Minnesota: 2030 industry chapter: Food and agriculture

Minnesota’s food and agriculture sector: opportunities for growth

Food is essential to Minnesota’s economy – and producing food has been a major Minnesota industry from its beginning.

Food and agriculture has always been an important sector to Minnesota, but the COVID-19 pandemic revealed once again just how important and resilient Minnesota’s agricultural and food production sector is to sustaining the lives and livelihoods of Minnesotans.

Food and agriculture drives a significant share of Minnesota’s overall economic activity, contributing $88.8 billion in total sales, $29.7 billion in value-added output and 320,000+ jobs. This represents 8% of the state’s workforce and 9% of state GDP.

The range and breadth of Minnesota’s food industry includes not just crop, dairy and livestock production, but also value-added activities such as grain milling, livestock processing, food manufacturing and food marketing.

Minnesota’s food sector connects the state’s diverse economic regions, with a significant $16.9 billion in food and farm products traded within the state.

Minnesota’s food and ag sector goes beyond farms and processing plants. The state is also a national and global hub for food innovation, technology, management, marketing, sales, distribution and retailing.

Minnesota’s strength and integration across the value chain drives our competitiveness in this important sector – and presents significant opportunities for future growth.

Key stats for Minnesota’s food and agriculture sector:

- 320,178 total employment

- $29.7 Billion in value-added output

- $88.8 Billion in total output (sales)

Source: Decision Innovation Solutions (September, 2020)

How is Minnesota’s food and agriculture sector performing?

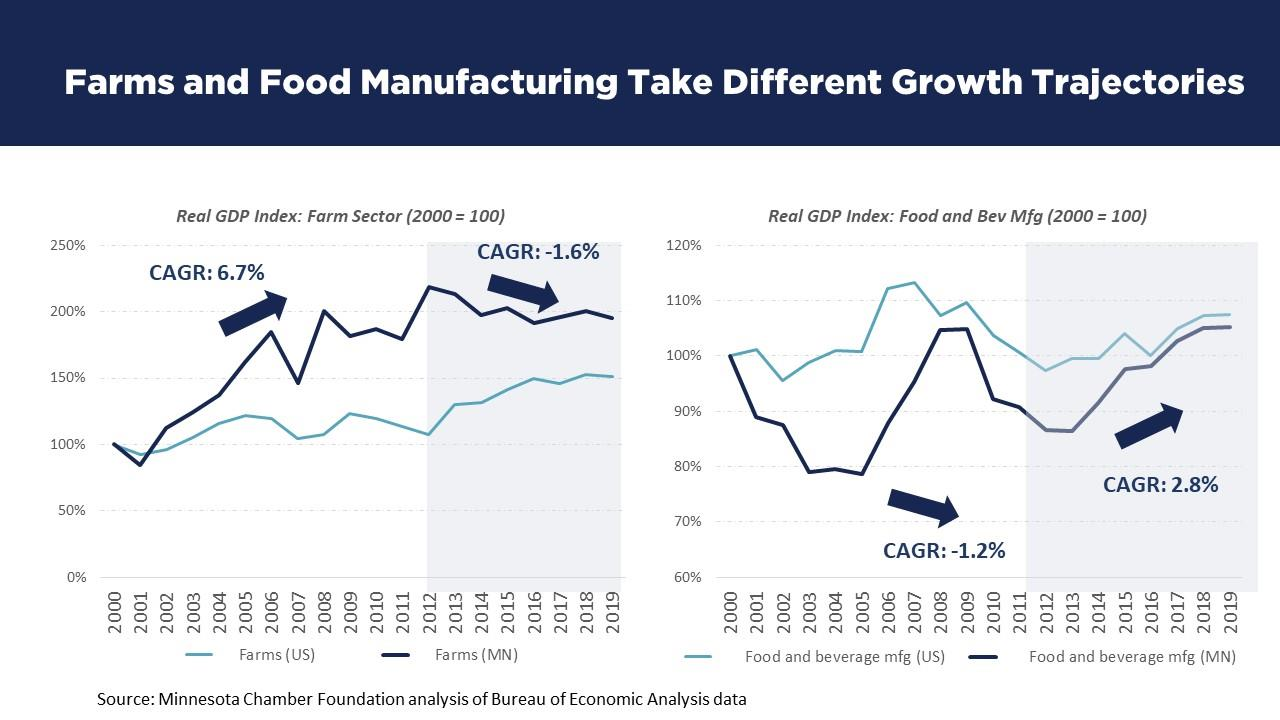

Minnesota’s farm sector experienced significant growth in value-added output in the first decade of the 21st century but began contracting after 2012 as falling commodity prices and global trade barriers inhibited growth. Food and beverage manufacturing was the mirror opposite, experiencing negative GDP growth from 2000-2012 before beginning a healthy rebound since that time.

