COVID-19 policy updates

The COVID-19 crisis brings many challenges for Minnesota businesses. One such challenge is keeping abreast of countless policy changes at the federal and state levels. Check back for this page as we recap the biggest policy changes and how they might impact your business during this difficult time.

Friday February 12

Starting February 13 at noon:

- The cap on bars and restaurants will move up to 250 people inside and 250 outside, with an occupancy limit of no more than 50% of established capacity.

- Onsite dining hours are extended to 11:00 p.m., for any establishment that serves food. Takeout may occur after 11:00 p.m.

- Indoor seated and non-seated entertainment occupancy limits expand to 250 people in each separate area, with a total max of 1,250 people, while maintaining social distancing. Food and beverage consumption is extended to 11:00 p.m.

- Outdoor entertainment food and beverage consumption is extended to 11:00 p.m.

- Private wedding, funeral, celebrations and parties will have an occupancy limit of 25%, up to a max. of 50 people with social distancing. These events may not occur between 11:00 p.m. and 4:00 a.m.

- Gyms, fitness centers and pools expand to 250 at 25% capacity. Social distancing at 6 feet.

Wednesday, January 6

Starting January 11:

- Indoor dining at bars and restaurants can open at 50 percent capacity, with a maximum of 150 people. Parties of no more than six people must remain six feet from other parties; bar seating is open to parties of two; reservations are required; and establishments must close dine-in service by 10 p.m.

- Gym capacity remains capped at 25 percent but maximum capacity increases to 150 and classes can increase to 25 people, assuming distancing can be observed. Machines and people must maintain 9 feet of distance. Face coverings are required.

- Outdoor events and entertainment continue at 25 percent capacity, but maximum capacity increases to 250 people. Social distancing is required.

- Indoor events and entertainment – like bowling alleys, movie theaters, and museums – may open at 25 percent, with no more than 150 people in each area of the venue. Face coverings are required, and they may not offer food service after 10 p.m.

- Youth and adult organized sports have resumed practice as of January 4 and games resume January 14 with spectators, following the appropriate capacity limits for indoor or outdoor venues. Inter-region tournaments and out of state play are discouraged.

- Pools opened on January 4 for some activity and may now open, like gyms, at 25 percent capacity.

- Wedding receptions and other private parties may resume with limits. If food and drink are served at the event, then they are limited to two households or 10 people indoors and 3 households or 15 people outdoors. If there is no food or drink, they are covered by event venue guidelines. Any related ceremony – like a wedding or funeral ceremony – is guided by rules for ceremonies and places of worship.

- Places of worship remain open at 50% capacity but without an overall maximum capacity.

Thursday, December 17

In-person dining closures continue through holidays

Governor Walz announced an extension of in-person dining closures while lifting some restrictions on outdoor dining and gyms and fitness centers. Details of the announcement – per Forum News – include:

- Restaurants, bars and breweries can remain open for takeout and delivery and will be able to offer outdoor service at 50% capacity with a maximum of 100 guests. The limit on people at each table is four, tables must be spaced at least six feet apart, and outdoor service space cannot be fully enclosed. A 10 p.m. closing time for onsite service will be imposed.

- Gyms and health clubs will be allowed to reopen for individual exercise at 25% capacity with a maximum of 100 people. Face masks and social distancing are required. Guidance for group classes is forthcoming and those will be allowed to restart Jan. 4.

- Outdoor entertainment venues can reopen at 25% capacity of up to 100 people. Indoor entertainment centers like theaters, museums and bowling alleys are to remain closed.

The original restrictions were set to expire tomorrow, and the Chamber urged the governor to end the "pause" and allow shuttered businesses to reopen while keeping employees and customers safe. It's important to understand what continued closures and restrictions mean for Main Street businesses: potential permanent closures, laying off employees and the loss of a livelihood for thousands of Minnesotans.

Needed relief on the way for businesses

This week, the Legislature passed bipartisan legislation providing $216 million in grants to businesses impacted by COVID-19. Governor Walz signed the bill into law Wednesday afternoon. The legislation includes:

- $88 million will be sent in direct payments to businesses.

- Grants will vary from $10,000 up to $45,000 based on employee count.

- $14 million for movie theaters and convention centers processed by DEED.

- $114.8 million in business grants sent to counties for grants to be provided to for-profit and non-profit businesses.

- An additional 13 weeks of unemployment benefits for individuals.

- Employers will not have an increase in experience rating for unemployment insurance.

- Waiver of license renewal penalties by commissioner of agriculture for food retailers, food manufacturers, wholesalers and brokers.

- Waiver of certain liquor permit fees.

This is welcome news for Minnesota businesses. The Chamber played a pivotal role in getting this aid passed and into the hands of employers and employees. The continued closures and restrictions have created hardships for thousands of employers and employees alike. The bipartisan agreement is meant as a temporary bridge to help keep the doors open for Minnesota small businesses. The Chamber will continue to advocate for additional business relief when the legislative session kicks off next month.

Head to the Chamber's COVID-19 Business Toolkit Funding - Loans and Grants section to find out more details from the Department of Revenue on eligibility and payments.

Wednesday, November 18

Governor Walz has officially ordered the closure of bars, restaurants, entertainment venues and fitness clubs beginning Friday.

Other details:

- Bars and restaurants may still offer delivery and takeout.

- Barbershops, salons, licensed child care providers and retail stores may remain open.

