Fueling prosperity through productivity and innovation

Overview and key findings

Defining an equation for growth

Growth in the state’s economy matters. Businesses expect to increase their bottom line so that workers and families can earn more income. Investors expect returns. Communities expect improvements in their schools, infrastructure and amenities. Delivering these outcomes requires sustained, healthy growth in the economy over time.

This has raised concerns for Minnesota in recent years, as economic growth has slowed to less than 1.4% annually this decade, ranking in the bottom third of states. Indeed, Minnesota’s economy has expanded faster than the national average just five times in the past twenty years and not once in the past decade – growing at an average annual rate of just 1.5% since 2004. The impacts of slow growth are typically felt more in the long term than in the present moment. At current growth rates, it would take Minnesota 52 years to double the size of its economy, compared to just 29 years in the U.S. This means that future Minnesotans would inherit an economy relatively less prosperous with lower living standards than its peers nationally.

Yet, how an economy grows is as important as the rate at which it expands. Economics 101 dictates that there are two ways to grow an economy: add more people to the workforce or increase output per hour worked – people plus productivity.

At current growth rates,

it would take Minnesota 52 years

to double the size of its economy,

compared to just 29 years in the U.S.

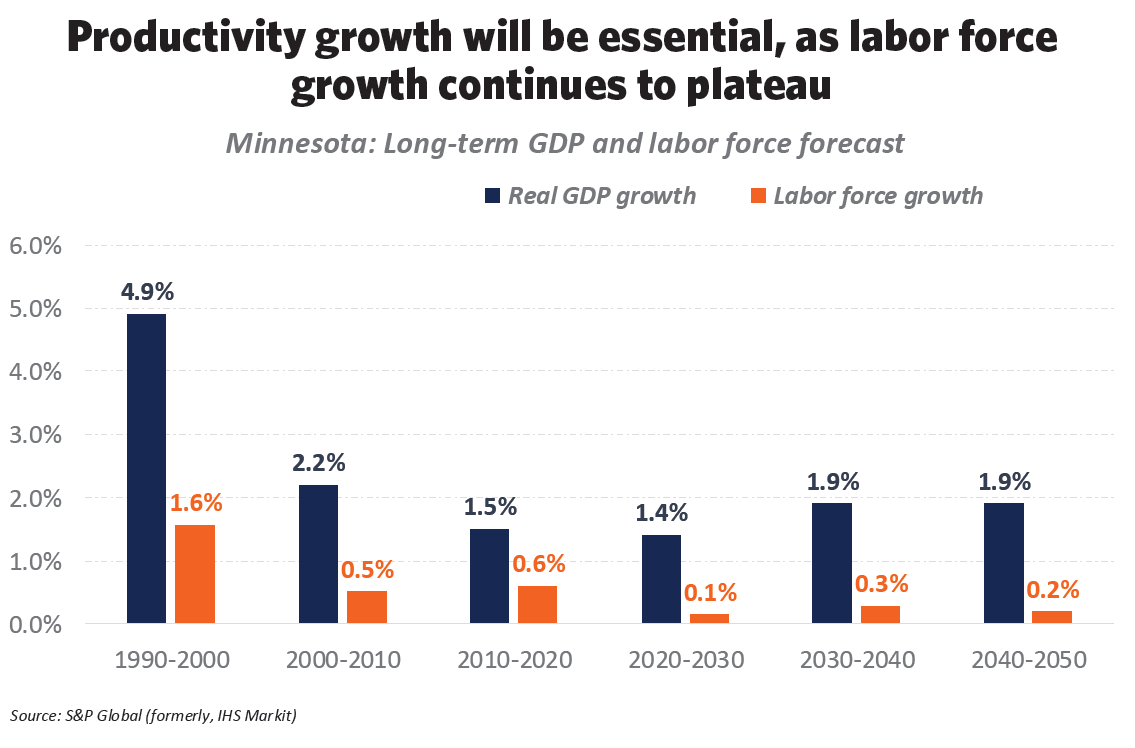

The people part of this equation has posed challenges for Minnesota in recent years. The state’s long-term demographic trajectory has left Minnesota with fewer new workers entering the workforce and more people retiring – leading to structurally low labor force and job growth. Projections show that this dynamic is likely to continue for the foreseeable future.

But while Minnesota needs strategies to grow its workforce, the state’s historic strengths relate more to its innovative businesses and highly skilled workforce than to a booming population. Minnesota is a hub for corporate headquarters, health care and medical innovation, finance and insurance, advanced manufacturing and natural resources. The state is home to many groundbreaking inventions and perennially ranks near the top five states for new patents per million residents. The development of the state’s economy has driven prosperity over time, with per-capita incomes in Minnesota exceeding U.S. levels every year since 1973. These strengths are the result of long-run productivity growth that has driven value in the economy, even as population growth has been more modest.

As the state looks to the future, however, it is necessary to ask: is Minnesota building on the strengths that can fuel innovation and prosperity going forward? And is it prepared to capitalize on emerging changes in the broader economy? That is the subject this report seeks to investigate.

This first phase of our research takes a high-level look at Minnesota’s recent productivity growth and the underlying forces that drive it – namely its skilled workforce, innovation levels and capital investments – to identify potential warning signs and opportunities that could be addressed to improve growth and performance in the state’s economy in coming years.

Key findings:

Productivity will be the key driver of future economic growth in Minnesota, as the state’s labor force is projected to remain relatively flat in coming decades. Minnesota grew its labor force by just 0.5% since January 2020 and is projected to grow by less than half a percent annually in the coming years. This will put greater reliance on productivity to drive overall gains in the economy.

