How close is Minnesota’s economy to full recovery?

Why getting there will require more job seekers, not just more job openings.

April 2021 marked the one-year point from the largest economic downturn in Minnesota’s modern history. The shock to the economy last spring was staggering: Minnesota shed more than 400,000 jobs and lost over $36 billion dollars in GDP output, as in-person activities ground to a halt to slow the spread of COVID-19. To put this in perspective, Minnesota’s 2020 job losses exceeded the size of North Dakota’s entire workforce.

Yet the unique circumstances surrounding this downturn – both the public health crisis that caused the downturn and the massive federal response to keep families and businesses afloat – meant that the path of recovery has had few historical parallels from which to draw. This has involved greater uncertainty about near-term projections and a murkier set of signals to measure economic recovery.

Of particular note is the continued disparity between overall employment levels – which remain well below the pre-pandemic peak – and the apparent surge in labor demand, as measured by job openings and a slurry of anecdotal evidence from employers struggling to find workers.

The question remains: how close is Minnesota to full recovery? And how will we know when we get there?

Recent data from federal and state agencies give us a sense of just how far Minnesota has to go. Let’s dive in.

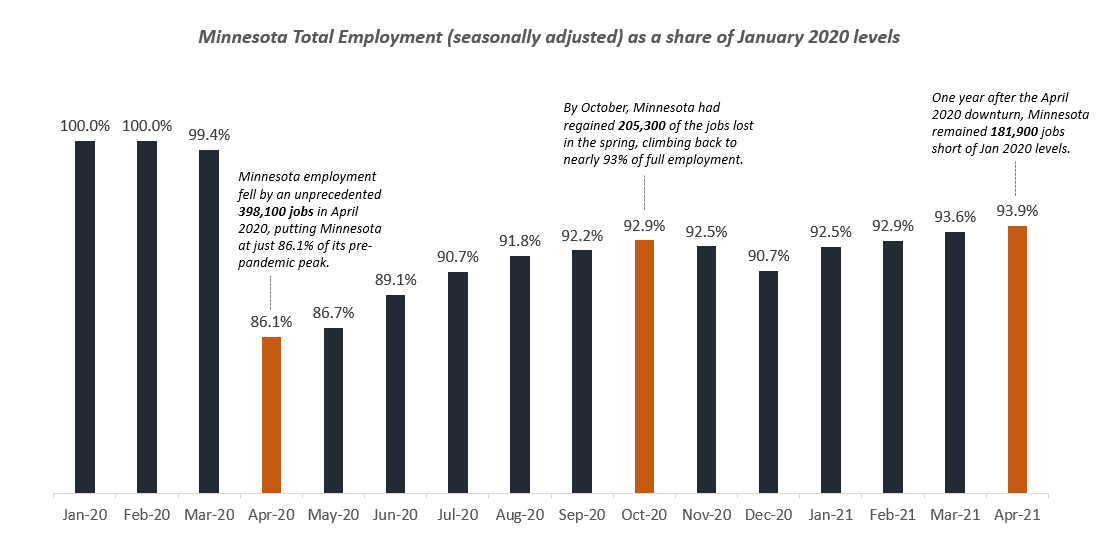

1. As of April 2021, Minnesota had 181,900 fewer jobs than it did in January 2020. Yet job openings have reached pre-pandemic levels.

Minnesota’s total nonfarm employment inched up to 2,815,300 on a seasonally adjusted basis in April. This is a considerable improvement from one year prior but still leaves the state with nearly 182,000 fewer jobs than before the pandemic. Minnesota is at 94% of full employment compared to January 2020 levels.

Unlike previous recessions, the key to full job recovery may lie on the supply side of the equation. Recent data from DEED show that job vacancies have already returned to pre-pandemic levels, with employers reporting over 127,000 unfilled jobs in the fourth quarter of 2020. National data also suggest that new job postings have surpassed pre-COVID numbers, indicating strong employer demand for workers.