- FAQ about the new Executive Order

- Industry Guidance for Safely Reopening: Restaurants and Bars

- COVID-19 Non-Seated Recreational Entertainment and Meetings under Executive Order 20-99

- COVID-19 Seated Recreational Entertainment and Meetings under Executive Order 20-99

Friday, June 5

On Friday, June 5, Governor Walz announced guidance for expanded reopening of restaurants, bars, gyms, fitness centers and entertainment venues starting June 10.

Businesses throughout the state have eagerly awaited this type of announcement and welcome this progress. They have taken the necessary safety precautions and are ready to open their doors.

The Chamber asks that the state recognize the importance of advance notice on the next steps. THe Chamber urges the governor to accelerate this process and open all Minnesota businesses no later than June 19. Knowing that they could reopen or increase customer capacity on a certain date would help small businesses start to refuel our economy, and safely welcome back their employees and customers.

Reopening guidance from DEED includes:

Restaurants and bars can reopen for indoor service as long as they:

- Have adopted and implemented a COVID-19 Preparedness Plan

- Ensure a minimum of 6 feet of distance between tables

- Limit indoor occupant capacity to no more than 50% up to 250 persons

- Do not exceed 250 persons in outdoor spaces

- Limit table service to 4 persons, or 6 if part of one family unit

- Require reservations

- Require workers to wear masks at all times and strongly encourage customers to wear masks when not eating or drinking

Gyms, studios and fitness centers can reopen as long as they:

- Have adopted and implemented a COVID-19 Preparedness Plan

- Ensure social distancing (6 ft between persons) and limit occupant capacity to no more than 25%; not to exceed 250 persons for indoor and outdoor settings each

- Strongly encourage that masks be worn by workers and users

- Establish regular disinfection routine and train staff

- Ensure ≥6 ft of distancing between equipment; greater distancing should be implemented for treadmills and other aerobic activity that encourages high exertion

- Group exercise classes should only be offered if distancing requirements can be maintained and with no person-to-person physical contact

Seated and recreational entertainment and meeting venues can reopen as long as they:

- Have adopted and implemented a COVID-19 Preparedness Plan

- Limit occupant capacity to no more than 25% not to exceed 250 persons

- Ensure social distancing and a minimum of 6 feet between persons

- Strongly encourage masks for workers and customers

Personal care services (such as hair salons, barbershops and tattoo parlors) can reopen to provide services indoor as long as they:

- Have adopted and implemented a COVID-19 Preparedness Plan

- Limit number of clients inside the business at any time to ensure 6 feet of distance between persons except when providing services

- Limit occupant capacity to no more than 50% not to exceed 250 persons

- See clients by appointment only; do not allow walk-ins

- Require workers and clients to wear masks at all times. For services where the client cannot wear a mask, the worker should add a face shield in addition to their mask.

Click here to view additional guidance.

Wednesday, May 20

Today, Governor Walz announced outdoor restaurant patios, salons and campgrounds could open at limited capacity on June 1. However, indoor bars and restaurants, gyms, movie theaters and bowling alleys will remain closed until an unknown date in the future. While continued progress to reopen is important, we hoped the governor would take more meaningful steps today. We understand the focus on safety, and so do businesses that have protection plans in place and are ready to open. The approach announced today doesn’t sufficiently recognize the ability of businesses – many of them small businesses – to innovate and protect employees and customers.

This additional delay must have a timetable for the future. Without further action to promptly open, more of our small businesses will be unable to return, serve their customers and support their communities.

Reopening guidance from DEED includes:

Restaurants and bars can reopen for outdoor service only as long as they:

- Have adopted and implemented a COVID-19 Preparedness Plan

- Ensure a minimum of 6 feet of distance between tables

- Limit on-premises capacity to no more than 50 persons

- Limit table service to 4 persons, or 6 if part of one family unit

- Require reservations in advance

- Require workers to wear masks and strongly encourage masks be worn by customers

Personal care services (such as hair salons, barbershops and tattoo parlors) can reopen to provide services indoor as long as they:

- Have adopted and implemented a COVID-19 Preparedness Plan

- Limit number of clients inside the business at any time to ensure 6 feet of distance between persons except when providing services

- Reduce occupant capacity to no more than 25%

- See clients by appointment only; do not allow walk-ins

- Require workers and clients to wear masks at all times; do not provide services that cannot be performed without masks

Click here to view additional guidance.

Monday, May 18

The COVID-19 pandemic upended the 2020 legislative session, resulting in legislative breaks, remote hearings, limited public engagement and challenges to the governor’s peacetime emergency executive powers. The difficulties culminated to an inconclusive finish at midnight last night. Urgent priorities like delaying tax payments, providing small business relief through federal Section 179 conformity and covering the costs of a new unfunded worker’s compensation mandate were left incomplete. Governor Walz will likely call the Legislature back on June 12 in order to extend his current peacetime emergency authority.

The Minnesota Chamber will urge legislators to bring a laser focus to their work over the next several weeks: to help Minnesota find its footing in the economic devastation the pandemic has brought to so many employers in our state. To learn more about what transpired and what the future looks like at the Capitol, register for our session wrap-up webinar, Thursday, May 21 here or Minnesota Chamber members can check their inbox for the latest edition of At the Capitol.

