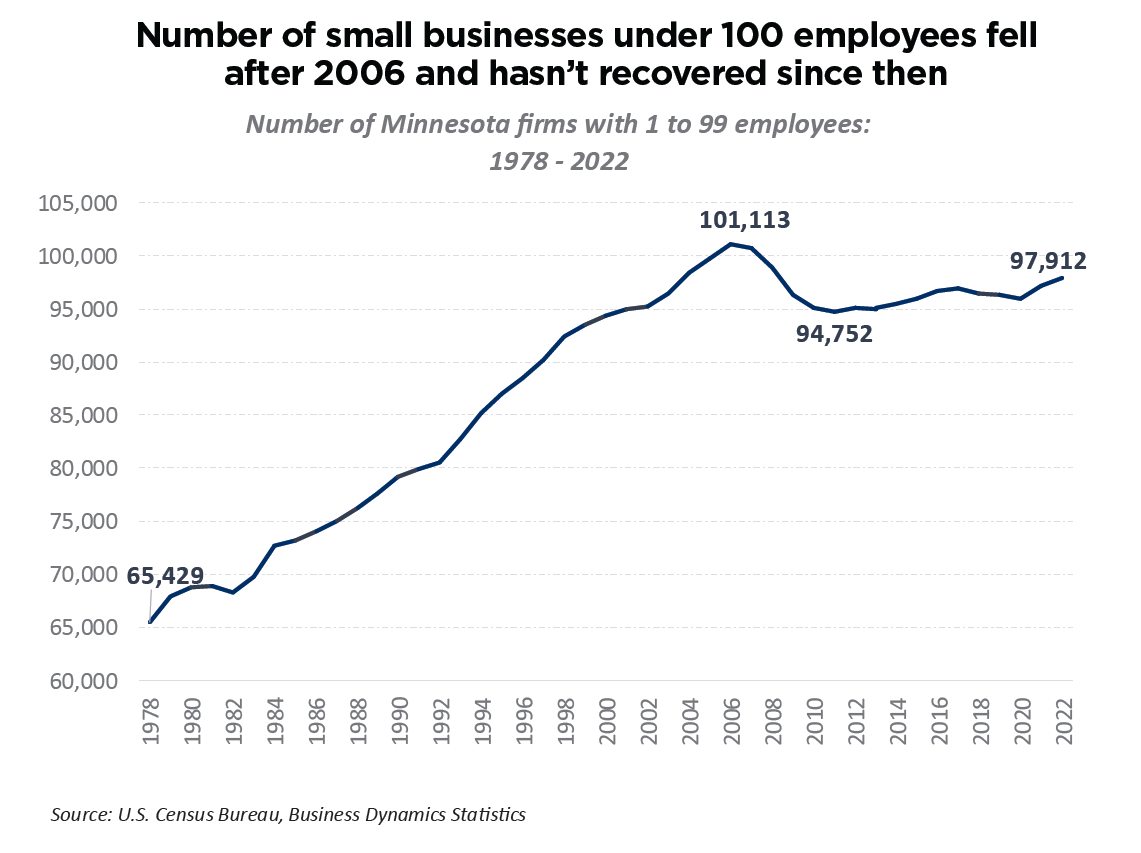

After several decades of growth, Minnesota experienced a sharp decline in the number of small businesses under 100 employees from 2006 to 2011, and the total number has yet to fully recover. As of 2022, there were still fewer small businesses than in 2006.

