Are you ready for Paid Family and Medical Leave (PFML) in Minnesota?

The information contained on this website is provided for informational purposes only and does not constitute legal advice. Paid Family and Medical Leave guidance provided by DEED. If you have further specific questions on what PFML means for your business and your employees, please reach out to DEED at paidleave@state.mn.us.

About Paid Family and Medical Leave (PFML)

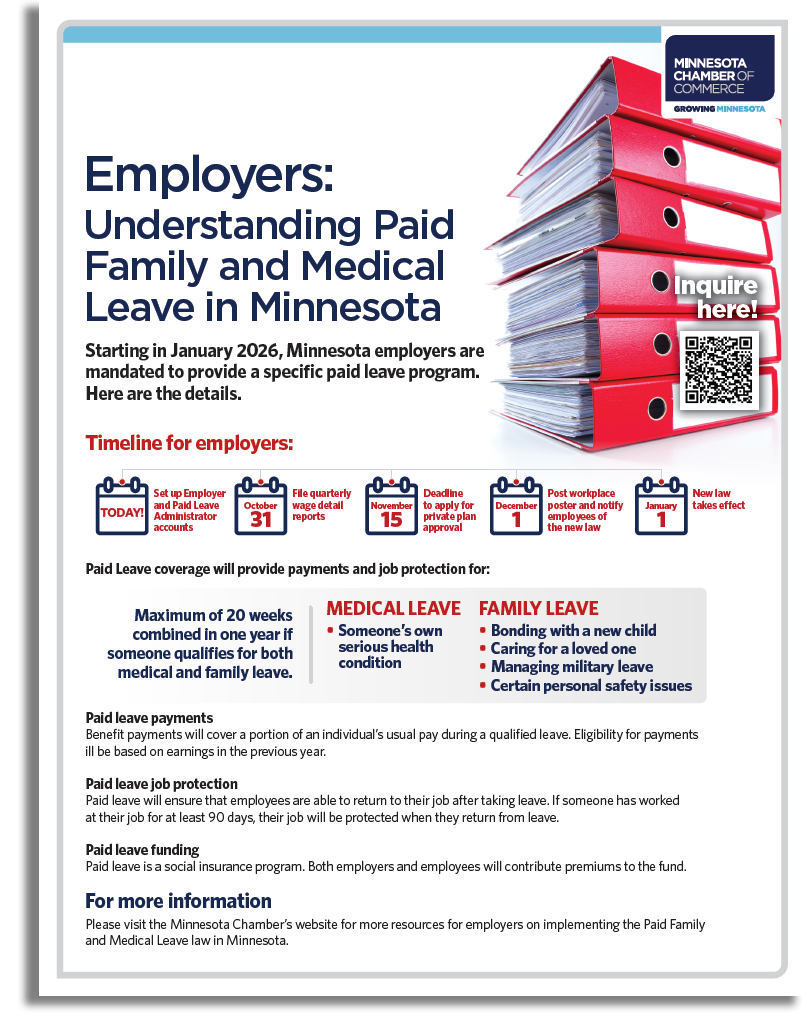

In 2023, the Legislature passed the most broad-sweeping workplace mandates in recent history, including two new paid leave mandates that impact every employer in the state – regardless of the size of business: Earned Sick and Safe Time (ESST) and Paid Family and Medical Leave (PFML). Please note – these two programs are administered differently and interact and stack with each other. ESST went into effect on January 1, 2024 and PFML is scheduled to go into effect on January 1, 2026. This page will focus on PFML. A detailed comparison between ESST and PFML can be found here. To learn more about ESST specifically, please click here and here.

Paid Family and Medical Leave (PFML): Starting January 1, 2026, this paid leave mandate forces every employer in the state to offer 12 weeks paid medical leave and 12 weeks of paid family leave (maxing out at 20 weeks total in a 52-week period) for all employees. The program will be administered by a new state agency within the Minnesota Department of Employment and Economic Development (DEED) with over 400 full-time employees. It is paid for through surplus funds and a considerable increase in payroll taxes (0.88% amended from the originally stated 0.7%), which can be split between employers and employees.