Wednesday, May 13

Minnesota's stay-at-home order set to expire, more businesses to reopen

On Wednesday, May 13, Governor Walz issued a new executive order allowing “all retail stores, malls and other businesses that sell, rent, maintain and repair goods to open beginning on Monday, May 18 as long as they have adopted and implemented a COVID-19 preparedness plan including social distancing guidelines for workers and customers, and allow no more than 50% of the establishment’s occupant capacity at any time.” Click here to view reopening guidance from DEED.

The new executive order is welcome news for businesses throughout the state who are eager to get our economy moving again. Those who have not yet opened their physical doors have been taking responsible steps to design safe work environments and inspire consumer confidence. The Minnesota Chamber is thankful that they will now have that opportunity.

Have questions on the new order or need assistance creating a return to work plan?

- View the Minnesota Chamber’s return to work best practices

- Download the Chamber's return to work business checklist

- Contact the Chamber’s business assistance team, the Grow Minnesota! Partnership

- List of executive orders from Governor Tim Walz

Tuesday, May 12

This session, the Chamber advocated for a deferral of the May 15 business property tax payment to provide much-needed breathing room for businesses struggling to navigate COVID-19. This would help businesses until they can be back up and running, earning income and until loan assistance arrives. The Legislature did not pass a statewide delay, so it’s counties who have taken the lead in helping their area businesses with a deferral. Click here to view a list of counties that enacted some type of waiver or delay to help businesses during this time. A big thank you to the local chambers of commerce for their advocacy work.

The property tax extensions vary by county as some counties are providing a 60-day payment extension for all non-escrowed property taxpayers; others have reduced the tax penalties; and others are providing the extension for only certain taxpayers such as Hennepin passed a 60-day extension but with a cap for taxpayers with $50,000 or less in property taxes ($100,000 for the year) and other counties may have a waiver process. If you have questions, please contact your county directly to see if they have approved an extension.

Tuesday, May 5

The Minnesota Legislature is rapidly approaching the May 18 adjournment date. The House and Senate policy committees are wrapping up their committee work this week as the four legislative leaders sent a joint letter asking that all chairs and leads finalize outstanding issues by Saturday, May 9 at midnight. If no agreement by that time then considered an “...impasse and further action during 2020 regular session may not occur.” We expect final negotiations between the governor and legislative leaders will still occur on bonding, taxes, state employee contracts, COVID-19 funding issues and ongoing executive peacetime emergency powers prior to adjournment.

Today, Minnesota Management and Budget released a new forecast showing a deficit of $2.426 billion for the remaining 14 months of the state’s two-year budget cycle – a difference of almost $4 billion from the $1.5 billion surplus forecasted in February. Minnesota’s general fund does have other resources to help with the deficit that are not included in this forecast including the COVID-19 federal funds of $2.187 billion and the $2.359 billion in budget reserves. This forecast includes $550 million in new spending for COVID-19 that should be reimbursable from the $2.187 billion in federal funds. Tax revenues are expected to be $3.611 billion (7.4%) lower than the February forecast.

Some key assumptions in the forecast are:

- The spread of COVID-19 will peak and then dissipate in the second calendar quarter of 2020, allowing social distancing restrictions to be lifted during the third quarter.

- Economic recovery begins in the third quarter, and real GDP growth turns positive in the fourth.

- Forecasting a 5.4 percent decline in real GDP in 2020 and real GDP growth in 2021 of 6.3 percent.

- Estimated 5.9% decline in Minnesota wage and salary income decline of 5.9% in 2020 as employers reduce hours, cut pay, and lay off and furlough workers.

The forecast notes that the outlook for the U.S. economy is exceptionally uncertain and we should expect the economic outlook to remain volatile and unpredictable for some time.

Thursday, April 30

Today, Governor Walz announced an extension of the stay-at-home order until May 18, 2020 with an easing of some restrictions on customer-facing businesses. The new order allows any customer-facing retail business that sells goods to engage in curbside or outside pick-up and delivery, as long as customers do not enter the business premises. Click here for guidance on what the latest executive order means for your business.

Easing Minnesota’s stay-at-home order for retailers is a step in the right direction. Businesses throughout the state are preparing to fully return to work and taking steps to do so responsibly and expeditiously. The Chamber urges the governor to continue to recognize that businesses can and have designed plans for safe work environments and allow more businesses to return to work soon.

Minnesota Chamber members are eager to get back to work. The Chamber's working to help businesses safely return while keeping employees and customers safe. Learn more how your business can create a return-to-work plan by visiting the COVID-19 prevention best practices page.

Today, the Minnesota Senate passed tax relief legislation on a bipartisan vote to help mitigate some of the economic impacts of COVID-19 on employers and employees. Provisions of the bill that would help businesses during this time include:

- Full conformity of Section 179 business expensing provisions to help encourage investment in Minnesota operations by small businesses and farmers.

- Tax payment extensions for income taxes; property taxes and June accelerated sales tax.

- Provisions relating to angel tax credit and clarification on the taxation of PPP loans.

The tax bill passed by the Senate today would bring much-needed relief to small businesses who are trying to stay afloat amid this crisis. They are the economic fuel for our state’s future, and providing tax relief will help them until they are allowed to fully reopen. The Senate will wait for House action on their tax bill and then will likely have a conference committee.

Read the Chamber's statement on today's news here.

Wednesday, April 29

Today, the Chamber's Bentley Graves testified in the Senate Capital Investment Committee on the importance of investing in the state’s transportation infrastructure to ensure business’ ability to get their goods to market and their employees and customers to their door.