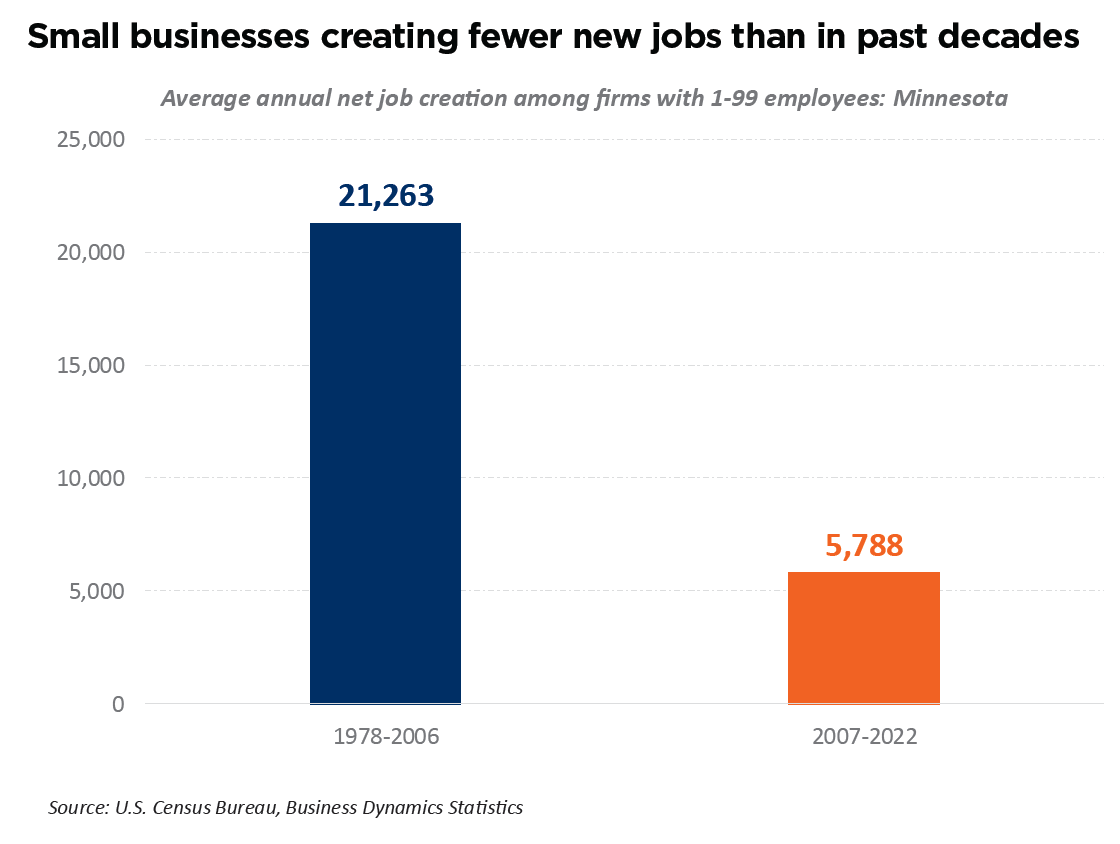

Small business job creation has also slowed. From 1978 to 2006, small businesses in Minnesota averaged over 21,000 net new jobs per year. Since 2006, that number has dropped to less than 5,800 per year.

However, there are signs of renewed entrepreneurial activity. New business applications surged in 2020 during the pandemic and have remained elevated since. This trend aligns with a noticeable increase in very small firms (under five employees) in 2021 and 2022.

Why supporting small business growth is critical

Helping small firms grow and scale-up is essential to Minnesota’s overall economic success.

Firms with 20–99 employees create the largest share of new jobs among all business size categories in the state. Having a robust sector of growing small businesses in this size range can add dynamism to the state economy.

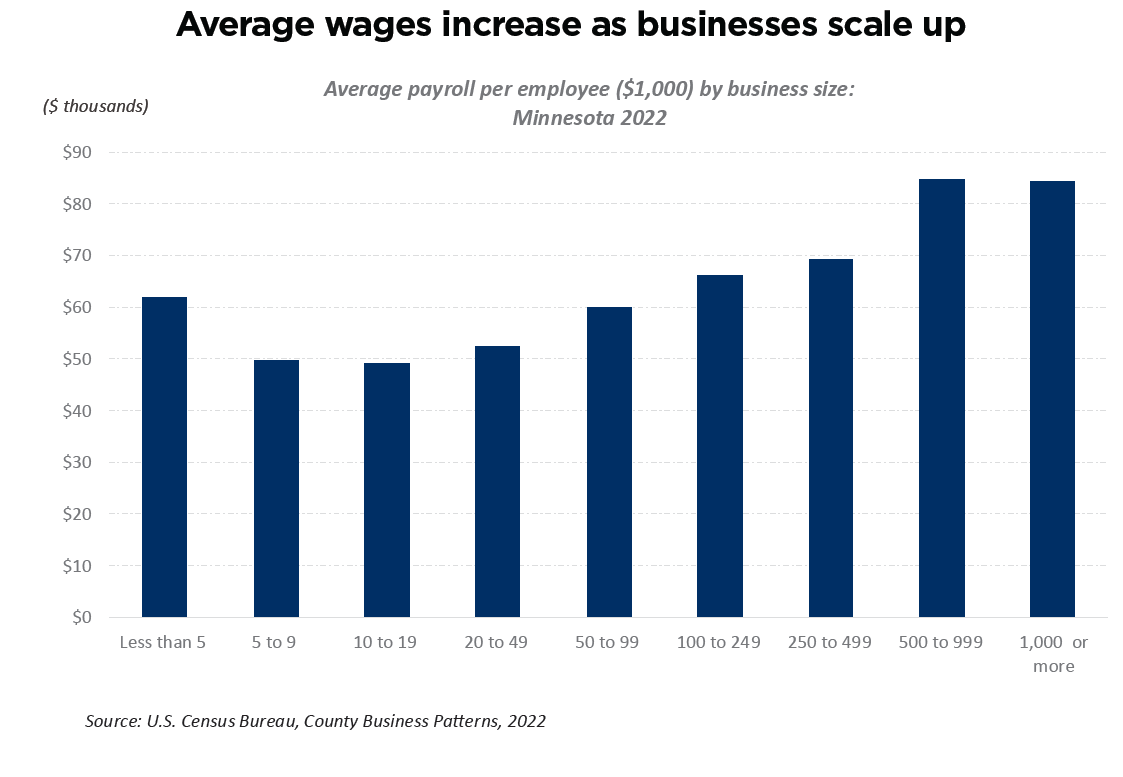

As businesses scale, their economic contributions grow significantly, including higher employment levels and rising average wages.

