Exporting trends: Growing Minnesota through global trade

Overview

Global trade plays a critical role in Minnesota’s economy. Exports of goods alone make up 7% of Minnesota’s total GDP, support more than 112,000 Minnesota jobs, and reflect the state’s global competitiveness in key industries.

Trade is also a growth opportunity for individual firms. Research from the Institute for International Economics shows that exporters achieved higher average sales than non-exporters and were 8.5% less likely to go out of business. Data from the Minnesota Chamber of Commerce’s Grow Minnesota! program similarly shows that nearly 80% of exporters visited reported increased revenue in the prior year, compared to only 69% of non-exporters who had increased revenue. Further, over 87% of Minnesota’s 6,941 exporters in 2019 were small and medium-sized businesses, showing the broad impact of trade on companies of all sizes.

Yet, the events of the past several years have created complex challenges and new questions for the future of Minnesota exports. The COVID-19 pandemic disrupted global trade patterns, negatively impacting some export sectors and markets while spurring new growth in others.

This report assesses changes in Minnesota’s export performance over time, with a focus on emerging trends during the past two years. How have Minnesota exports grown and changed in recent decades? How does Minnesota’s performance compare to other states? What goods and markets are driving growth for state exports over time, and how is this changing as we emerge from the pandemic?

The report seeks to answer these questions by analyzing data from the U.S. Census Bureau’s USA Trade Online portal, which tracks exports of goods at the state level each month, starting from 2002. It should be noted that this dataset does not include information on service exports (see the U.S. Coalition of Services Industries state fact sheet for more info on Minnesota service exports). Despite this limitation, however, U.S. Census data on goods exports provide valuable insights into Minnesota’s trade activities over time and by detailed product categories to each country around the world.

Finally, the last section of the report includes a snapshot of four key resources available to help Minnesota businesses export their goods and services to foreign markets. These grants, financing tools, and consulting services remain important tools to drive the state’s exporting performance in an increasingly complex global trade environment.

Highlights

- Minnesota surpassed pre-pandemic export levels in 2021 but trailed U.S. growth, following a longer-term trend. Minnesota export growth ranked 29th among states from 2019-2021 and ranked 36th from 2002-2021.

- About half of Minnesota’s total exports went to its top three export markets (Canada, Mexico, and China) in 2021, up from about one-third in 2002. Exports to Canada accelerated by 39% from 2019-2021, driving overall recovery for Minnesota exports.

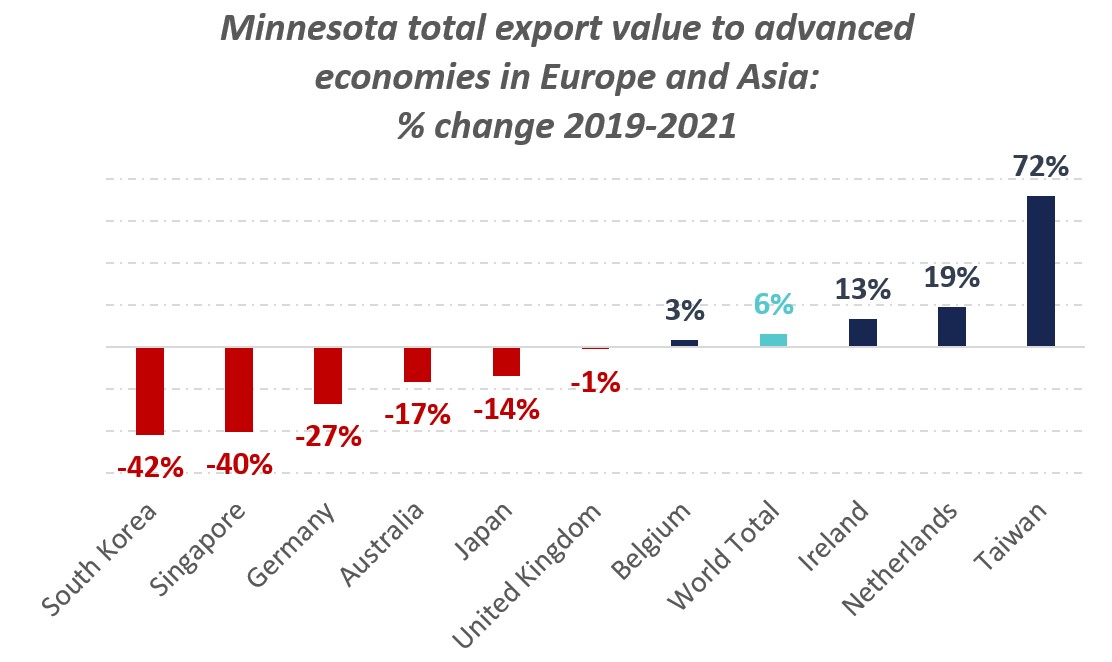

- Advanced economies in Europe and Asia continue to be large export markets for Minnesota. However, growth to these countries has been slower over time and declined by -12% during the 2020 downturn and 2021 recovery period.

