Minnesota Chamber Foundation quarterly economic snapshot: summer 2023

The Quarterly Economic Snapshot is an overview of key indicators measuring Minnesota’s current economic performance. Analysis is provided in partnership with Grow Minnesota! and the Minnesota Chamber Foundation.

Overview and highlights:

Minnesota’s economy remained stable and continued to grow in the first half of 2023 despite earlier predictions that the U.S. would fall into a mild recession sometime this year. Minnesota – like the U.S. economy – has experienced falling inflation levels alongside GDP gains and continued low unemployment rates into the middle of 2023. The better-than-expected data at the national level has increased the likelihood that the U.S. will avoid a recession and approach a so-called “soft landing” that has so far eluded federal policymakers.

Other positive trends for Minnesota include recent gains in labor force participation, state exports, and new business applications, all of which can add capacity to the state’s economy.

At the same time, there are notable headwinds to consider.

First, in nearly every major economic indicator – GDP, total employment, population and labor force growth, domestic migration, new business starts, per capita income – Minnesota is growing at a slower rate than the U.S. average and in most cases ranks in the bottom 20 states.

Slow growth may not seem like a problem in the short term, but it does have a cost over time. For example, Minnesota’s real GDP (adjusted for inflation) would be $9.7 billion larger if the state’s economy grew at the national average since the pre-pandemic peak of Q4 2019. Minnesota had the 17th largest economy heading into the new decade. But by 2021 and 2022, the state dropped to number 20 in the rankings after being passed by Tennessee, Arizona and Indiana.

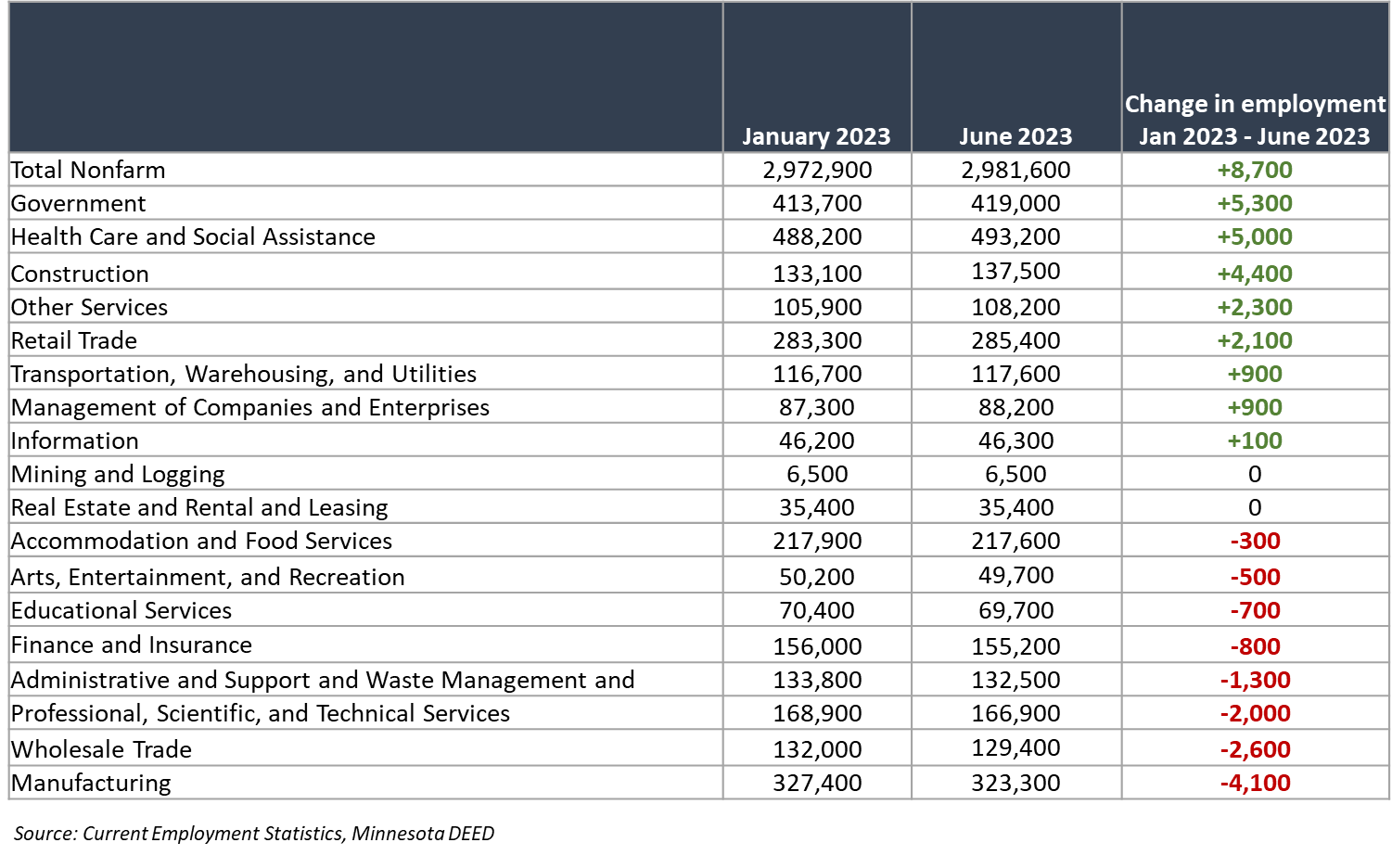

Second, Minnesota’s labor demand cooled in recent months, creating some uncertainty going forward. Total employment dropped by 4,300 jobs in June, and 8 of 20 industries had negative job growth so far this year, including manufacturing, professional services and wholesale trade. These three sectors alone shed a combined 8,700 jobs since January 2023.