Back to top

Paid Family and Medical Leave FAQs

What is Paid Family and Medical Leave (PFML)?

A new state-mandated, state-run employee benefit starting on January 1, 2026. PFML requires every employer in the state to offer up to 12 weeks of paid medical leave and up to 12 weeks of paid family leave (maxing out at 20 weeks total in a 52-week period) for all employees. Wage replacement is partial, and job protection after 90 days from date of hire. The program will be administered by a new state agency within the Minnesota Department of Employment and Economic Development (DEED), unless an employer substitutes an equivalent private plan.

PFML is paid for through surplus funds and through payroll taxes – the current rate is 0.88% (up from the originally stated 0.7%), which can be split between evenly employers and employees. Certain small employers pay a reduced payroll tax rate if they employ 30 or fewer people and the average employee wage is less than 150% of the statewide average weekly wage. Employees will apply for and received payments directly from the state, not the employer, under this new social insurance program, unless an employer substitutes an equivalent private plan.

To learn more about how to substitute an equivalent private plan, click here.

To learn more about small business rates, click here.

For how long can employees take leave?

PFML requires every employer in the state to offer up to 12 weeks of paid medical leave and up to 12 weeks of paid family leave (maxing out at 20 weeks total in a 52-week period) for all employees. Employees can take qualified leave:

- Up to 12 weeks of medical leave (to care for self) to take care of a serious health condition, including pregnancy, childbirth, recovery, or surgery.

- Up to 12 weeks of family leave (to care for someone else) to:

- Bond with a child through birth, adoption, or foster placement

- Care for a loved one with a serious health condition

- Support a military family member called to active duty

- Respond to certain personal safety issues such as domestic violence, sexual assault, stalking, or similar issues.

- Bond with a child through birth, adoption, or foster placement

Employees can take both types of leave in the same year but cannot exceed 20 weeks total within a benefit year. A benefit year starts the first day the employee takes leave. An employee can split time and take intermittent leave:

- all at once in a single block

- on a regular schedule (e.g. recurring medical treatments)

- only when needed it (e.g. to manage flare-ups of a chronic health condition)

- at different times in a year, for the same condition or more than one condition.

How is it paid for?

Paid Leave is paid for by a 0.88% payroll tax on employee wages, which is split between the employer and employees. Employers can begin to deduct the employee share on January 1, 2026, when benefits become available. Employers will pay the first payroll taxes to the State of Minnesota's Department of Employment and Economic Development by April 30, 2026 based on wages paid from January 1, 2026 to March 31, 2026. To estimate the cost for your company and your employees, you can utilized DEED’s “Premium Calculator.”

Small employers pay a reduced payroll tax rate if they employ 30 or fewer people and the average employee wage is less than 150% of the statewide average weekly wage. Learn more here.

Who is covered under the program?

Almost all employers in Minnesota are required to participate. Therefore, most people who work in Minnesota - whether it’s work full time, part-time, temp work, hourly, seasonally, or more than one job - are covered. Undocumented workers, youth workers, and new workers are also covered.

Covered employees:

- Work at least 50% of the time from a location in Minnesota. This includes employees who work from home in Minnesota or spend some time working in other states.

- Earned 5.3% of the state's average annual wage (about $3,700) in the past year.

Self-employed, freelancers, or gig workers (like rideshare or delivery drivers), are not automatically covered—but can choose to opt in to the program. More information on how to opt in will be available in the coming months.

When would the program begin?

Portions of the program are already in effect, as the implementation process began in 2023. The first quarterly wage detail reports were due on October 31, 2024. These reports are submitted by employers and detail the wages paid to employees during various reporting periods, similar to Unemployment Insurance.