- Emerging markets drove Minnesota export growth over the past two decades and continued to play a pivotal role during Minnesota’s recovery from the pandemic. Exports increased the most to China and Mexico by total value since 2002 among all emerging markets, while export growth rates were highest to Costa Rica, Vietnam, and Indonesia among emerging markets that received at least $100 million in Minnesota goods last year.

- Minnesota’s export recovery from the pandemic has been uneven across product categories, with food and ag, mineral fuel/oil, and semiconductor-related products surging since 2019. Export values of these three categories increased by $3.4 billion from 2019-2021 and remain nearly 2.25x higher in Jan-May 2022 than in the same months of 2019.

1. Minnesota surpassed pre-pandemic export levels in 2021 but recovery trailed U.S. growth, following a longer-term trend.

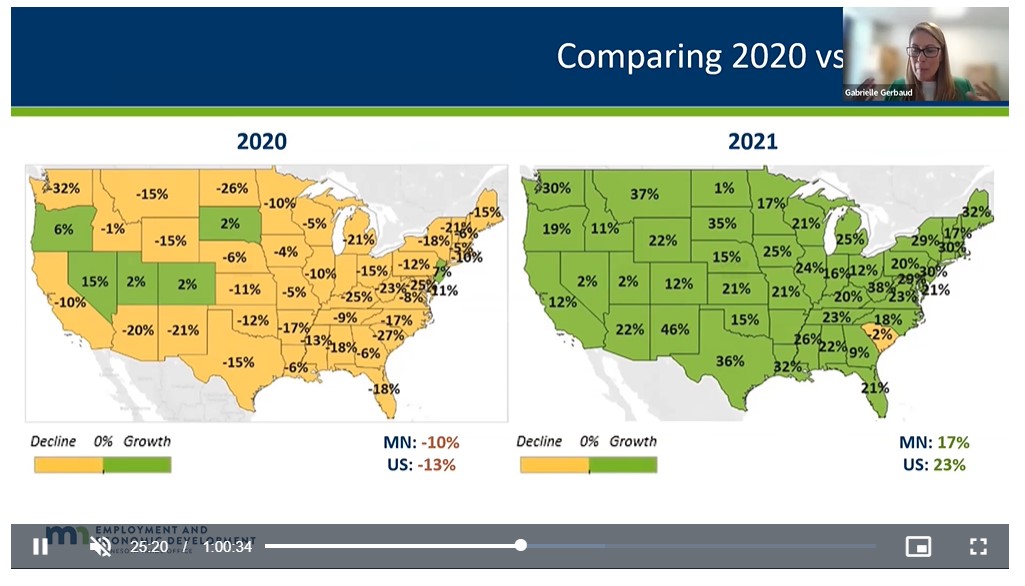

- The COVID-19 pandemic brought significant disruptions to global trade activity. Total exports declined by -10% in Minnesota and -13% in the United States in 2020. However, this decline proved short-lived, with exports bouncing back strongly in 2021 and early 2022. Minnesota exports grew by 17% in 2021, reaching $23.5 billion in total annual value – its highest on record since the beginning of the data series in 2002. The first five months of 2022 have seen continued growth, with exports from January to May 2022 being valued at $10.5 billion. This is an 11.5% increase from the first five months of 2021.