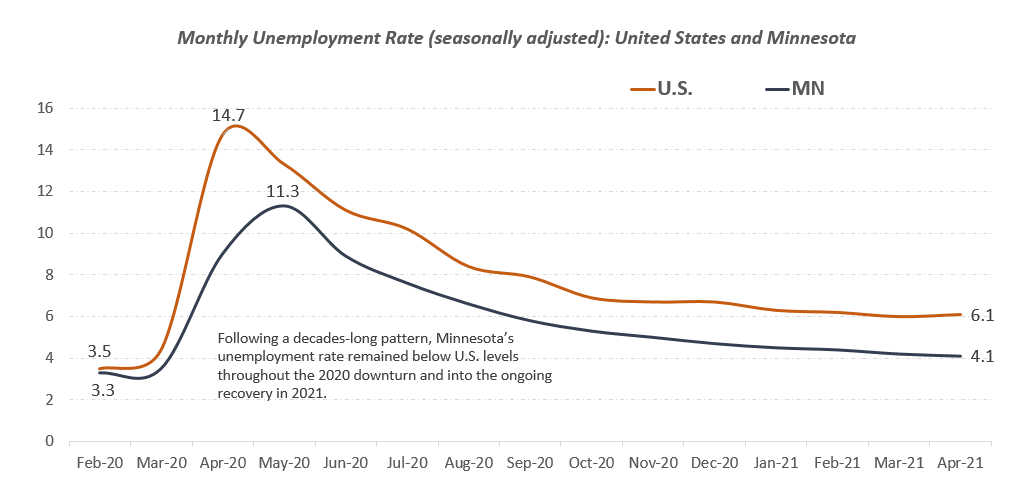

2. Unemployment fell steadily over the past 12 months, hitting 4.1% in April. This is partly due to Minnesotans dropping out of the labor force altogether.

After peaking at 11.3% in May 2020, Minnesota’s unemployment rate receded through the rest of the year and into 2021, hitting a low point of 4.1% this April. This is welcome news considering that some projections early in the pandemic showed unemployment spiking to over 20% by the end of 2020.

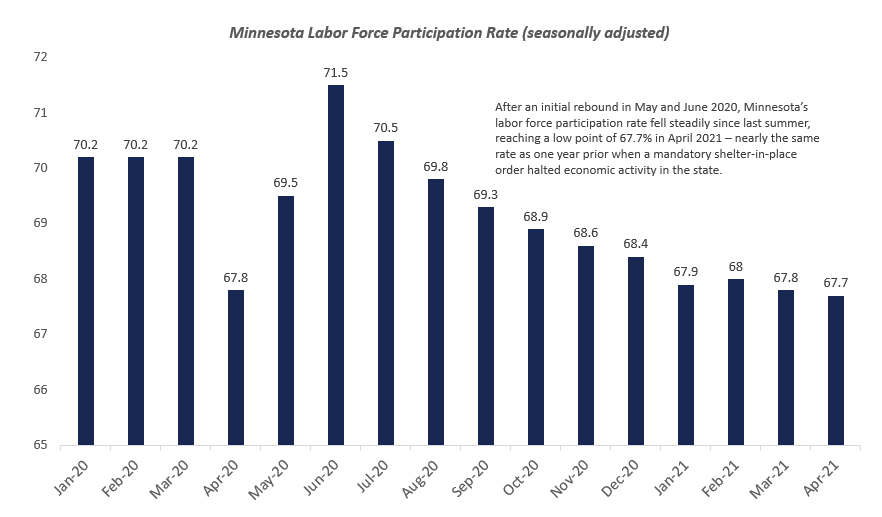

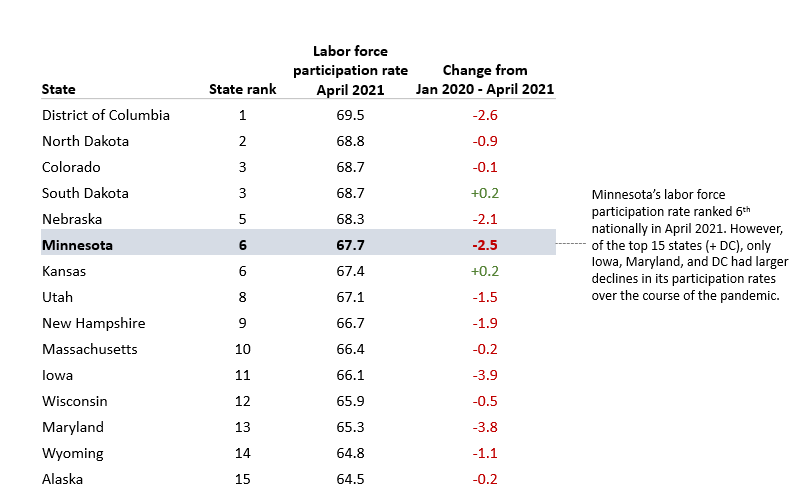

However, the state’s official unemployment rate may not fully reflect labor market conditions. Minnesota’s labor force participation rate (i.e. the share of people over 16 that are working or looking for work) fell by two-and-half percentage points since January 2020. Some Minnesotans have dropped out of the workforce altogether and are simply not being counted in the official unemployment rate. As shown in the table below, Minnesota is not alone in this issue, but the state’s workforce participation rate has fallen more than many other peer states. This is an ongoing concern and imperative for Minnesota to address.

