Grow Minnesota! quarterly economic snapshot fall 2022

The Quarterly Economic Snapshot is an overview of key indicators measuring Minnesota’s current economic performance. Analysis is provided in partnership with Grow Minnesota! and the Minnesota Chamber Foundation.

Overview and highlights:

Minnesota’s economy continued to show mixed signals through October of 2022.

Minnesota experienced two consecutive quarters of negative GDP growth, which is often used as a benchmark indicator of a recession. This has been coupled with low consumer sentiment and falling business investment in the U.S. economy, all of which would seem to point to weak economic conditions in normal times.

These are not normal times, however. In unusual fashion, these trends have occurred alongside continued strength in the labor market and stable overall demand in the economy. Unemployment remains at historic lows – despite a slow, steady uptick in recent months – and employers continued to add jobs this fall. Indeed, October was the strongest month of job growth for Minnesota in 2022, putting the state closer to recovering the 418,000 jobs that were lost in early 2020.

The near-term outlook is still clouded with uncertainty, as the U.S. economy braces for a potential recession in late 2022 or early 2023. Further, the decline of workforce availability has deepened the severity of hiring challenges in the short-term and created renewed concerns over the state’s capacity for future growth.

Key findings:

-

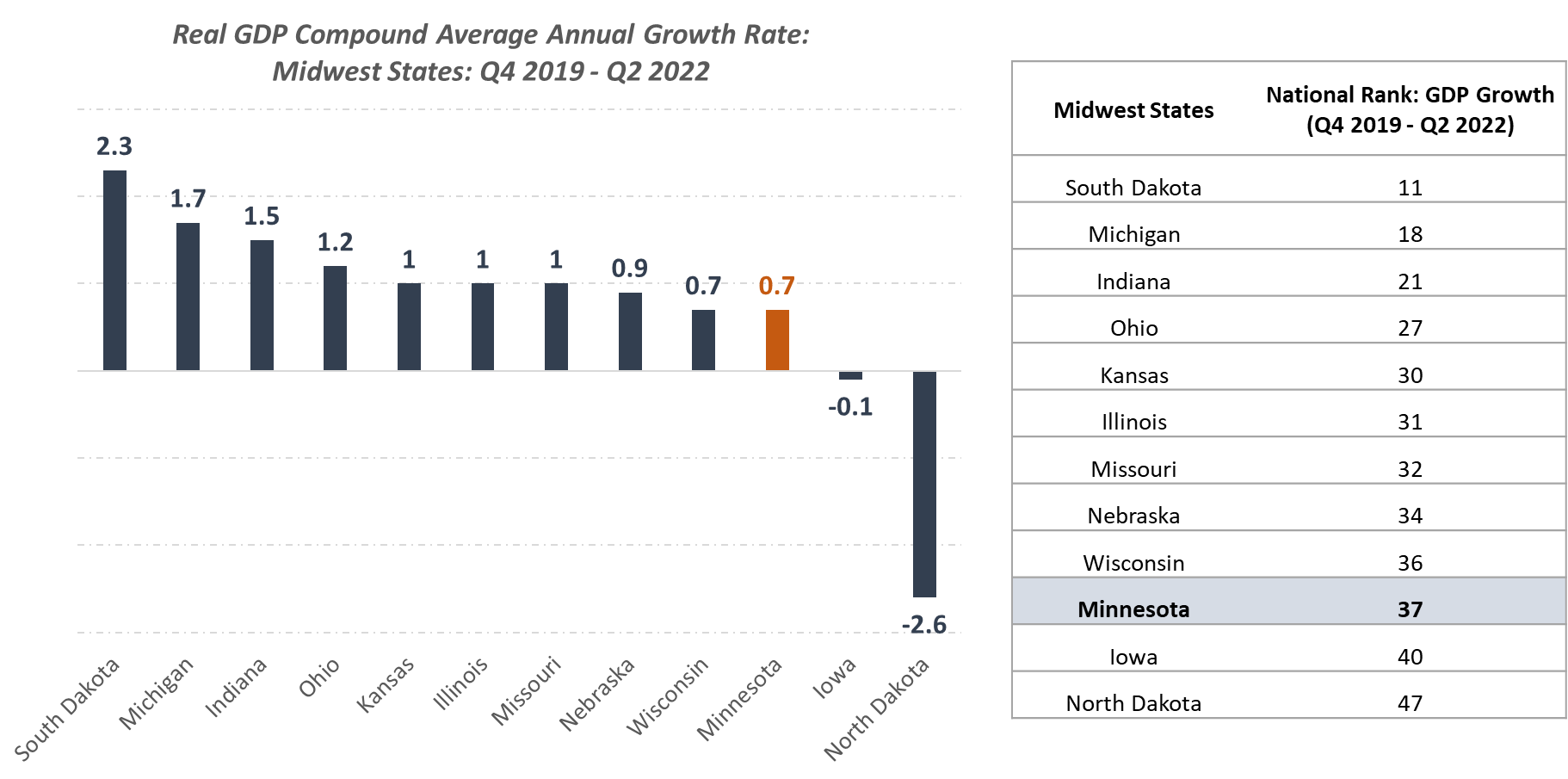

Minnesota’s real GDP fell by -1.3% in Q2 2022 (latest available data), declining for a second consecutive quarter. While Minnesota has largely followed U.S. trendlines, the state’s economy has grown more slowly than many states, ranking 37th overall in GDP growth since the pre-pandemic peak in Q4 2019.

-

Declining workforce participation and historically low unemployment rates continue to create severe hiring challenges for employers. Minnesota’s unemployment rate rose slightly to 2.1% in October, while the state’s labor force participation rate declined for the fourth consecutive month, falling to 68% in October.