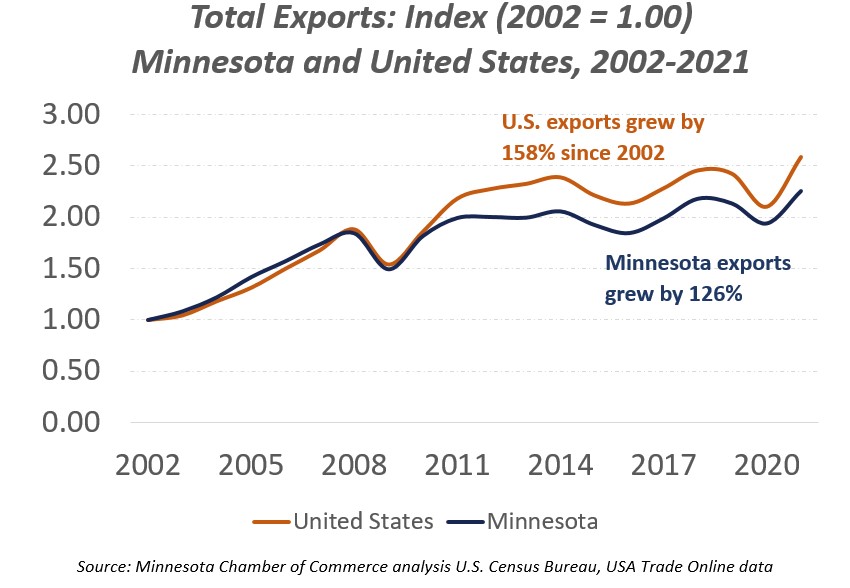

- While this is good news for Minnesota’s economy, the state’s exports rebounded at a slower rate than the U.S. in 2021, following a longer-term trend of slower total export growth. Since 2002, Minnesota’s total export value grew by 126% (ranked 36th) compared to 158% export growth for the U.S. The state’s performance improved in the most recent timeframe, ranking 28th among states in total export growth from 2019-2021.

- States with the largest export growth since 2019 include New Jersey, South Dakota, Maryland, Massachusetts and Alaska. Notably, three of Minnesota’s neighboring states (South Dakota, Iowa, and Wisconsin) ranked in the top 15 states for export growth since 2019.

- Despite Minnesota’s below-average export growth, the state’s trade deficit has shrunk since 2008 in contrast to the U.S. economy which has seen larger trade deficits in recent years. Minnesota had an average annual trade deficit of $8.2 billion over the past three years (2019-2021), down from the prior 10-year average of $10.2 billion from 2008-2018.

2. About half of Minnesota’s total exports went to its top three export markets (Canada, Mexico, and China) in 2021, up from about one-third in 2002. Exports to Canada accelerated during the pandemic, driving overall recovery.

- Canada, Mexico, and China are Minnesota’s largest export markets by a large margin, making up roughly half of the state’s total annual exports. Minnesota exported $1.1 billion more in goods to its third-ranked market (China) than its fourth-ranked one (Japan) in 2021, demonstrating the significant role these countries play in Minnesota’s global exports. Minnesota businesses also benefit from greater access to its North American trading partners through the trilateral United States-Mexico-Canada Agreement (USMCA) which supplanted the former North American Free Trade Agreement (NAFTA) in 2020. This stability and access created through USMCA may offer improved opportunities for nearshoring activities going forward as well.

- State exports to Mexico and China have grown more prominent over time. In 2002, Mexico was only the state’s eighth-largest export market, and China was its tenth-largest. But that quickly changed as exports to China accelerated rapidly after 2004 and started accelerating to Mexico after 2009. By 2021, export values had increased nearly 7x to China and nearly 5x to Mexico compared to 2002 levels.

- Despite faster export growth to China and Mexico, Canada has long-remained Minnesota’s largest export market in terms of total export value. Minnesota exports over 2.5x more to Canada than to Mexico or China. Canada’s combination of geographic proximity to Minnesota, economic scale, shared language and culture, and free trade agreements with the United States make Canada a first stop for many Minnesota businesses looking to sell goods and services abroad. Indeed, Minnesota is ranked 12th among all states in the share of its total exports that went to Canada last year.

- Exports to Canada began falling after 2012, declining from a peak of $6.3 billion in 2012 to a low point of $4.1 billion in 2016. However, exports to Canada began increasing again steadily in the following years and then accelerated during the COVID-19 pandemic. Exports to Canada spiked by 39% from 2019-2021, reaching a record high of $6.6 billion last year. This was driven in large part by mineral fuel/oil exports, which increased by $1.5 billion since 2019. Exports of food and ag products (such as fertilizers, cereals, and food industry residues) and industrial goods (electrical equipment, plastics, etc.) also grew significantly over the past two years, demonstrating the strong supply chain links between Minnesota and Canada.

3. Advanced economies in Europe and Asia continue to be large export markets for Minnesota. However, growth to these countries has been slower over time and declined during the pandemic downturn and recovery period.

