How are digital technologies shaping Minnesota’s small business recovery?

Minnesota’s small business recovery

Minnesota’s economy is largely powered by small and medium sized businesses (SMB’s). SMB’s make up 99.5% of all Minnesota firms and employ nearly 47% of all Minnesota workers. Small businesses also drive job growth in the state’s economy. In 2019 SMB’s were responsible for over 22,000 net new jobs, with firms under 20 employees creating the largest share of new jobs.

The performance of Minnesota’s small business sector is thus critical to the overall health of the state’s economy.

Small businesses were disproportionately impacted by the COVID-19 pandemic, however, and face continued challenges one year after the unprecedented economic downturn in spring of 2020. Consider the following trends:

- Data from the software company Womply indicates that by June 2021 Minnesota small business revenue remained 32% below pre-pandemic levels, and 33% fewer small businesses were open than in January 2020.

- A February 2021 survey of small businesses in the Federal Reserve’s 9th district (which includes Minnesota) shows similar concerns. Eighty-eight percent (88%) of small business respondents reported that they had still not recovered sales to pre-pandemic levels, and a staggering 30% of those businesses said they would likely not survive without additional government assistance.

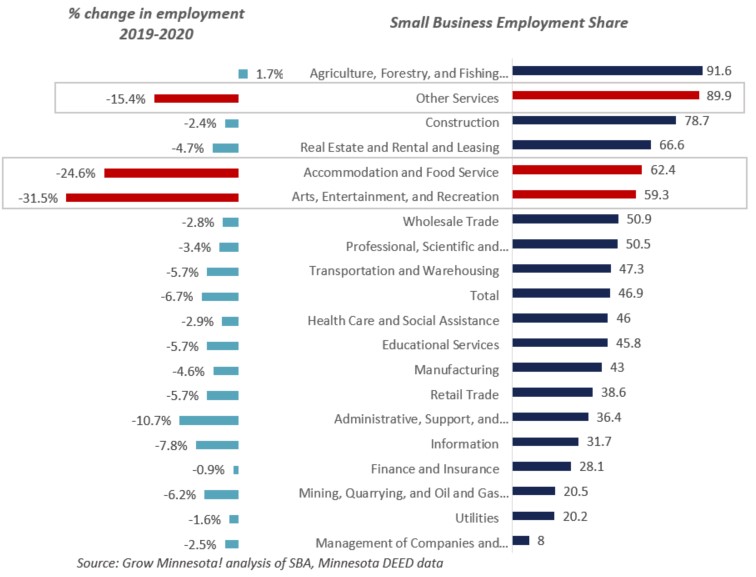

- Small businesses are also overrepresented in industries hit hardest by the pandemic, compounding the challenges facing the state’s SMB sector. The three hardest-hit industries – Arts/Entertainment/Recreation; Accommodation/Food Services; Other Services (which includes things like personal services, hair/nail salons, laundromats, etc.) – accounted for 88,910 of the 194,657 jobs lost between 2019 and 2020. Each of these three industries are overwhelmingly composed of small firms.

What is holding back recovery for Minnesota’s small and medium sized businesses? And what can be done to accelerate their recovery and long-term growth?

The list of potential answers to this question is long, ranging from overall consumer spending levels, to local and state policies that inhibit or encourage investment, to hiring challenges that prevent businesses from finding the people they need to ramp up operations.

However, a less obvious trend may be contributing to Minnesota’s small business recovery trends: use of digital tools and technologies within individual firms.

Industries hit hardest by COVID-19 are overwhelmingly made up of small businesses

How does Digitalization Impact Small Business Recovery?

A growing body of research shows that the level of digital technology use is a key indicator of overall performance for small and medium sized businesses in the U.S. and around the world. Digital tools (e.g. e-commerce platforms, customer analytics tools, digital marketing, artificial intelligence, etc.) helped fueled growth for SMB’s heading into the pandemic and provided an essential “digital safety net” over the past year.

We reviewed five studies conducted just prior to or during the pandemic to better understand how SMB’s are utilizing digital technologies to survive and grow, and what this means for Minnesota’s economic recovery.