-

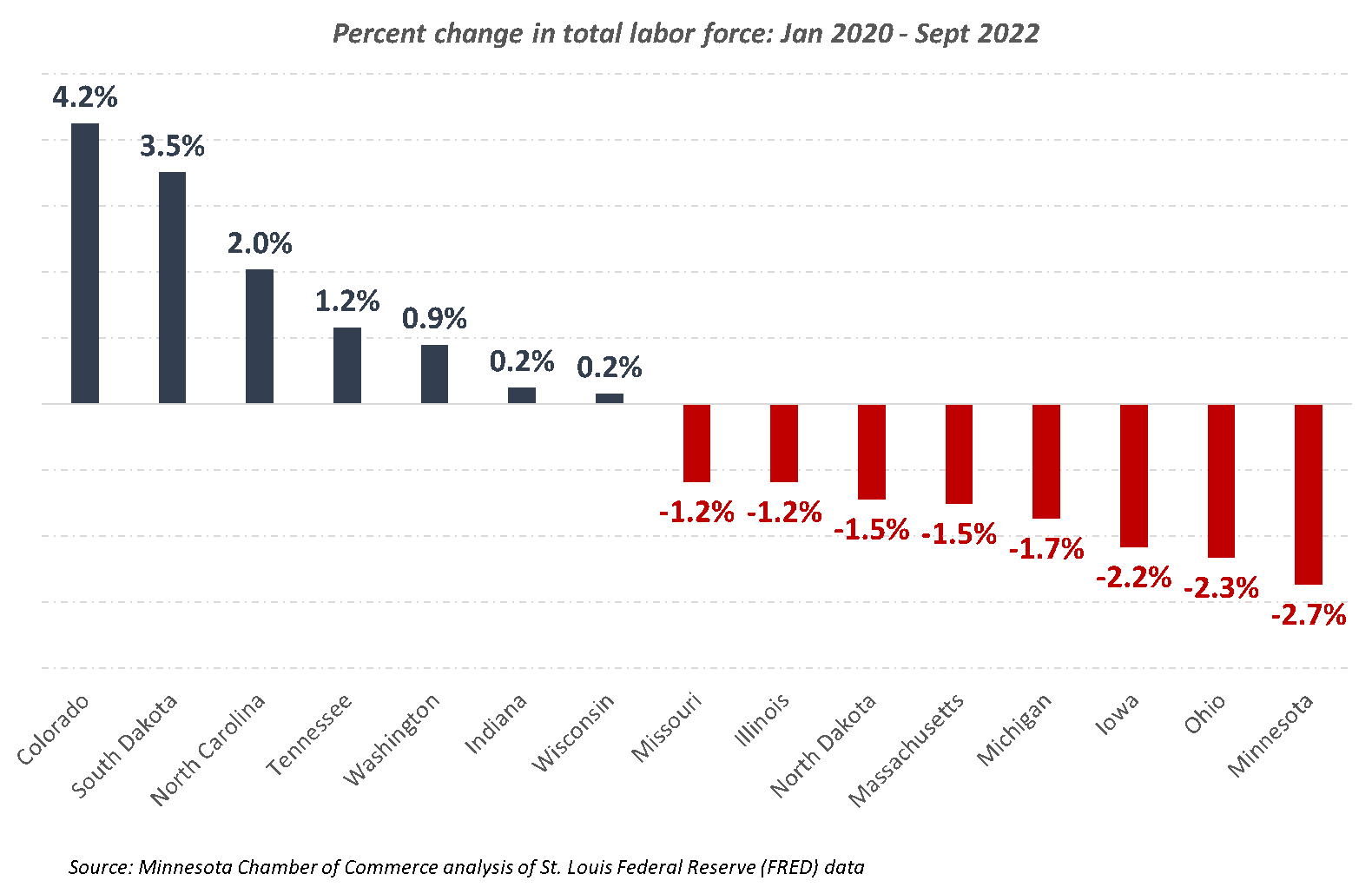

Minnesota’s below-average economic growth rankings may be explained in part by labor availability challenges. Though Minnesota is not alone in workforce declines, the state has suffered the largest setbacks in total labor force availability of any state in the Midwest since early 2020 and stands in stark contrast to other states like Colorado and North Carolina that have grown their total labor supply this decade.

-

Despite a cooling economy and hiring challenges, Minnesota employers continued to add jobs in recent months. Total payroll employment increased by 21,700 jobs in August through October, with October seeing the strongest month of job growth in 2022. This puts Minnesota within 41,200 jobs of its pre-pandemic peak.

-

U.S. inflation slowed slightly to 7.7% in October. The impact of inflation has produced mixed and unusual signals, with consumer and business sentiment plummeting while overall spending and demand has remained stable.

GDP

Minnesota’s GDP declined for second consecutive quarter in Q2 2022, as U.S. economy cools. Minnesota ranks 37th in GDP growth since the pre-pandemic peak in 2019.

- Minnesota’s real GDP fell by -1.3% in Q2 2022, declining for a second consecutive quarter. While this meets the traditional benchmark of a recession, the unusual combination of declining GDP with continued job gains and low unemployment has prevented many economists from declaring a recession as of yet.