- Outside of Minnesota’s “big three” markets of Canada, Mexico, and China, the state has considerable trade with advanced economies in Europe and Asia. Countries such as Japan, Germany, Belgium, South Korea, the United Kingdom, Ireland, Singapore, and the Netherlands make up a large share of Minnesota exports. However, export growth to these counties has underperformed compared to North America, China, and a variety of emerging economies around the world. Exports to advanced economies in Europe and Asia declined by -0.9% from 2011- 2021, compared to a positive 13% growth rate for state exports to all countries.

- This trend continued during the pandemic. Minnesota exports to advanced countries (excluding Canada) fell by -12% from 2019-2021, even as the state’s total export value to all countries grew by 6% in that time.

- Similar trends are evident by assessing state exports by global regions. Minnesota exports to Europe increased by 40% since 2002, while state exports increased by between 134% and 189% to all other regions around the world.

- Despite lower growth rates, advanced economies in Europe and Asia continue to be among the most important trading partners for Minnesota businesses. These countries offer immense market size, stable institutions, rule of law, advanced industries, established trade partnerships and distribution channels, and, in many cases, have direct flights from the MSP airport. Such attributes make these countries attractive markets for Minnesota companies across a range of industries and sizes.

4. Emerging markets drove Minnesota export growth over the past two decades and continued to play a pivotal role during Minnesota’s recovery from the pandemic.

- Minnesota businesses have found new growth opportunities through expanding their sales in emerging markets around the world. This includes large emerging economies like China, Mexico, Brazil, and India, as well as smaller economies such as Costa Rica, Vietnam, Indonesia, and the Philippines.

- Together, emerging and developing economies made up 37% of Minnesota’s total exports in 2021 and grew at an outsized pace over the past two decades. Exports to emerging and developing economies grew by 327% from 2002-2021, compared to just 77% for advanced economies. Much of this growth occurred in the early 2000s and then leveled off after the global financial crisis in 2007-2008. Yet, these countries still drive much of Minnesota’s export growth and were pivotal to the state’s economic recovery from the downtown in 2020. Exports to emerging markets bounced back by 23% in 2021 and continue to perform well in early 2022.

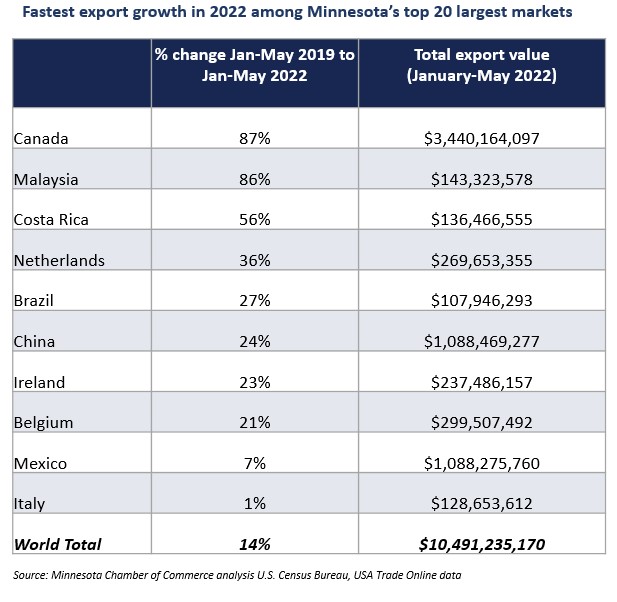

- For example, exports grew by 86% to Malaysia, 56% to Costa Rica, 27% to Brazil, and 24% to China between the first five months of 2019 and the first five months of 2022. Only Canada and the Netherlands grew as much in that time among the state’s twenty largest export markets.

- While Minnesota’s export growth to some emerging markets (such as China and Mexico) has stemmed from broader global economic trends, other trade relationships have formed through more unique circumstances. For example, Minnesota exports to Costa Rica increased by over 3,300% since 2002, making it one of the fastest growing markets for Minnesota goods despite the country’s small size. A deeper look helps explain how this came to be.

- Costa Rica began efforts to diversify its economy in the late 1980s and 1990s, attracting foreign direct investment from consumer electronics and medical device manufacturers. This seeded the ground for further development of the country’s medical device industry, which expanded in the 2000s and has since grown to become a life sciences hub and the second largest medical device exporter in Latin America.