"Investment through state bonding allows the leveraging of state borrowing authority to make strategic investments in transportation infrastructure in all corners of the state – benefitting the economic competitiveness of the state as a whole," said Graves.

Watch the full testimony below:

Tuesday, April 28

Today, two more Minnesota counties enacted deferrals of the May property tax payments to help businesses during this time. The new counties include:

Dakota County: Approved 60-day deferral of property tax payments from May 15 to July 15 for first-half property tax payment for non-escrowed residential, agricultural, vacant rural, open space, apartment, commercial and industrial property. Taxes paid through an escrow service and properties classified as utility, railroad, machinery and transmission lines are excluded from the waiver. Read more here.

Washington County: Approved 60-day deferral of property of the May 15 first-half property tax payment for property taxpayers who own non-escrow properties for commercial/industrial properties with 2020 total tax due of $100,000 or less; residential properties; and agricultural/rural vacant land properties. Read more here.

Friday, April 24

Earlier today, President Trump signed legislation totaling $484 billion to small businesses, hospitals and increased COVID-19 testing. The big news for small businesses is a $310 billion increase for the SBA’s Paycheck Protection Program (PPP), as well as a $10 billion increase for EIDL grants and $50 billion to support EIDL loans. This is a needed investment as small businesses struggle to navigate COVID-19. To learn more about these assistance programs, visit the Funding – Loans and Grants section of the COVID-19 Business Toolkit.

The Chamber continues to advocate for a deferral of the May 15 business property tax payment. A deferral of business property taxes would help provide much-needed breathing room. This will help businesses until they can be back up and running, earning income and until loan assistance arrives. We're not advocating for payments not to be made. We’re asking for time for your businesses to be able to continue to have cash to pay employees, pay benefits, pay operating costs and access federal and state loans and grants.

The Legislature is considering the issue, but it’s counties who have taken the lead in helping their area businesses with a deferral. Below is a list of counties that enacted some type of waiver or delay to help businesses during this time. A big thank you to our local chambers of commerce for their advocacy work.

Crow Wing County: Provides for a hardship waiver process for residents and businesses to allow for waiver of late payments penalties. View more here.

Hennepin County: Waives the penalties for late payment of the May 15 first-half property tax payment until July 15 for property taxpayers who owe less than $50,000 ($100,000 annually). Property tax payments in escrow are not included in this resolution. Taxpayers that owe more than $100,000 annually are able apply for deferred payment if they can show a factual basis for waiving the penalty. Read the resolution here.

Houston County: Approved 60-day deferral of property tax payments from May 15 to July 15 without penalties or interest except for individuals and businesses with escrowed property or payments through automatic ACH payments. Click here to view the resolution.

Kandiyohi County: Approved a 60 day-deferral of property tax payments from May 15 to July 15 without penalties or interest. Property tax payments in escrow are not included as part of this resolution.

Mower County: Approved 60-day deferral of property tax payments from May 15 to July 15 without penalties.

Olmsted County: Approved 60 day-deferral of property tax payments from May 15 to July 15 without penalties or interest. Property tax payments in escrow are not included as part of this resolution.

Ramsey County: Approved 60-day deferral of property tax payments of the May 15 first-half property tax payment until July 15 for property taxpayers for non-escrowed homesteads, small businesses with taxes less than or equal to $50,000 and residential non homesteads (1 to 3 units) with taxes less than or equal to $20,000. Click here to view the resolution.

Sherburne County: Reduces penalties for late payment reduce penalties for late payment on all but utility and railroad real and personal property, as follows: reduced to 1% the penalty for unpaid taxes between May 16, 2020 and June 30, 2020; reduced to 2% the penalty for unpaid taxes between July 1, 2020 and July 31, 2020. See press release, here.

Steele County: Approved 60-day deferral of property tax payments of May 15 first-half property tax payments.

Winona County: Approved 60-day deferral of property tax payments from May 15 to July 15 without penalties or interest. Property tax payments in escrow are not included as part of this resolution. Resolution on page 236 here.

Thursday, April 23

On Thursday, April 23, Governor Walz issued a new executive order to start returning some Minnesota employees to work. This order impacts workers in non-customer facing industrial and office-based businesses who cannot work from home. According to DEED, the order "will allow around 20,000 businesses and roughly 80,000 – 100,000 workers to go back to work beginning on Monday, April 27."

Minnesota’s business community welcomes today’s news about easing the stay-at-home order to allow workers in industrial and office settings to return to work. We appreciate the Governor’s recognition of returning more businesses to protect our state’s economy. Employers are taking meaningful steps to protect the health and safety of their employees. Others are poised to reopen responsibly and get our economy moving.

Click here to learn more.

Wednesday, April 22

Today, Governor Walz announced a partnership between the University of Minnesota, Mayo Clinic, and other Minnesota health systems to quickly expand the state’s COVID-19 testing capabilities to test up to 20,000 residents per day.

Today’s announcement to leverage the unique capabilities of the Mayo Clinic, University of Minnesota and our incredible health systems statewide will ensure Minnesota has the testing and related public health infrastructure necessary to support businesses and their employees as they work to re-engage the economic engine of the state. We urge the Governor to move expeditiously on testing as we work to bring more businesses and employees safely back to work.

