Industry report: Medical devices are saving lives and Minnesota’s economy

Overview:

Minnesota’s economy is made up of a diverse set of industries. Understanding trends across industry sectors can better illuminate underlying strengths and challenges in the economy.

This report looks beneath the aggregate data to see how Minnesota’s various industry sectors are performing and tracks progress in the development of key sectors of its economy.

Findings:

-

Locally oriented industries like construction, health care, and arts/entertainment/recreation led job growth in Minnesota’s economy in 2023, while tradable industries like manufacturing and business services lost employment this year.

-

Minnesota built on its competitive advantages in health care and medical technology so far this decade, demonstrated by growth in employment, strong investments in startups and facility expansions, and increasing market share in sector employment nationally.

-

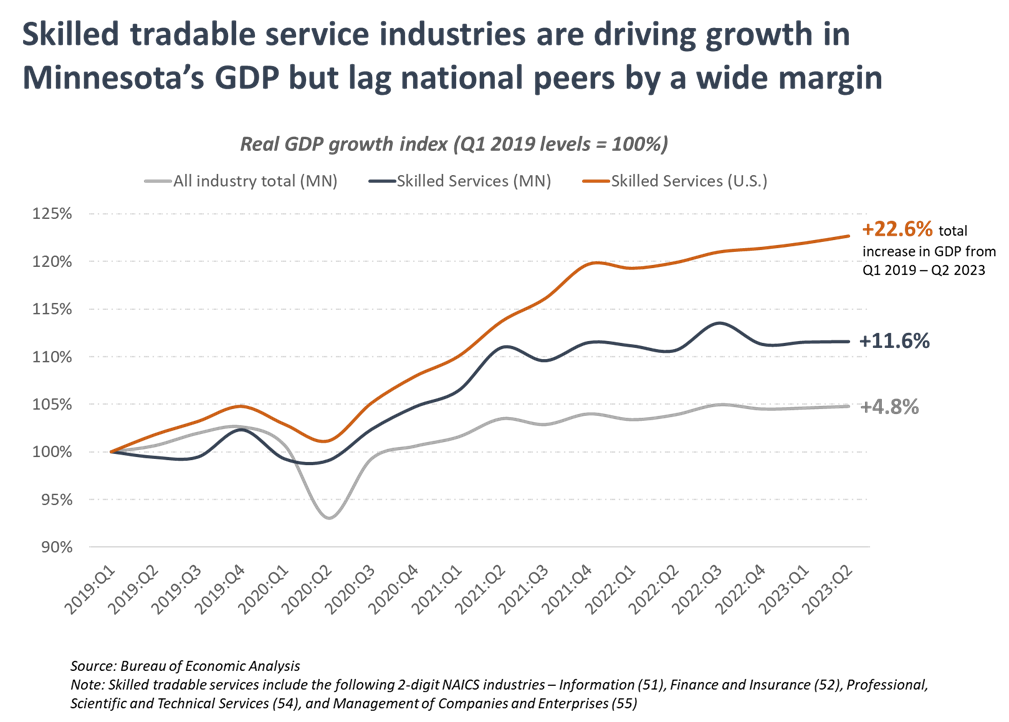

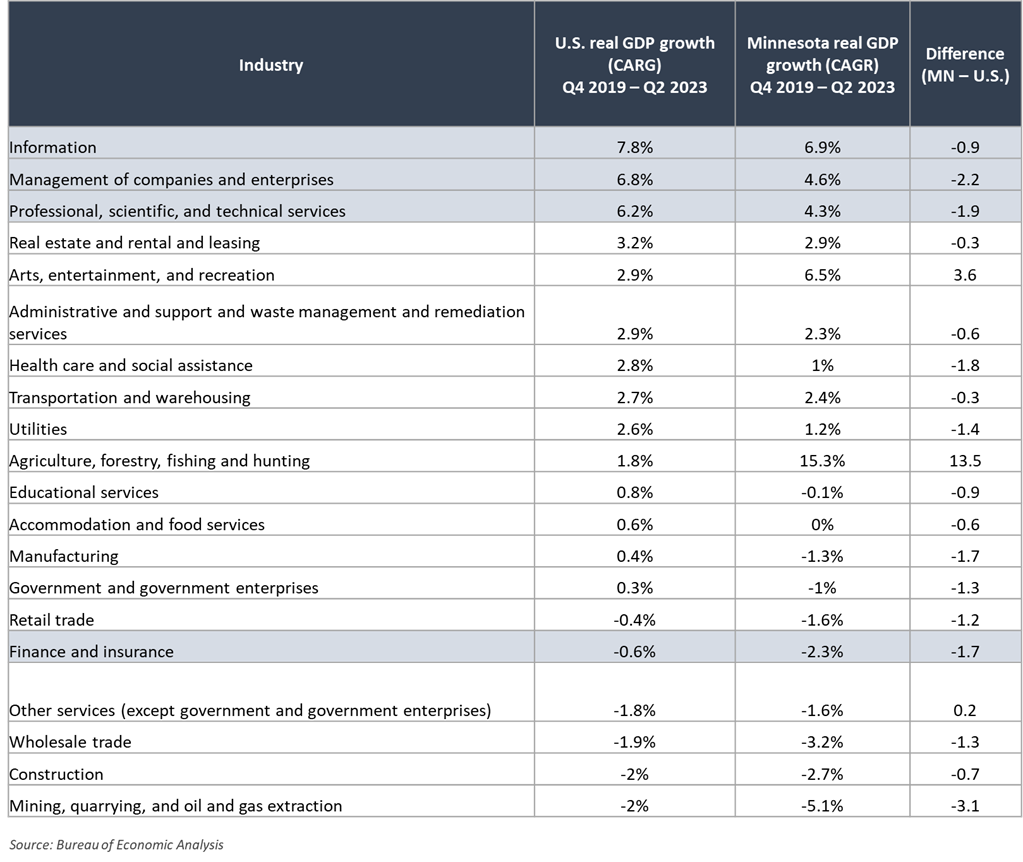

Tech and business service sectors are driving GDP growth in the state and national economy. However, Minnesota continues to lag the U.S. in these industries, helping explain the state’s overall below-average economic growth in recent years. Real GDP in skilled tradable service industries grew by a total of 22.6% in the U.S. compared to just 11.6% in Minnesota from Q1 2019 to Q2 2023.