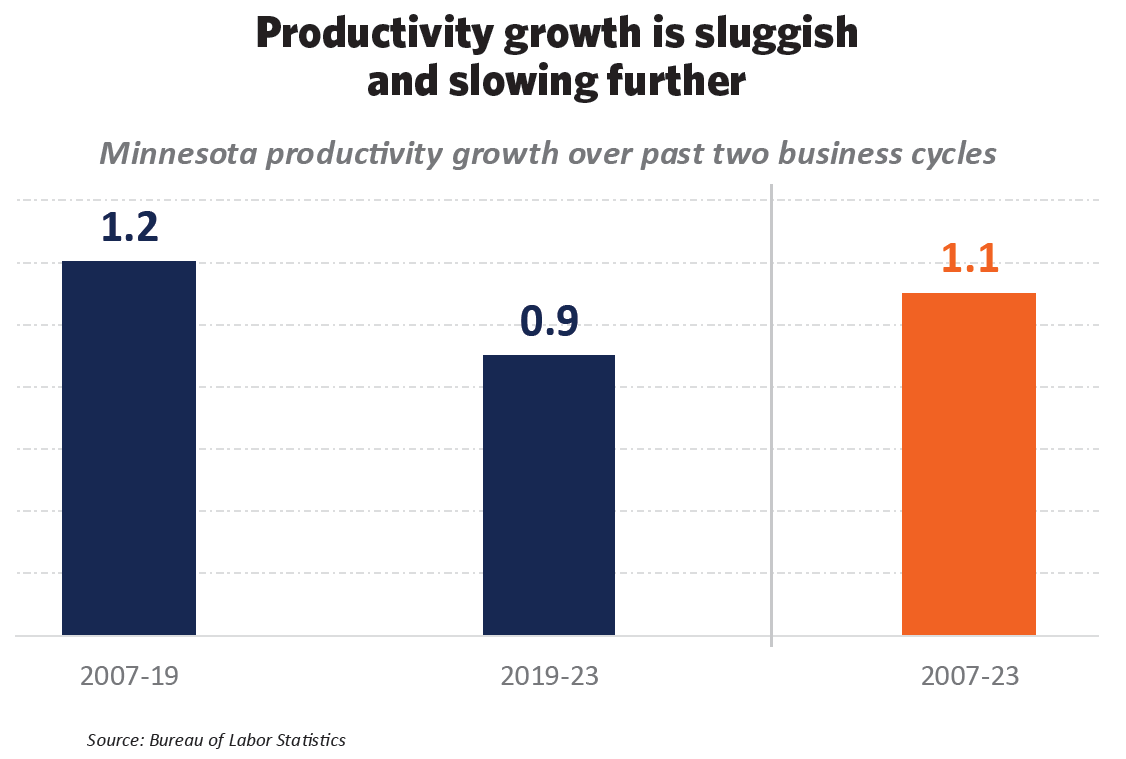

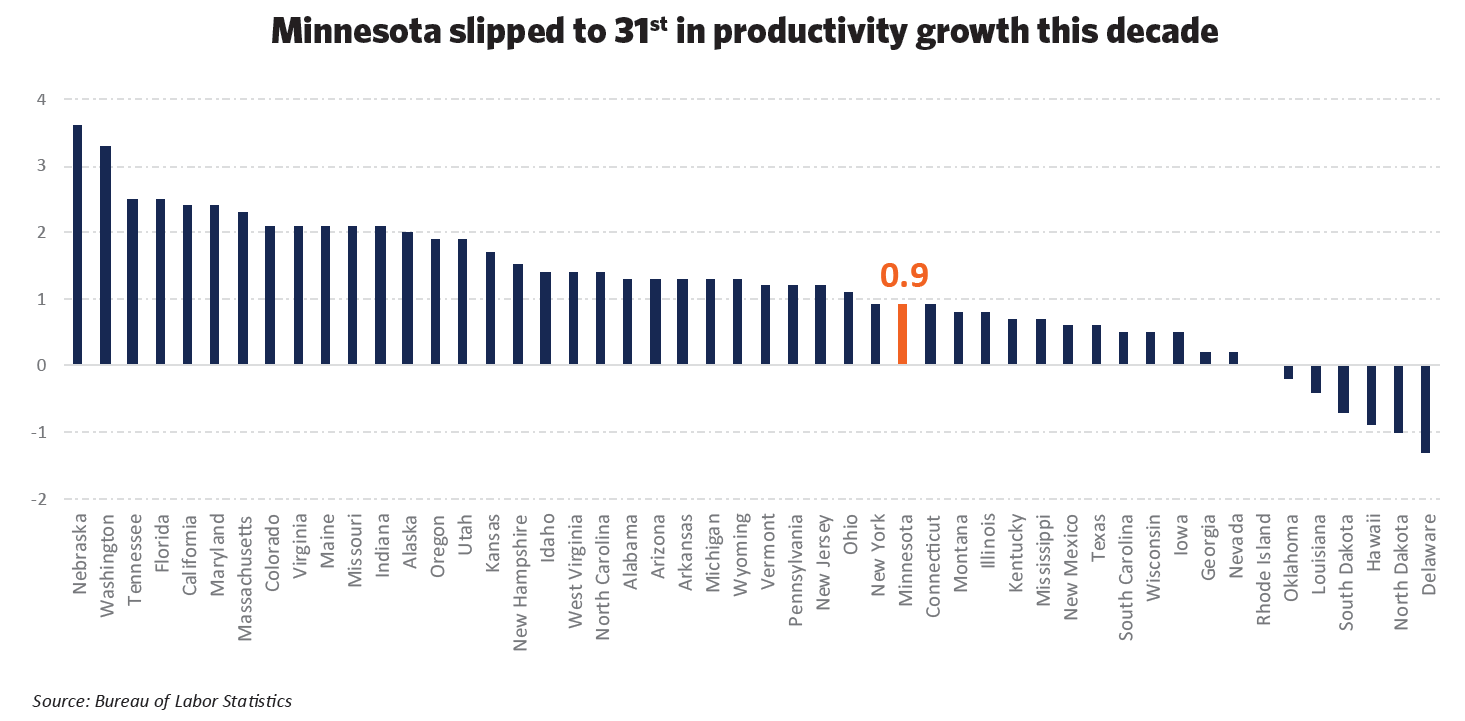

Minnesota has experienced relatively slow labor productivity growth rates over the past two business cycles and trails U.S. productivity growth. Labor productivity grew by a modest 1.2% annually from 2007- 2019 and slowed further to 0.9% annually from 2019-2023, ranking 31st among states.