Economic conditions can change quickly. But as Minnesota enters the late summer and early fall, it appears to be charting a continued path of relatively stable labor markets and slow growth that has defined the state’s economic performance for nearly two years.

Key Findings:

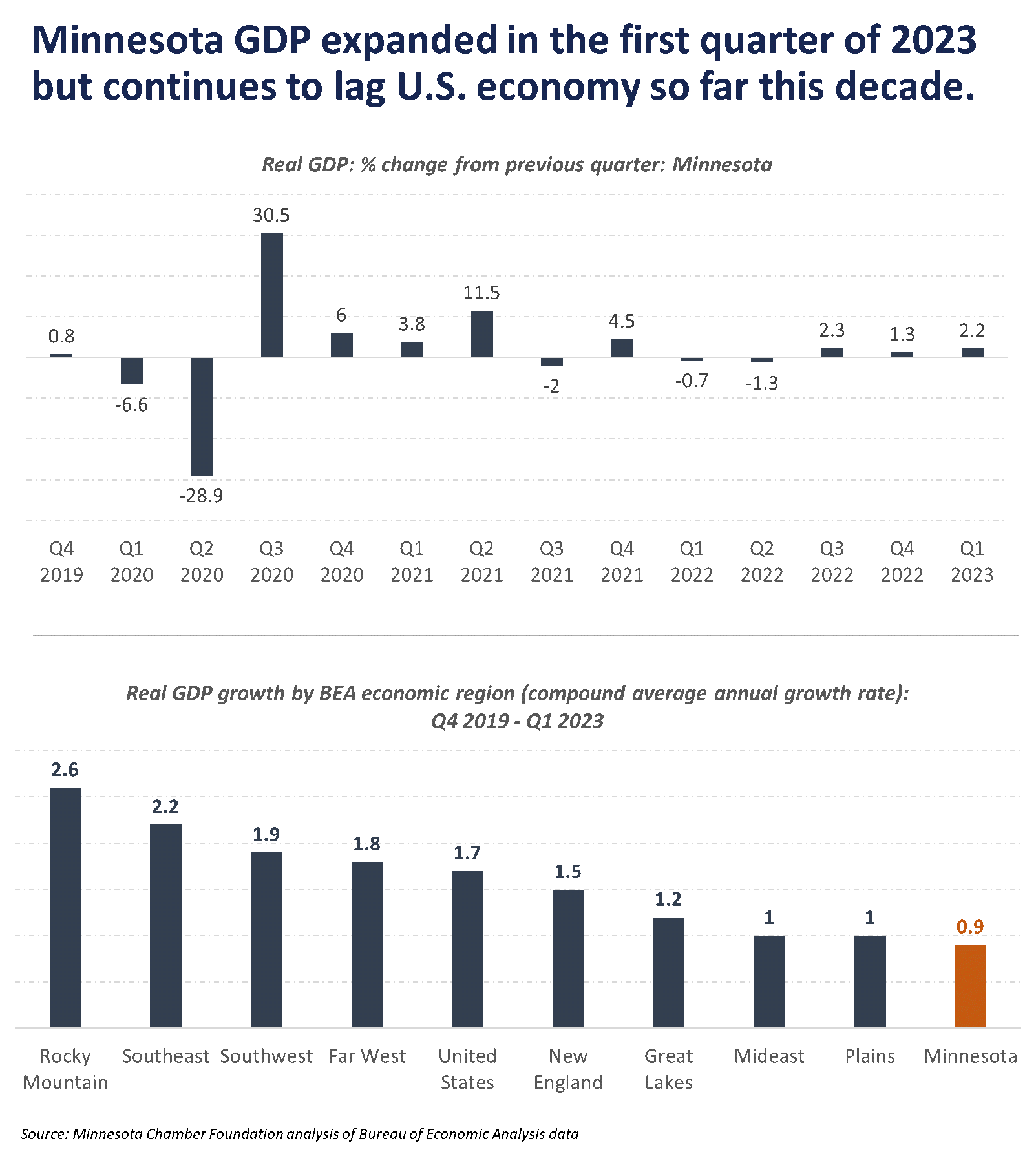

- Minnesota’s real GDP grew by 2.2% in the first quarter of 2023 but continues to lag growth in the U.S. economy. Minnesota and other upper Midwest states continue to grow slower than the national average, with Minnesota ranking 35th in real GDP growth from Q4 2019 to Q1 2023.