Just yesterday, the Chamber testified in the Senate Health and Human Services Committee in support of increased testing as one way to help businesses safely to return to walk. Watch the testimony below.

For more information, click here.

Monday, April 20

Today, The Chamber's Lauryn Schothorst testified in the Senate Jobs and Economic Growth Committee on a plan to reopen businesses in the state. "Minnesota businesses are ready to open. Employers want to provide safe and healthy workplaces for their employees and customers," said Schothorst.

Watch the full testimony below.

Friday, April 17

Governor Walz announced the reopening of some outdoor recreational activities. Under the new executive order, facilities that may reopen or remain open include:

- Bait shops for live bait

- Outdoor shooting ranges and game farms

- Public and private parks and trails

- Golf courses and driving ranges

- Boating and off-highway vehicle services, including:

- Marina services

- Dock installation and other lake services

- Boat and off-highway vehicle sales and repair, by appointment only

As these and other industries return to work, we’ll continue to identify best practices for safe workplaces, and help decision-makers apply those standards to help more Minnesotans safely return to work. Business operations can and should return to a sustainable level without jeopardizing worker or customer safety. Many Minnesota businesses have developed detailed strategies to protect their workforce from the Coronavirus while ensuring continuity of operations. By learning from these strategies, designing plans for their unique business, and implementing business-wide procedures, more businesses should open for business.

The Legislature passed a bill temporarily allowing bars and restaurants to sell beer, wine, hard seltzer, and cider with food orders. The legislation allows for the sale of one bottle of wine or 72 ounces – the equivalent of a six-pack – of beer, hard seltzer and hard cider. Governor Walz quickly signed the bill into law and will take effect Saturday. This is positive news for the restaurant industry that’s been hit hard by the current “stay-at-home” order.

Thursday, April 16

Today, on behalf of the United for Jobs Coalition, Chamber President Doug Loon sent a letter to legislative leaders urging a 60-day extension of the May 15 property tax payment for business property taxpayers without incurring penalty and interest.

This morning, the Chamber's Beth Kadoun testified in the Senate Taxes Committee to advocate for businesses during this time. Specifically, the Chamber is pushing for a deferral of May 15 business property tax payment: “[A deferral of business property taxes] will help provide much-needed breathing room…This will help businesses until they can be back up and running, earning income and until loan assistance arrives," said Kadoun.

Watch the testimony below.

Tuesday, April 14

Today, Chamber President Doug Loon sent a message to Chamber members regarding our push to safely reopen parts of the state's economy. You can read an excerpt below and find the entire message here.

"Just over a month ago, the Chamber sent its first email to members, inviting them to a webinar called, “Is your business COVID-19 ready?” What a month it’s been, especially for many companies seeking to understand Governor Walz’s “stay at home” order and its implications on operations and supply chains.

Throughout this process, we’ve advocated on behalf of our members and kept them informed. Our goal has been to strike a balance between safeguarding health and protecting Minnesota’s economy.

To further that goal for balance, we should immediately move toward the opportunity for more Minnesotans to return to work, protect workers and continue to fight against the spread of COVID-19.

Business operations can and should return to a sustainable level without jeopardizing work or customer safety. Many Minnesota businesses have developed detailed strategies to protect their workforce from the Coronavirus while ensuring continuity of operations. By learning from these strategies, designing plans for their unique business, and implementing business-wide procedures, more businesses should open for business."

Thursday, April 9

Yesterday, Governor Walz extended the current “stay at home” order until May 4. This morning, new guidance was issued on new exemptions for industries and businesses. Click here to view the additional exemptions to the executive order.

Today, the Minnesota Department of Revenue announced a further extension of sales and use taxes due on March 20 or April until May 20.

The Department of Revenue will not assess penalties or interest on affected businesses that:

• Have monthly payments due March 20, and pay by May 20

• Have monthly or quarterly payments due April 20, and pay by May 20

It’s important to note that there is no grace period for monthly payments due on May 20, 2020.

While a further extension of sales and use taxes is good news for Minnesota businesses, we’d like to see further extensions of income and property taxes due in the next 40 days to give businesses more available cash to handle immediate expenses and retain employees.

We're not advocating for payments not to be made. We’re asking for time for your businesses to be able to continue to have cash to pay employees, pay benefits, pay operating costs and access federal and state loans and grants. Tell state legislators and Governor Walz how delaying tax due dates would help your business. Your story will help lawmakers understand the importance of this tax relief during a critical time.

Wednesday, April 8

Today, Governor Walz extended the "stay at home" executive order until May 4. Although it did not include major modifications to the current order, it may expand exemptions going forward.

At the Minnesota Chamber, we understand that this news will be met with questions and concerns from the business community. We will share information and resources as they become available to us. Please refer to our COVID-19 Business Toolkit or reach out to staff directly with any questions.

Our message to Governor Walz is simple: the business community is doing its part to mitigate the health risk of this crisis and protect our economy for the short and long term. Balancing the health impact with the economic impact must be part of the equation.

Chamber members have detailed their experiences for us every day since COVID-19 arrived in Minnesota. Trying to adjust their operations, make payroll and ensure that their business can withstand these challenges. If you'd like to add your story, please fill out our short survey and tell us how COVID-19 is impacting your business and ways we can help. With that data, we will continue to work with the governor and legislators to make sure that businesses are well-represented and can obtain meaningful relief.