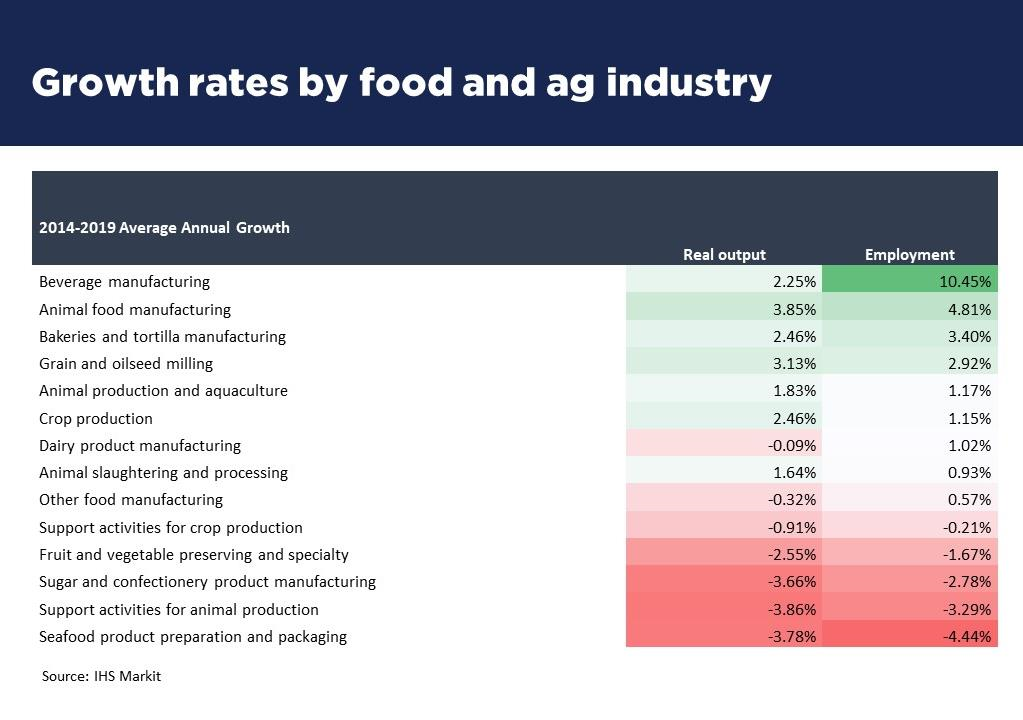

Beverage products and animal food manufacturing grew fastest in last decade, in part driven by the emergence of craft breweries, craft coffee and tea products, and growth in pet ownership, all of which created market opportunities for Minnesota producers.

Processing of dairy, sugar, fruits and vegetables, on the other hand, and support activities for animal production have contracted in the face of headwinds.