Benefits become available on January 1, 2026, which is also when employers can begin to deduct the employee share of the payroll tax. Employers will pay the first payroll taxes to the State of Minnesota's Department of Employment and Economic Development (DEED) by April 30, 2026 based on wages paid from January 1, 2026 to March 31, 2026.

Please note: by December 1, 2025, employers must inform their employees about their rights and benefits under this new program. Employers need to notify employees in their native language and hang a workplace poster in English and any language spoken by five or more employees. DEED will provide written materials in different languages that employers can use to meet their requirements.

How will the PMFL program help my organization plan for employee leave?

DEED has indicated that the process for applying for PFML will begin with a conversation between the employee and their employer. It is expected that employees should notify their employer of their intention to take leave using the employer’s time and attendance processes prior to applying to DEED for benefits.

To learn more about DEED’s employer resources and processes, click here.

Do all employers need to participate?

Yes. PFML covers most Minnesota employers with one or more employees, with exceptions for employees of tribal nations or the federal government. Self-employed individuals and independent contractors are not covered by PFML but can choose to opt in beginning in 2025.

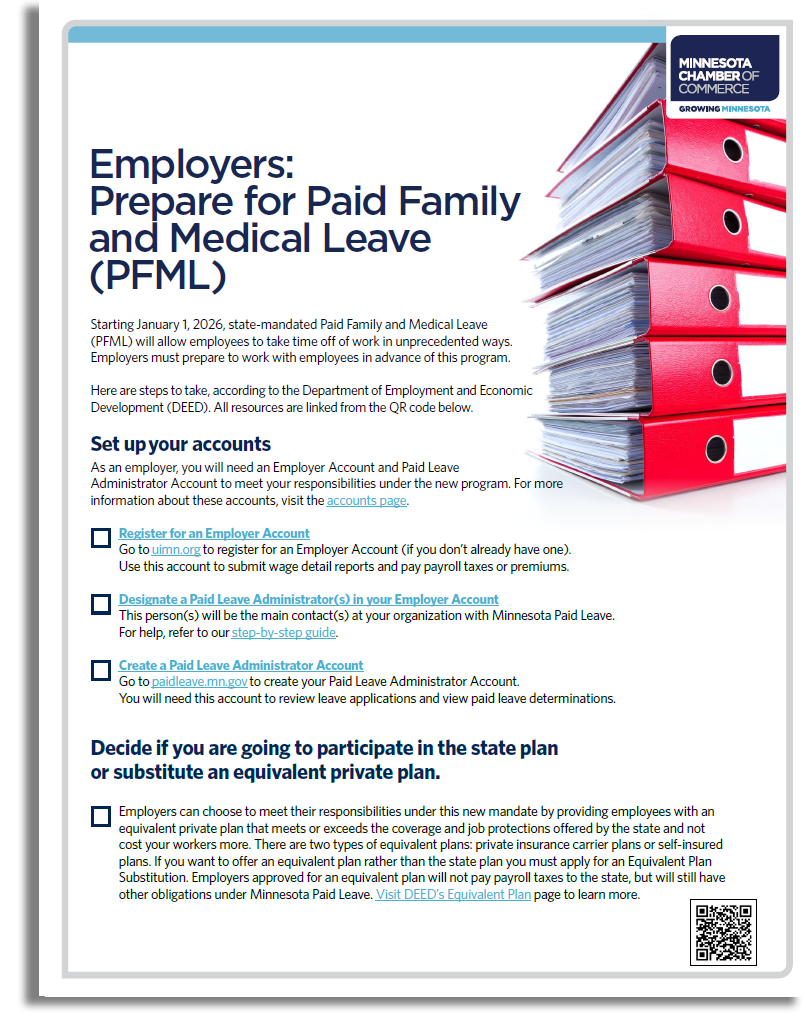

Employers may satisfy their obligations under this law by substituting an equivalent private plan. To learn more about how to substitute an equivalent private plan, click here.

Are small employers exempt?