-

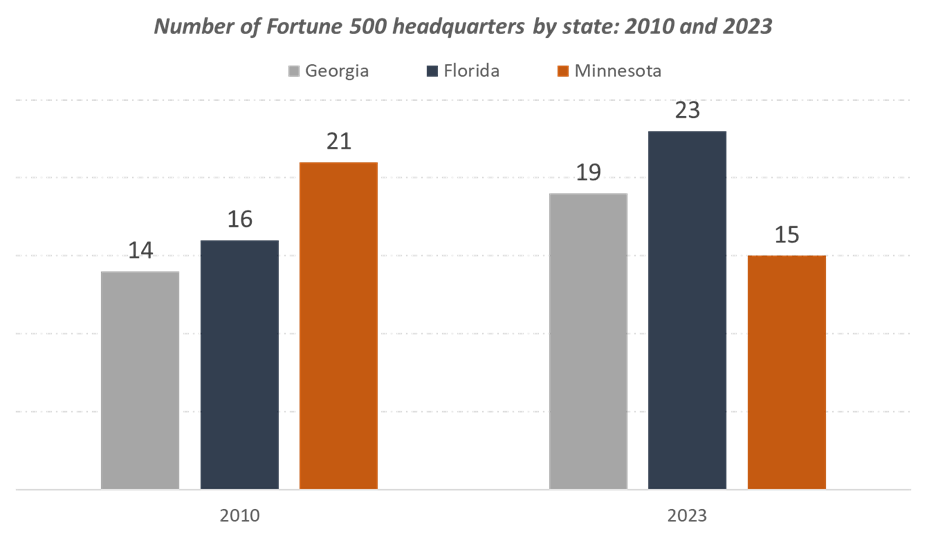

Minnesota’s cluster of corporate headquarters showed mixed results in recent years. The state continues to have the highest concentration of jobs in the Management of Companies and Enterprises industry in the country. However, the number of Fortune 500 companies headquartered in Minnesota fell steadily in recent years, declining from a peak of 21 in 2010 to 15 in 2023.

-

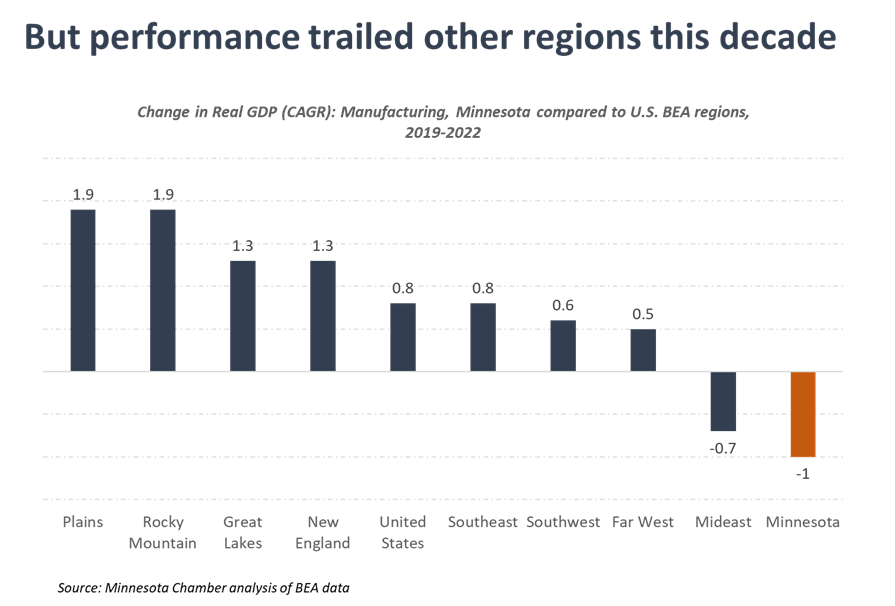

After outperforming the U.S. manufacturing sector from 2007-2019, Minnesota manufacturing ranked last in the Midwest and 40th nationally in real GDP growth from 2019-2022. The sector faced further setbacks in 2023, shedding 5,700 jobs from January to October and performing worse than the U.S. manufacturing sector.

-

Developments in Minnesota’s food and natural resource-based industries have been mixed so far this decade. On the plus side, the state’s real GDP output in farms and food processing surged and expanded faster than the national average. Mining and forestry industries saw declining output in the first three years of the decade but maintained steady employment levels in that time.

2023 Employment Trends by Industry

Local service industries drove growth in Minnesota’s economy in 2023, as consumer spending helped stabilize economic conditions.

-

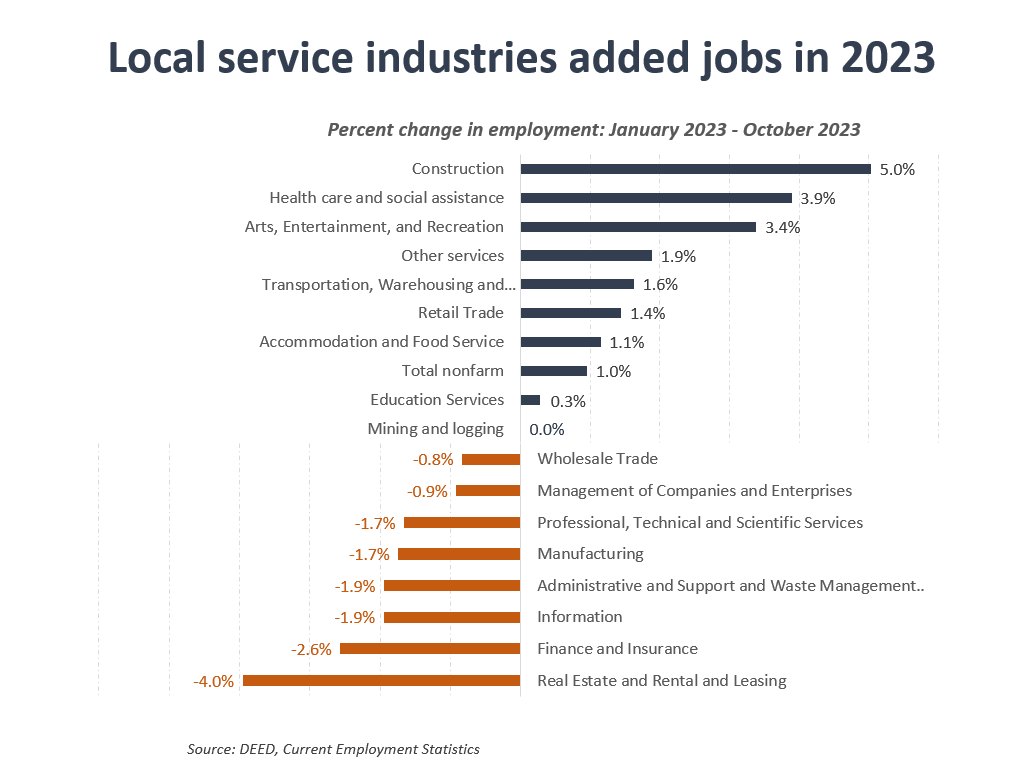

Consumer spending in the national economy grew well-above expectations through the first three quarters of 2023, propelling U.S. GDP to grow by a robust 4.9% in the third quarter. These consumer spending levels seem to reflect trends across Minnesota’s industry sectors this year as well, as local service industries – which are tied more closely to consumer spending – outperformed tradable industries like manufacturing and office sectors like professional, scientific and technical services.

-

Current Employment Statistics data show that seven industries grew faster than the state economy as-a-whole in the first three quarters of 2023. A common characteristic among these seven industries is that each one primarily serves local markets in which the business establishment resides. Examples of these “local industries” include things like retail stores, restaurants, construction firms, entertainment venues, hospitals and health care clinics.