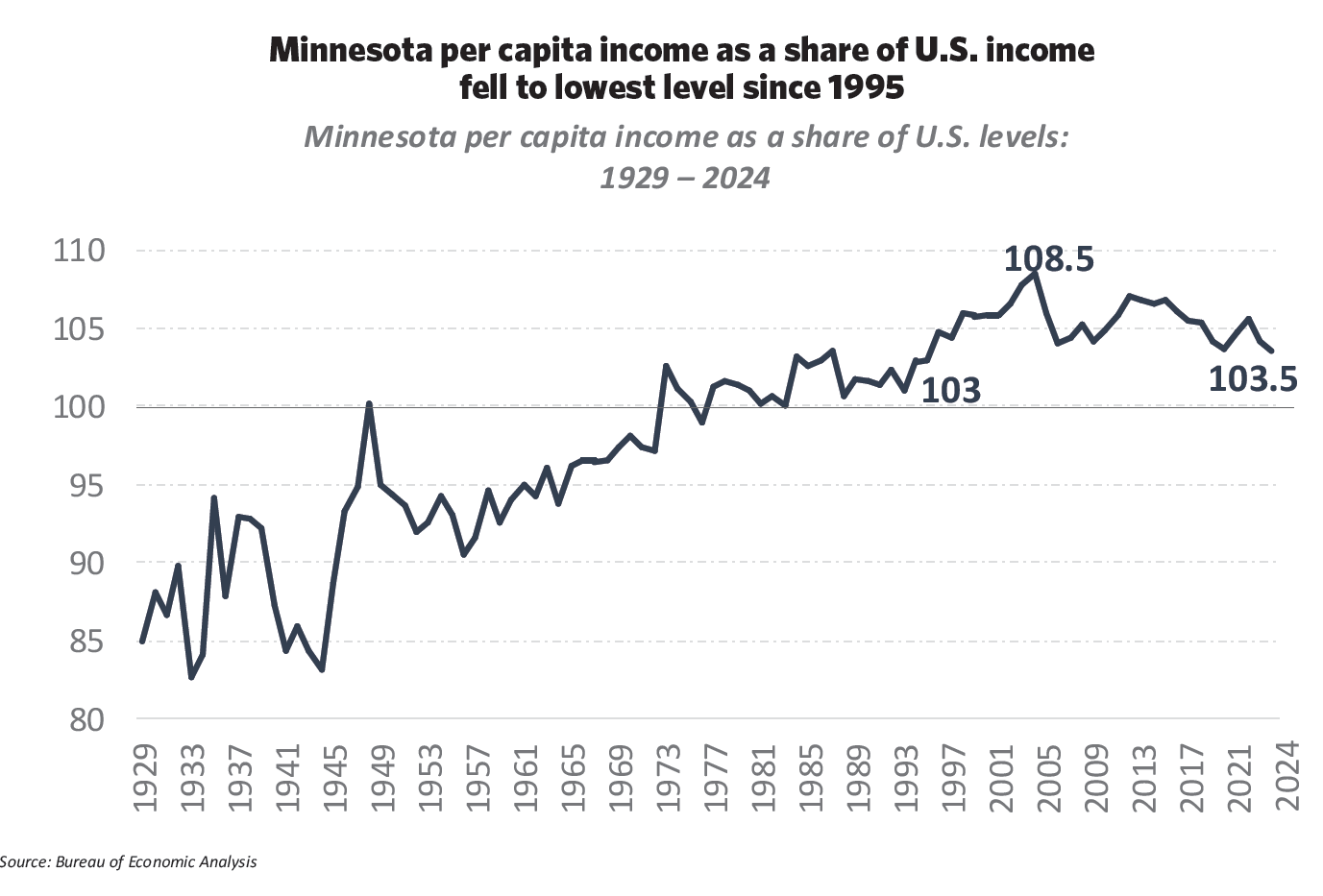

Slowing productivity and economic growth has led to a decline in Minnesota’s per capita income and GDP advantages relative to the U.S. economy. Minnesota per capita incomes grew 40th fastest among states from 2004-2024 and grew 35th fastest since 2014. Minnesota’s per capita incomes have exceeded U.S. levels every year since 1973, but that advantage declined over the past two decades. By 2024, Minnesota’s per capita income was just 3.5% higher than the U.S. average, marking the state’s narrowest income margin over the nation since 1995.

Tech and skilled service sectors account for a large portion of productivity gains in the U.S. economy so far this decade – a trait shared by states with the fastest labor productivity growth. Research from the International Monetary Fund shows that 70% of U.S. productivity growth since 2019 was driven by just two sectors: information and professional services. Minnesota’s information and professional services sectors grew at a healthy pace this decade but trailed the national average, ranking 34th and 44th respectively among states from 2019 to 2024.

