Minnesota Entrepreneurship: A turning point

Entrepreneurship is at a turning point in Minnesota. After several decades of declining business formation rates, the COVID-19 pandemic created a surprising surge in entrepreneurial interest in the U.S. and Minnesota alike. New business applications – a leading indicator of new business starts – rose by 26% in 2020 and 2021. This surge has only gained momentum throughout the pandemic.

It is not just small-scale businesses that are gaining traction. The rise in new business applications has been coupled with significant growth in venture capital investment. Minnesota startups raised a record $1.5 billion in 2020 and completed a record 175 venture capital deals in 2021. This is important because research shows that a relatively small subset of all new businesses disproportionately drives innovation, job creation and output.

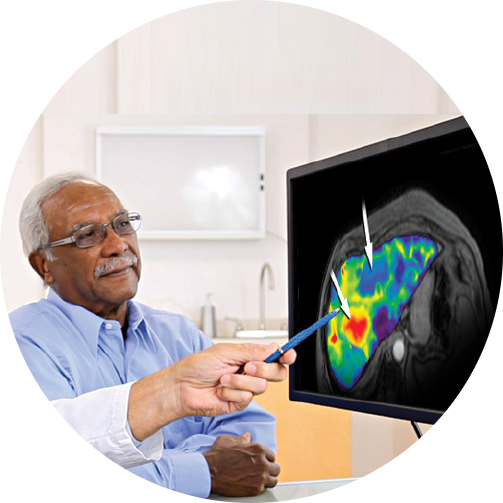

Minnesota’s newest wave of innovative companies reflects the state’s diverse economy, with venture capital deal flow ranking high in verticals such as ag-tech, edtech, advanced manufacturing, fintech, 3D printing, wearables and supply chain tech. Leading the way is the next generation of health care startups, ranging from digital health and biotechnology to medical devices and insurance. This shows Minnesota’s ability to align its historical industry strengths with emerging technologies and verticals.

Yet, it is not enough to just produce innovative new companies – those companies must also survive and grow past their critical early years in order to contribute to the state’s economy.

Most new businesses in the U.S. fail to make it past their fifth year. The inverse is true in Minnesota, however, with over half of all businesses clearing this threshold. Remarkably, this held true even during the immense challenges of the pandemic. A nation-leading 56% of Minnesota businesses survived past their fifth year in 2020, helping to create stability in the state’s economy during the pandemic-induced downturn.

All of this has occurred alongside a host of new startup support resources to provide funding, networking, mentoring and technical assistance to new businesses in Minnesota. This strengthening of the state’s startup ecosystem provides an essential infrastructure to support further entrepreneurship gains in coming years.

But while entrepreneurship is at a turning point, it is not clear what lies around the corner. Notable challenges must be addressed to propel this recent momentum.

Slowing population and labor force growth were key contributors to declining business formation prior to the pandemic. Minnesota’s mediocre population growth – along with persistently tight labor markets and business climate concerns – present potential headwinds for new business growth. Indeed, Minnesota consistently lags the U.S. in the number of new employer businesses per capita, ranking 31st across all states in 2019. Sustaining the rise in new businesses beyond the pandemic will require addressing the underlying conditions that make it difficult for startups to invest, find talent and scale.

Early-stage funding also remains a barrier for even the most innovative new startups. This may be particularly true for founders who lack access to the referral networks that can help them get the attention and trust of investors. Increasing the number of local startup investors and widening access to startup capital will be critical to fuel entrepreneurial growth that is both robust and inclusive.

Finally, while Minnesota’s startup ecosystem is gaining steam, it faces challenges related to sustaining awareness and support amidst the multitude of priorities that vie for our collective attention as a state. Entrepreneurs are often unaware of the resources that exist to support them. Individuals may have the ability and interest to invest in local startups but lack the knowledge of how to do so. Business support organizations may struggle to keep up with rising demand amidst their own resource constraints. Minnesota will need to broadly promote and strengthen the existing tools to support new companies going forward.

All of these issues require strategic action from business leaders, economic developers, chambers of commerce, financial institutions, policymakers and anyone else with a stake in Minnesota’s economic future.

In this report, we unpack some of the key trends shaping entrepreneurship outcomes in Minnesota, including how these outcomes vary across sectors, regions of the state and demographic groups. We then sketch out three broad objectives and nine strategic areas to help clarify the priorities that should guide future action. While the potential actions are as wide-ranging and diverse as the startup community itself, they all point to a future where the next generation of homegrown companies can start, invest and grow here in Minnesota.

Key findings

-

Prior to the pandemic, formation of new employer businesses had been slowing over time, with startup rates declining slightly faster in Minnesota than the U.S. this century.

-

States in the Sun Belt and Western regions have seen the largest relative startup gains, while states in the Midwest and Northeast have seen the largest declines.

-

Entrepreneurship is increasingly shifting to nonemployer firms over time.

-

Startups in Minnesota get off the ground faster and survive longer than peers in other states.

-

High growth startups are a Minnesota strength, and there is positive momentum on this front.

-

New business applications spiked during the pandemic both nationally and in Minnesota.

-

Minnesota startups are nationally competitive across a range of verticals; health care and medical innovation remain a core strength.

-

Startups are forming in areas with greater population density. However, changes during the pandemic may offer new opportunities for rural communities in Minnesota.

-

BIPOC businesses remain underrepresented in Minnesota’s economy. But they are growing at a fast rate and outperforming BIPOC businesses in the U.S.