-

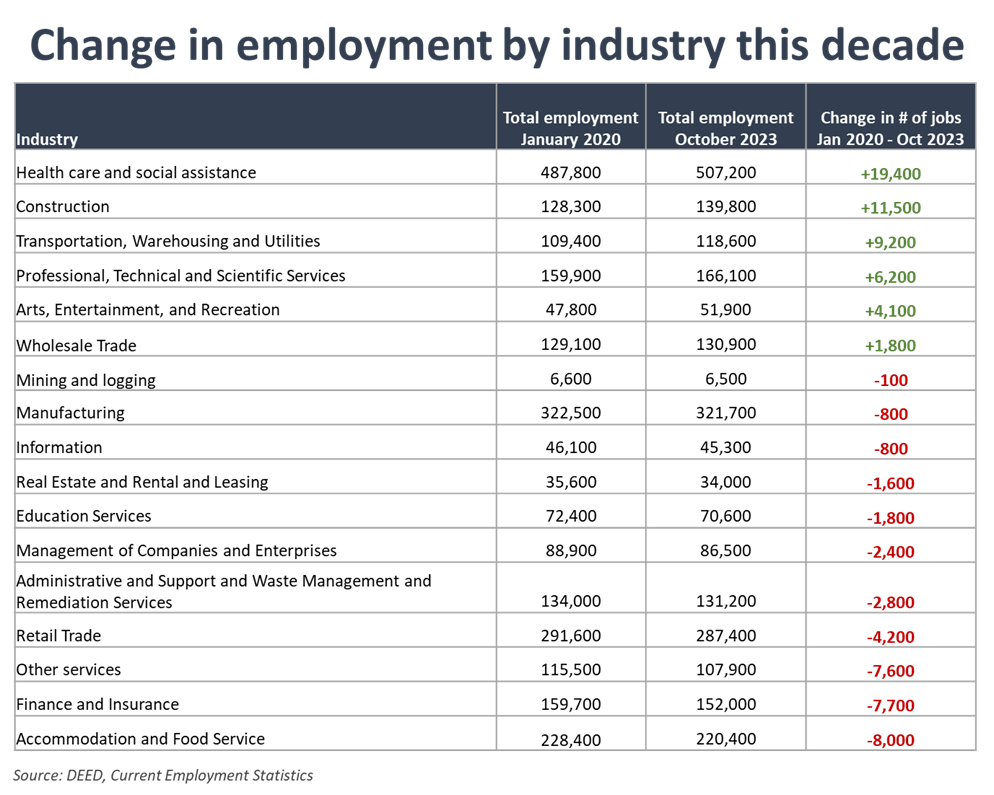

Local service sectors were among the hardest hit during the COVID-19 pandemic, as in-person commerce activities ground to a halt. For example, the Arts, Entertainment, and Recreation industry shed nearly 40% of its total jobs in the spring of 2020 but has now surpassed pre-2020 employment levels, having 4,100 more jobs in October 2023 than it did in January of 2020. Other local industries, like accommodation and food service (i.e. hotels and restaurants), continue to recover the jobs lost in 2020.

-

State GDP data show a similar trend for Minnesota in 2023, as local service sectors outperformed sectors with tradable goods and services, although with some exceptions.

Manufacturing, real estate and office sectors declined in 2023 amidst local and national headwinds.

- Despite overall job growth in Minnesota’s economy this year, more than half of Minnesota’s major industry sectors experienced job losses through the first three quarters of 2023.

- These losses were most pronounced in real estate, finance and insurance, and information, as well as in other tradable industries (i.e. industries with goods and services that can be sold and consumed outside of the region or state they are produced) like manufacturing, professional services, and management of companies and enterprises (e.g. corporate headquarters).

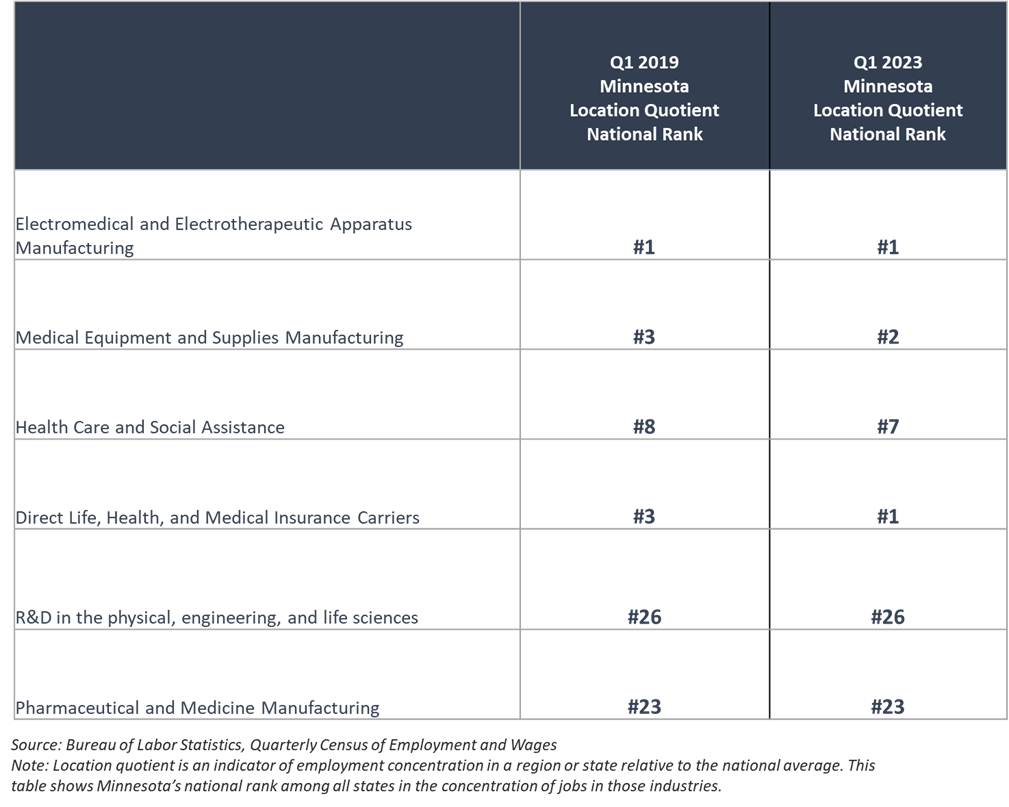

- Tradable industries are more exposed to national and global markets and include many of the sectors where Minnesota possesses an above-average concentration of activity compared to national peers. For example, of the five sectors where Minnesota has a location quotient above 1.0 (meaning the state has a higher concentration of employment in that sector relative to the national average), only one of them (health care and social assistance) is in a local service sector. The rest (manufacturing, management of companies, wholesale trade, and finance and insurance) are tradable industries where companies can export their products and services outside the immediate region. Economic studies show that these tradable industries have an outsized impact on the economic development of an area, as they have higher average wages, productivity levels and create the potential for regions to develop specialized industry clusters. For this reason, Minnesota’s recent declines in these sectors warrants some concern and should be tracked closely in coming months.

Is Minnesota Building on its Key Industry Strengths?

Minnesota is a national hub for corporate headquarters, manufacturing, health care and medical technology, financial services, and natural resource-based industries like food and agriculture, mining and forestry. Past research from the Minnesota Chamber Foundation set out to identify opportunities for development of the state’s key industry sectors. As described in its Minnesota: 2030 report:

“The first strategic priority of Minnesota: 2030 is to

build on Minnesota’s existing industry strengths to

foster a diversified and growing economy. Building

on our strengths means looking first at existing

industries and businesses and enabling their continued

expansion over time. It also means capitalizing on new

opportunities that may arise through

changing market conditions.”