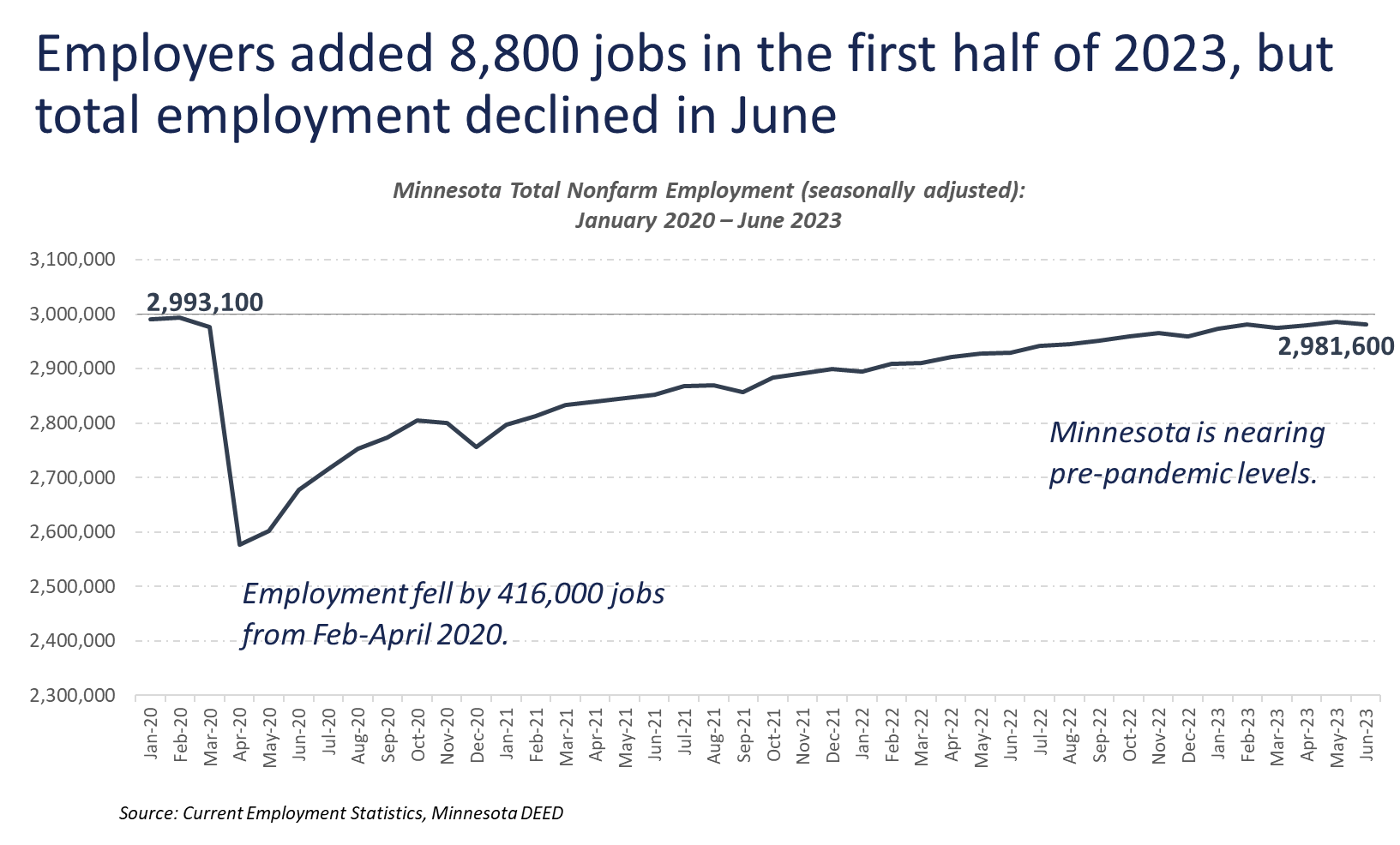

- Job growth cooled at the midyear point, with total employment falling by 4,300 jobs in June. Minnesota employers added 8,800 jobs in the first six months of the year, increasing at less than half the rate of the U.S. economy. Minnesota is one of 14 states that has yet to recover the jobs lost in the 2020 downturn.