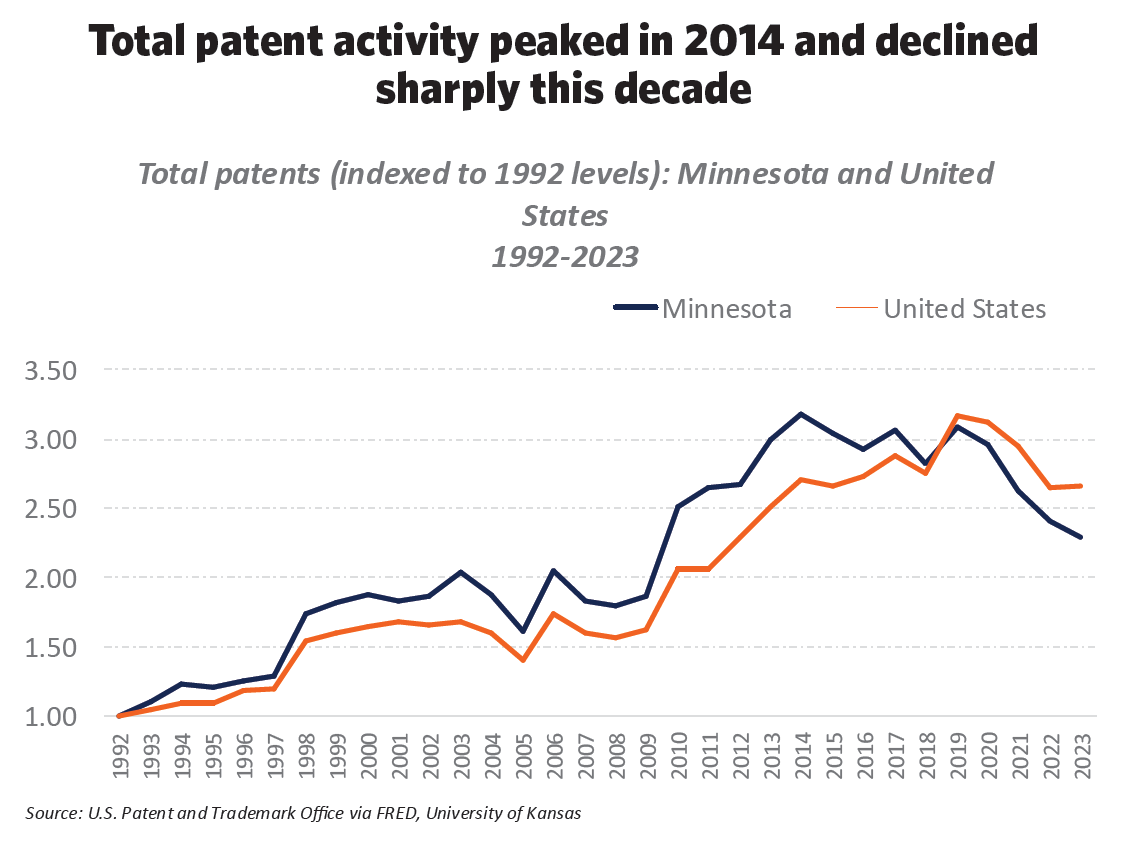

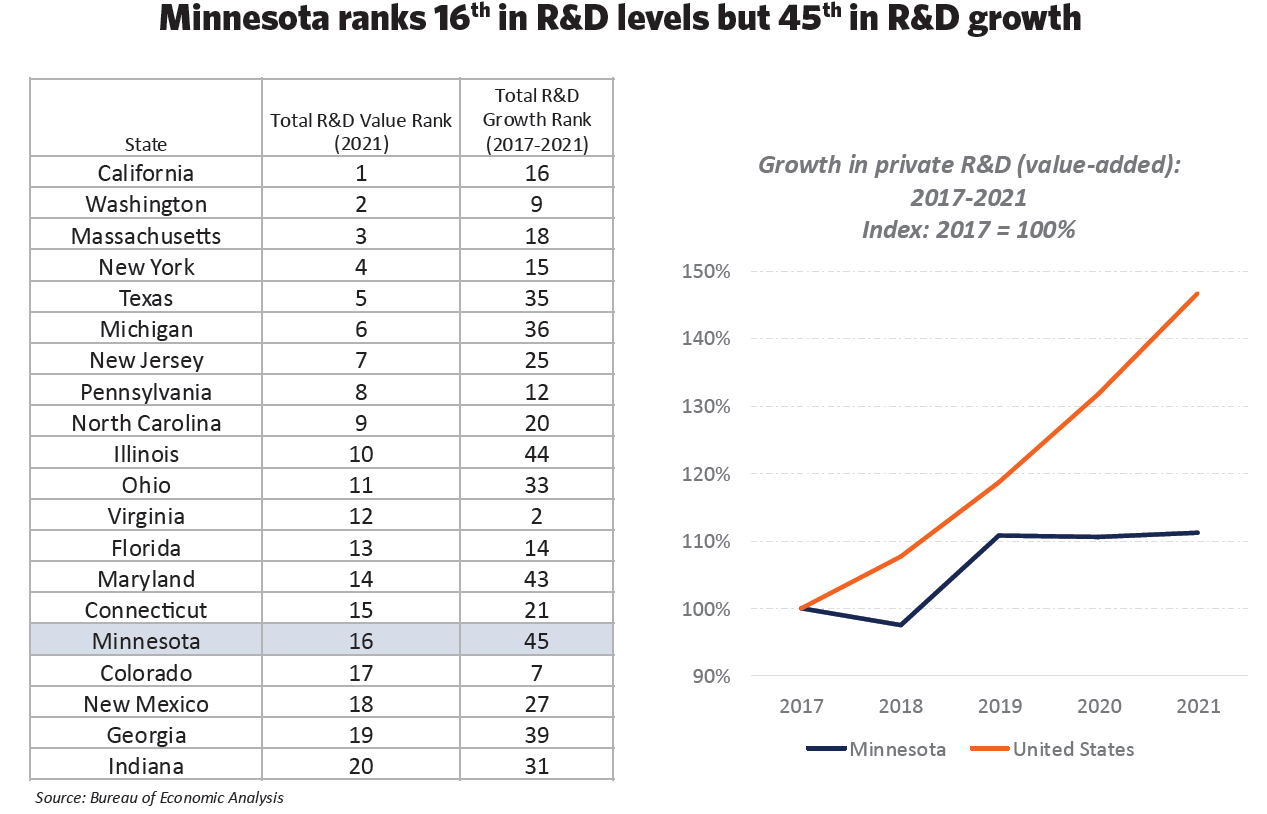

Minnesota continues to rank high in absolute measures of innovation and talent, but growth in several key indicators has flattened or declined in recent years. Total patents in Minnesota peaked in 2014 and declined sharply this decade. Minnesota ranked 47th in new patent growth from 2013-2023. Likewise, Minnesota had the 16th highest total R&D value-added among states from 2017 to 2021 but ranked 45th in R&D growth over the period and ranked 48th in R&D growth since 2013.

Emerging changes in the broader economy – such as advancements in AI and federal efforts to increase domestic investments – could have significant impacts on future productivity outcomes, providing an opportunity for states like Minnesota. Minnesota’s diverse strengths in skilled services, manufacturing and natural resources position it for distinct opportunities in the coming years. It is still too early to tell how AI technologies will impact businesses and the labor market, or whether the national push for more domestic investment will come to fruition. Yet, Minnesota should assess its strengths and weaknesses and take actions to capitalize on the potential productivity gains these changes may offer.

Back to top

Productivity and prosperity in Minnesota’s economy

Productivity growth is the most important driver of long-term gains in income and living standards. Minnesota’s recent productivity performance, like its labor supply, has grown slowly in recent years – trailing the U.S. average and peer states. Following are key stats on Minnesota’s recent productivity growth:

- From 2007 to 2019, Minnesota’s labor productivity grew at just 1.2% annually – well below the U.S. long-run average. Since 2019, labor productivity growth has slowed further to just 0.9% per year, with Minnesota falling to 31st in the nation.

- This stands in contrast to recent national trends. After a decade of sluggish gains, U.S. productivity has shown surprising strength in the past two years, helping to boost national GDP and outpace most global peers. U.S. productivity grew by 1.8% in 2023 and a robust 2.7% in 2024.

- Fast productivity growth states like Nebraska, Washington, Florida, Tennessee and California have outperformed in a combination of tech and professional service industries and capital-intensive sectors like manufacturing and utilities. This reflects data at the national level showing that just two sectors – information and professional services – drove 70% of productivity gains in the U.S. economy so far this decade.

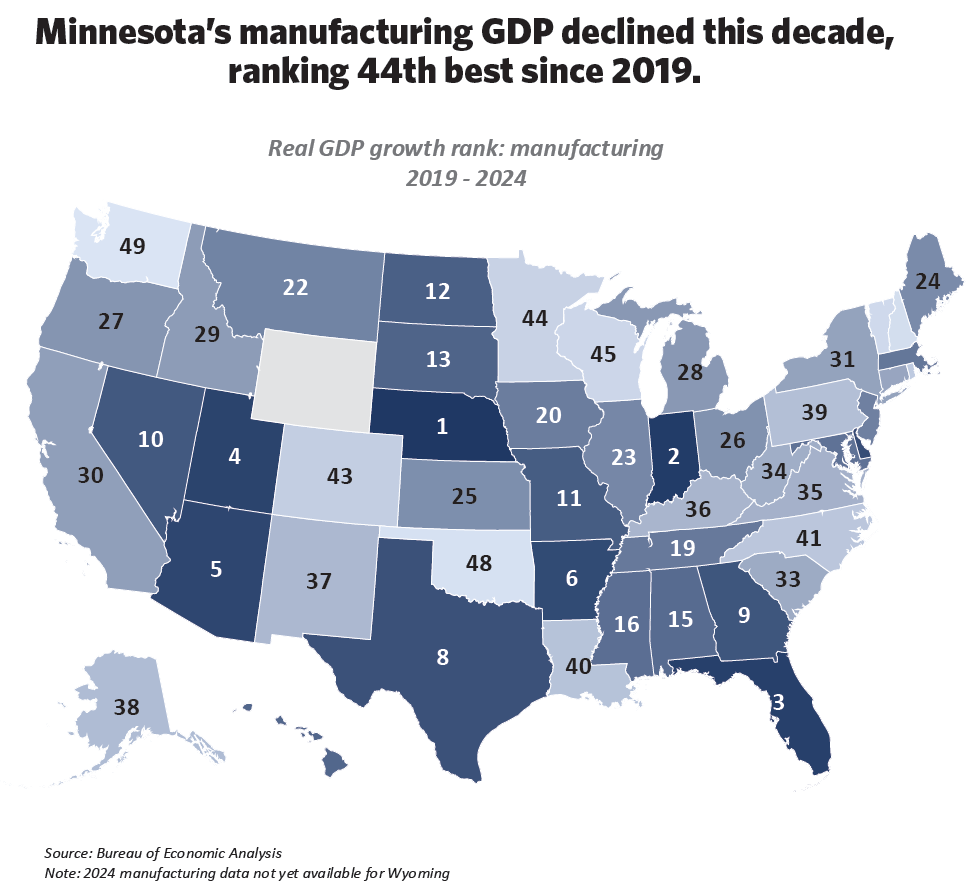

- Minnesota has ranked in the bottom third of states for real GDP growth in these high output per employee sectors, ranking 44th in manufacturing and professional services from 2019 to 2024.

The imperative to accelerate productivity isn’t needed just to grow the economy in an abstract sense.

Productivity growth directly relates to overall income and prosperity levels. Since 1973, Minnesota has boasted higher per capita incomes than the U.S., with the state’s relative advantage peaking in 2004 when Minnesota per capita incomes were at 108.5% of U.S. levels. Yet, the state’s slowing economy has led to a decline in its relative income advantage over time.

- Minnesota per capita incomes grew 40th fastest among states from 2004 to 2024 and grew 35th fastest since 2014.

- By 2024, the state’s per capita income advantage fell to its lowest levels since 1995 – a nearly 30-year low.

- Likewise, analysis from the Center for the American Experiment shows that Minnesota’s advantage over the U.S. in real GDP per capita has eroded over the past decade and by early 2024 had fallen below the U.S. average.

What is productivity growth and how is it measured?

At its simplest, productivity growth describes increases in output per unit of input. Though simple in concept, measuring productivity is more challenging.

There are several methods of calculating productivity, but the most common are:

- Labor productivity: Labor productivity measures total output per hour of work. This is the most common and available measure of productivity and is closely tracked at the national level to examine overall economic performance.

- Total factor productivity: Total factor productivity (TFP) refers to gains in output that can’t be explained by increases in labor or capital – the remainder is the result of innovations and management practices that create efficiencies without adding more direct inputs. TFP measurements are not typically calculated at the state level, though a recent report from the Center for the American Experiment provides a useful examination of this topic and does provide TFP estimates by state.

Due to availability of data, this report primarily uses labor productivity as the baseline measurement.

Back to top

Underlying factors driving productivity – Innovation, investments and talent

Unlike labor force growth, which relies on increasing the number of people in the workforce, productivity relies on increasing human capital (skills and knowledge of the workforce), investments in physical or intangible capital (equipment, technologies, buildings) and innovation or managerial practices that create value through new ideas and ways of producing goods and services. In short, productivity is driven by innovation, investments and talent.