The following section explores trends in the state’s sectors so far this decade to assess whether and how Minnesota is capitalizing on its opportunities to build on its diverse industry strengths.

Tech and business service sectors are driving output growth, but Minnesota lags national peers.

Digital technology and business service industries have been the fastest growing sectors of the U.S. economy over the past two decades. While representing a diverse range of activities – from software publishing and engineering to financial services and corporate headquarters – these skilled tradable service industries are notable for having high median wages, a high concentration of educated workers, and the ability to export their knowledge-based services to markets around the U.S. and the world.

On paper, Minnesota is well-positioned to lead as a regional hub for growth in these industries within the Midwest. The state has the talent base, leading companies, and culture of innovation to support new growth in tech, finance, professional services and headquarters operations. Indeed, Minnesota’s past development of these industries is a large part of what distinguishes its economy from surrounding states.

Yet, Minnesota’s performance in these industries has been mixed this decade, with overall sector growth lagging peers in the national economy and some industries seeing overall declines in employment.

-

Skilled tradable services drove output growth in Minnesota this decade, but the state continues to lag U.S. growth in these industries. Minnesota’s skilled tradable service industries grew at just over half the rate of their peers nationally since the beginning of 2019. This is particularly evident in digital technology industries where Minnesota has ranked near the bottom of all states, despite having built-in advantages that could position it well to play a larger role within the Midwest tech economy. CompTIA’s annual State of the Tech Workforce report shows that Minnesota’s net tech employment grew 45th fastest in 2022 and was projected to grow 48th fastest in 2023 (see page 124 in their full report). And while tech jobs are spreading beyond the coasts to midsized metros like Denver, Dallas and Miami, the Minneapolis-St. Paul MSA lost market share in tech jobs this decade.

-

Diverging trends in output and employment for some industries. Some skilled service industries expanded GDP output this decade but experienced declining employment. The Management of Companies and Enterprises industry, for example, expanded GDP output by an average annual rate of 4.6% since late 2019, but employed 2,400 fewer people in October 2023 than it did in January 2020. Likewise, real GDP in the tech-heavy Information sector (which is comprised of telecom, software and internet companies, and traditional publishing industries) grew by 6.9% annually so far this decade but lost 800 jobs since January 2020. Some of these divergences could be related to timing in data collection and reporting, but it may also reflect high productivity levels within these industries. As this paper shows, wages and productivity within these high-skilled industries has outpaced job growth in the U.S. economy since at least 1980.

-

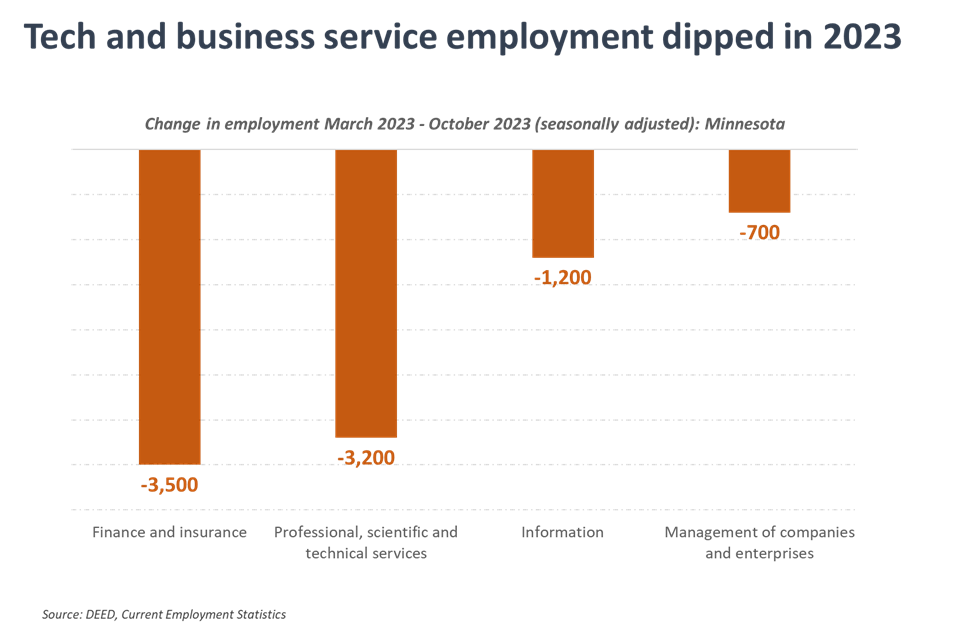

Overall activity in skilled tradable industries cooled in 2023 after strong growth in 2021-22. After strong growth during the recovery from the Pandemic-Recession, tech and business service industries cooled in the past year, with employment declining through much of 2023. This was seen most clearly in Minnesota’s professional, scientific and technical services industry, which had among the fastest job growth in 2021 and 2022 but shed -3,200 jobs since March 2023.

-

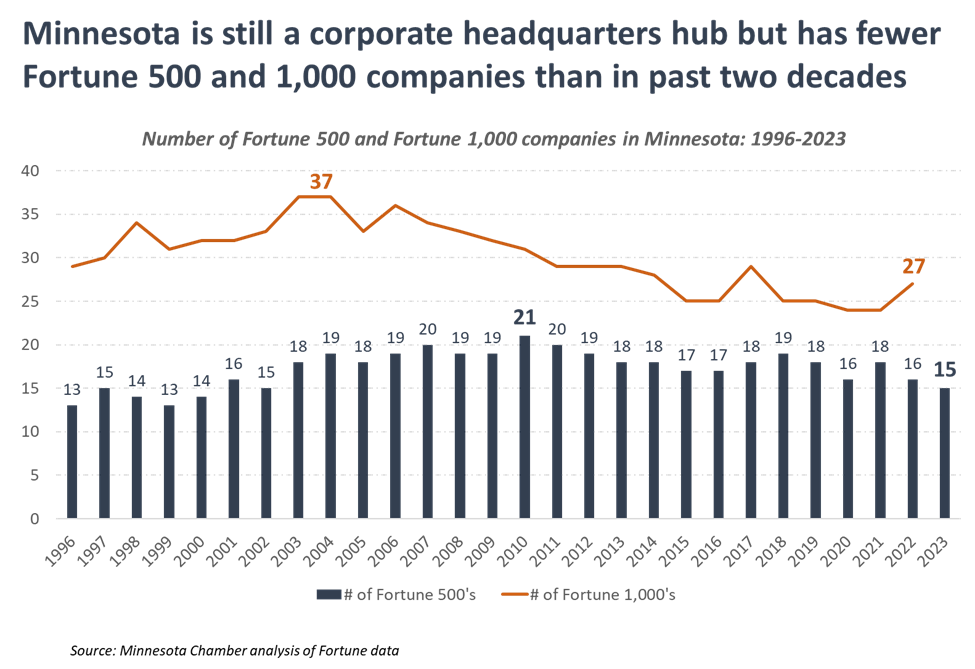

Headquarters paradox: Minnesota is maintaining its high concentration of jobs in the Management of Companies and Enterprises industry, but the number of Fortune 500 and Fortune 1,000 companies headquartered in Minnesota is declining over time. By one measure, Minnesota has the highest share of headquarters jobs in the country. The state has a location quotient of 1.88 in the Management of Companies and Enterprises industry – leading all states – and this indicator of employment concentration has intensified slightly in recent years.