No. PFML covers most Minnesota employers with one or more employees, with exceptions for employees of tribal nations or the federal government. Certain small employers will pay a reduced payroll tax rate if they employ 30 or fewer people and the average employee wage is less than 150% of the statewide average weekly wage, unless an employer substitutes an equivalent private plan.

To learn more about small business rates, click here.

To learn more about how to substitute an equivalent private plan, click here.

Can a sector, or subsector, be exempt?

No. PFML covers most Minnesota employers with one or more employees, with exceptions for employees of tribal nations or the federal government.

What information needs to be shared with DEED?

Every quarter, employers are required to submit a report to the state that details wages paid to their employees. After benefits begin in 2026, this information will determine the payroll tax paid by employers and employees, and the eligibility and benefit amount for individuals under PFML.

Employers will need to provide the first and last name, social security number, wages paid and hours worked for each employee. This is identical to information provided for Unemployment Insurance wage detail reports.

Employers will pay the first payroll taxes to the State of Minnesota's Department of Employment and Economic Development by April 30, 2026. First premiums will be based on wages paid from January 1, 2026 to March 31, 2026.

More information on data formats and submission methods for wage detail reporting can be found on the Unemployment Insurance Minnesota website.

How will my organization pay the payroll tax?

Employers will pay the first payroll to the State of Minnesota's Department of Employment and Economic Development by April 30, 2026. First premiums will be based on wages paid from January 1, 2026 to March 31, 2026.

To learn how to make these payments, click here.

How much will this cost my organization?

It depends on your payroll. The payroll tax rate of 0.88 percent for 2026 covers the premium for medical leave (0.61 percent) and family leave (0.27 percent). This can be split between employer and employee contributions.

Payroll taxes are only due on wages up to the Old-Age, Survivors and Disability Insurance (OASDI) limit set by the United States Social Security Administration.

The payroll tax rate will be set each year, subject to a maximum set in state law, based on how the program is running and best budgeting practices to keep the fund at a healthy level.

To learn more about PFML payroll taxes and estimate payments, click here.

Is there a cap on the payroll tax?

Yes. The current PFML payroll tax cap is statutorily set at 1.1%.

If an employee is out on parental or medical leave in 2025, are they able to “double dip” with PFML for the same event(s) in 2026?

Yes, with some considerations.

Minnesota’s PFML law goes into effect on Jan 1, 2026 - so leave taken in 2025 does not “count against” PFML leave that can be taken in 2026, provided the employee is otherwise PFML eligible (e.g. requisite number of wage credits; time worked in Minnesota etc.) and the situation still qualifies for PFML (e.g. condition has a 7-day duration; health care provider has certified need etc.) in 2026. There are still some parameters – all leaves are subject to the limitations or maximums set forth in the law (12 weeks family leave; 12 weeks medical leave; combined 20 total weeks in a benefit year; certified need; bonding leave within 12 months of birth or placement etc.).

The most commonly cited “double dipping” example relates to birth and bonding leave for children born, adopted, or placed in 2025. An employee can take bonding leave in 2026, as long as the leave is completed within 12 months of the child's birth, adoption, or foster placement. This means that parents who welcome a child in 2025 could each take up to 12 weeks of bonding leave in 2026 – even if they have already utilized an employer sponsored or job-protected leave in 2025 for this purpose. If an employee gave birth in 2025, that employee may also be able to take medical leave in 2026 if a medical provider certifies that the employee requires time off to manage health and recovery. If an employee takes both bonding leave and medical leave in the same year, that employee may be able to take up to 20 total weeks of leave. Employees will be able to “pre-apply” for leave to be taken in 2026, and DEED is developing a single application for birth and bonding leave requests. Both will be subject to DEED’s application timeline and process.

Are payroll tax amounts dependent on income?

The PFML payroll tax is only due on wages up to the Old-Age, Survivors and Disability Insurance (OASDI) limit set by the United States Social Security Administration.