Here are three big takeaways from a review of these studies that can guide further investigation:

1. Digitally advanced SMB’s significantly outperform less advanced peers and have fared better during the COVID-19 pandemic.

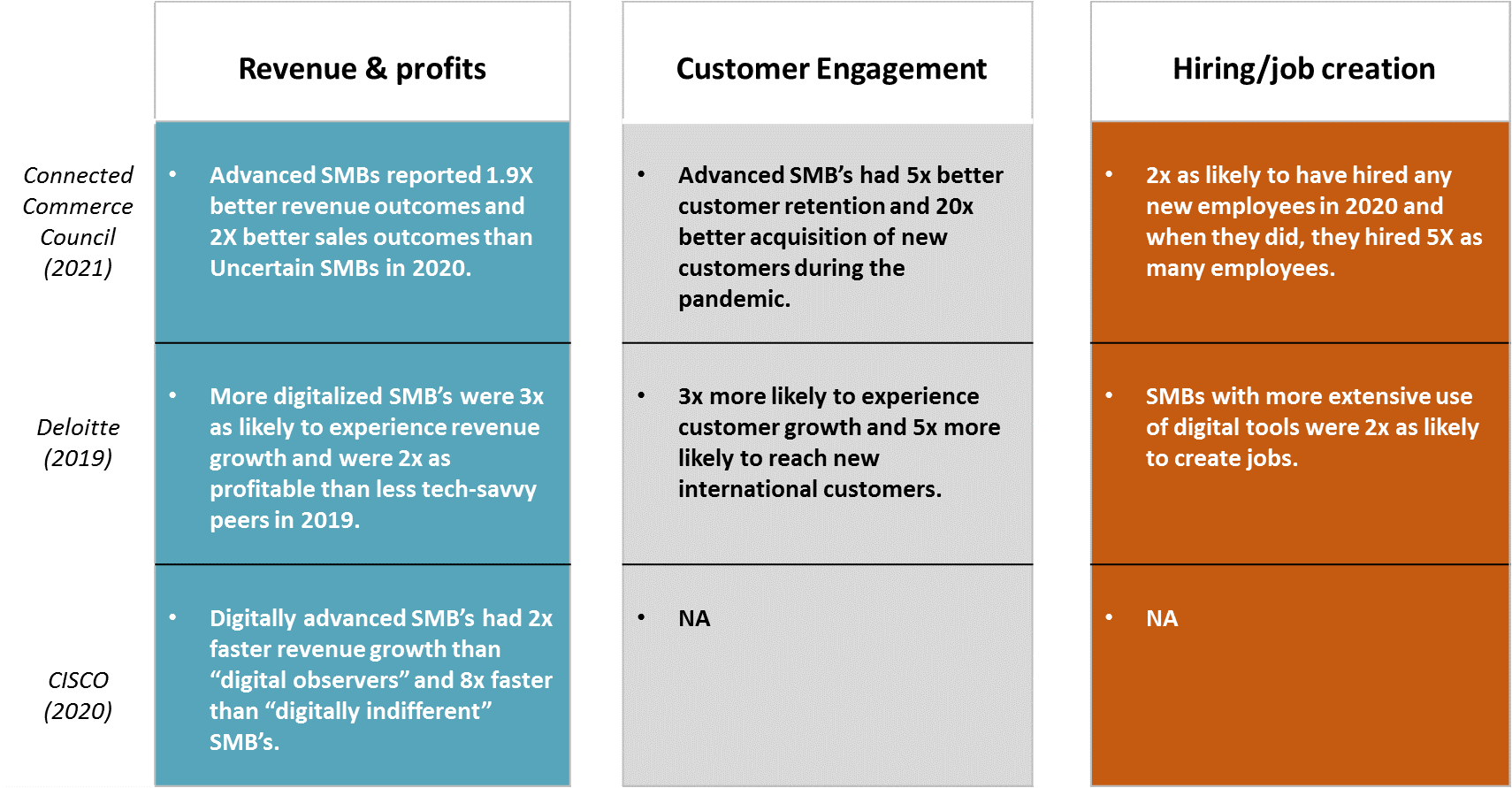

Recent survey data show a consistent pattern of use of digital tools being correlated with better performance in key metrics such as sales/revenue, profitability, job creation, and new customer growth. The performance differential is not small – more extensive use of digital tools by small and medium sized businesses is associated with 2-3 times better revenue/sales outcomes, twice the level of job creation and 5-20 times the rate of customer retention/growth.