- These developments occurred in part through investments from several companies with Minnesota ties, including Medtronic and Boston Scientific, as well as from the University of Minnesota, who helped establish a medical device engineering master’s program in Costa Rica in 2014. Furthermore, Costa Rica ratified the Dominican Republic-Central America-United States Free Trade Agreement (CAFTA-DR FTA) in 2009, which created greater market access for U.S. companies to trade and invest in the country. These efforts contributed to the growth of Minnesota’s own medical device exports to Costa Rica, which grew by an astonishing 50,000% from 2002-2021. By 2021, Costa Rica had become Minnesota’s sixth largest market for medical goods exports in the world. This case study demonstrates the impact that can occur through intentional trade development strategies and serves as a lesson for future efforts.

5. Minnesota’s export recovery from the pandemic has been uneven across product categories, with food and ag, mineral fuel/oil, and semiconductor-related products driving growth.

*This section uses Harmonized System (HS) commodity codes to designate product categories.

- Minnesota’s diverse economy is reflected in its wide base of exported goods. The state has sizable exports of medical goods, machinery, electrical equipment, food and ag products, metal ores, aircraft, transportation equipment, mineral fuel/ oil, and a variety of other manufactured goods. Minnesota’s abundant natural resources and high value-added manufacturing industries are a strength for its global competitiveness.

- The state’s three largest export product categories are machinery, optical/medical goods, and electrical equipment. Together, these products make up close to half (47%) of the state’s total export value. Minnesota is nationally competitive across these three categories, being the fifth largest exporter of optical/medical goods, 13th largest exporter of electrical equipment, and 16th largest exporter of machinery.

- Exports of these categories grew over the past two decades, though each had a slightly different growth trajectory heading into the 2020s. For example, Minnesota exports of machinery grew at a slow, steady rate from 2002-2013 but then declined the rest of the decade. Exports of medical goods, on the other hand, declined in the years surrounding the Great Recession but then surged by 61% between 2011-2019. Electrical equipment took a different trajectory, growing at a fast rate of 126% from 2002-2019, with only a brief interruption during the Great Recession.

- The 2020 pandemic recession negatively impacted most of Minnesota’s major export product categories, with only mineral fuel/oil and meat products increasing in value that year among the state’s top ten categories. However, the ensuing recovery in 2021 showed a wider divergence in outcomes across product categories. Notably, exports of medical goods and pharmaceuticals, metal ores, and plastics manufacturing remained 15%-31% below pre-pandemic levels. Exports of these products continued to lag in early 2022.

- Exports of other goods surged during the pandemic and ensuing recovery, however. The most notable growth areas have been mineral fuels/oil, semiconductor-related products, and food and ag products.

- Leading the way was Minnesota’s mineral fuel/ oil exports, which increased by a staggering 468% since 2019, driven largely by demand increases in Canada over the past two years.

- Additionally, exports in Minnesota’s food and ag sector and semiconductor-related products accelerated during the pandemic and recovery. For example, the global chip shortage helped drive an increase of $1.1 billion in Minnesota’s exports of semiconductors, semiconductor machinery, and integrated electrical circuits compared to 2019 levels. Recent Congressional passage of the CHIPS Act of 2022 presents further opportunities to leverage this strength for future growth in Minnesota’s semiconductor industry.

- Similarly, Minnesota’s food and ag exports increased by $766 million from 2019-2022, contributing to a spike in GDP growth for the sector. Minnesota’s agriculture/forestry/hunting/ fishing industry led all sectors in real GDP growth at 13% from Q4 2019 to Q1 2022.

- Together, exports of these three categories increased by $3.4 billion from 2019-2021 and continued to perform well in the first five months of 2022. The total value of these three categories was nearly 2.25x higher in Jan-May 2022 than in the same months of 2019.

How can Minnesota businesses grow their international reach?

With over two-thirds of the world’s purchasing power existing outside of the U.S., exporting offers an important growth opportunity for businesses. However, exporting can be a complicated task, especially for small businesses. Fortunately, numerous resources exist locally and nationally to help companies simplify and succeed in this often-complicated process.

Below are four key resources that can be utilized at little to no cost to help Minnesota businesses successfully export to foreign markets.

1. Working Capital Loan Guarantee – Export-Import Bank of the United States (EXIM)

The risks associated with international sales can prevent lenders from providing the working capital needed to fulfill export orders. A Working Capital Loan Guarantee from the Export-Import Bank of the United States (EXIM) often gives these lenders confidence to provide U.S. exporters with the financing to take on new business abroad. EXIM works with a U.S. company’s lender to provide a loan guarantee that backs the exporter’s debt. With this guarantee in place, the lender can extend a working capital loan to improve the company’s cash flow.