One critical step that lawmakers can take is to push back the income and property tax deadlines for businesses. According to a survey of business of many of our members, a majority would benefit from delaying these payments (66% from income and 74% from property taxes).

We're not advocating for payments not to be made. We’re asking for time for your businesses to continue to have cash to pay employees, pay benefits, pay operating costs and access federal and state loans and grants.

Please add your voice to this effort, if you can.

Thank you for your contributions to our economy and the quality of life in Minnesota. COVID-19 has presented challenges unlike many businesses have experienced before. But the extraordinary innovation, determination and perseverance that we’ve seen from employers and employees in recent weeks gives me hope for the future of our economy.

Tuesday, April 7

The Minnesota Chamber maintains a statutory seat on the Workers’ Compensation Advisory Council (WCAC). Today, the WCAC approved legislation that provides a “presumption” for first responders as well as certain health care and child care workers responding to the COVID crisis.

For most Minnesota employers, this policy change will not have a direct impact. However, this change will impose new costs on the workers compensation system as a whole and that cost is not fully understood nor was it subsidized in the legislation. Informal estimates from the Minnesota Departments of Commerce and Labor and Industry predict that claims could total hundreds of millions of dollars – from $320 million to $580 million, or greater.

Minnesota policymakers plan to continue work on a funding mechanism. The Chamber suggested some of the $2.1 billion that Minnesota is getting in federal COVID-19 response funding should be used to cover part of the new costs – and have flagged for legislators that attempts to simply socialize the costs across all of the business community or raid work comp reinsurance funds would be met with opposition. It is expected that a funding plan could be developed by the end of April.

Since all businesses in Minnesota are required to carry – and pay for – workers’ compensation insurance, the Chamber has a fundamental role in ensuring that the system remains solvent and that all businesses are protected from proposals that will increase costs within the system. The agreement guarantees a process for first responders and health care workers to receive needed care should they contract COVID-19 while providing necessary safeguards for employers who remain focused on supporting essential workers and the patients they care for.

If you have questions, click here to view an FAQ from the Minnesota Department of Larbor and Industry.

Friday, April 3

Earlier today, the Chamber’s Laura Bordelon testified in a teleconference of the Senate COVID-19 Response Working Group to advocate for ways the state can help Minnesota businesses navigate the COVID-19 crisis.

A main suggestion from the Chamber is to delay certain tax payments on all businesses in order to free up cash now until federal or state dollars become available.

“I just want to be clear, we’re not asking for payments not to be made,” said Bordelon. “We’re asking for time for business to be able to continue to have cash to pay employees, to pay benefits, to pay operating costs and then access federal dollars.”

Bordelon also relayed stories from real Minnesota business owners on how a tax extension could be a major help for businesses.

“We need time to figure out longer term impacts of COVID-19. Delaying tax payments gives us some more time to figure this out. Not delaying tax payments would require us to make worst case assumptions now,” said one business owner.

Would a delay in business tax payments help your business during the COVID-19 crisis? Tell your story to your legislators by click here. Your voice can make a difference.

Tuesday, March 31

Federal and state lawmakers have passed legislation to speed critical resources to businesses throughout Minnesota. While much of this assistance is helpful, more can be done to ease the tax burden and keep cash in businesses to continue payroll and other financial obligations.

Today, we sent a survey to businesses around the state to ask how tax extensions might help their business during the COVID-19 crisis. Would it help your business if policymakers delayed the April 15 tax payments on income for businesses and the first half of the May 15 property tax payment? What would your business be able to do if these payments were delayed or what would happen in your business if they continued on their current timeline? You can take the survey here.

Currently:

- The federal government has allowed for a 90-day extension of the April 15 tax payments for all taxpayers and for delay in first quarter estimated tax payment. Minnesota’s 90-day extension of the income tax payment applies to individual taxpayers including those paying business income taxes through Minnesota individual income tax. Businesses that pay taxes at the entity level do NOT have a payment delay but should have a filing delay. Minnesota did NOT delay the first quarter estimated tax.

- The first half payment for property taxes is due on May 15. The Chamber recommends this payment be delayed for 60 days without incurring penalties and interest for business property taxpayers.