At the same time, the number of Minnesota companies listed on Fortune 500 and Fortune 1,000 – which ranks the largest U.S. companies by annual revenue – has dwindled over the past decade. At its peak, Minnesota had 21 companies on the Fortune 500 list. By 2023, that number fell to just 15.

The apparent contradiction in these data points can be explained in part by mergers, acquisitions, or corporate inversions that have relocated the address of some former Minnesota headquarters while leaving their local jobs and operations intact. In other cases, a Minnesota company may simply move off the Fortune 500 or Fortune 1,000 list as other U.S. firms outpace them in revenue, even as the company continues to operate their business in Minnesota. Yet, whatever the reasons, the decline in the number of Fortune level headquarters is noteworthy and demands further attention, both for reputational considerations and because firms often make important civic, philanthropic and economic investments in communities where they are headquartered.

Minnesota is building on its health care and med-tech advantages.

Minnesota is a global leader in health care and medical technologies (see Minnesota: 2030 industry report). The state has long been a hub for innovation in health care delivery, insurance, medical devices and equipment manufacturing. Additionally, while biotech and pharmaceutical manufacturing remain less fully developed in the state, they are among the fastest growing parts of Minnesota’s medical industry portfolio.

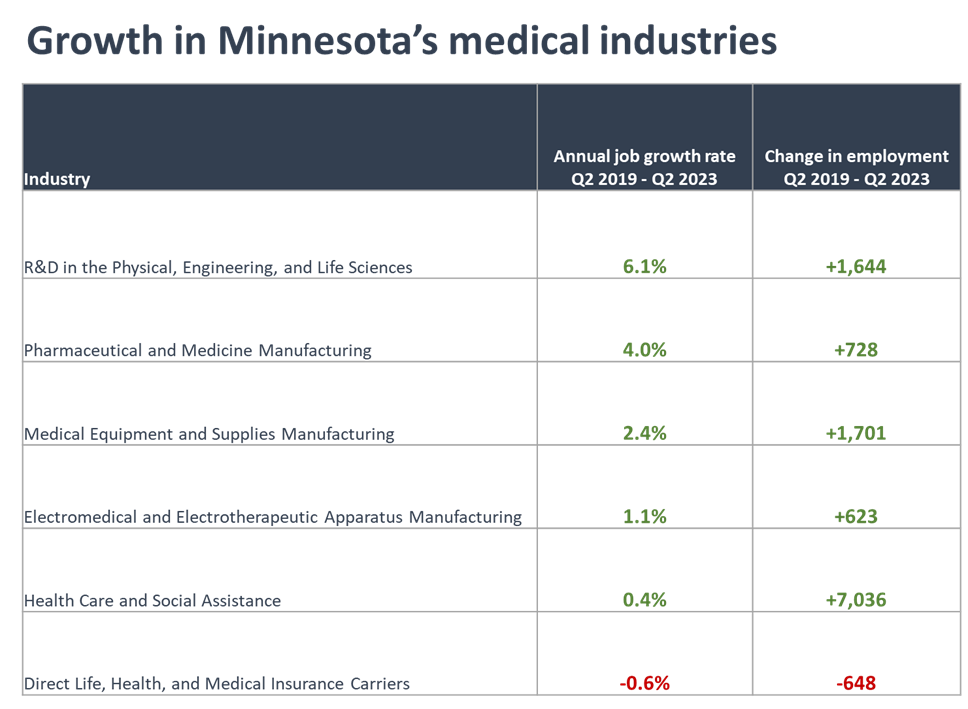

Minnesota increased its advantages in health care activities this decade and intensified its position as a leader in the sector nationally. Evidence of this includes growing employment across most health care related industries, notable business expansions, strong startup investment, and a rising market share of jobs relative to the national average.

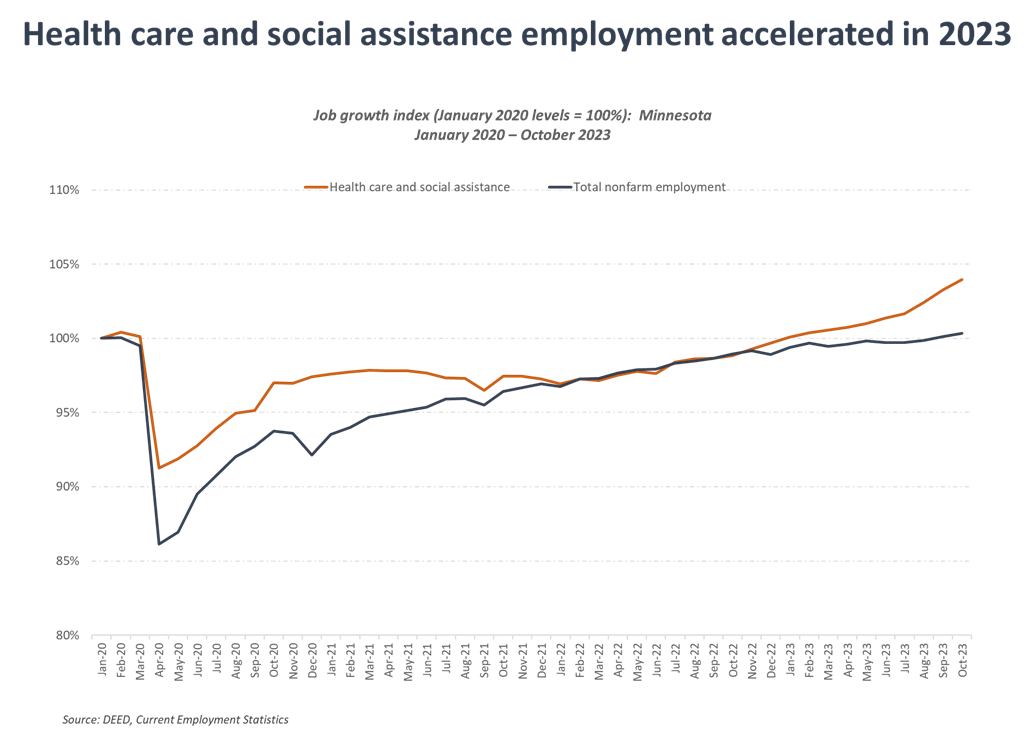

- Despite notable challenges and volatility, Minnesota’s medical sector grew in the first part of the decade. Total employment grew from Q2 2019 to Q2 2023 across all segments of the sector, except for health insurance carriers which fell by 0.6%. The state’s health care and social assistance industry added over 7,000 jobs in that time. Biopharma and med-tech industries also expanded jobs, adding nearly 5,300 jobs since mid-2019. Current Employment Statistics data – which is released monthly and offers a more recent snapshot – shows that Minnesota’s health care and social assistance saw particularly strong performance in the middle part of 2023. The industry was the largest contributor to job growth in the state through October 2023, expanding by 3.9% and adding 19,000 jobs since January on a seasonally adjusted basis.