The table below compares key performance metrics between digitally advanced SMB’s and less advanced peers across three recent surveys conducted in 2019, 2020 and 2021.

Digital tools proved to be a critical factor in helping SMB’s buffer the impacts of the COVID-19 pandemic. In fact, the Connected Commerce Council found evidence that SMB’s that failed to leverage digital tools went out of business at a higher rate over the past year. They state:

“We also found indirect evidence that they are failing and closing during the pandemic more than digitally-driven SMBs. Put bluntly: SMBs not embracing digital tools increase their risk of going out of business permanently. (Connected Commerce Council, p 8)”

2. COVID-19 accelerated digitalization across all SMB’s, but the gap is widening between more and less digitally advanced businesses.

COVID-19 led to greater use and reliance on digital tools for businesses to maintain operations, work and collaborate remotely, shift products/services to digital channels and find new customers.

- In a global survey of SMB’s, 70% of respondents said COVID-19 has been a key driver for fast-tracking their digitalization journey, and 93% said that COVID-19 has made them more reliant on technology.

- Similarly, the Connected Commerce Council found that 81% of SMB’s in the U.S. made digital changes due to COVID-19.

Yet, while SMB’s across the board made greater use of digital tools during the pandemic, it appears that more digitally advanced businesses are pulling away from less advanced peers, creating a widening gap in the so-called “digital divide.”

The Connected Commerce Council shows that advanced SMBs are “2.3X more likely to report that they are planning to use digital tools more post-pandemic,” and that this gap has only intensified between summer 2020 and spring of 2021.

Differences between small and large firms may be increasing as well. As the OECD put it, “SMEs lag the capacity to undertake this digital transformation. The smaller [the business], the less likely a company is to adopt new digital business practices.” They go on to say, “Small firms remain less digitalized than medium-sized firms, and medium-sized firms less than large firms.”

These gaps in digitalization also increase as the level of sophistication of the tools increase. The Connected Commerce Council found that digitally advanced SMB’s a.) use a greater number of digital tools (and use them more often), and b.) use the most powerful tools – like customer insights, data analytics, and online training platforms – at much higher rates.