- Cost: Free to apply

- Eligibility: Must be a U.S. company with at least one year of operating history and have a positive net worth. Exports must be shipped from the United States. Exports have a minimum of 50 percent U.S. content based on all direct and indirect costs (e.g., labor, materials, administrative costs).

- How to access: EXIM specialists are ready and waiting in your area to give you a free consultation: Talk to an expert.

2. STEP Program - Minnesota Trade Office (MTO)

Aeli Wiebolt, International Marketing Specialist & STEP Grant Administrator for the Minnesota Trade Office

The STEP program provides financial and technical assistance to qualifying Minnesota small businesses with an active interest in exporting products or services to foreign markets. Reimbursement of up to $500 for export training that will result in the development of an export strategy or up to $7,500 for approved export-development activities.

- Cost: Free to apply

- Eligibility: Participants may be first-time exporters or companies currently exporting but are interested in expanding into new international markets. Eligible companies must also fit the SBA definition of a small business based on annual sales or the number of employees.

- How to apply: Applications will be evaluated by a review committee on a competitive basis as they are received, and proposals must be submitted by the applicant electronically. Refer to the STEP program webpage for details.

3. Exporting Consulting and Other Services U.S. Commercial Service in Minnesota - U.S. Department of Commerce

The U.S. Commercial Service is the lead trade promotion agency of the U.S. Government. Commercial Service trade professionals in over 100 U.S. cities and more than 75 countries help companies get started in exporting or increasing sales to new global markets. Their experienced staff of International Trade Specialists will help companies identify and evaluate international partners, navigate international documentation challenges, create market entry strategies, and help with other export-related guidance.

- Cost: Free

- Eligibility: Available to all

- How to access: For export assistance, contact Minnesota’s team of International Trade Specialists.

4. Export Counseling and Assistance - Minnesota Trade Office (MTO)

The Minnesota Trade Office’s regional trade managers guide companies through the challenges of conducting international business. From basic guidance for companies new to exporting, technical, regulatory, and logistical information for more experienced companies, to market intelligence and research, to the art of conducting business across borders and cultures, MTO’s regional trade managers have answers for your most pressing questions.

- Cost: Free

- Eligibility: Available to all

- How to access: For general trade assistance, call the helpline at 651-259-7498 to reach a regional trade manager who can answer your questions or make appropriate referrals. For trade questions related to specific markets or industries, contact the appropriate regional trade manager at the bottom of this page.

Conclusion

Minnesota export activity underwent significant shifts in recent years. Economic disruptions caused by the COVID-19 pandemic had uneven impacts across the wide range of export products and markets. The pandemic reinforced the importance of the state’s largest trading partner, Canada, while creating a drag on exports to other key partners such as Germany, Japan, and South Korea. Likewise, key industries such as mining, med-tech, and transportation equipment remain well below pre-pandemic export levels, while other industries like food and ag, refined petroleum products, and semiconductor-related goods have surged amidst shifting demand and global supply shortages. These trends are occurring against a backdrop of broader economic uncertainty as the U.S. economy cools and inflation continues to unnerve consumers and markets around the world.

Despite these uncertainties and challenges, Minnesota businesses have ample opportunity to expand their international sales both in the short and long run. The ability to access new markets has long been a proven ingredient of growth for individual firms and the state’s economy. Further, Minnesota businesses have access to key exporting resources and partners who can provide consulting, financing, market research, and technical assistance to increase their international reach.

The Minnesota Chamber of Commerce’s Grow Minnesota! team will continue exploring these exporting trends in the coming months and offer assistance to connect Minnesota businesses to resources that can help them export their goods and services abroad.

Looking to dive deeper?

On-demand webinar: Expanding your exporting potential - Sponsored by

Minnesota businesses have access to a range of financing tools and free or low-cost services that can help them find international customers and grow their international sales. View this on-demand webinar and familiarize yourself with types of accessible exporting programs and contacts to take the next step and explore these programs further.

Learn more about Grow Minnesota!

Minnesota has a legacy of building and growing businesses here that keep the economy strong and provide a quality of life for our communities. Grow Minnesota!® is the Minnesota Chamber’s premier economic development program focused on retaining and growing Minnesota businesses. Our staff helps businesses overcome challenges, make new connections, and grow – in any part of the state. Working with Grow Minnesota! means access to economic data and insights as the state moves toward economic recovery and access to Minnesota-based suppliers on any number of products and services that could help your company grow.

For more information, access the MN Supplier Match or schedule a visit from our Grow Minnesota! team, please visit our website or email Vicki Stute, Vice President, Programs and Services.