- Minnesota ranks 37th among all states in real GDP growth from the pre-pandemic peak (Q4 2019) to Q2 2022. The state’s sluggish growth is explained in part by its regional location in the upper Midwest, which has seen the lowest growth of all economic regions in the U.S. However, Minnesota trails all but North Dakota and Iowa among Midwest states as well.

- Another likely factor of Minnesota’s slow economic growth is the state’s particularly steep drop in labor force availability, which ranks worst among all states in the Midwest (see Unemployment and Labor Force Participation section below).

- The state’s economic recovery continues to be uneven across sectors. As of Q2 2022, eleven of 20 major industry sectors had higher GDP values than prior to the pandemic, while 9 industries had yet to recover the losses endured in the spring of 2020. Agriculture, information, management of companies and enterprises (i.e. corporate headquarters), and professional, technical, and scientific services lead the way in GDP growth since late 2019.

EXPORTS

Minnesota exports continued to grow through mid-year of 2022.

-

Minnesota exports continued to rise this fall. State export values increased by 28% year-over-year in the third quarter, reaching a record $7.3 billion dollars.

-

Canada has driven much of Minnesota’s export growth in the past two years. In Q3 2022, export values to Canada surged to $2.5 billion and represented over a third of the state’s total exports.

-

While Minnesota exports outpaced U.S. growth in the third quarter, a recent Grow Minnesota! report showed that Minnesota’s exports have grown more slowly over time, increasing by 126% from 2002-2021 compared to 158% in the U.S. as-a-whole and ranking 28th among states from 2019-2021.