The data reveal a persistent pattern: Minnesota continues to have an innovative business sector and highly skilled workforce, but growth in many indicators is flattening or declining. Further, the state’s notable successes – like educational attainment rates or high-profile innovation examples – are not translating into broader gains. Below is a breakdown of key indicators on Minnesota’s human capital, innovation and capital investment trends.

Human capital:

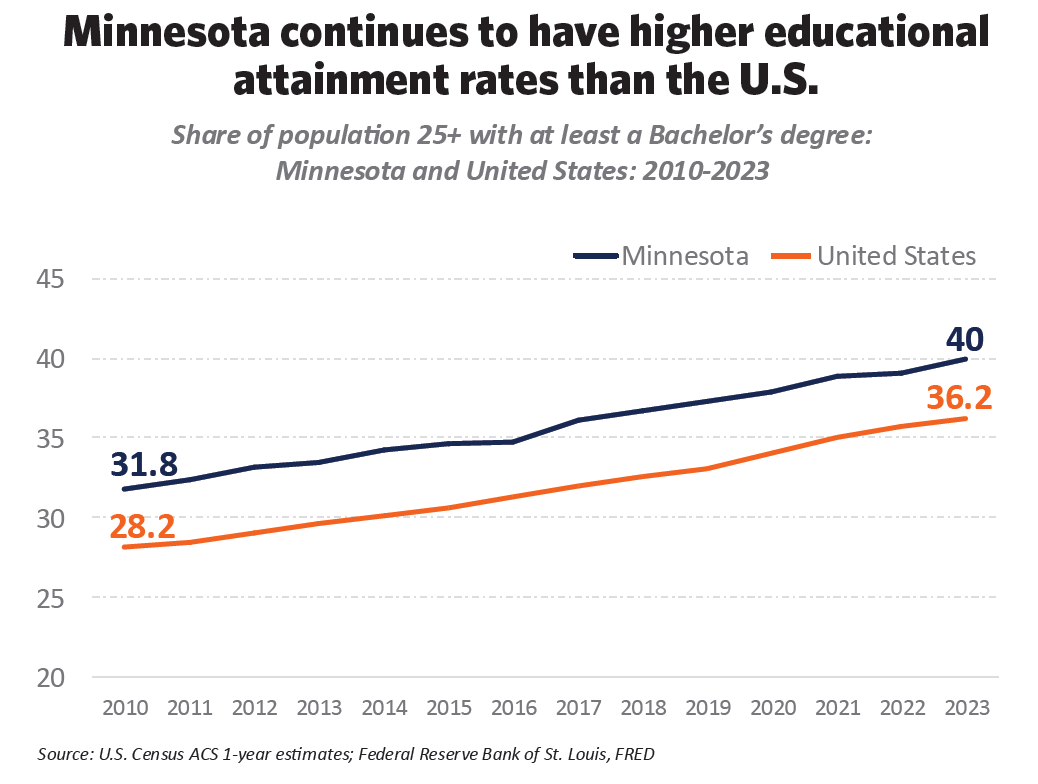

- Minnesota continues to have a highly educated and skilled workforce. Educational attainment rates in Minnesota remain well-above the national average – with the state having the 6th highest share of adults with at least a high school diploma and the 12th highest share of adults with a bachelor’s degree or higher.

- This advantage in attainment rates continues to be sustained over time. Since 2010, Minnesota had the 17th largest increase in college-educated adults – with 40% of adults over the age of 25 having at least bachelor’s degree in 2023. However, there has only been a weak positive correlation between growth in the share of the population with a bachelor’s degree and productivity growth at the state level since 2007. This aligns with findings from other studies, suggesting that the quality and type of education plays a role in productivity gains in addition to overall attainment rates.

- While Minnesota continues to rank high in educational outcomes overall, K–12 test scores in reading and math have dropped sharply in both 4th and 8th grades—declining faster than the national average.

- There is also evidence that the state’s education system is not adequately aligned with the needs of advanced sectors. An annual report from Code.org shows that Minnesota continues to rank nearly last among states in its share of high schools offering computer science curriculum.

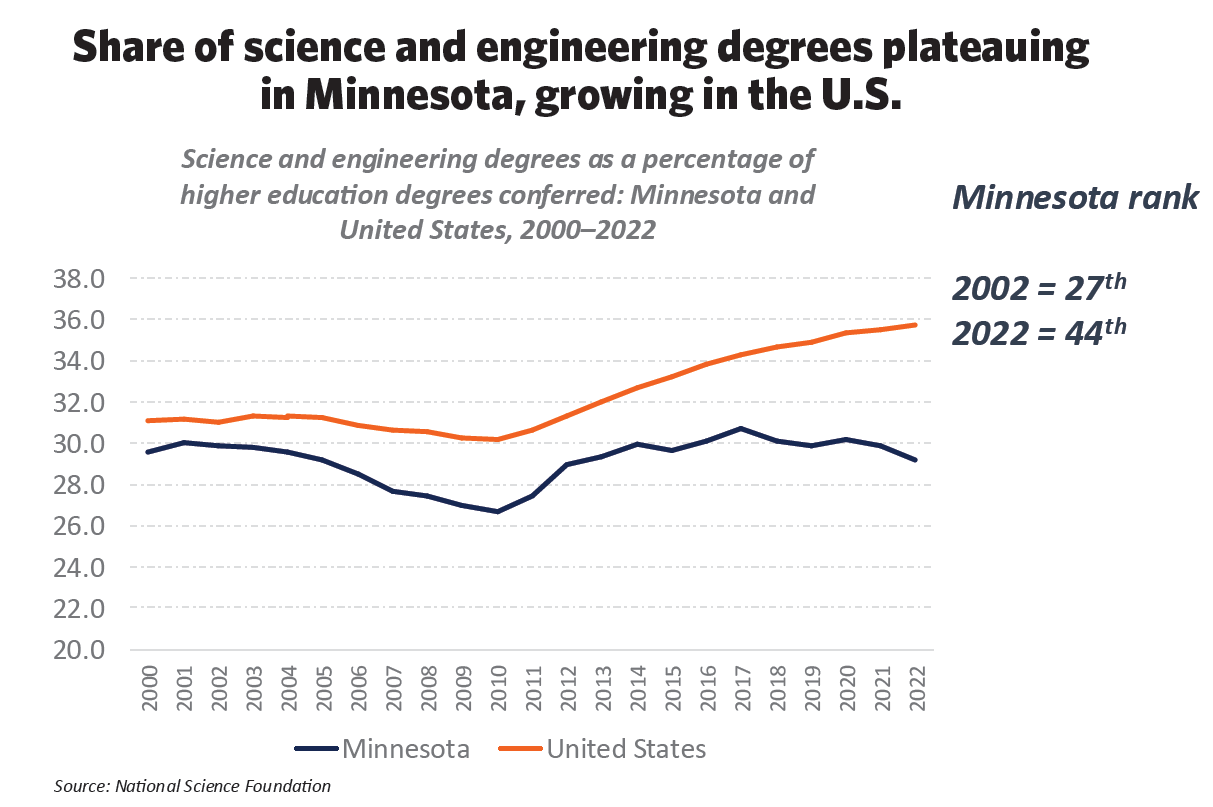

- Similar concerns exist at the post-secondary level. For example, data from the National Science Foundation show that the share of Minnesota higher education degrees awarded in science and engineering fields has plateaued over the past decade and declined since 2017, even as national shares continue to rise.