The payroll tax rate will be set each year, subject to a maximum set in state law, based on how the program is running and best budgeting practices to keep the fund at a healthy level.

Can my organization pay the full payroll tax?

Yes. Starting in January 2026, employers will contribute a minimum of 50 percent of the total premium, though they may choose to pay up to 100 percent of the premium. Employers will be able to deduct the remainder from employee pay, up to a maximum 50 percent of the premium.

Can my organization pay the wage gap to ensure my employee has a full wage replacement while on leave?

Yes. Employers will be able to designate certain paid benefits like Paid Time Off, vacation and sick time as "supplemental benefits," which will allow employees to choose to receive up to full salary continuation during their leave. The decision to offer supplemental benefits is completely up to the employer.

What are Employer Accounts and who is a Paid Leave Administrator?

Employers will need accounts with both Unemployment Insurance (UI) and Minnesota Paid Leave to meet their responsibilities under PFML. These accounts will allow employers to report wage details, pay payroll taxes, review leave applications, and more. These two accounts will work together.

Employers will designate one or more “Paid Leave Administrators” to manage its PFML account. A Paid Leave Administrator will act as a hub.

For more information about these accounts and how to create them, click here.

To access the Paid Leave Administrator account, click here.

How long in advance will the employer know that an employee needs to take leave?

If the need for leave is foreseeable, an employee must provide the employer at least 30 days advance notice before leave is to begin. If 30 days notice is not practicable because of a lack of knowledge of approximately when leave will be required to begin, a change in circumstances, or a medical emergency, notice must be given as soon as practicable.

"As soon as practicable" means as soon as both possible and practical, taking into account all of the facts and circumstances in the individual case. When an employee becomes aware of a need for leave less than 30 days in advance, it should be practicable for the employee to provide notice of the need for leave either the same day or the next day, unless the need for leave is based on a medical emergency.

An employer may generally require an employee to comply with the employer's notice and procedural requirements for requesting leave, including the employer's attendance or call-out policies and procedures. An employee may be required by an employer's or covered business entity's policy to contact a specific individual or designated phone number to report this information.

An employer may require that an employee taking leave provide a copy of the required PFML certification as well. Upon written request from the employer, the employee shall provide a copy of the certification as soon as practicable and possible given all of the facts and circumstances in the individual case. To learn more about or to download DEED’s new certification forms directly, click here.

How will employees “certify” their leave(s)? Is there a form?

When an employee applies for PFML, they will need to provide a certification document to DEED. These forms verify an employee’s reason for taking leave. An employer may require that an employee taking leave provide a copy of the required PFML certification as well.

For most types of leave, this will be a certification form. Each type of leave has its own form. An employee only needs to complete the form that matches the type of leave being requested.

A health care or service provider will also need to fill out part of the form and sign it. All PFML forms are fillable PDFs. Employees can complete them electronically or print and fill them out by hand:

PFML certification forms are similar to Family and Medical Leave Act (FMLA) forms. Because PFML in Minnesota covers more situations than FMLA, some leave that qualifies for PFML may not qualify for FMLA. DEED will accept FMLA certification forms if they include all required information.

Employer-developed forms may be accepted case-by-case if they contain all required information. DEED recommends that PFML forms be used.

Employers may also require employees taking leave to provide a copy of the required PFML certification. Upon written request from the employer, the employee must provide a copy as soon as practicable given the circumstances.

Back to top

If interested in receiving a Paid Family and Medical Leave (PFML) private insurance quote, please contact Annette Kojetin at akojetin@mnchamber.com.

Click for more information on equivalent plans for paid leave

Back to top

Resources

- Minnesota Chamber on-demand webinar with DEED

- Employers Questions and Answers regarding the Paid Family Medical Leave (PFML) program

- Premium calculator

- Wage detail how-to

- Employer role and responsibilities

- Information on equivalent plans for paid leave

- Mandatory employer workplace poster

- Estimate Paid Leave payments

Back to top