ENTREPRENEURSHIP AND STARTUP INVESTMENT

Startup activity remains elevated through October 2022 despite headwinds.

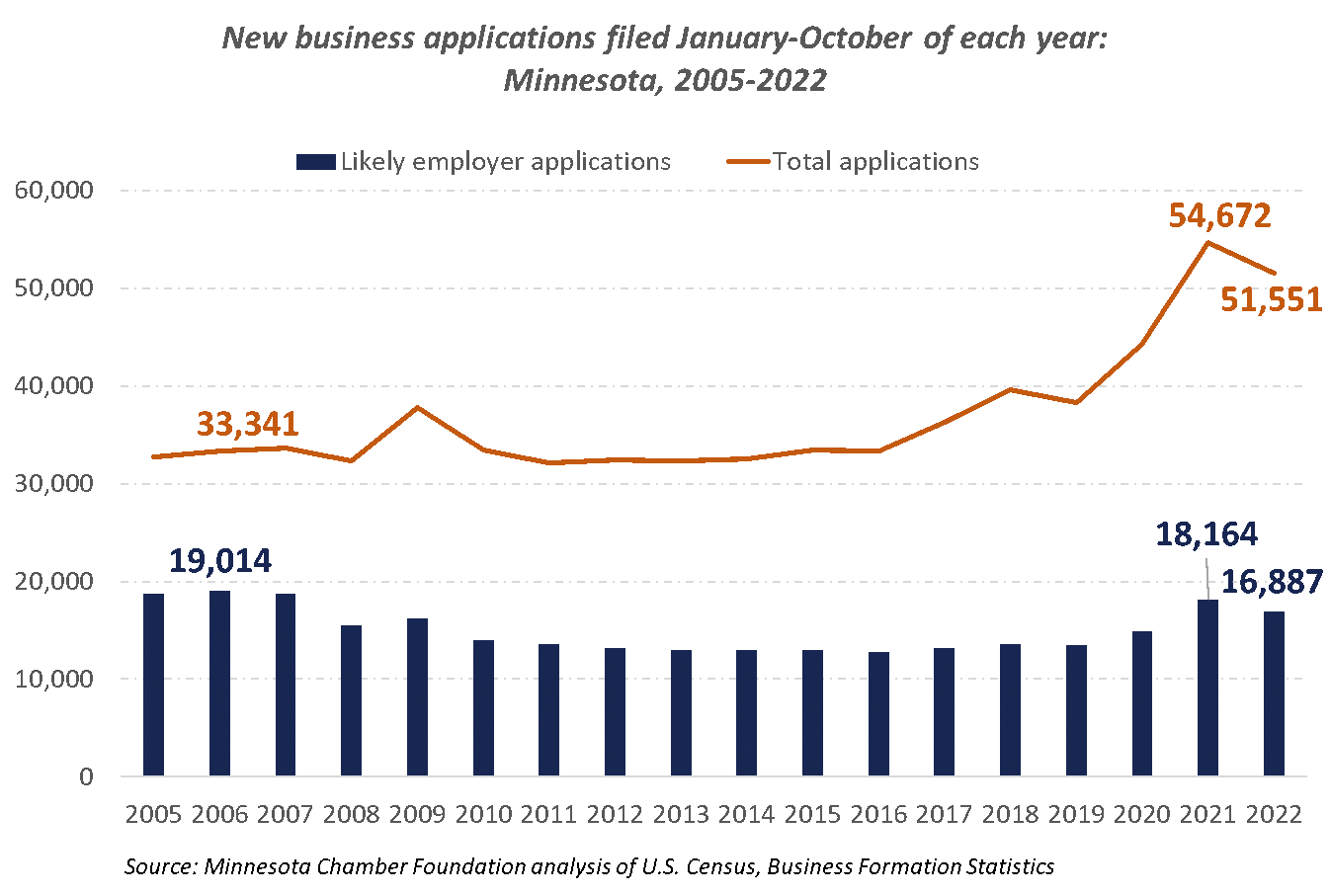

- Entrepreneurs filed a total of 51,551 new business applications from January to October 2022. This is 34% higher than the 15-year average from 2005-2019, though is down from 2021 levels.