- Investment in medical startups and business expansions remained strong this decade. Health care businesses were a bright spot among Minnesota startups in 2023. As a report from Medical Alley shows, health care startups raised nearly $1.8 billion in the first of 2023, even as total venture capital investment fell by 63% in Minnesota in that time. Further, a dashboard from the Department of Employment and Economic Development shows that life sciences companies announced over $255 million in new or expanded operations in Minnesota so far this year, led by a $170 million project from Boston Scientific to increase their operations in Maple Grove.

Minnesota manufacturers face an array of headwinds as costs and regulatory burdens pile up.

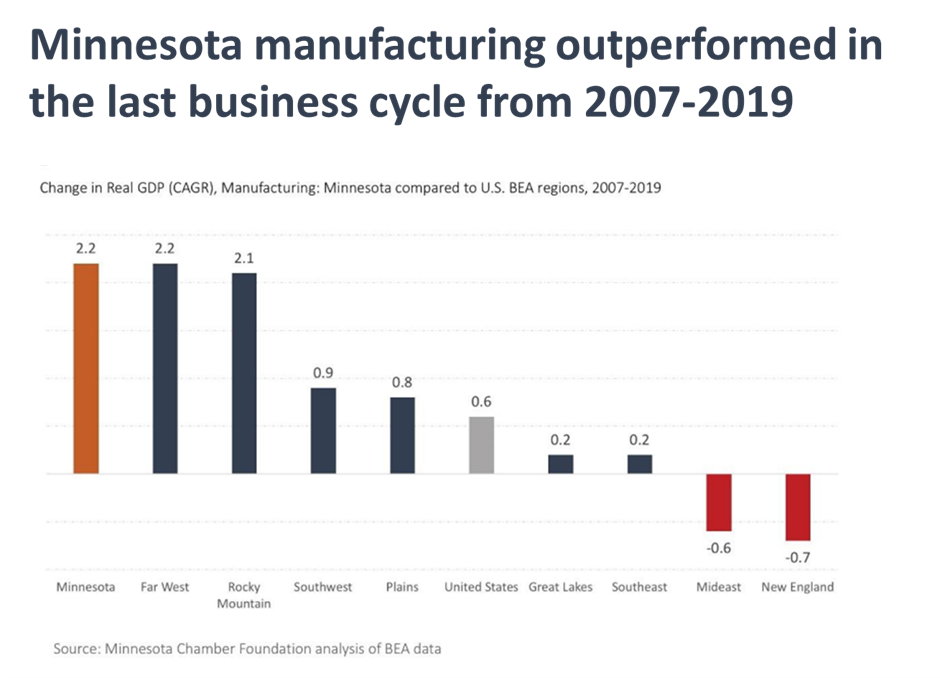

Heading into the new decade, Minnesota’s manufacturing sector was poised to continue its outperformance of other midwestern states. Minnesota has a diverse manufacturing sector with strengths in high value-added industries like computers and electronics, medical goods, machinery, building products and transportation equipment. This favorable profile of industries, along with a skilled manufacturing workforce, enabled Minnesota to lead the region in manufacturing GDP growth over the previous business cycle from 2007-2019.

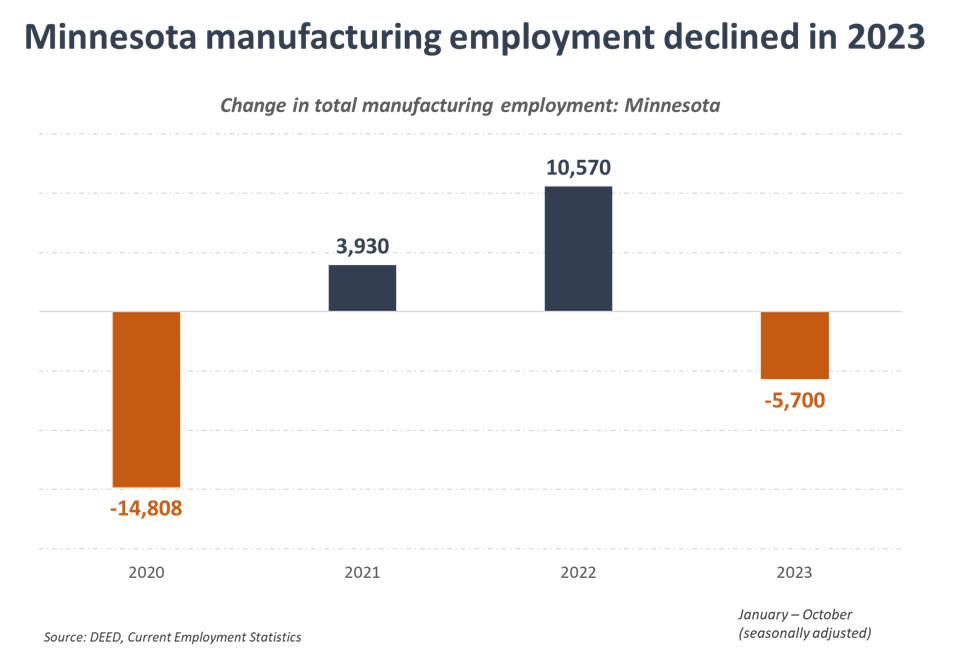

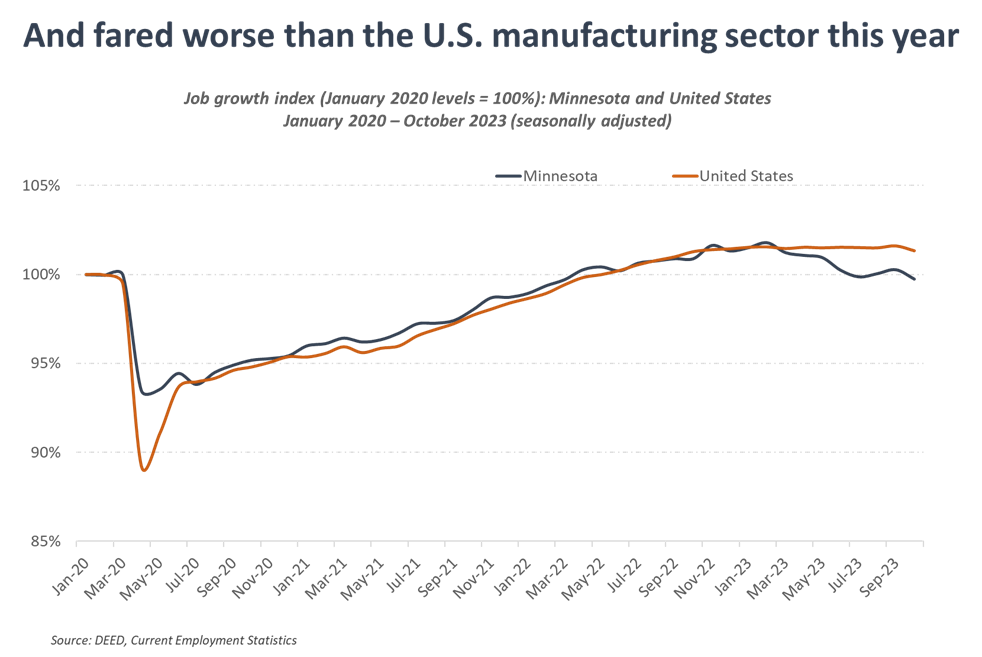

However, performance in the state’s manufacturing sector suffered setbacks in the early 2020’s being impacted by a range of headwinds, first from the COVID-19 pandemic and then from inflation, rising interest rates, workforce shortages and growing costs and regulatory hurdles imposed at the state level. Minnesota’s manufacturing sector ranked last in GDP growth among Midwest states from 2019-2022 and shed 5,700 jobs in 2023 as challenges continued to mount.