Monday, March 30

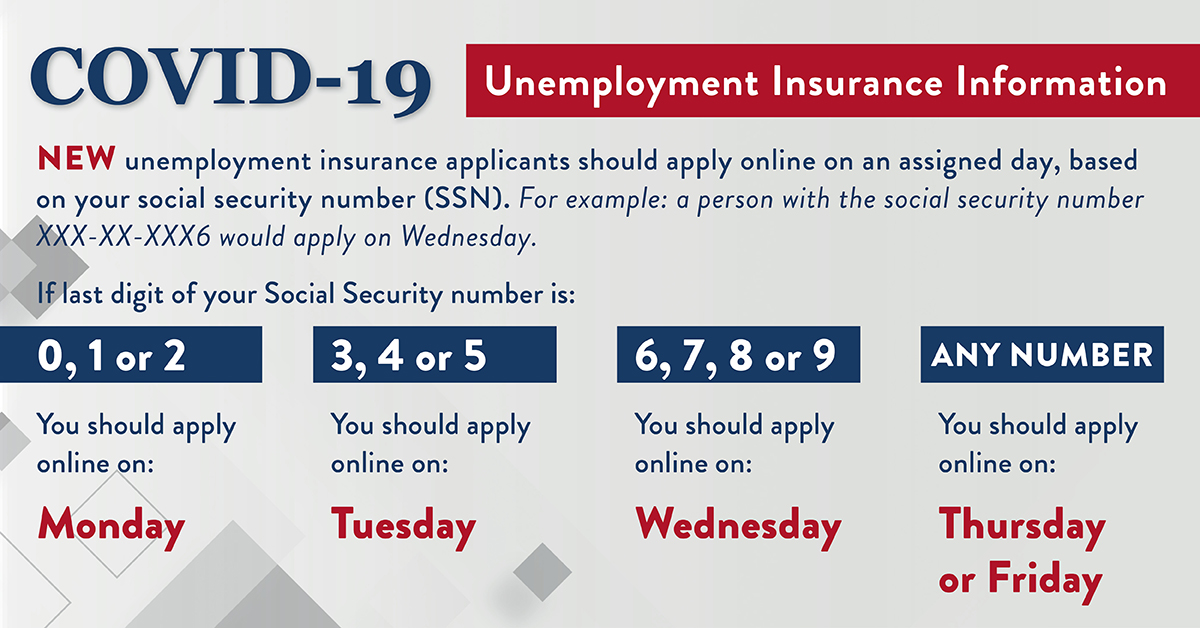

With record unemployment insurance applications, DEED is asking Minnesotans to only apply online on certain days. See the chart below and use the final digit of your Social Security number to see when to apply. Click here for more information on unemployment insurance.

Friday, March 27

The federal Coronavirus Aid, Relief and Economic Security, or “CARES” Act was signed today and includes:

- Emergency grants for small businesses to cover immediate operating costs.

- Forgivable loans for small businesses, up to $10 million per business, administered through the Small Business Administration (SBA).

- Relief for small businesses on existing SBA loans.

- A refundable tax credit for businesses of any size that are impacted by COVID-19. The credit covers up to 50 percent of payroll on the first $10,000 of compensation, including health benefits, for each employee.

- An additional 13 weeks of unemployment insurance, as well as increased unemployment benefits, and broadened eligibility.

Thursday, March 26

On Thursday, the Minnesota House and Senate passed legislation to provide $332 million for COVID-19-related needs in the state. This assistance is in addition to the $251 million that was passed earlier in session for COVID-19 and natural disasters. The bill codifies some of the governor’s executive orders and supplemental budget requests to provide additional funding for small business loans, childcare grants, homeless, food shelves and other COVID-19 resources. The only tax change is an extension of the timeline for property tax valuation appeals so taxpayers will not miss the ability to dispute/appeal their market valuation assessment.

Two small business assistance programs were included in the bill. The small business loan guarantee program is a new resource of $10 million to provide an 80% loan guarantee for businesses that have been impacted by COVID-19 and are unable to access SBA disaster loan assistance. This would be another way to help businesses across the state secure private funding to provide state guarantees of loans to small businesses.

The other program was codifying the governor’s Executive Order 20-15 providing $30 million for the Small Business Emergency Loan program for emergency loans to small businesses during the COVID-19 peacetime emergency.

The bill also relaxes the identification requirements necessary to apply for a REAL ID and provides funding to increase staffing to shorten the timeframe for getting a REAL ID. This, along with the REAL ID extension from the federal government, will make it easier for businesses and individuals to become REAL ID-compliant before the October 2021 deadline.

It also extends the expiration date for driver’s licenses until two months after the emergency is over. Despite the “stay at home” order, many employers need their employees out on the road and this allows time to receive a new, valid driver’s license.

The bill allows for commissioner of commerce to delay or waive licensing, investigative, or other deadlines that will provide the needed flexibility during the COVID-19 crisis so that professional licenses do not lapse.

The legislation also contains language on emergency purchasing and workforce and equal pay certificates. Under normal circumstances, the state requires vendors to provide workforce affirmative action and equal pay certificates in order to contract with the state at certain financing levels. This might have prevented your organization from contracting with the state in the past. For the duration of the peacetime emergency, this new law temporarily exempts state contracts for certain emergency purchases from this existing requirement.

Wednesday, March 25

Governor Walz has issued Executive Order 20-20, directing Minnesotans to limit movements outside of their homes beyond essential needs from March 27 at 11:59 p.m. to April 10 at 5:00 p.m. See below for resources on what this means for Minnesota businesses.

- Is your business or industry considered critical under the new Executive Order?

- There are three possible steps to determine if a business falls under a provided exemption from the Executive Order 20-20. The DEED website clarifies that a business does not need to qualify in all three. Rather, they may qualify under one or two, but not necessarily under NAICS.

- Step 1: Businesses can look at federal guidance from the Cybersecurity and Infrastructure Security Agency (CISA) list to see if included in essential. If included as essential – STOP, no need to look further.

- If not included, Step 2: Look at the governor’s executive order. If included as essential – STOP, no need to look further.

- If you are still uncertain, then apply for clarification here. DEED is working toward a fast turn-around of business inquiries through this process.

- List of Executive Orders from Governor Tim Walz

- Stay at Home resource page

- Frequently asked questions on the Stay at Home order

The Minnesota Department of Revenue updated their website with additional guidance on what taxpayers will receive the 90-day payment delay for the filing and payment of the April 15, 2019 income tax. Minnesota does not fully conform to the federal extensions as Minnesota’s extension only applies to individual taxpayers for 2019 tax year and does not allow an extension of estimated 2020 taxes for any taxpayer. The Minnesota Department of Revenue clarified that pass-through entities paying their business income taxes through their Minnesota individual income tax will receive the 90-day payment and filing delay for the 2019 income taxes due on April 15, 2019. Businesses that pay taxes at the entity level do NOT have a payment delay but should have a filing delay.