- New business filings represent a wide range of business types, from sole proprietor micro-businesses to new startups that have the intention and capacity to add jobs, raise capital, and achieve significant growth. As the chart below shows, there was an increase for new businesses of all types since 2020. However, the increase was smaller for “likely employer” businesses, and both categories of business filings have slowed in 2022 compared to their 2021 peak.

- This means that while Minnesota is continuing to experience elevated levels of entrepreneurship, these new businesses are skewed toward firms without employees that (on average) contribute much less to overall economic growth than employer firms. See this recent Minneapolis Federal Reserve article and the in-depth 2022 Minnesota Chamber Foundation report on entrepreneurship trends to explore this topic further.

- Venture capital investment in Minnesota startups also remains elevated despite headwinds in U.S. capital markets. Pitchbook and NVCA’s Q3 2022 Venture Monitor report shows that 116 Minnesota startups raised $1.23 billion in venture capital through September 2022. This is off the pace of 2021, but still much higher than pre-2020 levels.

- These preliminary numbers would put Minnesota at 18th nationally for most VC raised so far this year, and second behind only Illinois among midwestern states.

- The PitchBook and NVCA Venture Monitor report also notes that the U.S. venture capital market is showing mixed signals, with deal activity still above historic averages but exits/public listings down and uncertainty on the horizon.

Job Growth

Minnesota recovered another 21,700 jobs from August to October, putting Minnesota within 41,200 jobs of full recovery from the 2020 downturn.

-

Despite two consecutive quarters of declines in real GDP, Minnesota businesses continued to add jobs throughout the first ten months of 2022.

-

Total payroll employment increased by 21,700 jobs in August through October, with October seeing the strongest month of job growth in 2022. This puts Minnesota within 41,200 jobs of its pre-pandemic peak.

-

Minnesota ranked 32nd among states in job growth from January 2020 – October 2022.

-

As of October 2022, twenty-seven states had fully recovered or exceeded employment levels compared to January 2020. Idaho, Utah, Florida, Texas, and North Carolina led all states in job growth, while Hawaii, Vermont, New York, Louisiana, and Maryland were the bottom five states. See the Minnesota Chamber Foundation’s Economic Recovery Dashboard to explore state-by-state comparisons.

UNEMPLOYMENT AND LABOR FORCE PARTICIPATION

Unemployment rate remains at historic lows, while labor force participation declined through the summer and fall.

-

The combination of historically low unemployment and a sharp drop in labor force participation has combined to create severe labor shortages throughout Minnesota over the past year.

-

There were some indications that labor force availability was improving earlier this year, as the state’s labor force participation rate increased each month from January to June 2022. However, this trend reversed by July, leaving Minnesota with declining labor force participation each month from July to October. The state’s labor force participation rate shrunk to 68% in October, sitting nearly three percentage points lower than pre-pandemic levels.

-

While Minnesota is not alone in workforce declines, the state has suffered the largest setbacks of any state in the Midwest since early 2020. Minnesota has roughly 87,000 fewer individuals working or looking for work than prior to the pandemic, despite high labor demand, rising wages, and greater availability of remote/hybrid work options.

-

Meanwhile, the state’s unemployment rate hit the lowest levels of any state since 1976 (when the dataset begins), reaching 1.8% in June and July 2022. Since July, Minnesota’s unemployment rate has crept up slowly, hitting 2.1% in October. Despite the small increase, unemployment remains well below historically low levels and has not substantially changed overall labor market tightness.

SUPPLY CHAIN AND INFLATION

High inflation continues to hurt consumer and business sentiment, though demand and spending remain stable.

-

U.S. inflation remained high this fall, though there were some signs that prices may be moderating with the year-over-year inflation rate ebbing slightly to 7.7% in October.

-

The impact of inflation on consumers and businesses has produced mixed and unusual signals. As the U.S. Chamber of Commerce describes, “both consumers and businesses feel bad about the economy, yet consumers keep spending and businesses keep hiring, raising wages, and investing.”

-

While conditions can change quickly, the economy has remained relatively stable in the face of low sentiment and high prices.

-