- Further, while Minnesota has a high concentration of jobs in advanced sectors, job growth in these industries has been flat or declining in recent years. CompTIA data show that Minnesota ranked 50th in net tech job growth from 2018 to 2023.

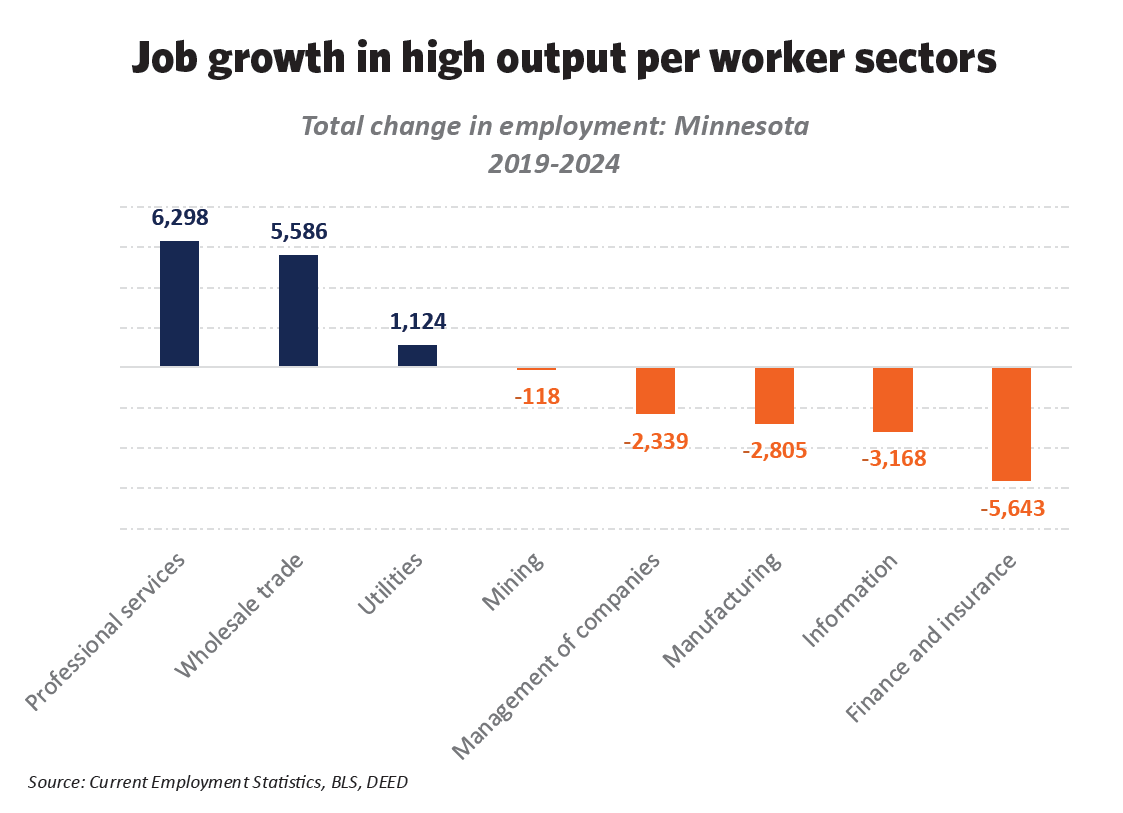

- Since 2019, Minnesota has had a decline in total employment in 5 of 8 industries with the highest GDP output per person, including finance and insurance, information, management of companies (i.e., corporate headquarters), manufacturing and mining.

These shifts suggest that Minnesota must examine how its education and workforce training systems are enabling the state’s key industries to accelerate growth.

Innovation and investments:

Minnesota continues to have a highly innovative economy with strengths across diverse sectors. This innovation strength shows up in the state’s businesses – from long-established global leaders to cutting-edge startups.

The concern, however, is that these individual successes are not matched by broader gains throughout the economy. The data show that while absolute measures of innovation remain high, Minnesota is not increasing these advantages in the aggregate – and in many cases the trendline is stagnating or declining. For example:

- While Minnesota still ranks 6th in patents per capita, the volume of new patents peaked in 2014 and has declined steadily since—with a particularly sharp drop this decade. Between 2013 and 2023, Minnesota ranked 47th in patent growth, experiencing one of the steepest declines in the country.

- The same pattern holds for research and development. Minnesota ranks 16th in R&D output but just 45th in R&D growth between 2016 and 2021. Likewise, research from the State Science & Technology Institute (SSTI) shows that R&D spending in Minnesota grew 48th fastest among states from 2013-2022.

- Investment in physical capital – especially large business expansions and new facilities – also lags. During the previous business cycle, Minnesota outperformed the national average in non-residential construction. But since 2020, nonresidential construction has flattened in Minnesota while increasing sharply in the U.S. as a whole. U.S. trends have been driven by a surge in manufacturing and data center construction. As detailed in the Minnesota Chamber Foundation’s Grow Minnesota! research, evidence suggests that Minnesota trails its Midwest peers in business expansions, even as total project volume has increased.

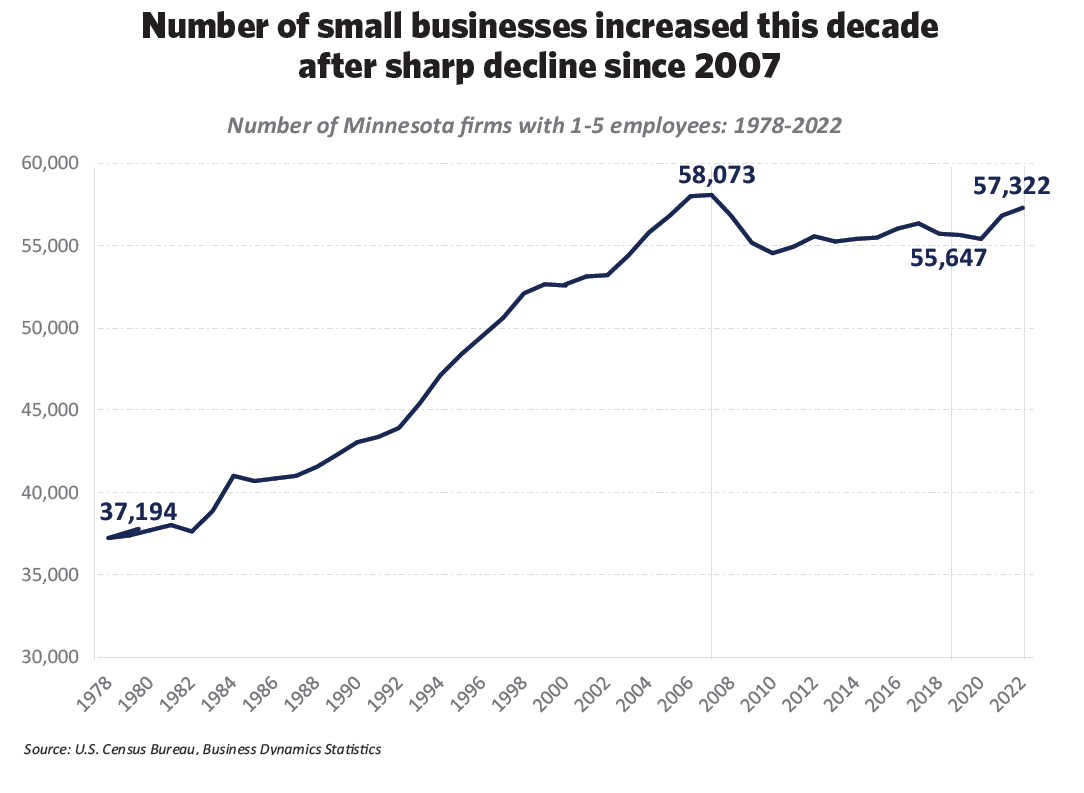

- One bright spot has been the uptick in new business formations this decade. After a decades-long slowdown in entrepreneurship rates, new business applications spiked in the middle of 2020 and have remained well above pre-2020 levels through early 2025. Should this trend continue over the longer term, it could add a positive boost to productivity growth in the state.