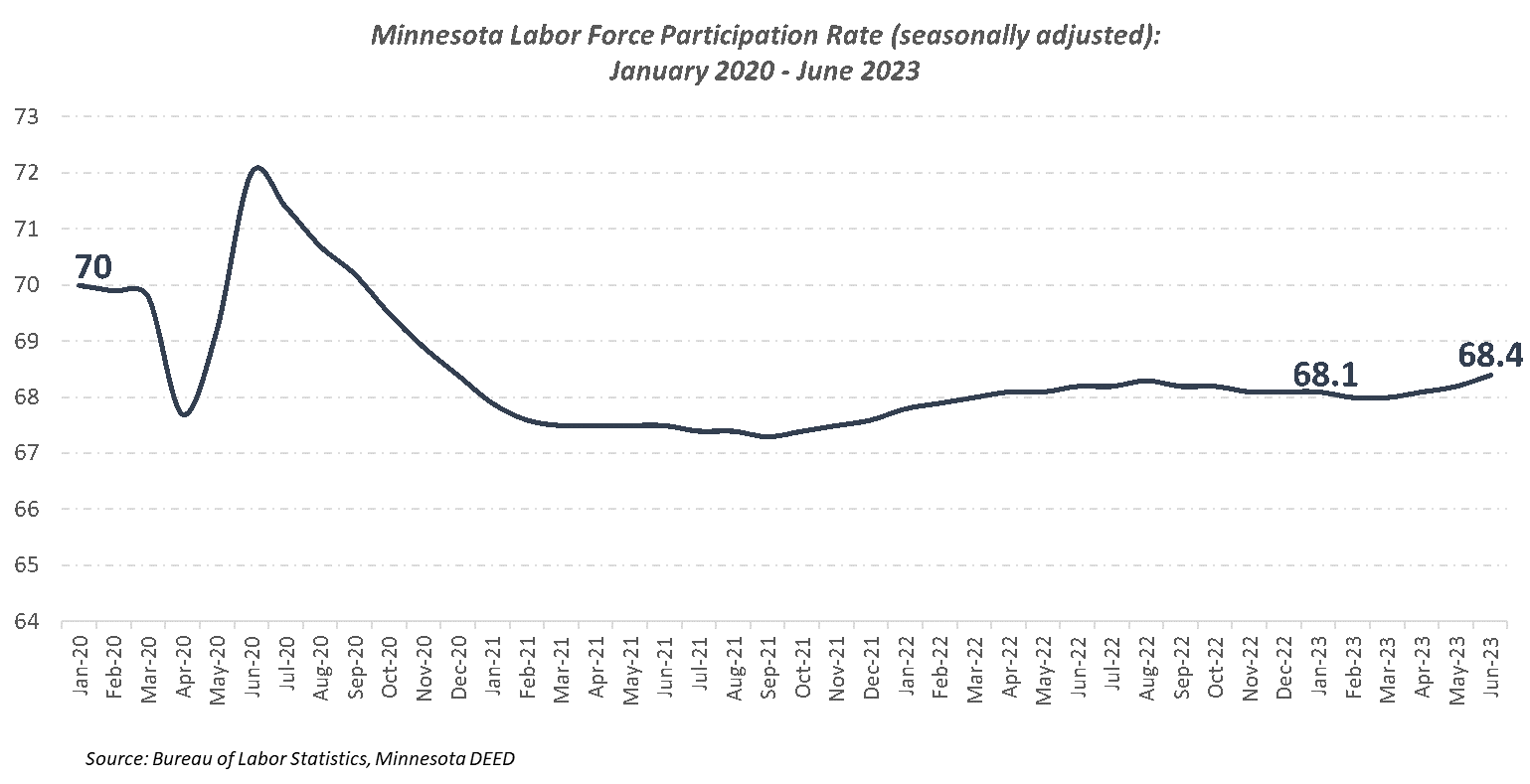

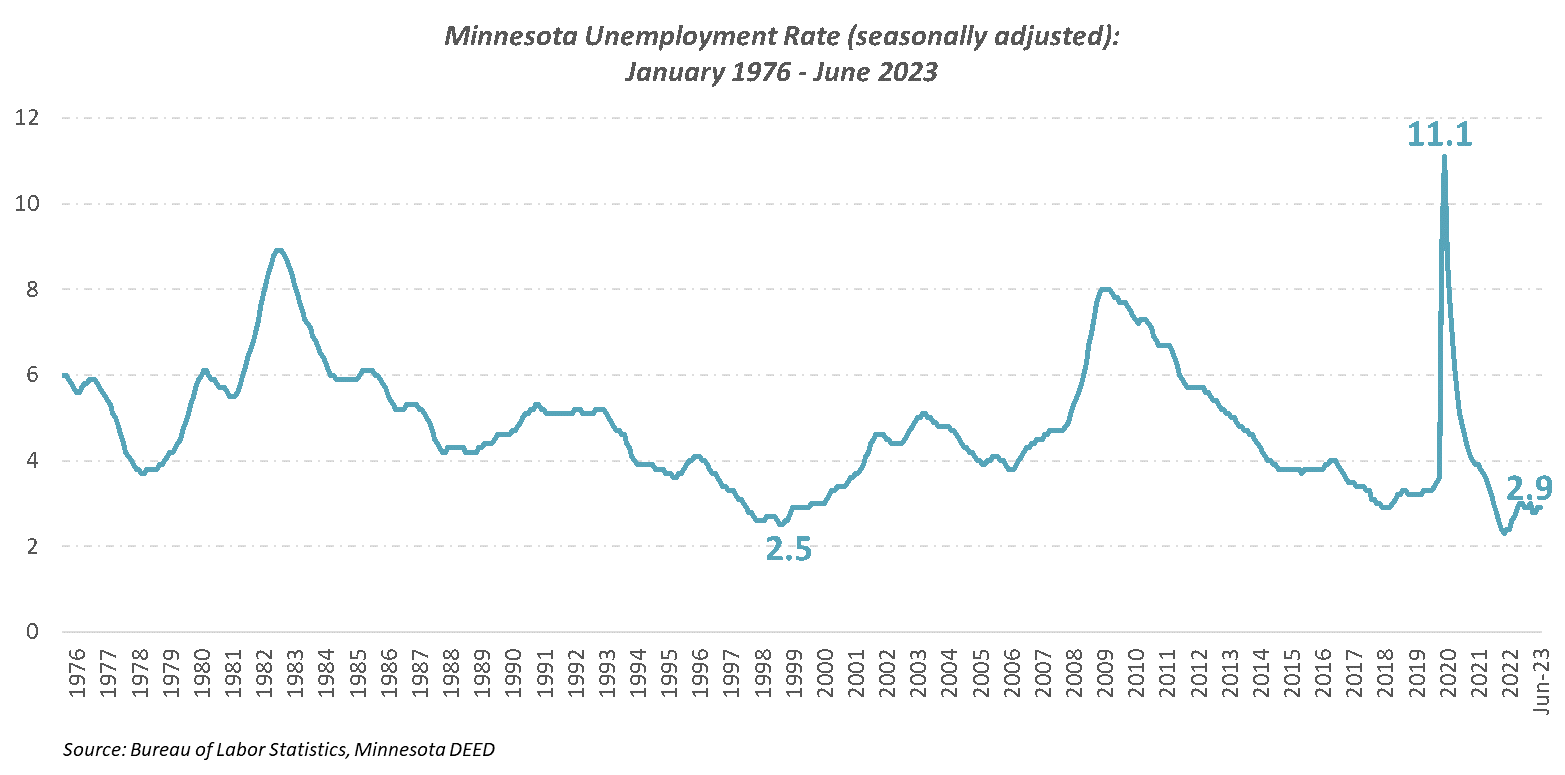

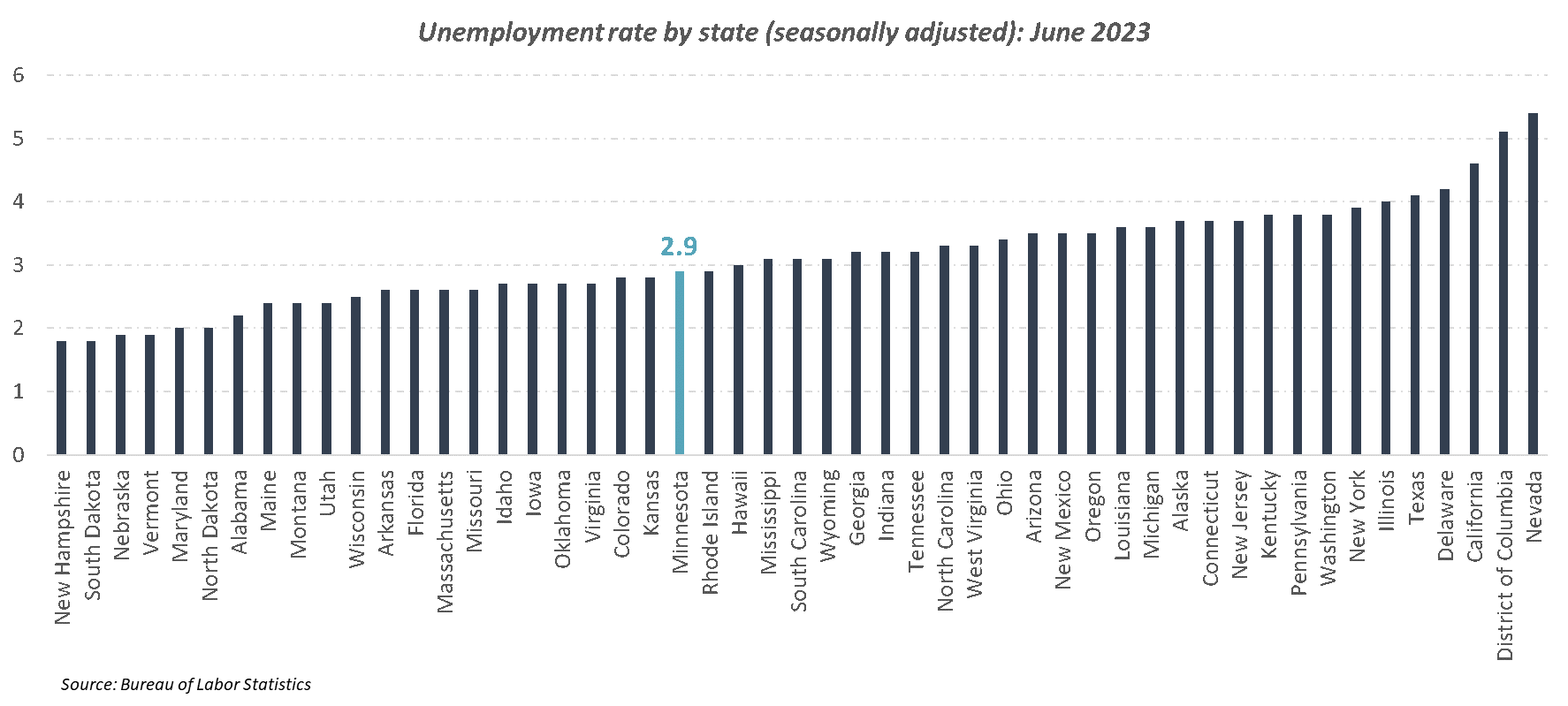

- Minnesota’s labor market remains strong with unemployment staying below 3% and 20,835 more Minnesotans joining the workforce in the first half of the year. The recent uptick in labor force participation alongside cooling demand has slightly lessened the intensity of Minnesota’s workforce shortage. However, Minnesota still only had 54 available workers for every 100 open jobs in June, underlying the continued challenge for the state’s workforce availability.