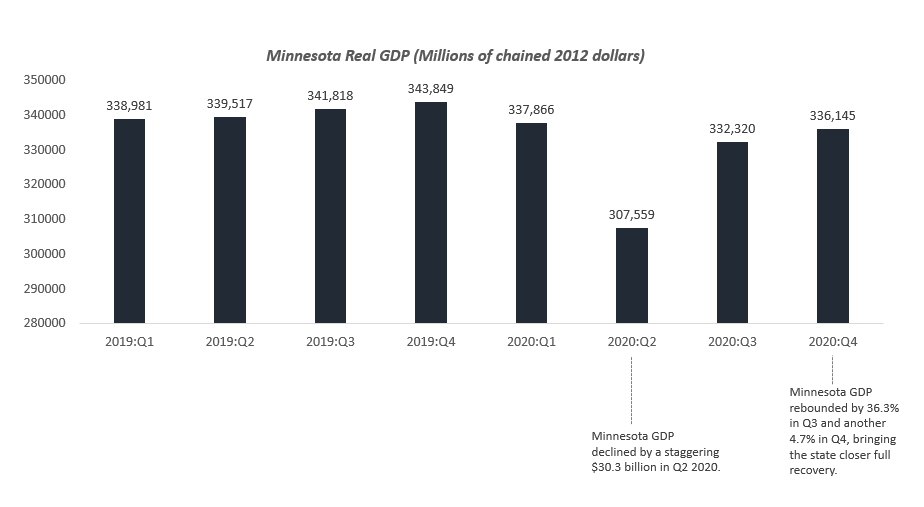

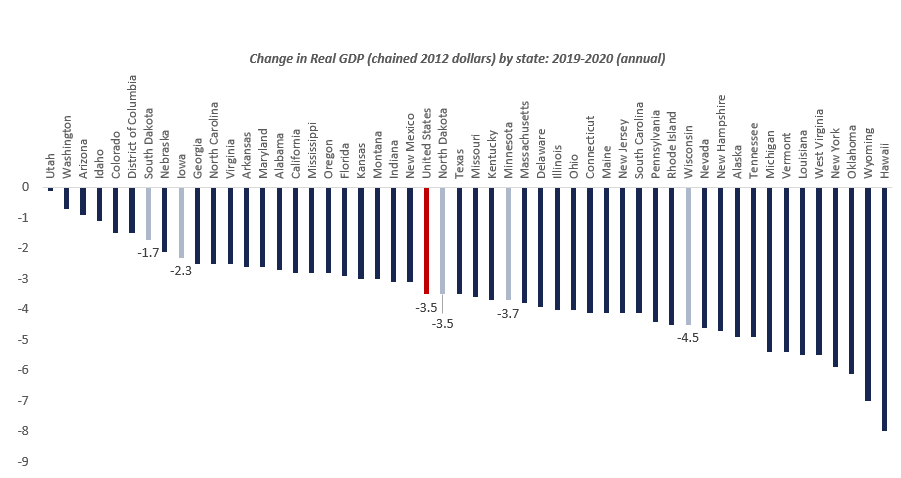

3. Minnesota GDP climbed back to 97.8% of its pre-pandemic peak by Q4 2020, but ranked 4th of 5 among its neighbors and 27th nationally in GDP losses last year.

Minnesota’s total GDP declined by over $36 billion in the first and second quarters of 2020. However, the state posted two subsequent quarters of gains, with GDP bouncing back by 36.3% in Q3 and another 4% in Q4 2020. This helped Minnesota reach nearly 98% of its pre-pandemic peak by year-end.

4. Minnesota lost $1 billion in total export value in the second quarter of 2020 but gained $800 million back by Q1 2021.

The COVID-19 pandemic majorly disrupted global trade and supply chain activity. The World Trade Organization estimates that world merchandise trade fell by 5.3% in 2020. Minnesota exports followed suite, declining by 10% from 2019-2020. By the first quarter of 2021, Minnesota exports climbed to $5.4 billion, inching closer to pre-pandemic levels.

The bottom line

Minnesota still has further to go before it reaches full strength in its economy, but it is not clear whether full strength will look the same as its pre-pandemic baseline until labor supply and demand find an equilibrium. The Minnesota Chamber Foundation will continue to track the state’s economic recovery and advance ideas to spur long term economic growth.

Visit the Economic Recovery Dashboard and read the recently released Minnesota: 2030 report to explore further.

Recommended Articles

The Minnesota Chamber of Commerce released this letter on behalf of more than 60 CEOs of Minnesota-based companies today.

The...