Monday, March 23

Governor Walz issued four new Executive Orders on Monday. The most impactful for Minnesota businesses was the announcement of emergency loans for small businesses and independent contractors. These interest-free loans range from $2,500 to $35,000 based on the firm’s economic injury and the financial need. Click here to more details on terms, eligibility and an application.

Another Executive Order asks businesses, nonprofits or non-hospital health care facilities with inventory of personal protective equipment (PPE) to take inventory of these products in case hospitals face a shortage during the crisis. Click here to learn more or donate needed PPE.

More guidance was issued by the Minnesota Department of Revenue on the April 15 tax payment extension. We were disappointed the Minnesota Department of Revenue did not fully conform to the IRS extension of the April 15 payment and filing deadlines for all taxpayers. It is positive news that Minnesota did partial conformity by providing a payment and filing extension to July 15 for individual taxpayers for the 2019 tax year. However, it is unfortunate that Minnesota did not provide the same payment deferral for businesses that are struggling with cash flow issues and lost business from COVID 19 impacts.

Two more extensions were also announced. The Minnesota Department of Revenue is granting a 60-day extension for MinnesotaCare tax returns for organizations that request an extension for their March 16 return. And the Minnesota Department of Revenue is granting a 30-day grace period for Lawful Gambling Tax payments for organizations that request an extension for their March 20 payment. These extensions help businesses and nonprofits that may be experiencing cash-flow issues and issues with processing and remitting sales tax while employees are not able to be at their workplace. Find more information on business and individual tax filing updates by clicking here.

President Trump announced a suspension of the October 1, 2020 REAL ID compliance deadline. This is especially important for Minnesotans and Minnesota businesses as there is a current backlog and lengthy waiting period to receive a REAL ID. No specifics were provided but we’ll continue to track this development.

Friday, March 20

The federal government announced that Tax Day will move from April 15 to July 15. Governor Walz announced the state will work to follow suit for state taxes, including no interest or penalties.This has yet to be finalized and still needs to be coordinated with the Minnesota Department of Revenue. Moving Tax Day is critical to help provide cash flow and liquidity for business taxpayers including over 90% of businesses file their business taxes as pass-through entities through their individual income tax returns.

The governor also announced a MNsure special enrollment period from March 23 until April 21. We encourage employers to bring this to the attention of employees who may need to purchase for themselves in the individual market.

Governor Walz announced three new Executive Orders today. The most impactful for Minnesota businesses is Executive Order 20-10 which prohibits price gouging during the peacetime emergency on essential goods for public health and safety.

The Minnesota Chamber, along with dozens of local chambers and other business trade associations, sent a letter to Governor Walz and legislative leaders urging timely action on a number of policy and regulatory changes to support businesses struggling to maintain their operations in these difficult times.

Wednesday, March 18

The Minnesota sales tax remittance due on March 20 has been delayed for 30 days for businesses that are required to close like restaurants, bars, theaters and other entertainment venues. This is a big help for businesses impacted by the temporary closures in Executive Order 20-04.

A new Executive Order added hair and nail salons to the list of temporary business closures throughout the state.

Tuesday, March 17

Governor Walz issued two Executive Orders today. The first, Executive Order 20-06, provides for emergency relief from various trucking regulations in Minnesota. This means trucks carrying supplies and materials to respond to COVID-19 won’t be subject to certain hours of service and weight restriction regulations, ensuring the businesses who are moving and receiving critical supplies can do so more quickly and efficiently.

The Senate passed a bill to provide a total of $200 million in additional emergency funding to respond to COVID-19. Much of the funding is in the form of grants to hospitals, nursing homes, etc. for response needs.

Monday, March 16

Governor Walz issued an executive order today temporarily closing all Minnesota restaurants, bars, food courts, coffeehouses, theaters, fitness centers, golf clubs, bowling alleys and other entertainment venues. Businesses who provide food are encouraged to offer food and beverage using delivery service, window service, walk-up service, or drive-up service, and to use precautions in doing so to mitigate the potential transmission of COVID-19.

In response to the previous Executive Order, Governor Walz issued another extending Minnesota unemployment benefits to applicants if:

- A health care professional or health authority recommended or ordered them to avoid contact with others.

- They have been ordered not to come to their workplace due to an outbreak of a communicable disease.

- They have received notification from a school district, daycare, or other childcare provider that either classes are canceled or the applicant’s ordinary childcare is unavailable, provided that the applicant made reasonable effort to obtain other childcare and requested time off or other accommodation from the employer and no reasonable accommodation was available.

- The one-week waiting period to receive benefits was also waived.

If you or your employees are eligible and would like to apply, visit https://www.uimn.org/.

Tuesday, March 10

Governor Walz signed legislation to add $21 million in funding to the Public Health Response Contingency Account to help fund the state’s response to the outbreak of COVID-19. These funds will be used help fund statewide monitoring and response to the crisis, staffing at the Minnesota Department of Health and local public health agencies to respond to the growing outbreak, more COVID-19 testing, and the acquisition of more personal protective equipment for health care workers and first responders who are on the front lines of working to contain the virus.