- Minnesota exports rose to $6.6 billion in Q1 2023. Exports gains continue to be driven by Canada which now receives nearly a third of the state’s total exports, compared to just 18.5% in 2019.

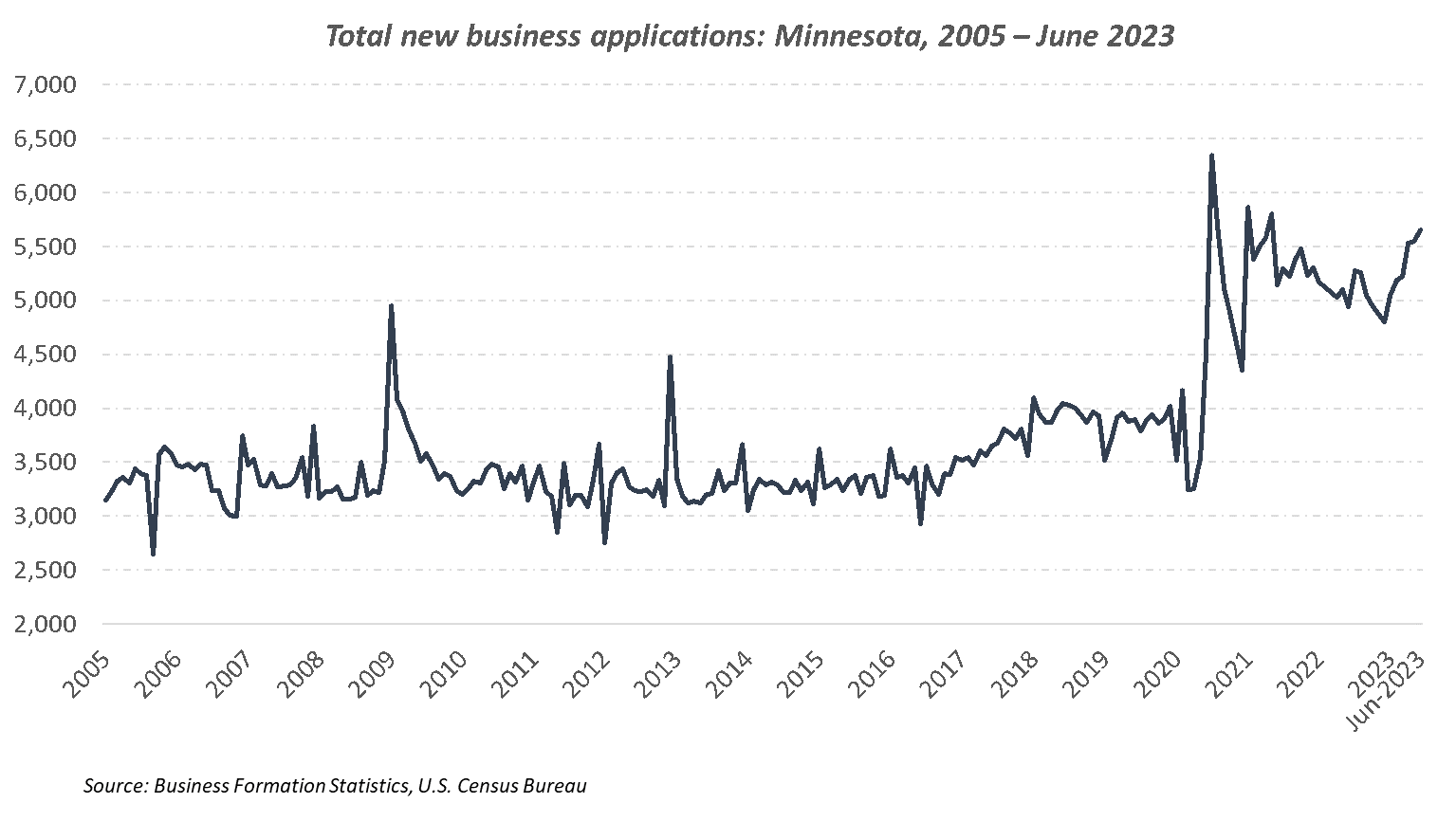

- Entrepreneurship showed mixed signals in the first half of the year. New business applications rose to their second highest levels on record. However, startup funding tightened considerably with total venture capital investment dropping by 63% compared to last year.

- U.S. inflation increased at the slowest rate in over two years this June, making a so-called “soft landing” appear within reach. Inflation in the Minneapolis-St. Paul MSA fell even lower to 1.8% in May 2023 (most recent data available), which was among the lowest across all U.S. metro regions.