Food Producers Bet Big on Minnesota’s Future

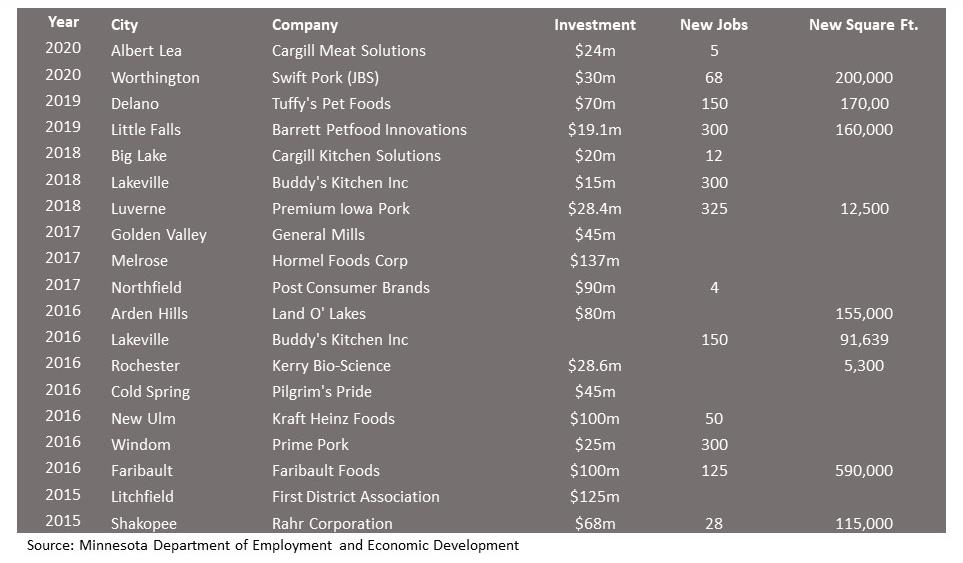

Publically announced food and beverage company expansions since 2015

The Minnesota Department of Employment and Economic Development lists 81 publically announced food and beverage manufacturing expansions since 2015. Together these expansions planned to invest $1.2 billion in capital investments and add over 2,800 new jobs. Below are some notable recent expansions.

Driving food innovation across the value chain

Minnesota’s greatest advantage lies in its concentration of innovation assets helping drive new product development, technologies, and food solutions for producers and consumers in Minnesota and around the world.

Headquartered companies and R&D – Four major food and agribusiness firms in the Fortune 500 – CHS, General Mills, Land O’Lakes and Hormel – call Minnesota home. Private companies, including Cargill, and leading research institutes like the Agricultural Utilization Research Institute (AURI) also set Minnesota apart. That concentration of companies and skills makes Minnesota a draw for talent in food and agriculture, including the 7th highest concentration of agriculture and food science technicians and the 8th highest number of food scientists in the nation. Minnesota’s food innovation cluster helped develop 103 new patents related to food just from 2008 to 2012, ranking second highest among all states.

Distribution, retail, restaurants – Minnesota is also a food retail and distribution leader, with headquarters companies such as Target and distribution leaders like United Natural Foods and SpartanNash, as well as major grocery retailers like Cub, Lunds & Byerly’s, Kowalski’s and Coborn’s. Restaurants are another major sector, with companies such as International Dairy Queen and Caribou having corporate headquarters and major operations in Minnesota.

Food and agriculture supply chain – Some of the major innovations in food and agriculture are coming from non-food industries, such as software, semiconductors, and equipment manufacturing. This creates measurement challenges, because the data doesn’t distinguish between food and nonfood technology applications. Nevertheless, innovations in technology, manufacturing, automation and controls are playing an important role in shaping the future of Minnesota’s food sector. Semiconductor facilities, for example, are developing chips that allow farmers to track real-time analytics of animal health. Software companies are developing artificial-intelligence products to help growers apply precision-spraying techniques, reducing waste and improving water quality in the process. A variety of electronics and equipment manufacturers are also producing automation technologies that will reshape how food is processed in the coming years. The strong base of other suppliers to the sector – from engineering and financial services to freight logistics and warehousing – have specialized expertise and services that cater to the food industry. Taken together, Minnesota’s food supply chain enables the state to lead on services and technologies serving food producers around the globe.

Industry support services – Additionally, Minnesota has one of the nation’s leading support ecosystems for the food and agriculture sector, including university research institutes, accelerator programs, industry associations, funding programs, and economic development organizations providing coordinated services to help serve and grow the industry. This supporting infrastructure helps food production leaders develop and execute strategies that will continue to grow Minnesota’s leadership in food production in the coming years.

Summary of recent trends

- Food manufacturing expanded at a healthy rate last decade growing at an annual rate of 2.8%, while agricultural producers faced significant market headwinds related to falling commodity prices and export barriers.

- Since 2015, 81 food/beverage manufacturing companies planned $1.2 billion in new capital investments, adding an expected 2,837 new jobs. This only includes publically announced expansions.

- Growth was strongest in beverage manufacturing, animal food, bakery/tortilla manufacturing, and grain/oilseed milling.

- Processing of dairy, sugar, fruits and vegetables contracted from 2014-2019.

- Food innovation remains a key strength. Minnesota ranks among the highest in the nation for food patents and ag/food science professions.

- Food innovation is taking place across the supply chain, including in digital technology, automation equipment, and semiconductors.

- Industry support organizations have increased funding, technical assistance, marketing, and advocacy services to further establish Minnesota as a global hub for food production and innovation.

- Workforce shortages have constrained growth in the food sector, particularly in Greater Minnesota regions where labor force growth has slowed the most.

- Rapid changes in regulations and consumer expectations have created uncertainty for producers.

![]()

What’s next for Minnesota’s food sector?