-

Minnesota manufacturers added jobs in 2021 and 2022 but sector employment fell by 5,700 jobs in the first three quarters of 2023. Responding to a shift from services to goods consumption during the COVID-19 pandemic, Minnesota manufacturers increased staffing levels over a two-year period, leading the sector to surpass pre-pandemic employment by April 2022. However, cooling conditions in the sector this year seem to have taken a toll, leading to declines in employment and GDP levels. Manufacturing employment fared worse in Minnesota than the national average, with jobs declining by -1.7% in Minnesota and by only -0.2% in the U.S.

-

Manufacturers cite state regulatory concerns as a barrier to growth in Minnesota. An annual poll of Minnesota manufacturers commissioned by Enterprise Minnesota showed that businesses face a range of challenges, with changes in state regulations – such as the new Earned Sick and Safe Time and Paid Family and Medical Leave requirements passed in the 2022 legislative session – leading their list of concerns. As stated in their report: “Manufacturers believe that these new regulations contribute to Minnesota becoming a less attractive business climate. In total, 59% reported that the new legislation makes the state less attractive for business, including 42% who say it is much less attractive.”

Additionally, several large manufacturing expansion projects pulled out of Minnesota in 2022, citing environmental permitting delays and complications. The Minnesota Chamber Foundation is currently conducting an in-depth report of the state’s permitting system to identify opportunities for improvement.

-

Bright spots in Minnesota’s manufacturing sector include transportation equipment, machinery, wood products, food processing and medical goods. Despite challenges overall in the sector, Minnesota gained headway in several key industries this decade. Machinery manufacturing led the way, adding 2,360 jobs from the middle of 2019 to the middle of 2023. Other growth industries include miscellaneous manufacturing (which includes medical equipment and supplies), transportation equipment (including snowmobiles), wood products (including doors and windows) and food and beverage manufacturing. All of these reflect some of Minnesota’s core industry cluster strengths and demonstrate continued competitive advantages in these activities. At the other end of the spectrum, however, were losses in other key manufacturing subsectors like printing, electrical equipment, and computer and electronics, which together shed over 5,700 jobs in that time.

Food, agriculture and natural resource industries experienced mixed results this decade.

Minnesota’s abundant natural resources continue to shape its economic development over time. The state is a leader in food and agriculture, metal mining, forestry products, and has emerging opportunities in clean energy technologies and supply chains. As global demands on food supplies, water and sustainable energy increase, Minnesota is positioned to leverage its combination of innovation and natural resources to meet the challenges and opportunities of the future.

Developments in these industries have been mixed so far this decade.