GDP

Minnesota’s GDP expanded by 2.2% in the first quarter of 2023, as the state and U.S. economy continue to defy recession predictions. Minnesota ranks 35th in GDP growth since the pre-pandemic peak in 2019.

- Minnesota’s real GDP grew by 2.2% in Q1 2023, expanding for a third consecutive quarter after falling in the first half of last year.

- Forecasts remain mixed for the U.S. economic outlook in the second half of the year, with some economists expecting a shallow recession in late 2023 and others suggesting the U.S. will avoid falling into recession territory as recent data show better-than-expected performance through midyear.

- Since the pre-pandemic peak at the end of 2019, Minnesota’s GDP gains have been largely driven by three sectors: professional, technical and scientific services; the tech-heavy information sector and management of companies and enterprises (i.e. corporate headquarters and management offices). These three knowledge-based service sectors alone account for 85% of Minnesota’s total change in GDP since the end of 2019. Agriculture and health care rank as the fourth and fifth largest contributors to state GDP growth in that time.

- Over the past four quarters, 13 of 20 Minnesota industry sectors expanded output, while sevent experienced a total decline in real GDP.

- Minnesota ranks 35th among all states in real GDP growth from the pre-pandemic peak (Q4 2019) to Q1 2023. The state’s sluggish growth is explained in part by its regional location in the upper Midwest, which has seen the lowest growth of all economic regions in the U.S. However, Minnesota trails all but Wisconsin, Iowa and North Dakota among the twelve states in Midwest region.

- Contact our Grow Minnesota! team to request a full breakdown of industry or regional trends in Minnesota.

EXPORTS

Minnesota exports grew to $6.6 billion in the first quarter of 2023.

- Minnesota exports continued to rise in the first quarter of 2023. State export values increased by 9% year-over-year in the first quarter, reaching $6.6 billion dollars.

- A continued story in Minnesota trade is the surge in exports to Canada experienced since 2019. Total exports to Canada were valued at $2.1 billion in Q1 2023 and represented nearly a third of the state’s total exports, up from just 18.5% in Q1 2019.

- Minnesota’s fastest growing exports on a year-over-year basis included mineral fuel/oils (74%), vehicles (37%), chemicals (15%) and optic/medical goods (14%). Of Minnesota’s top ten largest trading partners, exports grew fastest to Mexico (28%), Ireland (23%) and Germany (22%).

- Contact Grow Minnesota! for assistance to identify grants, financing and technical assistance resources for exporting activities.

ENTREPRENEURSHIP AND STARTUP INVESTMENT

New business applications continue their 2020’s surge, but venture capital investment drops amid tightening conditions nationally.

- New business applications rose in the first half of 2023, with Minnesota entrepreneurs filing a total of 32,191 applications from January to June this year. This was the second highest number on record, trailing only the 2021 pandemic-era surge.