Back to top

Emerging opportunities for productivity growth

Despite Minnesota’s recent slowdown in productivity, broader shifts in the national and global economy offer important opportunities for acceleration. Two trends stand out in particular: the rapid advancement of Artificial Intelligence (AI) and a growing consensus around increasing domestic investment in U.S. manufacturing, energy and natural resources. Together, these forces have the potential to reshape productivity growth in Minnesota over the next decade. Advancements in Artificial Intelligence Advancements in AI—especially generative and emerging agentic forms—are poised to impact future productivity growth and labor markets in profound ways. While the long-term effects are still uncertain, the potential impacts are large. Below is a preliminary review of what we know about AI in Minnesota and how it compares to national trends.

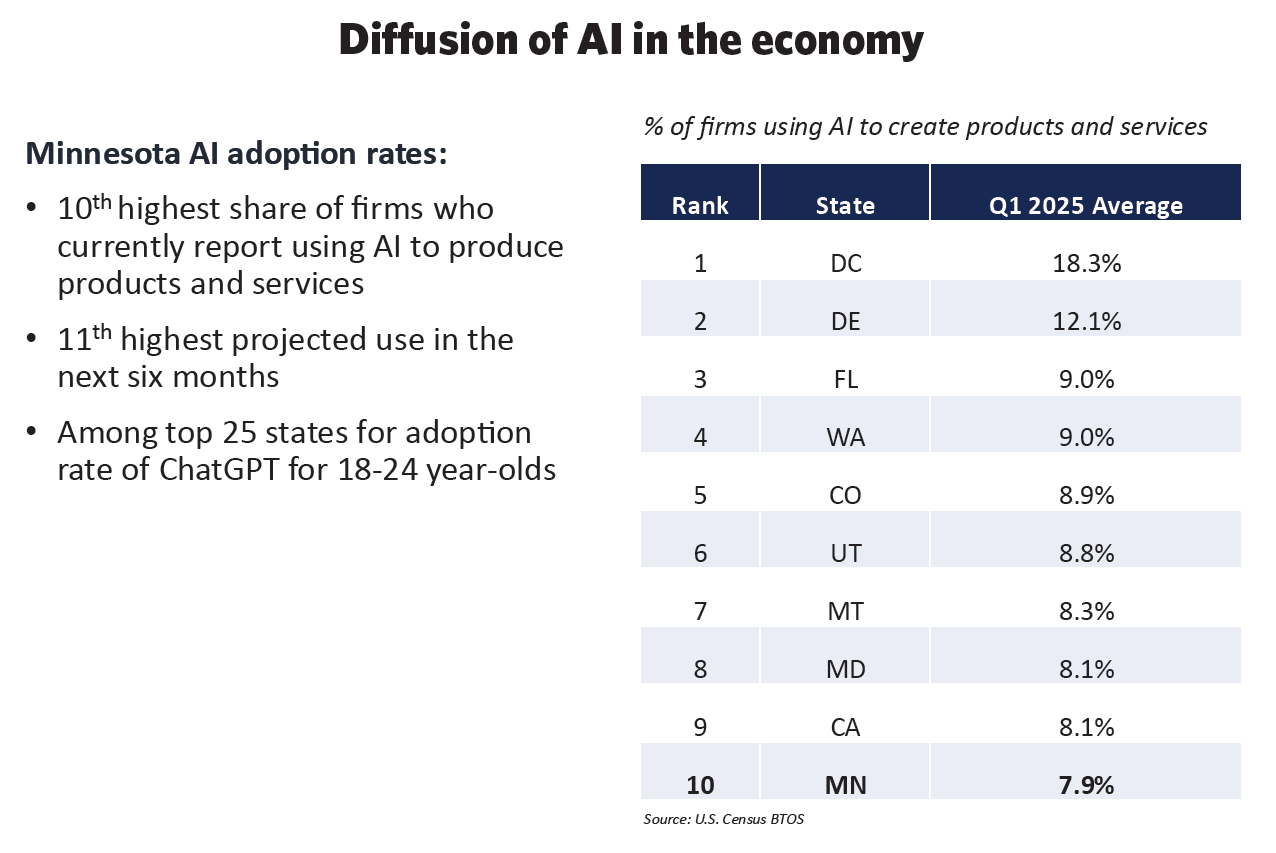

Reliable measurements of AI adoption remain limited. However, current evidence suggests that Minnesota may have above-average rates of adoption among firms and individuals. The U.S. Census Bureau’s Business Trends and Outlook Survey (BTOS), which offers one of the most consistent datasets on AI use, shows that Minnesota firms nearly doubled their reported use of AI tools between late 2023 and early 2025. As of early 2025, 8% of Minnesota businesses reported using AI in producing goods and services, placing the state 10th highest in the country. Minnesota also ranked 11th for the share of businesses expecting to adopt AI tools in the coming months. While these adoption rates remain relatively small, the survey sample and question phrasing may understate broader AI use by businesses. For example, research from the Federal Reserve shows that when weighted for employment size of the firms surveyed, AI adoption rates range closer to 20-30%, aligning more closely with other national surveys.

Individual-level surveys also point to increasing use. A 2024 report by OpenAI found that over one-third of U.S. adults aged 18 to 24 had used ChatGPT, with Minnesota ranking between 10th and 25th among states. While limited, these data points offer early clues that Minnesota’s businesses and workforce are actively engaging with emerging AI tools.

In addition to adoption rates, researchers have examined how AI may impact regions differently based on their occupational makeup. Generative AI is best suited to augment or automate cognitive, knowledge-based tasks, such as writing, coding and data analysis. As a result, local economies with a higher concentration of professional and technical occupations are more likely to be affected—whether positively and negatively.

A Minnesota Department of Employment and Economic Development (DEED) analysis shows that 56% of jobs in Minnesota have moderate

to high exposure to AI, with 37% falling into the highest quartile of exposure intensity. This aligns with the state’s employment profile, which features a strong presence in corporate headquarters, finance and insurance and professional services.

Exposure levels also vary widely across the state. According to a 2025 Brookings Institution analysis, 39% of jobs in Hennepin County are in high-exposure categories, compared to just 25% in Nobles County. Minnesota’s average AI exposure rate across counties was nearly 35% – the 10th highest among all states.

The same Brookings report indicates that the Twin Cities metro area compares closely with peer metros like Denver, Seattle, Boston and Austin, placing it among the most AI-exposed labor markets in the country. This presents both an opportunity for productivity gains and a challenge to ensure workforce readiness.

AI-related innovation and job creation remain geographically concentrated. However, Minnesota has carved out a mid-tier role in AI labor demand. According to the UMD-LinkUp AI Maps project, the state consistently ranked between 15th and 18th in total AI job postings through 2024 and early 2025. These postings are concentrated in Hennepin County and primarily found in finance, professional services, information and manufacturing.

Onshoring and industrial investment

A second major opportunity stems from the growing national push to strengthen domestic industrial capacity. Across the political spectrum, there is increasing consensus that the U.S. must produce more of its own critical goods—from semiconductors and medicines to energy and key minerals. Already this decade, the U.S. has experienced a surge in private-sector construction of new facilities, especially in manufacturing and data infrastructure.