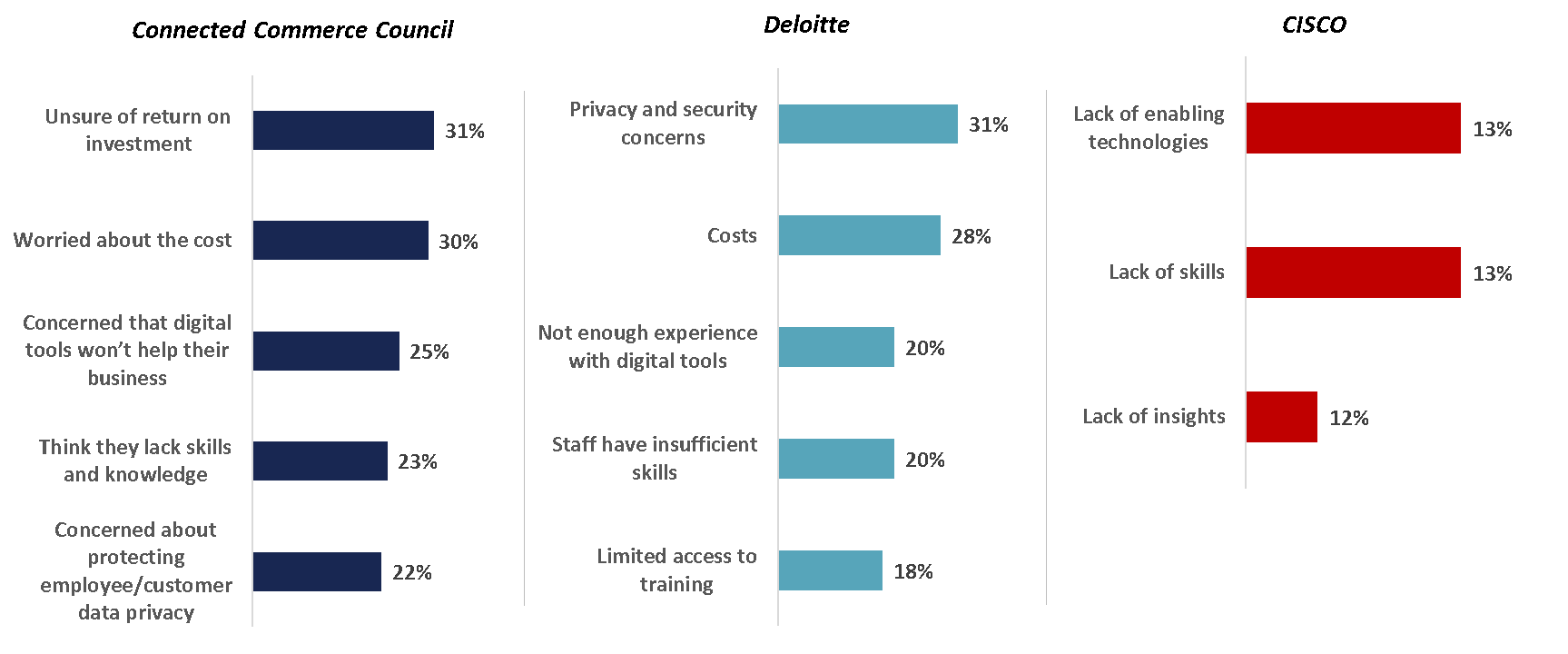

3. SMB’s report multiple barriers to adopting digital tools, including uncertainty about ROI, cost, security/risk, and lack of in-house knowledge and skillsets.

Barriers to small businesses adopting digital tools tend to be grouped around human capital, cost and security/risk factors – each of which presents their own unique challenges and potential solutions.

- Uncertainty about ROI – Small business owners and managers may be unaware of the potential return on investment that various digital tools offer. Finding the time to research and navigate the wide range of tools can be particularly challenging for small firms. Simply helping small businesses understand the potential options, value and return on investment of digital tools may be a good first step in accelerating digital uptake for SMB’s.

- Cost and financing – SMB’s also report cost and financing as a barrier to adopting digital tools. This is not a concern unique only to digital technologies. As the OECD states, small and medium sized businesses face challenges to “accessing appropriate sources of finance that are critical to innovation and growth (OECD, 2019).” Traditional financing sources may limit opportunities for SMB’s to invest in “asset-light” strategies such as digital marketing, web development, enterprise resource planning (ERP’s) systems, and e-commerce platforms.

- Information and data security – Cybersecurity threats have increased significantly in recent years, mirroring the parallel digitization of business processes. Deloitte found that over 3 in 10 SMB’s have concerns about privacy and security matters. This is not surprising given that over half of SMB’s report they have experienced cyber-attacks and security breaches – events that can cost a business anywhere from $2,100 and $1,000,000 on average (Deloitte, p 31). With fewer resources to devote to information security measures, small businesses may be more susceptible to data breaches and less able to mitigate their effects when they happen.

- Lack of skills/knowledge – Related to the barriers listed above is the human capital needed to a.) identify and set digital strategies by business leadership, and b.) implement digital tools at a staff level, particularly in areas that require higher levels of technical knowledge such as advanced analytics and programming. Small businesses may be less able to invest in the human capital to drive digital transformation. Lack of skills and knowledge ranked in the top five biggest barriers for SMB’s across each of the studies we examined, with 13% - 23% citing this concern.

What do businesses report as the biggest barriers to adopting digital tools?

Conclusions

Minnesota’s small businesses recovery is a critical ingredient for the state’s overall economic health and future growth potential.

Stakeholders across Minnesota should examine what resources and services are needed to help small businesses reach full recovery and compete in a post-COVID environment. Increasingly, this means helping businesses leverage digital tools to increase efficiency, reach new customers, develop new products and services, and recruit and train workers.

Over the next few months the Minnesota Chamber of Commerce’s Grow Minnesota! program will further examine a.) how small businesses are investing in digital technologies and b.) what resources they need to access and leverage these important tools.