10-year economic forecast

Over the next decade, Minnesota agriculture and food processing sectors are projected to expand faster than the state’s economy as a whole. Productivity gains will help accelerate real GDP gains in both farming and processing, while employment growth is projected to slow.

Bakery/tortilla manufacturing, support activities for crop production, animal food manufacturing, and animal slaughtering/processing are all expected to increase output at a fast rate over the next decade, reflecting investment trends seen in Exhibit 3. Processing of sugar, dairy, fruits and vegetables are projected to experience continued slow or even negative output growth. Additionally, after seeing fast expansion over the past decade, Minnesota beverage manufacturing is forecasted to contract in the coming years. Of course, forecasts are not crystal balls, and many contingent factors could change the outlook for better or worse.

Below are five trends that are likely to shape the food industry over the next decade. To capitalize on such changes and opportunities, Minnesota’s food sector will require strategic responses to each.

Six trends that will shape the future of food

1. Understanding consumers and consumer preferences.

Changing consumer preference has driven the biggest changes in food in recent years – and change brings both risk and opportunity. Major risks lie in failing to recognize changing preferences or failing to respond. Opportunity comes with embracing change, or better – in anticipating change. Shifting consumer trends have stalled growth in certain sectors, even reversed it. But responding to trends such as organic production or local sourcing can create opportunities that previously did not exist. Food producers will continue to be challenged in responding to such shifts, with narrow operating margins and changing markets and channels only making it more complex. Mega-trends, such as sustainability, transparency, environmental responsibility and climate change, will be major drivers as well. But within the U.S., anticipating and meeting consumer preferences will continue to drive performance in food production, processing, retailing, distribution and food service

.

2. Technology and talent are keys to leading on innovation.

Challenge and change only ups the ante for talent and technology. Minnesota’s strong talent base in food and ag should help Minnesota companies respond. A highly-skilled workforce will work to leverage new technologies to help producers navigate the cost and risk of change. New technologies such as artificial intelligence, automation equipment, water filtration, drones, and IoT (the Internet-of-Things) systems will continue to adapt and shape how food is grown, processed, and distributed. Talent and technology creates opportunity, as Minnesota’s food and ag businesses well know. Farmers and suppliers who adapt and lead on innovation will also continue to create solutions for food producers and consumers in Minnesota and around the globe.

3. Natural resources and environmental concerns are a Minnesota advantage and challenge.

For the most part, Minnesota is blessed with abundant, fertile lands and consistent, available water resources. Weather conditions, especially drought, can undercut those natural advantages. But overall, Minnesota is reasonably well-positioned geographically and topographically, even in event of climate change. Consistent and thoughtful environmental management has been a Minnesota strength, with Minnesota farmers largely embracing sustainability and environmental responsibility broadly. Regulation frameworks that would limit or impact agriculture unreasonably are a concern to guard against, because food and agriculture production is projected to remain a major engine of the state’s economy for decades to come.

4. Automation will drive productivity and wages but require a nimble workforce strategy to reduce displacement and ensure a skilled workforce.

Automation, artificial-intelligence, and technology-based machine controls will only grow in importance in the future. Adoption of such technologies could displace lower-skilled workers, but could also create new opportunities for higher-skill, higher-wage workers. In a low labor force growth environment, nimbly addressing that displacement with skills education and on-the-job training will be essential. Not every embrace of technology will require a college degree. Training and re-skilling can work. But not every opportunity can be embraced if the food and ag sector is unable to fully leverage and employ future technology.

5. Growth will be concentrated in emerging markets in Asia and Africa.

Between 2020 and 2030, the U.S. population is projected to grow by 22.5 million people – or roughly .7 percent per year. That means American farmers and food producers can expect the U.S. domestic market for food and food products to grow about 1 percent per year – not robust. The world population, on the other hand, is projected to reach 8.5 billion by 2030, up from 7.3 billion in 2015. Most of that growth will be in Asia and Africa. India is projected to overtake China as the world’s most populous country in that time frame. Asia is today’s biggest market. Africa will be the fastest growing. Market growth for American farmers and food producers will increasingly be in emerging markets Asia and Africa. Effectively competing and serving those growing markets outside the U.S. will only be more essential to Minnesota’s ag and food economy in the future. This may be particularly true as market shifts lead to oversupply of certain commodities. For instance, future growth in electric vehicles could reduce overall demand for ethanol, creating a greater reliance on new markets to replace declining domestic demand.