Yet, these investments have not been spread evenly across geographies. Domestic investments have been flowing to states with a combination of streamlined permitting systems, pro-business policies and strong talent pipelines.

- Indiana, for example, has announced over $104 billion in commitments from companies over the past five years to invest in new facilities and expansions.

- Other states such as Utah, Nebraska, and Arizona have all seen real manufacturing GDP growth of 4% or higher this decade. By contrast, Minnesota has experienced a decline in manufacturing output over the past five years.

- Past research from the Minnesota Chamber Foundation has identified several barriers and opportunities: streamlining environmental permitting timelines, aligning job training programs with business needs, improving site readiness, and addressing structural cost drivers like taxes and energy costs. In addition, investments in infrastructure – especially in energy, logistics and broadband—will be essential for improving competitiveness.

Why does industrial growth matter for productivity? Because GDP output per worker varies significantly by sector.

- In Minnesota, industries such as mining, utilities and information have labor productivity nearly 10 times higher than sectors like hospitality. Growth in capital-intensive industries tends to generate larger productivity and income gains.

- Data centers illustrate this dynamic. These facilities are vital to supporting AI technologies and are also among the most capital-intensive investments in the economy. In Minnesota, data processing and hosting GDP (which includes data centers along with other digital services) has grown by 17.8% annually since 2019 – outpacing the national average. Wages in the sector have nearly doubled since 2014, even as employment has remained relatively flat. Data centers are just one example of emerging opportunities in capital-intensive sectors. However, this points to a broader opportunity to accelerate gains in productivity, income and overall economic growth through improving Minnesota’s industrial competitiveness.

Back to top

Strategic objectives to accelerate innovation and productivity

There are numerous individual actions and strategies that could potentially improve Minnesota’s productivity performance. However, three high-level objectives should guide these efforts.

Minnesota should increase efforts to prepare its workforce and businesses for a more AI-driven economy. Much remains uncertain about how and when advancements in AI will have a measurable impact on the economy. However, the evidence suggests that: a.) the use of AI is growing rapidly, b.) the potential economic impacts are significant, and c.) Minnesota’s high concentration of knowledge sector jobs makes it more exposed to the benefits and risks of AI. Uncertainty about the future should not prevent near-term actions to prepare Minnesota businesses and workers for a more AI-driven economy. Below are examples of a few areas that could determine how well Minnesota leverages this emerging opportunity:

- AI education and workforce training As research from the National Academies of Sciences, Engineering and Medicine emphasizes, future productivity gains will depend on how AI is used within firms and how workers adapt the skills needed to use AI effectively. They write: “Productivity gains will also require complementary investments both in worker training and skill development and in programs to support the worker transitions necessitated by shifts in activities, occupations, and sectors.” Minnesota can influence this by equipping students, workers and businesses with access to training in AI tools and concepts. Minnesota should seek to lead in innovative approaches to AI training across a broad range of disciplines and industry applications.

Due to the continued changes and improvements in AI tools, creating flexible approaches to AI training will be necessary – both for students and the adult workforce. Retooling existing programs offers one opportunity to do this. For example, DEED’s Minnesota Job Skills Partnership announced $1.5 million in funding set aside for med-tech businesses to provide specialized AI training for their employees. Such adaptations of existing programs could supplement any new AI training initiatives. To identify new opportunities, Minnesota should assess how other states are preparing their businesses and workforce and adapt successful strategies for the unique needs of the state’s economy.

- Data infrastructure (data centers and broadband) AI growth depends on high-performance computing infrastructure, particularly data centers. Minnesota’s relatively cool climate and energy grid reliability give it natural advantages for data center location. The state has seen some recent announcements in data infrastructure but lags states like Iowa, Virginia and Arizona in overall activity. Further, broadband access remains uneven across rural areas, which may hinder AI adoption for certain firms and communities. Investments in last-mile connectivity and cloud infrastructure will be necessary to ensure full access to these technologies.

- AI regulation As national regulatory frameworks are still evolving, states like Minnesota should take caution in advancing AI-specific regulations that may conflict with federal rules or create unintended consequences that are hard to predict for a rapidly changing general-purpose technology.

Minnesota should take a comprehensive approach to increase its capacity and competitiveness for large-scale investments in industrial and natural resource sectors. Minnesota has a diversified base of manufacturing, agriculture, mining, power generation and technology sectors. As federal industrial policies shift to incentivize greater domestic investments, Minnesota should examine the full range of factors that both favor and limit its ability to compete for large- scale projects. The state has numerous examples of successfully leveraging its strengths to attract investments – often involving coordinated efforts across local and state agencies, elected officials, economic development organizations and other entities to help get a project to the finish line. Recent expansions in semiconductors, sustainable aviation fuels, data centers and med-tech illustrate these successes. Yet, Minnesota has also lost investments due to self-imposed barriers that create an overly narrow range of projects where Minnesota can compete.

This is relevant for projects requiring large footprints, complex permitting, substantial power demands and specialized workforce training needs. It is also relevant for more routine investments in new equipment, facility changes and production lines – investments that may not make headlines or receive public incentivizes but contribute to the overall growth and performance in Minnesota’s goods sectors. Too often these investments are delayed, deferred or go elsewhere because of the added costs and challenges that businesses face in Minnesota. The state’s negative GDP growth in goods sectors this decade signals that interventions are needed to improve performance. Taking a wholistic assessment of how Minnesota’s policy environment and economic development tools interact could enable smart reforms to make Minnesota ready for an era of heightened investments.

Minnesota should advance a grassroots approach to productivity, enabling a broader base of businesses to innovate, invest and grow. While individual success stories are important, overall productivity grows when tens of thousands of businesses start new ventures, invent new products, automate processes, upskill talent, adopt new technologies, invest in equipment and scale their operations. Minnesota continues to have some of the most innovative businesses in the world. Yet, total patents are declining, R&D is lagging and small businesses are growing at a slower rate than most other states. Policymakers, economic developers, universities and business leaders should seek ways to reduce barriers for businesses of all kinds to innovate and grow.

Minnesota offers a mixed bag in this regard. On the positive side, Minnesota’s entrepreneurship programs and support systems have enabled growth in new business startups in recent years. At the same time, however, policymakers have imposed costly and complex regulations that make it harder for those small businesses to scale and grow in the state. Similarly, programs like Minnesota’s R&D tax credit encourage companies to develop new products in the state. But onerous program requirements make it harder for small and midsized companies to apply and access the resources meant to help them. This kind of lens should be applied broadly as policymakers and regulators consider how programs and policies impact over 150,000 employer businesses in the state (and many more non-employer businesses). Productivity is measured by how workers and firms create value within a scarcity of time. Yet, rarely do policymakers consider the time-costs of regulatory compliance, program applications and administration, waiting times for permits and approvals, etc.

Reducing time, cost and complexity across a vast range of public policies can create a more conducive environment for businesses to invest capital and take risks necessary to spur productivity growth in the state’s economy. Such reforms can create a win-win situation, spurring private sector activities that drive economic growth and revenue collections without requiring new taxes or direct appropriations.

Back to top

Conclusion

Accelerating productivity and economic growth is imperative for Minnesota to support future prosperity. Economic growth is not only a business issue. The incomes of Minnesotans, the health of our communities and the quality of life we so highly value rely on a healthy growing economy. Unlocking growth will require sustained efforts to advance innovation, provide Minnesotans with the skills they need to succeed and remove the barriers to business investment and expansion.