These data suggest that fostering an environment where small firms can survive, grow, and scale will be critical to sustaining job creation and strengthening Minnesota’s economy.

Small business insights from survey results

Small businesses in Minnesota face intensifying external pressures, such as rising costs and workforce shortages. While larger firms may weather these issues more easily, small businesses often lack the staffing and financial buffers to absorb them, making the cumulative impact more severe.

Small and midsized businesses reported more volatility than larger firms last year, and fewer are expecting growth this year. Larger firms (300+ employees) reported more stable performance, with responses evenly split between moderate growth (33%), no change (33%) and moderate decline (28%). None reported significant revenue declines. In contrast, 6% of firms with 1–299 employees and 8% of non-employer firms reported significant revenue declines. Further, half of large firms expect moderate or significant growth in the coming year, compared to just 39% of businesses under 300 employees.

Rising operational costs are having a major impact on small businesses. 44% of small businesses reported significant impacts from cost increases, compared to just 36% of large firms who reported significant impacts. Open-ended responses demonstrate the disproportionate impact of these challenges on small businesses:

- “Labor rates and interest rates are causing higher than normal business expenses. Insurance costs have had a significant impact on the company’s bottom line as a small employer.”

- “With business expenses up across the board and inflation decreasing business, our profit has decreased. As small business owners we don’t have as much expendable income”

- “One of our greatest challenges is the ongoing uncertainty in consumer spending, which is especially tough for small, independently owned retail businesses. As household budgets tighten, discretionary spending has decreased, impacting sales and making it harder to plan for consistent growth.”

- “The cost of wholesale product has increased at least 30%. We are now paying sick and safe time to employees. The cost of building insurance has risen $100 per month. There was a slim profit before, now struggling each month to pay bills.”

Access to capital and borrowing costs are impactful to small businesses. Although interest rates didn’t top the list of general concerns, over half of respondents said access to capital has impacted operations and a third cited moderate or significant impacts. High borrowing costs are especially challenging for startups and growth-oriented small businesses:

- “Borrowing capital is much harder than in the past.”

- “As a startup, access to capital is very difficult to obtain in the current environment. If we have a good year, it will likely constrain our ability to expand.”

- “Additionally, high interest rates have significantly impacted our financial flexibility. With sales slowing due to broader economic uncertainty, the cost of borrowing has made it more difficult to manage cash flow and reinvest in growth opportunities.”

- “As a startup, we are more worried than ever about cash flow.”

- “With sales slowing due to broader economic uncertainty, the cost of borrowing has made it more difficult to manage cash flow and reinvest in growth opportunities. These factors combined have created a challenging environment where we are forced to make more conservative operational decisions, and we hope we can keep our doors open long enough to see things turn around.”

Small businesses report burdens navigating new regulations. Small firms face a disproportionate time burden navigating changes such as new mandates, rising insurance costs or supply chain adjustments. Time spent managing day-to-day challenges often comes at the expense of strategic planning and long-term growth.

- “Regulations don’t necessarily cost a lot out-of-pocket, but the amount of time they require is costly - especially as a startup.”

- “Complying with new mandates issued by the state of Minnesota have been costly in terms of time, resources, and energy. Insurance premiums have also increased significantly.”

- “While we support fair labor practices, the added financial burden is significant for small businesses with lean staffing models.”

- “All in all, Minnesota makes it very difficult for small businesses to grow with all of the mandates, taxes and little to no attention to workforce availability issues.”

- “It starts with regulations and mandates. Having to piece all of that together with limited resources because we are a small company creates stress and more work on others. This then costs money, causes errors (which can than increase insurance).”

Community commitment remains strong among small businesses. Despite economic pressures, many small businesses remain deeply committed to their local communities. Small businesses commented:

- “As a family-owned business with deep roots in the area, we have a strong desire to continue manufacturing locally.”

- “The focus is always providing services that are needed in our community and having highly qualified staff to provide care.”

Back to top

Conclusions

The 2025 State of Business Retention and Expansion report highlights a mixed picture for business growth in Minnesota. Minnesota’s competitive advantages have driven historic investments from companies choosing to expand in the state. Further, survey responses show that many businesses remain optimistic and are still planning for expansion in the coming years. Yet, businesses also report growing pressures that impact their ability to sustain operations and invest in growth.

Overall economic uncertainty, rising costs, continued workforce challenges and an influx of new regulations are dampening business activity. Comments from respondents reflect the substantial pressures that businesses are facing as a combination of rising costs and uncertain demand are squeezing their bottom line. These impacts are most strongly felt by small and midsized businesses, which are foundational to the state’s economic success.

Addressing business climate concerns while providing additional support to Minnesota businesses – whether through accessing financing, entering new markets or finding talent – will be essential in fostering a conducive environment for continued growth and expansion across the state.

Grow Minnesota!® and the Minnesota Chamber Foundation are committed to helping Minnesota businesses – from startups to large companies – solve challenges and access resources to grow in the state. The program will continue collecting insights, providing assistance and building partnerships to strengthen Minnesota’s economy.

Back to top