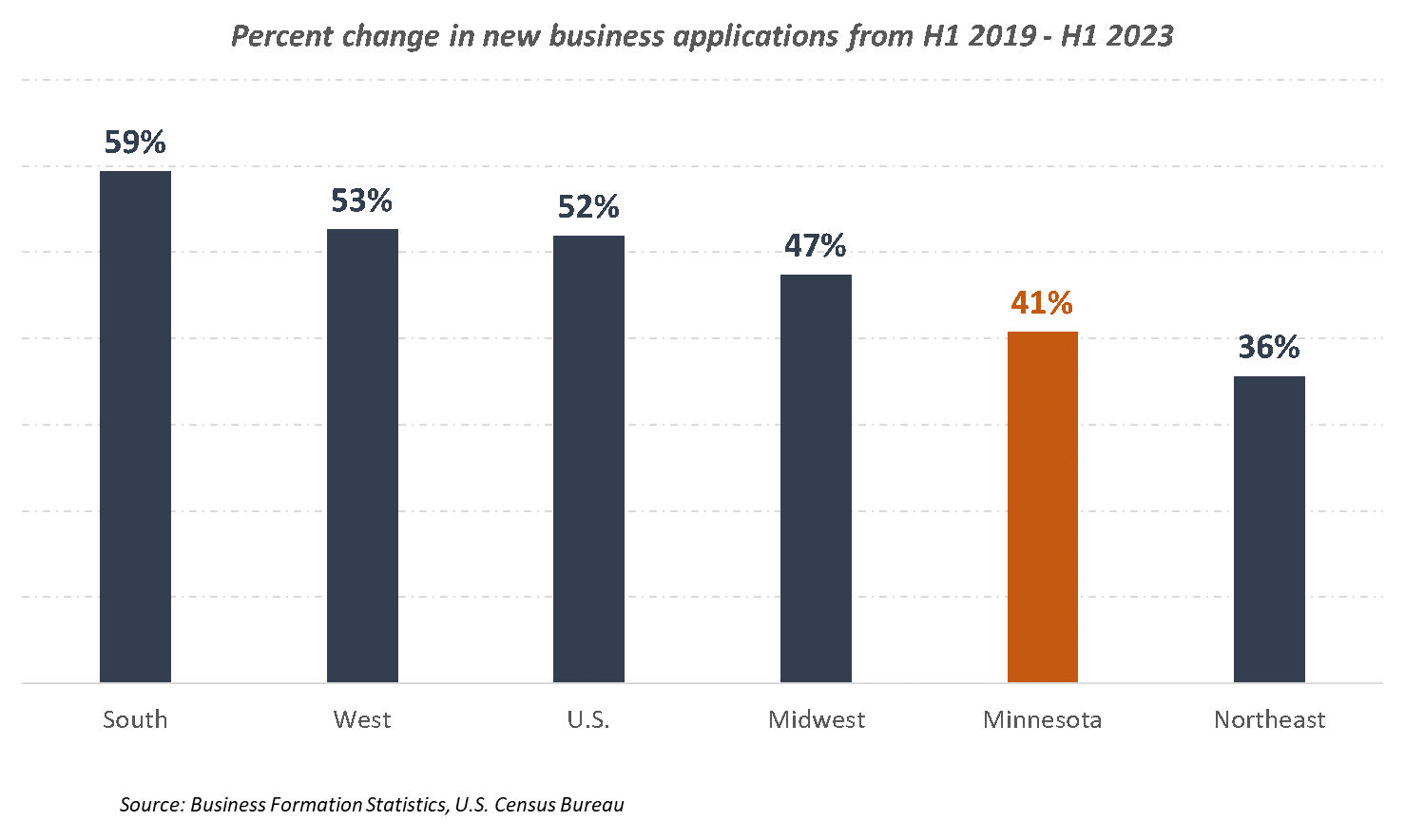

- Despite the notable uptick in new business starts, however, Minnesota trails the average rate of increase in new business applications compared to other regions around the U.S. New business applications in Minnesota rose 41% between the first half of 2019 and first half of 2023, compared to 47% in the Midwest, 52% in the U.S., and 59% in the nation-leading South. Only states in the Northeast saw a slower increase in that time.

- Following national trends, Minnesota venture capital investment dried up considerably in 2023 compared to recent years. Pitchbook and NVCA’s Q2 2023 Venture Monitor report shows that 92 Minnesota startups raised a total of $437 million in venture capital through June 2023. This is well behind the pace of the past three years, but still above pre-2020 levels.

- These preliminary numbers put Minnesota at 24th nationally for most VC raised so far this year, and fifth among the 12 midwestern states.

- Check out our Guide to Small Business Financing and Consulting Resources or contact the Grow Minnesota! team for free one-on-one assistance connecting to resources.

Job Growth

Minnesota employers added a total of 8,800 jobs from January to June 2023, nearing pre-pandemic levels. However, job growth cooled mid-year as total employment fell in June.

- Minnesota continues to inch nearer to pre-pandemic employment levels. Total nonfarm employment increased by 0.29% in the first half of the year, with employers adding 8,800 more payroll jobs from January to June.

- Job growth in Minnesota trailed the U.S., growing at less than half the rate of the national average this year. Minnesota ranks 41st among states in job growth from January 2020 – June 2023 and is one of 14 states that has yet to fully recover the jobs lost during the COVID-19 pandemic.

- Employment trends varied by sector in the first half of 2023. Job gains were highest in government (+5,300), health care and social assistance (+5,000) and construction (+4,400), while the largest declines occurred in manufacturing (-4,100), wholesale trade (-2,600) and professional, technical and scientific services (-2,000).

UNEMPLOYMENT AND LABOR FORCE PARTICIPATION

Unemployment rate remains at 2.9%, while labor force participation ticks up in 2023.

- Minnesota’s labor market remained strong in the first half of the year. The state’s unemployment hovered at 2.9% through June, despite a decline in total employment levels. At the same time, 20,835 more Minnesotans joined the labor force this year, bringing the state’s labor force participation rate up slightly to 68.4%.

- The combination of increasing labor force participation and cooling job growth has lessened the intensity of the state’s workforce shortage to some extent compared to its peak tightness in 2022 when unemployment dropped to a nation-leading low of 2.3%. By June of 2023, Minnesota had the 22nd lowest unemployment rate and the 16th most severe workforce shortage (as measured by job seekers/job openings). See this interactive chart from the U.S. Chamber of Commerce for a state-by-state comparison of workforce shortages.

INFLATION AND SUPPLY CHAIN

Inflation continues to ebb in 2023 but remains above Fed’s target of 2.0%.

-

U.S. inflation fell to 3% in June 2023, hitting the lowest year-over-year increase since March 2021. The slowdown in inflation combined with strong labor market conditions raises the likelihood of bring inflation rates down to the Fed’s target of 2% without triggering a recession and corresponding wave of job cuts.

-

Inflation in the Minneapolis-St. Paul MSA was among the lowest across all major metros in the U.S. in May, increasing at just 1.8% compared to the same time last year.

Want to learn more about Minnesota's economy?

Minnesota: 2030 – 2023 Edition builds on the original Minnesota: 2030 report. It provides an in-depth analysis of Minnesota’s economic performance since the pandemic and revised economic forecasts. The report builds on the original recommendations for growth and highlights some priority strategies moving forward.