-

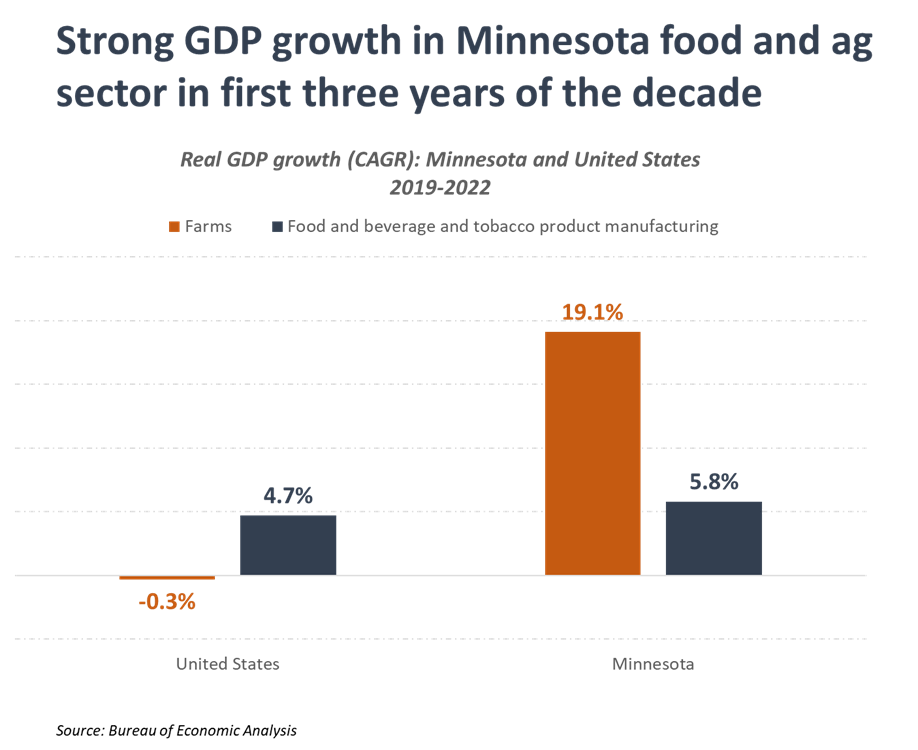

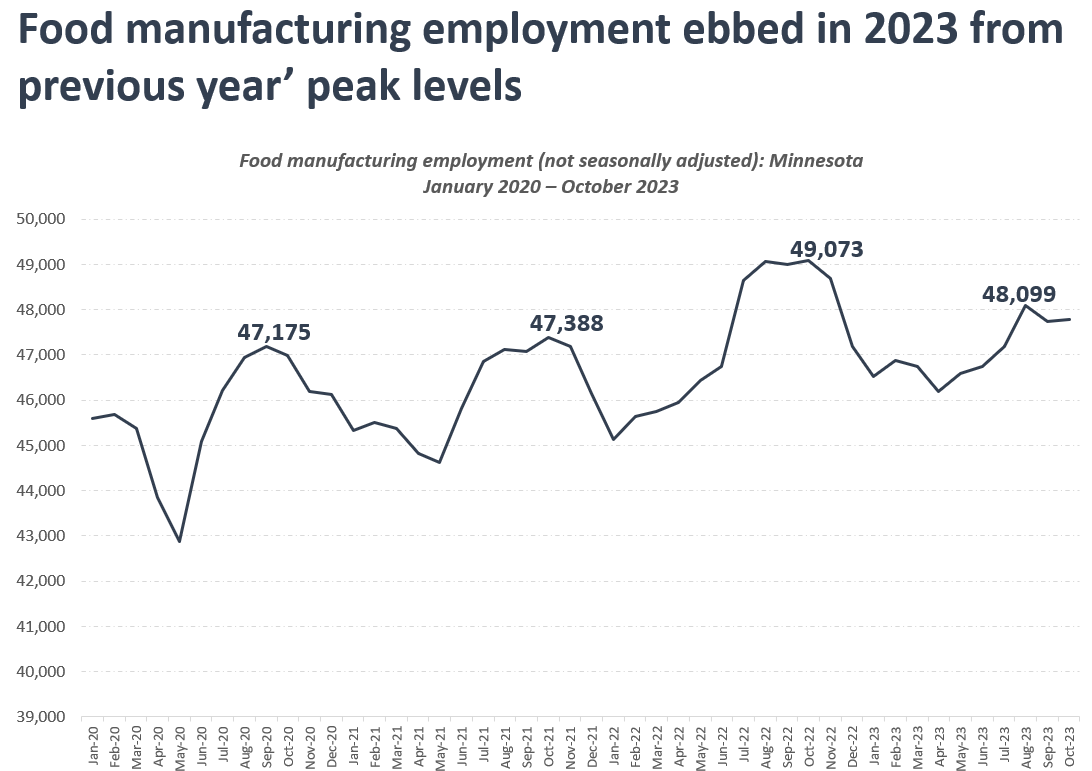

Minnesota’s food and agriculture industries expanded in the first years of the decade. The state’s farm output grew by a rapid 19.1% annually from 2019-2022, standing in stark contrast to the national farm sector which contracted by -0.3% in that time. Likewise, Minnesota’s food and beverage manufacturing industries outpaced the U.S., growing by 5.8% annually since 2019 (Detailed GDP data on state farm and food manufacturing for 2023 is not yet available at the time of this publication). Employment in Minnesota’s food manufacturing industry also grew from 2020-2022 but ebbed slightly in 2023.

-

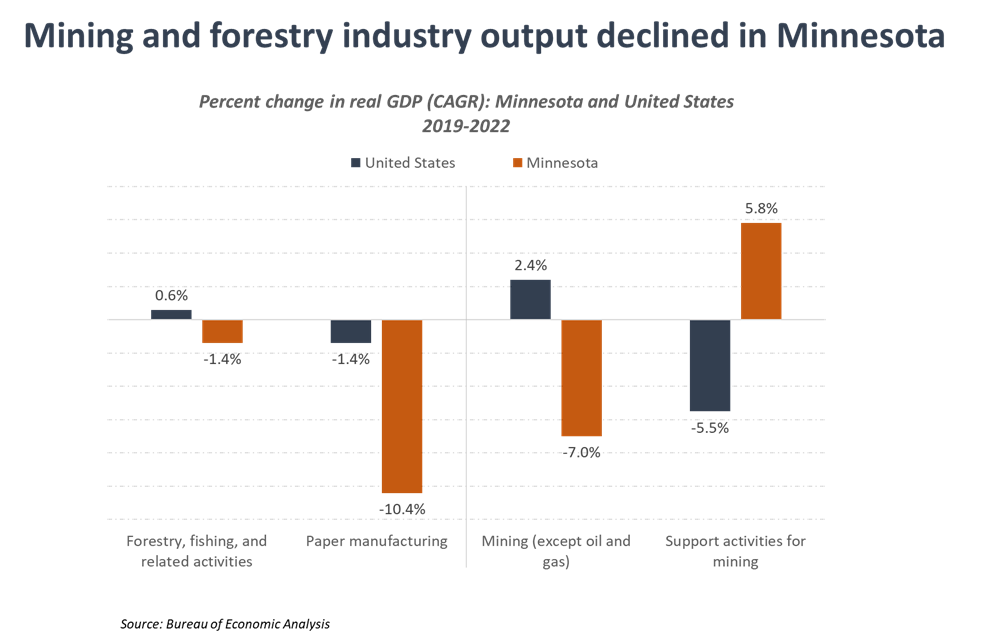

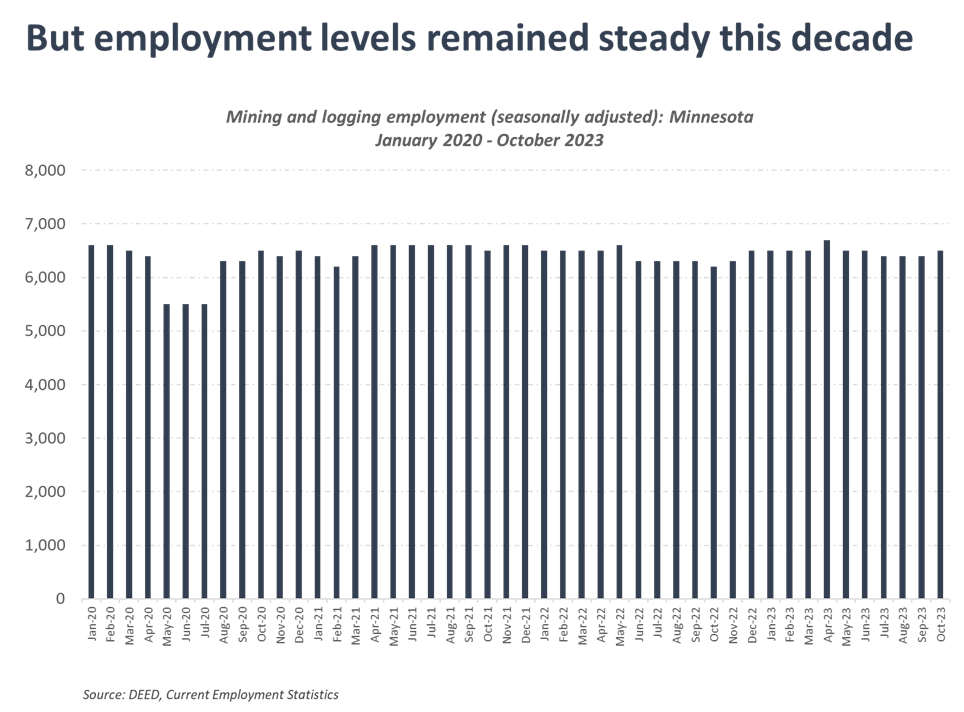

Mining and forestry products experienced declining output but steady employment levels in recent years. Real GDP declined by an average annual rate of -7.0% in Minnesota’s mining sector from 2019-2022 and by -1.7% in its forestry, fishing and related activities industry. Both industries fared worse than the U.S. average in that time. However, despite declining output, overall employment levels in the state’s mining and logging industries remained steady since the beginning of the decade. Minnesota entered 2020 with 6,600 direct jobs in mining and logging, and by October 2023 that number remained nearly unchanged at 6,500 jobs (on a seasonally adjusted basis). While more detailed GDP data won’t be available until 2024, quarterly data on the Mining, quarrying, oil and gas extraction (which for Minnesota is heavily dominated by mining activities) show a positive growth rate of 5.8% in the first two quarters of 2023.

-

Minnesota sees budding opportunities in clean energy, but hurdles exist to capitalize on the opportunity. Federal investments in clean energy technologies created new opportunities for Minnesota this decade. In October 2023, Minnesota and partnering states in the Heartland Hydrogen Hub coalition were awarded nearly $1 billion to advance hydrogen energy production and deployment in the region. The state has seen additional investments in solar and wind projects, as well as innovations in emerging technologies like sustainable magnet production and carbon capture facilities. However, Minnesota has also failed to capitalize on some of its largest opportunities, as regulatory barriers continue to sideline major mining and processing facilities that would make the state a key supplier to high-growth markets in electric vehicle and battery manufacturing, wind turbines, and solar panel manufacturing.

Want to learn more about Minnesota's economy?

Minnesota: 2030 – 2023 Edition builds on the original Minnesota: 2030 report. It provides an in-depth analysis of Minnesota’s economic performance since the pandemic and revised economic forecasts. The report builds on the original recommendations for growth and highlights some priority strategies moving forward.