6. Long-standing challenges must be addressed to capitalize on opportunities.

Fundamental infrastructure is critical to the future of food and agriculture. The issues for Minnesota’s food and ag future may not be what you would expect, but they are familiar. Like other industries and regions throughout Greater Minnesota, access to high-speed broadband will be essential for Minnesota’s food and ag industry. Broadband is essential to leveraging technology in farmer tractors and combines. Fertilizer application, irrigation, animal production will all increasingly leverage and rely on technology. Transportation will continue to be important, of course. But affordable housing and access to childcare are already a greater barrier in many parts of the state. As with every aspect of our future economy, workforce availability will be absolutely critical, as population and labor force growth continues to slow.

Minnesota’s opportunities to grow the food and agriculture sector

- Expand high-speed rural connectivity. Farming and food production is technology-intensive, and will only be more technology-empowered in the future. Mechanization and automation in food processing will accelerate, both to enhance productivity and to stretch workforce availability. Tractors will move toward autonomous operation. Fields are being monitored by sensors and satellite for optimal crop conditions assessed by analytics. Modern agriculture is empowered by technology and connectivity. That need will grow going forward. Minnesota must ensure that farmers, food producers and rural communities have high-speed connectivity to access the technology they need to grow and thrive producing the food on which we all depend. This includes wide access to quality rural broadband.

- Prioritize regulatory stability. Farming and food production has always included thoughtful stewardship of land and water resources. Regulatory stability, both from a market perspective and from a tax and environmental standpoint, is the thoughtful framework helping farmers succeed. It’s true at the state level, and also of the national and international level relative to stable, reliable inputs and predictable access to global markets. America’s farmers are the most productive in the world. Regulatory stability helps them continue to be.

- Leverage tech transfer to find market solutions for environmental challenges. Technology can also help address environmental challenges when and where they occur. But it may be beyond the ability of individual farmers, even groups of farmers, to access. Facilitating tech transfer that helps farmers manage operations while addressing necessary environmental requirements is a legitimate role for the state. Success in this area not only benefits farmers and ag producers but also the entire state.

- Double down on workforce training to prepare workers for a more technology-based and automated future. Farming and food production is leveraging technology to a much greater degree, but farmers and the food industry may need help with tools and training to succeed in a more technology-based future. Strengthening training relative to applied technology and technical skills in the workplace is an investment that will pay economic awards. It is true across economic sectors, of course, but it may be especially true in food and agriculture, where such skills may not always be resident but will be in ever higher demand.

- Provide greater promotion and support across the food supply chain (e.g. equipment, technology, professional/technical services, manufacturing), not just producers and processors. Food is a major economic sector in Minnesota well beyond the farm. Minnesota is a major food producer and processor, and our economy benefits substantially from our ability to add value beyond the farm via production, processing, engineering, food science and manufacturing. Alongside mining and forestry, food and agriculture is a foundational building block of our economy. Minnesota benefits in myriad ways from the strength and success of this key sector. Providing support and promotion of emerging connections and opportunities across the food supply chain will benefit Minnesota’s economy – and is a positive investment.

- Deepen market expertise, exports and channel expansion in the growth markets of Asia and Africa. A growing population and a growing middle class will mean the future growth markets for Minnesota agriculture will be Asia and Africa. Each is projected to add 400+ million people by 2030. That will result in substantially greater demand for food. Agriculture and food production is a global growth market of tremendous opportunity in the coming decade and beyond. Minnesota food producers should and must continue to deepen their knowledge and expertise in serving Asian and African markets – because they will be the world’s growth markets for food.

- Increase workforce availability through job awareness programs and continued immigration advocacy. Workforce growth, even basic workforce availability, is a concern for Minnesota’s economic future. With an already high labor force participation rate, but an aging population, Minnesota’s workforce constraints likely only increase by 2030. This is also true – or perhaps even more true – across Greater Minnesota and throughout Minnesota’s ag regions. Automation and productivity gains will help. But workforce opportunity awareness, training, and an embrace of immigration will also be required.

- Develop statewide emergency response strategies to ensure continuity of food production, distribution and supply in the event of natural disasters or subsequent public health outbreaks. If COVID-19 and the global pandemic taught us anything, it is the importance of our food supply and the tremendous value of the Minnesotans who fulfill those important roles for us all. Continuity of food production, distribution and supply is an imperative, especially in the event of natural disasters or public health outbreaks. Food production and distribution is a Minnesota strength that also enables us to help support and supply the nation. Strong and thoughtful planning and response strategies that seek to ensure that food production remains a stable, reliable strength will benefit us all – and should be part of the state’s future planning.